So, you’re ready to dive headfirst into the exciting world of trading? That’s fantastic! But before you execute that first trade, it’s essential to build your business on solid ground. Many traders focus solely on snagging “trader status” for the tax perks, but this can be a risky and complicated strategy. Let’s explore a smarter way to protect your hard-earned capital and set yourself up for long-term success.

Key Takeaways

- “Trader status” comes with stringent IRS guidelines and a high potential for audits.

- A Wyoming LLC, paired with a management C-Corp, offers a compelling combination of tax advantages and asset protection.

- This structure provides flexibility, security, and a solid foundation for sustained financial growth.

- Consulting with experienced tax and legal professionals is crucial for establishing and maintaining this structure effectively.

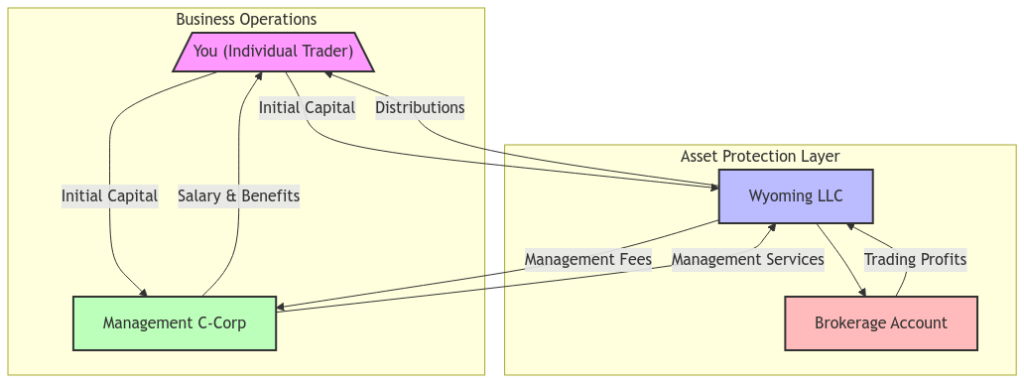

Visualizing the Structure

Before we delve deeper, let’s visualize the recommended business structure:

- You (the Trader): The individual conducting trading activities.

- Wyoming LLC: Serves as the holding company for your trading assets and brokerage account.

- Management C-Corp: Manages the LLC’s operations, providing services in exchange for fees.

The “Trader Status” Temptation (and Why It Might Not Be for You)

The appeal of trader status is undeniable. Who wouldn’t want to deduct all trading expenses and potentially sidestep self-employment tax? However, achieving this status requires clearing a high bar set by the IRS:

Understanding the IRS Guidelines

While the IRS doesn’t provide a specific checklist for qualifying as a trader in securities, tax professionals and court cases have established general guidelines:

- Trading Frequency: You should be trading on most trading days of the year—approximately 75% of available market days.

- Trade Volume: Executing a substantial number of trades annually, often suggested as over 720 trades per year.

- Holding Period: Maintaining an average holding period of less than 31 days to demonstrate that you’re not just investing but actively trading.

- Intent to Profit from Short-Term Market Fluctuations: Your trading activities should aim to profit from daily market movements, not long-term appreciation or income.

The Risks of Pursuing Trader Status

- IRS Scrutiny: Consistently reporting losses on your Schedule C can trigger IRS scrutiny and increase your chances of an audit. The IRS is vigilant about individuals claiming business losses to offset other income, especially if the activity resembles a hobby rather than a legitimate business.

- Ambiguity in Qualification: Since the IRS evaluates trader status on a case-by-case basis, meeting these guidelines doesn’t guarantee approval. The ambiguity can create uncertainty and stress.

A Strategic Alternative: The Wyoming LLC + C-Corp Structure

Instead of getting caught up in the complexities of trader status, consider a more strategic approach:

Wyoming LLC: Your Asset Protection Shield

This serves as the holding company for your brokerage account. But why Wyoming?

- Strong Asset Protection Laws: Wyoming boasts some of the strongest asset protection laws in the United States. The Wyoming Limited Liability Company Act provides robust charging order protection. This legal framework limits a creditor’s rights to only a charging order against a member’s LLC interest, meaning they can’t seize the LLC’s assets or force its dissolution.

- Privacy Benefits: Wyoming allows for anonymous ownership, providing an extra layer of privacy for your business activities.

- No State Taxes: Wyoming has no corporate or personal income tax, which can be advantageous depending on your overall tax strategy.

Management C-Corp: Optimizing for Tax Efficiency and Income Flexibility

This separate entity manages your LLC, and here’s where the real advantages come into play:

- Tax Advantages: A C-Corp allows you to deduct a wider range of business expenses, including health insurance premiums, 401(k) contributions, and other operational costs. For example, employer-paid health insurance premiums are deductible to the corporation and not taxable to you as an employee.

- Income Flexibility: You can structure your income through salaries, dividends, and other distributions. While C-Corps face double taxation (once at the corporate level and again on dividends), strategic planning can minimize this impact. For instance, paying yourself a reasonable salary reduces corporate profits, thereby lowering corporate taxes.

- Retention of Earnings: C-Corps can retain earnings for future growth without immediate tax implications for shareholders.

Comparing Entity Structures

To better understand why the Wyoming LLC + C-Corp structure stands out, let’s compare different entity structures:

| Feature | Sole Proprietorship | S-Corporation | LLC | LLC + C-Corp |

|---|---|---|---|---|

| Asset Protection | Low | Moderate | High | Very High |

| Tax Advantages | Limited | Pass-through | Flexible | Extensive |

| Administrative Complexity | Low | Moderate | Moderate | High |

| Ability to Retain Earnings | No | Limited | Limited | Yes |

| Privacy | Low | Moderate | Moderate | High (in Wyoming) |

| Subject to Double Taxation | No | No | No | Potentially (mitigated with planning) |

Cost-Benefit Analysis Example

Let’s consider an example to illustrate the potential benefits:

Scenario: You expect to earn $200,000 in trading profits this year.

- Without LLC + C-Corp Structure:

- Taxes: As a sole proprietor, you pay self-employment tax (15.3%) on net earnings plus federal and state income taxes.

- Total Tax Liability: Approximately $70,000 (varies based on state taxes and deductions).

- With Wyoming LLC + C-Corp Structure:

- Tax Deductions: Ability to deduct health insurance premiums ($15,000), retirement contributions ($19,500), and other business expenses ($10,000).

- Adjusted Taxable Income: $155,500.

- Corporate Tax Rate (21%): $32,655 at the corporate level.

- Potential Strategies: Retain earnings in the C-Corp, pay yourself a reasonable salary, and utilize fringe benefits to reduce taxable income.

- Total Tax Liability: Potentially reduced by $10,000 to $15,000.

Conclusion: While the administrative costs may increase, the tax savings and asset protection can outweigh these expenses, especially at higher income levels.

Beyond Tax Breaks: Building a Secure and Sustainable Trading Business

This structure offers more than just tax benefits; it’s about creating a robust and secure foundation for your trading endeavors:

- Enhanced Asset Protection: Wyoming’s charging order limitations provide a strong layer of protection against creditors, safeguarding your trading capital.

- Tax Optimization: Strategically utilizing the tax benefits of a C-Corp can significantly optimize your tax burden, allowing you to retain more of your profits.

- Long-Term Vision: This structure positions you for success beyond short-term trading gains, enabling you to diversify your investments and plan for long-term financial goals.

- Economic Substance: By establishing a legitimate business structure with a clear purpose beyond tax benefits, you comply with the IRS’s Economic Substance Doctrine, which requires transactions to have a substantial purpose other than tax avoidance.

Building Your Trading Fortress: A Step-by-Step Guide

Ready to establish a secure and optimized trading business? Here’s a roadmap to guide you:

- Seek Expert Advice: Consult with a tax attorney and a financial advisor specializing in trading businesses. They can provide invaluable guidance tailored to your specific situation, helping you navigate the legal and financial complexities involved. This step is crucial for understanding how state laws, the IRS code, and recent tax reforms may impact your business.

- Form a Wyoming LLC: Research the requirements and associated costs of forming a Wyoming LLC. You’ll need to file the necessary paperwork and ensure ongoing compliance with Wyoming state regulations. Expect to pay filing fees ranging from $100 to $250, plus the cost of a registered agent, which can be anywhere from $50 to $300 per year. Remember, if you operate from another state, you may need to register your LLC as a foreign entity there, which involves additional fees and compliance obligations.

- Establish a C-Corp: Create your management C-Corp in a state that aligns with your business goals. Formalize a comprehensive management agreement with your LLC. This agreement should clearly outline the roles, responsibilities, and interactions between the two entities. Incorporating a C-Corp can vary in cost depending on the state of incorporation and the complexity of the process. Consider factors like state corporate taxes and regulations when choosing where to incorporate.

- Open a Brokerage Account: Open your brokerage account under the name of your Wyoming LLC. This ensures that your trading activities are conducted within the protective structure of the LLC, shielding your personal assets. Notify your broker about the LLC’s structure to ensure compliance with financial regulations.

- Maintain Meticulous Records: Accurate and detailed record-keeping is paramount. Track every trade, expense, and relevant financial activity. Utilize accounting software tailored for trading businesses or consider hiring a professional bookkeeper. This not only ensures compliance with tax regulations but also provides a clear picture of your business performance, aiding in strategic decision-making.

Compliance is Key: Staying Ahead of the Game

Maintaining your Wyoming LLC and C-Corp in good standing requires ongoing compliance:

- Foreign Entity Registration: If you’re operating your business from a state other than Wyoming, you’ll likely need to register your Wyoming LLC as a foreign entity in your home state. This may involve additional paperwork, fees, and potential state tax obligations. Be aware that some states, like California and New York, have rigorous requirements and higher fees.

- Annual Reports and Fees: Both Wyoming and your state of incorporation (for the C-Corp) will likely require annual report filings and franchise taxes. Missing these deadlines can result in penalties or the loss of good standing, which can jeopardize your liability protection.

- Corporate Formalities: Maintaining proper corporate formalities is crucial for preserving the liability protection offered by your LLC and C-Corp. This includes:

- Holding Regular Meetings: Document shareholder and board meetings with minutes, even if you’re the sole owner.

- Accurate Records: Keep detailed financial records separate from personal finances.

- Adhering to Agreements: Follow the operating agreement for your LLC and bylaws for your C-Corp to the letter.

- Tax Filings: Ensure timely and accurate filing of all federal, state, and local taxes. This includes corporate income taxes, payroll taxes, and any applicable state taxes. Consider quarterly estimated tax payments to avoid penalties.

Additional Considerations: Navigating the Nuances

- Economic Substance Doctrine: Ensure that your business structure and transactions have a substantial purpose beyond tax avoidance. The IRS requires that business activities have economic substance; otherwise, they may disregard the structure for tax purposes.

- State Tax Laws: Be aware of the tax obligations in both Wyoming and your home state. Some states have laws that could negate the benefits of a Wyoming LLC if you’re conducting business elsewhere.

- Tax Law Changes: Stay informed about changes in tax laws that could affect your business. For example, shifts in corporate tax rates or deductions can significantly impact your tax strategy.

- Professional Services: Regular consultations with your tax advisor and attorney can help you adapt to changes in laws and ensure ongoing compliance.

FAQs

Is this Wyoming LLC + C-Corp structure suitable for all traders?

While this structure offers numerous advantages, it’s not a universal solution. The optimal structure for your trading business will depend on various factors, including your trading volume, frequency, risk tolerance, and individual financial goals. For traders with significant profits and assets to protect, the benefits may outweigh the costs. Consulting with a qualified tax professional is essential to determine the most suitable approach for your specific needs.

Are there any potential drawbacks to this structure?

Yes, there are potential complexities to consider:

Costs: Setting up and maintaining two separate entities involves filing fees, annual report fees, registered agent fees, and potentially higher accounting and legal costs.

Administrative Burden: Managing compliance requirements for both entities can be time-consuming.

Double Taxation: C-Corps face double taxation—profits are taxed at the corporate level, and dividends are taxed at the shareholder level. However, strategic tax planning can mitigate this issue.

State Regulations: Operating in states other than Wyoming may require additional registrations and adherence to those states’ laws, which could reduce some of the anticipated benefits.

Can I still pursue trader status with this structure in place?

Yes, you can pursue trader status if you meet the IRS guidelines. This structure doesn’t preclude you from qualifying; instead, it adds layers of protection and potential tax advantages regardless of your status. Even if you don’t meet the trader status criteria, the LLC and C-Corp setup can still offer significant benefits.

What about the “wash sale” rule? How does this structure affect it?

The “wash sale” rule disallows a tax deduction for a loss on a security if you purchase the same or a substantially identical security within 30 days before or after the sale. Using an LLC or C-Corp doesn’t inherently change this rule. However, careful planning and consultation with a tax professional can help you navigate these regulations effectively.

What are the estimated costs for setting up and maintaining this structure?

Setup Costs:

Wyoming LLC Formation: $100 – $250 filing fee.

C-Corp Incorporation: Varies by state, typically $100 – $500.

Legal Fees: $1,000 – $3,000 for drafting agreements.

Registered Agent Fees: $50 – $300 annually.

Ongoing Costs:

Annual Report Fees: $50 – $200 per entity.

Accounting and Tax Preparation: $2,000 – $6,000 annually.

Compliance Costs: Variable, depending on services used.

Need Help Navigating the Complexities? XOA TAX Can Guide You

Structuring your trading business strategically is crucial for long-term success. At XOA TAX, our team of experienced CPAs can provide personalized guidance and support to help you make informed decisions. We can help you:

- Understand the nuances of different business structures.

- Ensure compliance with all tax regulations, both federal and state.

- Develop a tax-optimized strategy to achieve your financial goals.

- Adapt to changes in tax laws and market conditions.

Connect with us today to schedule a consultation:

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime