Tax season often brings a sense of dread, but understanding your options can empower you to minimize your tax liability. One crucial decision you’ll face is whether to take the standard deduction or itemize. This post will guide you through the differences between these two approaches, helping you determine the best strategy for your unique tax situation in 2024.

Key Takeaways

- The standard deduction is a fixed amount that reduces your taxable income.

- Itemized deductions allow you to deduct specific eligible expenses.

- Choosing between the two depends on various factors, including your income, expenses, and filing status.

- Recent tax law changes have impacted itemized deductions, particularly for charitable contributions and medical expenses.

- XOA TAX can provide personalized guidance to help you optimize your deductions.

Understanding the Standard Deduction

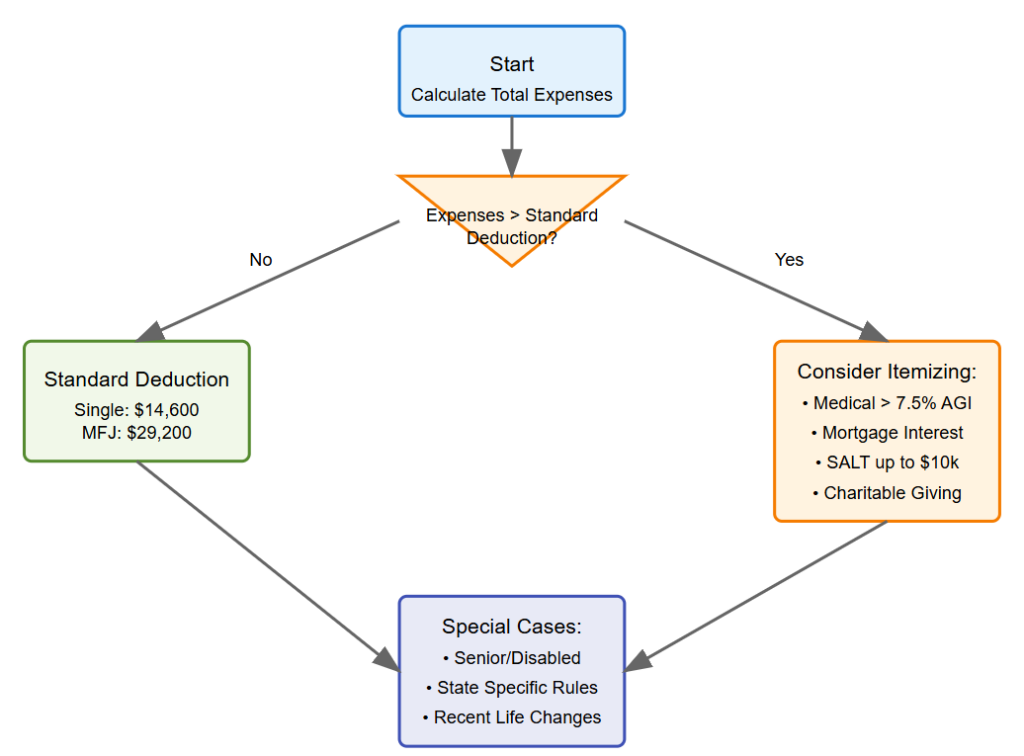

The standard deduction is a set dollar amount provided by the IRS that you can subtract from your Adjusted Gross Income (AGI) to lower your taxable income. This simplifies tax preparation for many taxpayers. For the 2024 tax year, the standard deduction amounts are:

- Single filers: $14,600

- Married filing jointly: $29,200

- Head of household: $21,900

Pros of Taking the Standard Deduction

- Simplicity: Claiming the standard deduction is straightforward and requires minimal effort.

- No Recordkeeping: You don’t need to worry about maintaining detailed records of expenses.

- Time-Saving: This option can significantly expedite the tax filing process.

Cons of Taking the Standard Deduction

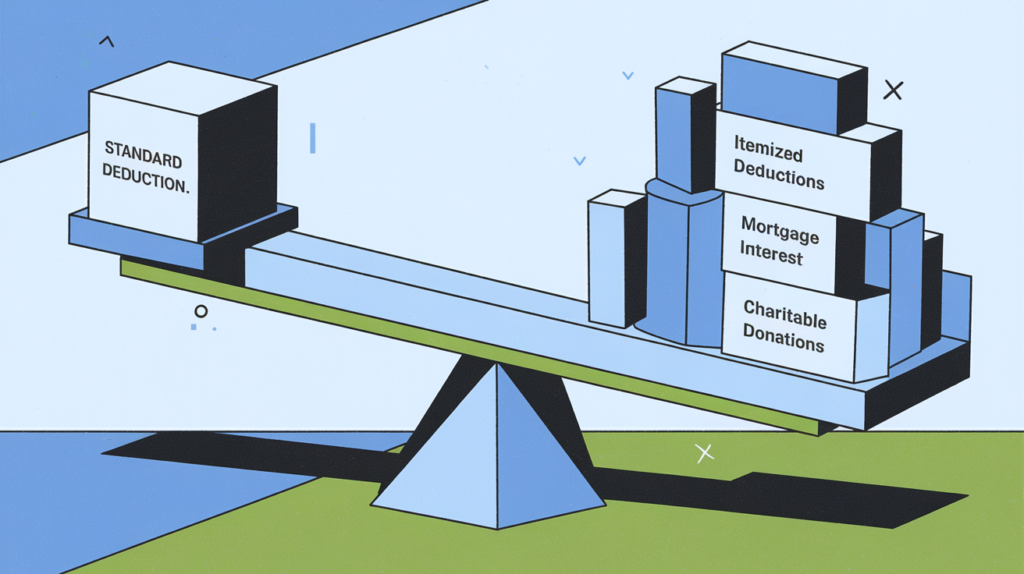

- May Miss Out on Tax Savings: If your eligible expenses exceed the standard deduction, itemizing could result in a lower tax liability.

Exploring Itemized Deductions

Itemized deductions allow you to deduct specific expenses incurred throughout the year. This can be beneficial if your eligible deductions exceed the standard deduction amount. Some common categories of itemized deductions include:

- Medical Expenses: You can deduct medical expenses exceeding 7.5% of your AGI. This encompasses costs like doctor visits, hospital stays, prescription medications, and medical equipment.

- State and Local Taxes (SALT): This deduction is capped at $10,000 per household ($5,000 if married filing separately) and includes property taxes, state and local income taxes, and sales taxes.

- Mortgage Interest: You can generally deduct the interest paid on a mortgage for your primary home or a second home. However, for mortgages originated after December 15, 2017, the deduction is limited to interest on the first $750,000 of qualified residence debt ($375,000 if married filing separately).

- Charitable Contributions: Donations to qualified charities are deductible. Generally, you can deduct cash contributions up to 60% of your AGI. For contributions of capital gain property, the limit is generally 30% of your AGI. However, there are specific rules and limitations depending on the type of contribution and the organization you donate to.

Important Note: For donations exceeding $250, you’ll need to obtain a contemporaneous written acknowledgment from the charity. This acknowledgment must include the amount of the contribution, a description of any property donated, and a statement regarding whether you received any goods or services in exchange for the contribution.

Pros of Itemizing Deductions

- Potential for Greater Tax Savings: If your eligible itemized deductions surpass the standard deduction, you can potentially reduce your taxable income significantly.

- Flexibility: Itemizing allows you to customize your deductions based on your individual financial situation.

Cons of Itemizing Deductions

- Complexity: Itemizing requires meticulous record-keeping throughout the year to track eligible expenses and ensure you have proper documentation.

- Time-Consuming: Gathering and organizing records for itemized deductions can be a time-intensive process.

When to Consider Itemizing

It’s generally advisable to consider itemizing if you:

- Have high medical expenses: If your medical expenses exceed 7.5% of your AGI, itemizing could be beneficial.

- Paid significant mortgage interest: Especially in the early years of your mortgage when interest payments are higher.

- Live in a high-tax state or locality: If you pay substantial state and local taxes, itemizing might help reduce your tax liability.

- Made large charitable donations: If you’ve made significant charitable contributions, itemizing could allow you to claim a deduction for these donations.

- Are a senior or disabled taxpayer: Seniors and disabled taxpayers may qualify for a higher standard deduction amount, but it’s still crucial to compare this to your potential itemized deductions.

State-Specific Considerations

While the federal government provides standard deduction amounts, it’s important to be aware that many states also have their own standard deduction amounts and rules for itemized deductions. These can vary significantly, so it’s crucial to research your state’s specific tax laws or consult with a tax professional to ensure you’re maximizing your deductions at both the federal and state levels.

Making the Right Choice

The best approach – standard deduction or itemizing – hinges on your unique circumstances. Evaluate your eligible expenses, consider your filing status, and compare your tax liability under both scenarios.

FAQ Section

Q: Can I switch between the standard deduction and itemizing from year to year?

A: Yes, you have the flexibility to choose the method that results in the lowest tax liability each year.

Q: Are there any limitations on itemized deductions?

A: Yes, certain itemized deductions, such as medical expenses, state and local taxes (SALT), and charitable contributions, have limitations and phase-out thresholds based on your income. Refer to IRS Publication 529 for detailed information.

Q: Where can I find more information about eligible itemized deductions?

A: The IRS website (IRS.gov) provides comprehensive information and publications on itemized deductions. You can also find valuable resources on our website, https://www.xoatax.com/.

Connecting with XOA TAX

Making informed decisions about your deductions can be complex. At XOA TAX, our experienced CPAs can provide personalized guidance to help you navigate these choices and optimize your tax strategy. We can assist you with:

- Analyzing your financial situation and eligible expenses

- Calculating your tax liability under both the standard deduction and itemized deductions

- Ensuring you meet all documentation requirements for itemized deductions

- Identifying potential tax planning opportunities

Contact us today to schedule a consultation:

- Website: https://www.xoatax.com/

- Phone: +1 (714) 594-6986

- Email: [email protected]

- Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often, and vary significantly by state and locality. This communication is not intended to be a solicitation and XOA TAX does not provide legal advice. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime