Stock trading can be an exciting way to grow your wealth, but it’s important to remember that Uncle Sam wants his share of your profits. As a CPA, I often see people get caught off guard by the taxes owed on their stock trades, especially if they’ve had a particularly good year. To avoid an unexpected tax bill and potential penalties, it’s crucial to understand how these profits are taxed and plan accordingly. This blog post will guide you through estimating your tax liability and offer practical tips for setting aside enough money throughout the year.

Key Takeaways

- Trading profits are taxed as capital gains.

- Holding periods determine if gains are short-term or long-term.

- Tax rates vary based on your income level and filing status.

- Estimating and setting aside taxes throughout the year can prevent a hefty tax bill come April.

Understanding Capital Gains Taxes

When you sell a stock for more than you paid for it, you realize a capital gain. These gains are subject to capital gains tax, which is divided into two categories:

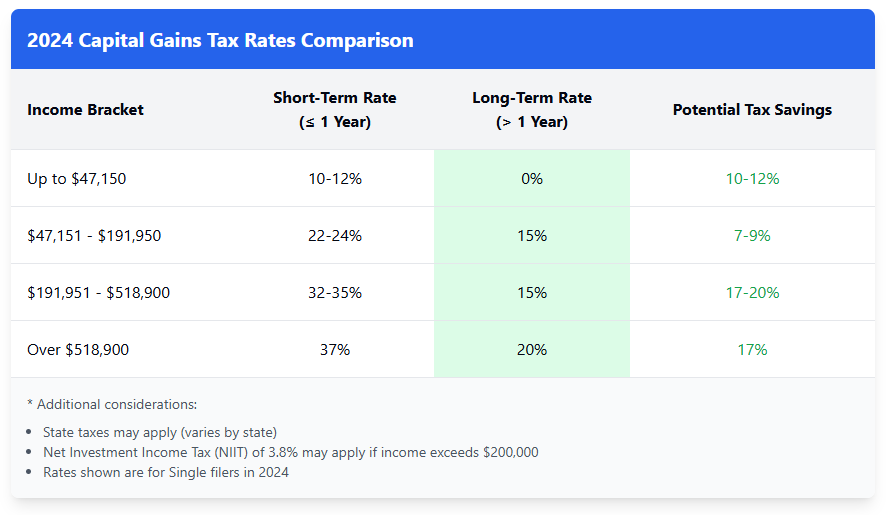

- Short-term capital gains: Apply to assets held for one year or less. These are taxed at your ordinary income tax rate.

- Long-term capital gains: Apply to assets held for more than one year. These are taxed at lower rates, typically 0%, 15%, or 20%, depending on your income bracket and filing status.

You can find the current capital gains tax rates on the IRS website.

Understanding Wash Sales

A wash sale occurs when you sell a stock at a loss and, within 30 days before or after that sale, you (or your spouse) buy the same stock or a “substantially identical” security. This also includes acquiring contracts or options to buy substantially identical securities.

Essentially, the wash sale rule prevents you from claiming a tax loss if you’re maintaining basically the same investment position. The disallowed loss gets added to the cost basis of the replacement shares, and the holding period of the original shares is tacked onto the holding period of the new shares.

Example:

You buy 100 shares of XYZ at $50 per share ($5,000 total). The stock drops to $40, and you sell all 100 shares ($4,000 total), realizing a $1,000 loss. Within 30 days, you buy 100 shares of XYZ again at $45 per share ($4,500 total).

Result: Your $1,000 loss is disallowed and added to your new cost basis. Your new cost basis becomes $5,500 ($4,500 + $1,000), or $55 per share.

Key points about wash sales:

- Wash sales can occur across different accounts, including IRAs.

- The rule applies to both stocks and options.

Special Note on Cryptocurrency Trading

While this guide focuses on stock trading, it’s important to note that cryptocurrency trading has different tax implications. The IRS treats cryptocurrency as property, not securities, which means:

- Wash sale rules technically don’t apply (though this may change).

- Every crypto-to-crypto trade is a taxable event.

- Mining income and staking rewards have special tax treatment.

If you trade both stocks and cryptocurrency, consult a tax professional for specific guidance.

Mark-to-Market Election

Traders who qualify as ‘traders in securities’ can opt for the mark-to-market election. This means they treat all their securities as if sold at year-end, simplifying tax reporting and potentially offering tax advantages. However, this election has specific requirements and implications, so consulting a tax professional beforehand is crucial.

Alternative Minimum Tax (AMT)

In some cases, capital gains can trigger the Alternative Minimum Tax (AMT), a separate tax calculation that may result in a higher tax liability. It’s important to be aware of this possibility, especially if you have significant capital gains.

Estimating Your Tax Liability

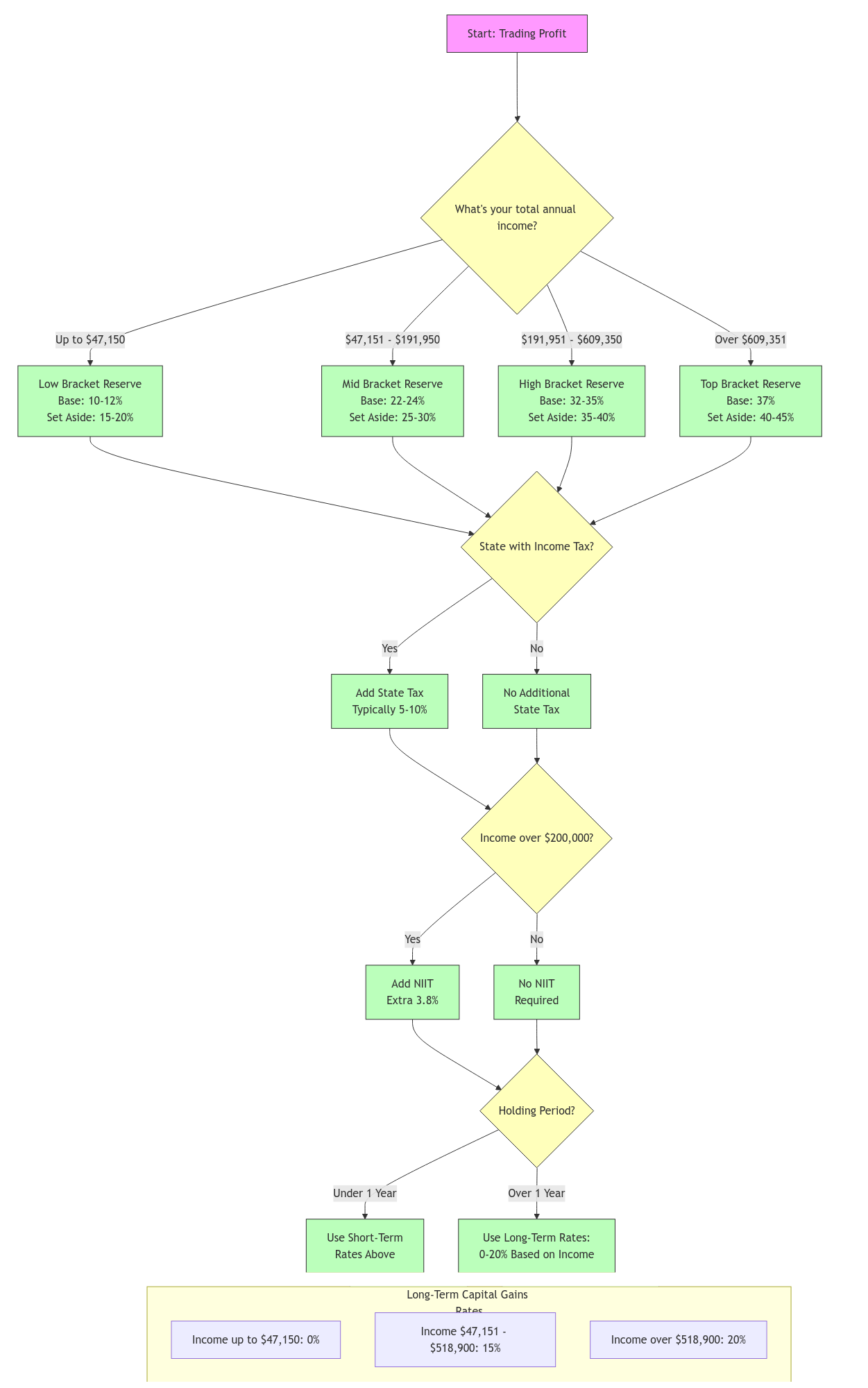

Estimating your taxes on trading profits requires considering a few factors:

- Your holding period: Keep track of how long you’ve held each stock to determine if your gains are short-term or long-term.

- Your income level: Your overall income, including from sources other than trading, will affect your tax bracket and the rate applied to your gains.

- Your filing status: Whether you file as single, married filing jointly, head of household, etc., also influences your tax bracket.

While it might seem complex, you can use a few methods to estimate your tax liability:

- Conservative Approach: Set aside a percentage of each profitable trade. If your income falls within the lower tax brackets (10-12% federal) and you live in a state without income tax, setting aside 15-20% of your profits might be sufficient. However, those in higher tax brackets (22-37% federal) or high-tax states might need to reserve 30-40% or even more to cover their potential tax liability. High-income individuals may also be subject to the Net Investment Income Tax (NIIT) of 3.8% on certain investment income, including capital gains.

- Tax Software: Utilize tax software or online calculators that consider your income, filing status, and holding periods to provide a more precise estimate.

- Consult a Tax Professional: For personalized guidance, reach out to a qualified CPA. They can help you understand your specific tax situation and optimize your tax strategy.

Example Tax Calculation

Let’s say you’re a California resident making $150,000 in regular income:

- Trading profit: $50,000 (short-term)

- Federal tax bracket: 32%

- California state tax: 9.3%

- NIIT: 3.8%

Total tax obligation:

- Federal: $16,000 (32% of $50,000)

- State: $4,650 (9.3% of $50,000)

- NIIT: $1,900 (3.8% of $50,000)

- Total: $22,550 (45.1% effective rate)

This illustrates why high-income traders in high-tax states need to set aside 40-45% of profits.

Practical Tips for Setting Aside Taxes

Separate Account: Open a separate savings account specifically for tax payments. This helps you avoid accidentally spending the money intended for taxes.

Automated Transfers: Set up automatic transfers to your tax savings account after each profitable trade.

Quarterly Payments: Consider making estimated tax payments quarterly to avoid penalties for underpayment. These payments are typically due on April 15th, June 15th, September 15th, and January 15th of the following year. You can use Form 1040-ES, Estimated Tax for Individuals, to calculate and pay your estimated taxes. To avoid underpayment penalties, aim to pay either 100% of your prior year’s tax liability or 90% of your current year’s tax liability through withholding and estimated tax payments.

Reporting Your Stock Trades

When it comes to tax time, you’ll need to report your stock trades to the IRS. This involves using Form 8949, Sales and Other Dispositions of Capital Assets, to list each transaction. You’ll then summarize these gains and losses on Schedule D, Capital Gains and Losses, which is attached to your Form 1040. Your broker will provide you with Form 1099-B, Proceeds From Broker and Barter Exchange Transactions, to help you with this reporting. It’s crucial to keep good records of your trades, including dates, purchase prices, and selling prices, as brokers may not always report your cost basis accurately.

State Tax Implications

Remember that in addition to federal taxes, you may also owe taxes to your state on your stock trading profits. State tax rates and rules vary, so it’s essential to understand your state’s specific requirements.

Multi-State Considerations

If you trade while living in or traveling between multiple states, you may need to apportion your trading income between states. This can affect:

- Which state(s) can tax your trading income

- What tax rates apply

- What deductions are available

Keep detailed records of where you were when executing trades.

A Note on Tax Preparation Software

While tax preparation software can be helpful for many taxpayers, it’s important to be aware of its limitations. If you’re an active trader with complex situations, such as wash sales across multiple accounts, options trading, or cryptocurrency transactions, you may benefit from professional tax preparation services. A CPA can ensure accurate reporting, identify potential deductions, and help you navigate any complexities in your tax situation.

Quick Reference: Tax Document Timeline

| Month | Action |

|---|---|

| January | Receive Form 1099-B from brokers. |

| April 15 | Q1 estimated tax payment due. Previous year’s tax return due. |

| June 15 | Q2 estimated tax payment due. |

| September 15 | Q3 estimated tax payment due. |

| January 15 | Q4 estimated tax payment due. |

FAQs

Do I have to pay taxes on every stock trade?

No, you only owe taxes when you sell a stock for a profit. If you sell at a loss, you might be able to use that loss to offset other gains or even deduct it from your ordinary income (up to certain limits).

What if I reinvest my profits without withdrawing them?

Even if you reinvest your profits, you still owe taxes on the realized gains in the year the sale occurred.

Are there any strategies to minimize taxes on stock trading?

Yes, there are several strategies, such as tax-loss harvesting (selling losing stocks to offset gains). Be mindful of the wash sale rule, which disallows a loss if you repurchase the same or a substantially identical security within 30 days before or after the sale. While capital losses can offset capital gains, you can only deduct up to $3,000 of net capital losses against your other income each year. Any excess losses can be carried forward to future years. Other strategies include holding stocks for longer than a year to qualify for lower long-term capital gains rates and utilizing tax-advantaged retirement accounts. However, it’s essential to consult with a tax professional before implementing any tax strategies.

What happens if I don’t pay enough taxes on my trading profits?

You may be subject to penalties and interest on the underpayment. It’s crucial to estimate your tax liability accurately and make timely payments.

When do I have to pay taxes quarterly versus annually?

The requirement for quarterly tax payments depends on your expected tax liability. Here’s a breakdown:

You MUST make quarterly estimated tax payments if BOTH:

1. You expect to owe $1,000 or more in taxes for the year, AND

2. Your withholding and credits will cover less than:

– 90% of your tax liability for the current year, OR

– 100% of your tax liability from the previous year (110% if your AGI was over $150,000)

Connecting with XOA TAX

Navigating the complexities of capital gains taxes can be challenging, especially for active traders. At XOA TAX, our experienced CPAs can provide personalized guidance and help you optimize your tax strategy. We can assist with:

- Estimating your tax liability on trading profits

- Developing a tax-efficient investment plan

- Preparing and filing your tax returns

- Answering any questions you have about taxes on investments

Contact us today to schedule a consultation and learn how we can help you achieve your financial goals while minimizing your tax burden.

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime