Hey there, fellow learners! We get it – juggling classes, exams, and maybe even a part-time job is a lot. Now, throw taxes into the mix, and things can get really confusing! But don’t worry, we’re here to help. At XOA TAX, we believe that understanding your taxes shouldn’t be another test you have to stress over. So, let’s break down some common tax situations students face and how to handle them.

Key Takeaways

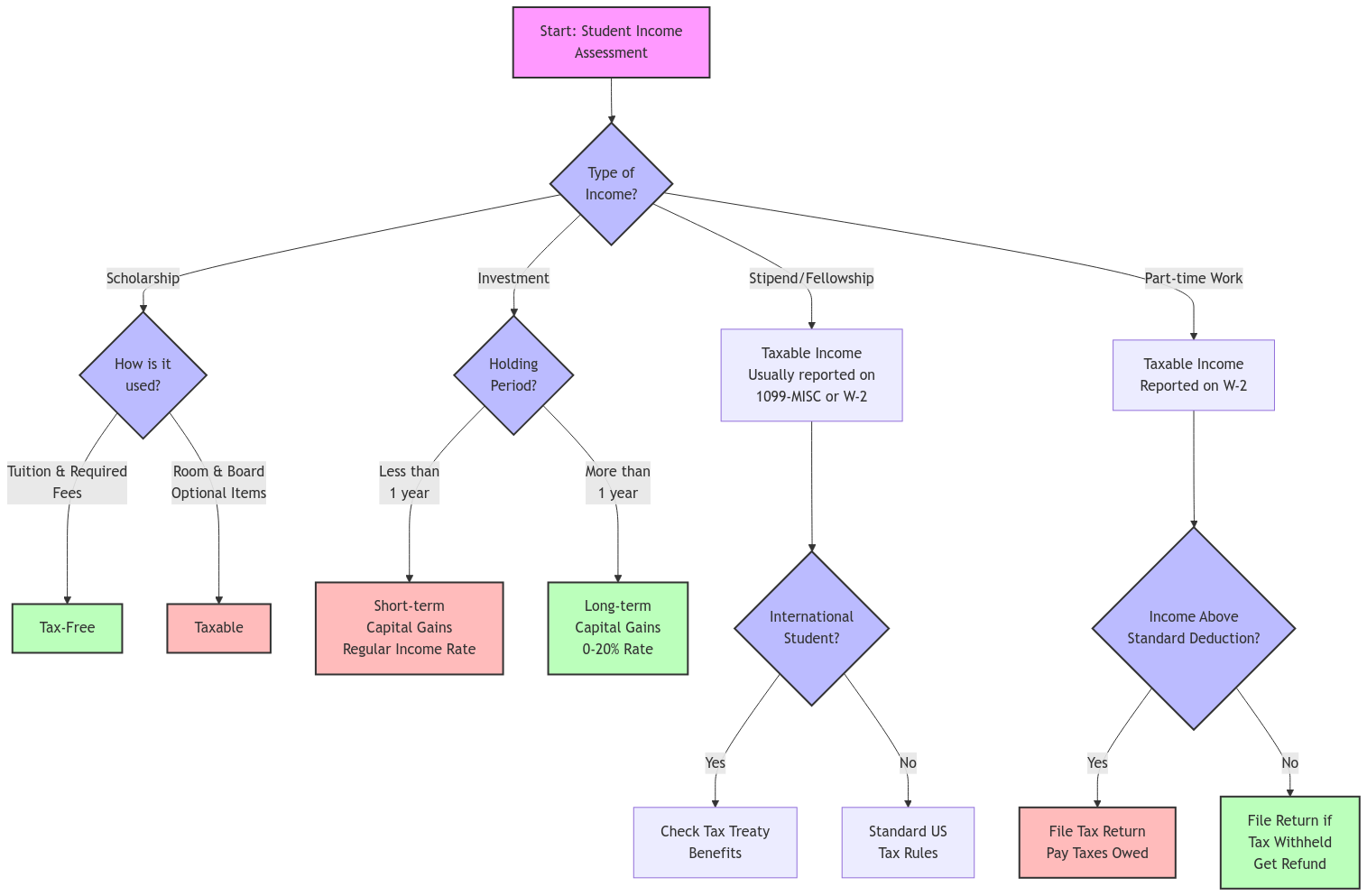

- Stipends are usually taxable: That’s right, the money you receive for research or teaching assistantships is often considered income.

- Scholarships can be tricky: Some scholarships are tax-free, but others aren’t. We’ll show you the difference.

- Investments have tax implications too: Even “playing around” with stocks can have tax consequences.

Types of Income and Their Tax Treatment

| Income Type | Tax Treatment | Required Forms | Key Notes |

|---|---|---|---|

| Stipends | Taxable Income | W-2 or 1099-MISC | May require estimated tax payments if no withholding |

| Scholarships (Qualified) | Tax-Free | 1098-T | Must be used for tuition, fees, books |

| Scholarships (Non-Qualified) | Taxable Income | 1098-T | Room, board, travel expenses |

| Work-Study | Taxable Income | W-2 | Treated as regular employment income |

| Teaching Assistantship | Taxable Income | W-2 | Usually includes tax withholding |

Understanding Stipends

Think of a stipend like a part-time job. You’re providing a service (like teaching or research) and getting paid for it. This means your stipend is usually taxable income. You’ll likely receive a W-2 form from your university, and you’ll need to report this income on your tax return.

Example: Let’s say you’re a graduate student and receive a $20,000 stipend for your teaching assistantship. This $20,000 will be considered taxable income, just like if you earned it working at a local store.

But wait, there’s more! Sometimes, you might receive a fellowship instead of a traditional assistantship. In this case, your income might be reported on a 1099-MISC instead of a W-2. It’s important to check your tax forms carefully to know what kind of income you’ve received.

And if you’re an international student, you might be eligible for tax treaty benefits that can reduce or eliminate your tax liability. You can find more information about tax treaties on the IRS website (www.irs.gov).

Decoding Scholarships

Scholarships can be a bit more complex. Here’s the simple breakdown:

- Tax-free scholarships: If your scholarship is used to pay for qualified education expenses, like tuition and required fees, it’s usually tax-free.

- Taxable scholarships: If your scholarship covers things like room and board, travel, or optional equipment, that portion may be taxable.

Example: You receive a $10,000 scholarship. $6,000 goes towards tuition, and $4,000 covers your dorm expenses. The $6,000 for tuition is tax-free, but you may need to pay taxes on the $4,000 used for room and board.

Important Note: Your university will send you a Form 1098-T, which reports your qualified education expenses and any scholarships you received. Make sure to keep this form handy when you’re filing your taxes!

Don’t Forget the Credits!

Did you know that you might be able to claim the American Opportunity Tax Credit (AOTC) or the Lifetime Learning Credit (LLC) even if you have a scholarship? These credits can help offset your tax liability, even if your scholarship covers some of your tuition. You can find more information about these credits on the IRS website or by talking to a tax professional.

Investing 101 (and the Taxes That Come with It)

Even if you’re just starting out, it’s awesome that you’re exploring the world of investments! But remember, there are tax implications here too.

Dividends: If you earn dividends from stocks, you’ll need to report this on your tax return. You’ll receive a Form 1099-DIV from your brokerage firm showing the amount of dividends you earned.

Capital Gains: If you sell stocks for a profit, you’ll have a capital gain. The tax rate on your capital gain depends on how long you held the stock:

- Short-term capital gains (held for less than a year): Taxed at your ordinary income tax rate.

- Long-term capital gains (held for more than a year): Taxed at a lower rate.

Kiddie Tax: If you’re a dependent student and have significant investment income, the “kiddie tax” rules might apply. This means some of your investment income might be taxed at your parents’ tax rate. You can find more information in IRS Publication 929, Tax Rules for Children and Dependents.

Short-term vs Long-term Capital Gains Tax Rates (2023)

| Type | Holding Period | Tax Rate | Special Considerations |

|---|---|---|---|

| Short-term | Less than 1 year | Regular income tax rate (10-37%) | Added to regular income |

| Long-term | More than 1 year | 0% (Income up to $44,625) 15% ($44,626-$492,300) 20% ($492,301+) |

Rates shown for single filers |

Why Am I Paying Self-Employment Tax?

This is a great question, and it’s where a lot of students get confused.

Here’s the deal: Most stipends from universities for teaching or research assistantships are not considered self-employment income. You should receive a W-2, not a 1099-MISC.

However, some fellowships and grants might be considered self-employment income. This is more common if you receive a grant for independent research or a fellowship that doesn’t involve direct employment by the university.

- W-2 Income: If you receive a W-2, you’re generally an employee of the university and don’t need to worry about self-employment tax.

- 1099-MISC Income: If you receive a 1099-MISC, you might be considered an independent contractor and may need to pay self-employment tax.

- Grant Income: If you receive grant income, you might need to file Schedule C with your tax return and pay self-employment tax.

If you’re unsure whether you should be paying self-employment tax, it’s always a good idea to talk to a tax professional.

What’s a CP2000 Notice?

A CP2000 notice from the IRS can seem scary, but it’s not the end of the world. It just means the IRS has found a mismatch between the information on your tax return and what they have on file. This often happens with income that’s reported to the IRS, like your stipend.

What to do if you receive a CP2000:

- Don’t panic! Read the notice carefully. It will explain the discrepancy and how much you might owe.

- Gather your records. Collect any documents that support the information on your original tax return, like your W-2.

- Compare and contrast. See if you made any errors on your return. If you agree with the CP2000, you can simply pay the amount due.

- Disagree? Respond to the notice. The notice will have instructions on how to respond if you disagree with the IRS’s findings.

- Still confused? Get help! Reach out to a tax professional for assistance.

Important Reminders:

- Time Limit: You usually have 30 days to respond to a CP2000 notice.

- Interest and Penalties: If you owe money, interest and penalties may apply if you don’t pay on time.

- Appeal Rights: You have the right to appeal an IRS decision if you disagree with it.

State Tax Obligations

Remember that in addition to federal taxes, you might also have to file a state income tax return. This depends on what state you live in and the type of income you have. Each state has its own tax rules and deadlines, so it’s important to check with your state’s tax agency for specific information.

State vs Federal Tax Obligations

| Aspect | Federal Taxes | State Taxes |

|---|---|---|

| Filing Deadline | April 15th | Varies by state (usually April 15th) |

| Tax Rates | Progressive 10-37% | Varies by state (0-13.3%) |

| Education Credits | AOTC, LLC available | State-specific credits may apply |

| Multiple State Income | Report all US income | May need multiple state returns |

Do I Need to File a Tax Return?

Not all students are required to file a tax return. Whether you need to file depends on your income, filing status, and age. The IRS has specific income thresholds that determine if you need to file. You can find this information on the IRS website or by using the IRS Interactive Tax Assistant tool.

Estimated Taxes

If you have income that isn’t subject to withholding, like self-employment income or investment income, you might need to make estimated tax payments throughout the year. This helps avoid a big tax bill at the end of the year and potential penalties. You can learn more about estimated taxes in IRS Publication 505, Tax Withholding and Estimated Tax.

FAFSA and Your Taxes

Your tax information plays a role in determining your eligibility for financial aid. When you fill out the Free Application for Federal Student Aid (FAFSA), you’ll be asked to provide information from your tax return. This helps determine your Expected Family Contribution (EFC), which is used to calculate how much financial aid you can receive. You can find more information about the FAFSA on the Federal Student Aid website (studentaid.gov).

Student Loan Interest Deduction

Did you know that you might be able to deduct some of the interest you paid on your student loans? The student loan interest deduction allows you to deduct up to $2,500 from your taxable income. This can help reduce your tax bill and make your student loans a little less burdensome. You can find more information about the student loan interest deduction in IRS Publication 970, Tax Benefits for Education. To claim this deduction, you’ll need Form 1098-E from your loan servicer, which shows the amount of interest you paid during the year.

Free Tax Help for Students

Filing your taxes can be confusing, but you don’t have to do it alone! There are resources available to help you, even if you’re on a tight budget. The Volunteer Income Tax Assistance (VITA) program offers free tax preparation services to eligible individuals, including students. You can find a VITA site near you on the IRS website.

A Simple Tax Calculation Example

Let’s say you’re a single student with a part-time job and you earned $12,000 for the year. You also received a $5,000 scholarship, all of which went towards your tuition.

Here’s how your taxes might look:

- Income: $12,000 (from your job)

- Standard Deduction: $13,850 (for 2023)

- Taxable Income: $0 (Your standard deduction is higher than your income)

- Tax Liability: $0 (Since your taxable income is $0, you don’t owe any federal income tax)

This is a simplified example, and your situation might be different. But it illustrates how the standard deduction can help reduce your tax liability, even if you have some income.

Keep Good Records!

Keeping good records is essential when it comes to taxes. Make sure to keep all your tax documents organized and in a safe place. This includes your W-2, 1099 forms, 1098-T, and any receipts for deductible expenses. Good record-keeping can make tax time much less stressful and help you avoid problems with the IRS.

E-file Your Taxes

Filing your taxes electronically is the easiest and fastest way to get your tax return to the IRS. E-filing is also more secure than mailing a paper return. The IRS website has a list of IRS-approved e-file providers, including options for free filing if you meet certain income requirements.

Work-Study and Taxes

If you have a work-study job, your earnings are generally considered taxable income, just like a regular part-time job. You’ll receive a W-2 from your employer and will need to report this income on your tax return.

Health Insurance and Taxes

Under the Affordable Care Act, most people are required to have health insurance coverage or pay a penalty. However, there are some exceptions for students, such as being enrolled full-time in a qualifying student health plan. You might also be eligible for a tax credit to help you pay for health insurance. You can find more information about health insurance requirements and tax credits on the Healthcare.gov website.

Frequently Asked Questions About Student Taxes

Do I need to file a tax return as a student?

It depends on your income level and filing status. For 2023, if you’re single and your income is less than $13,850 (the standard deduction), you might not need to file. However, you should still file if:

You had taxes withheld from your paycheck and want a refund

You’re eligible for refundable credits like the American Opportunity Credit

You had self-employment income over $400

You’re required to report scholarship income

What tax forms should I expect to receive as a student?

Common tax forms for students include:

Form W-2 (for jobs and work-study positions)

Form 1098-T (tuition statement)

Form 1098-E (student loan interest)

Form 1099-MISC (some fellowships)

Form 1099-DIV (investment income)

When are my taxes due?

For most students, federal tax returns are due on April 15th. If you have self-employment income, you might need to make quarterly estimated tax payments throughout the year.

Are my scholarships taxable?

It depends on how you use the scholarship money:

Amounts used for qualified education expenses (tuition, required fees, books) are generally tax-free

Amounts used for room, board, travel, or optional expenses are typically taxable

Scholarships that require services (like teaching or research) are usually taxable

Does financial aid affect my taxes?

Different types of financial aid have different tax implications:

Grants and scholarships: May be partially taxable (see above)

Student loans: Not taxable when received, but interest payments may be deductible

Work-study earnings: Taxable as regular income

How do I report scholarship income on my tax return?

Report taxable scholarship amounts on Form 1040 as income. Your 1098-T form will show the total scholarship amount you received, but you’ll need to determine what portion is taxable based on how you used the funds.

Are graduate student stipends taxable?

Yes, stipends are generally taxable income. However, the tax treatment depends on how the stipend is classified:

Teaching/research assistantships usually generate W-2 income

Fellowships might be reported on 1099-MISC

Some portions might be reported as scholarship income

Why didn’t my university withhold taxes from my fellowship?

Universities often don’t withhold taxes from fellowship payments, even though they’re taxable. You might need to:

Make estimated tax payments throughout the year

Set aside money for taxes

Consult with a tax professional about your obligations

I’m an international student. How does that affect my taxes?

International students have special tax considerations:

You might be eligible for tax treaty benefits

Different tax forms may be required (Form 1040-NR)

Special rules apply to scholarships and fellowships

Consult your university’s international student office for guidance

What education tax credits can I claim?

The main education tax credits are:

American Opportunity Tax Credit (AOTC): Up to $2,500 per year for the first four years of undergraduate education

Lifetime Learning Credit (LLC): Up to $2,000 per year, available for undergraduate, graduate, and professional courses

Can I deduct my tuition payments?

The tuition and fees deduction has been replaced by expanded education credits. Focus on claiming the AOTC or LLC instead.

Can I deduct my student loan interest?

Yes, you can deduct up to $2,500 in student loan interest payments per year if you meet income requirements. You’ll receive Form 1098-E showing how much interest you paid.

What if I receive a CP2000 notice from the IRS?

A CP2000 notice means there’s a discrepancy between your tax return and information the IRS received. To handle it:

Read the notice carefully

Compare it with your records

Respond within 30 days

Pay any amount due or dispute the notice if you disagree

Seek professional help if needed

What if I have income from multiple states?

You might need to file multiple state tax returns if you:

Attended school in one state and worked in another

Had internships or jobs in different states

Moved between states during the tax year

How long should I keep my tax records?

Keep tax records for at least 3 years from the date you filed or the due date, whichever is later. For education-related expenses, consider keeping records longer to support credits claimed over multiple years.

What if I made a mistake on my tax return?

If you discover an error, you can file an amended return using Form 1040-X. Generally, you have three years from the original filing date to amend a return.

Do I need to report health insurance on my taxes?

While the federal penalty for not having health insurance has been eliminated, some states still have coverage requirements. You might need to:

Report coverage on your state tax return

Claim Premium Tax Credits if you purchased insurance through the marketplace

Consider whether you’re covered under your parents’ plan (allowed until age 26)

Can I get tax credits for health insurance?

If you purchase insurance through the Health Insurance Marketplace, you might be eligible for Premium Tax Credits to help cover the cost. These credits are based on your income and family size.

Feeling Overwhelmed? XOA TAX is Here to Help!

We know that taxes can be a lot to handle, especially when you’re busy with school. If you’re feeling lost or confused, don’t hesitate to reach out to us at XOA TAX. We’re experts at making taxes simple and stress-free, and we’re always happy to help students navigate their tax obligations.

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime