Are you ready to embark on your investing journey but feel a bit lost when it comes to the tax implications? Don’t worry, you’re not alone! Many investors find themselves scratching their heads when trying to understand how taxes can affect their investment returns. That’s where tax-efficient investing comes in.

In this comprehensive guide, we’ll break down the essentials of tax-efficient investing, empowering you to make informed decisions and keep more of your hard-earned money. We’ll explore various investment types and their tax implications, share valuable tips for minimizing your tax liability, and provide real-world examples to illustrate the power of tax-advantaged investing.

Whether you’re a complete beginner or have some investing experience, this guide will equip you with the knowledge and strategies you need to navigate the world of investing while keeping your taxes in check. So, let’s dive in and discover how you can make your money work smarter, not harder!

Key Takeaways

- Understanding tax implications: can significantly impact investment returns.

- Different investment types: have varying tax treatments.

- Strategic asset location: can enhance after-tax returns.

- State taxes: matter as much as federal taxes.

- Professional guidance: is crucial for optimal tax efficiency.

What is Tax-Efficient Investing?

Think of tax-efficient investing as a strategy to minimize the tax bite on your investment gains. It’s about making savvy choices that allow your money to grow faster while keeping more of it in your pocket.

2024 Tax Brackets Quick Reference

Long-Term Capital Gains Rates:

- 0%: Income up to $47,025 (single), $94,050 (married)

- 15%: Income up to $518,900 (single), $583,750 (married)

- 20%: Income above these amounts

Different Investment Types and Their Tax Implications

Not all investments are created equal in the eyes of the taxman. Understanding these differences can significantly impact your returns. Let’s explore some common investment types:

- Stocks: When you sell stocks for a profit, you’ll have a capital gain. These are taxed at different rates depending on how long you held the stock. Hold for over a year? That’s a long-term gain, taxed at a lower rate. Sell within a year? That’s a short-term gain, taxed at your regular income tax rate.

- Bonds: Interest earned on most bonds is typically taxed as ordinary income.

- Mutual Funds: These can be a bit trickier. They can generate both capital gains and dividends, each with its own tax implications.

- ETFs (Exchange-Traded Funds): These are similar to mutual funds but often more tax-efficient due to how they are structured and traded.

- Dividends: There are two main types: qualified dividends, which are taxed at the lower capital gains rates, and non-qualified dividends, taxed as ordinary income.

- Real Estate: Rental income from properties is taxed as ordinary income, while profits from selling a property are considered capital gains.

- Municipal Bonds: Issued by state and local governments, these often offer tax-free interest income, making them a popular choice for tax-efficient investing. To compare them with taxable bonds, look at the tax-equivalent yield, which shows the interest rate a taxable bond would need to offer to provide the same after-tax return.

- Health Savings Accounts (HSAs): These offer a triple tax advantage – contributions are tax-deductible, the money grows tax-free, and withdrawals for qualified medical expenses are tax-free. For 2024, you can contribute up to $4,150 for individuals and $8,300 for families.

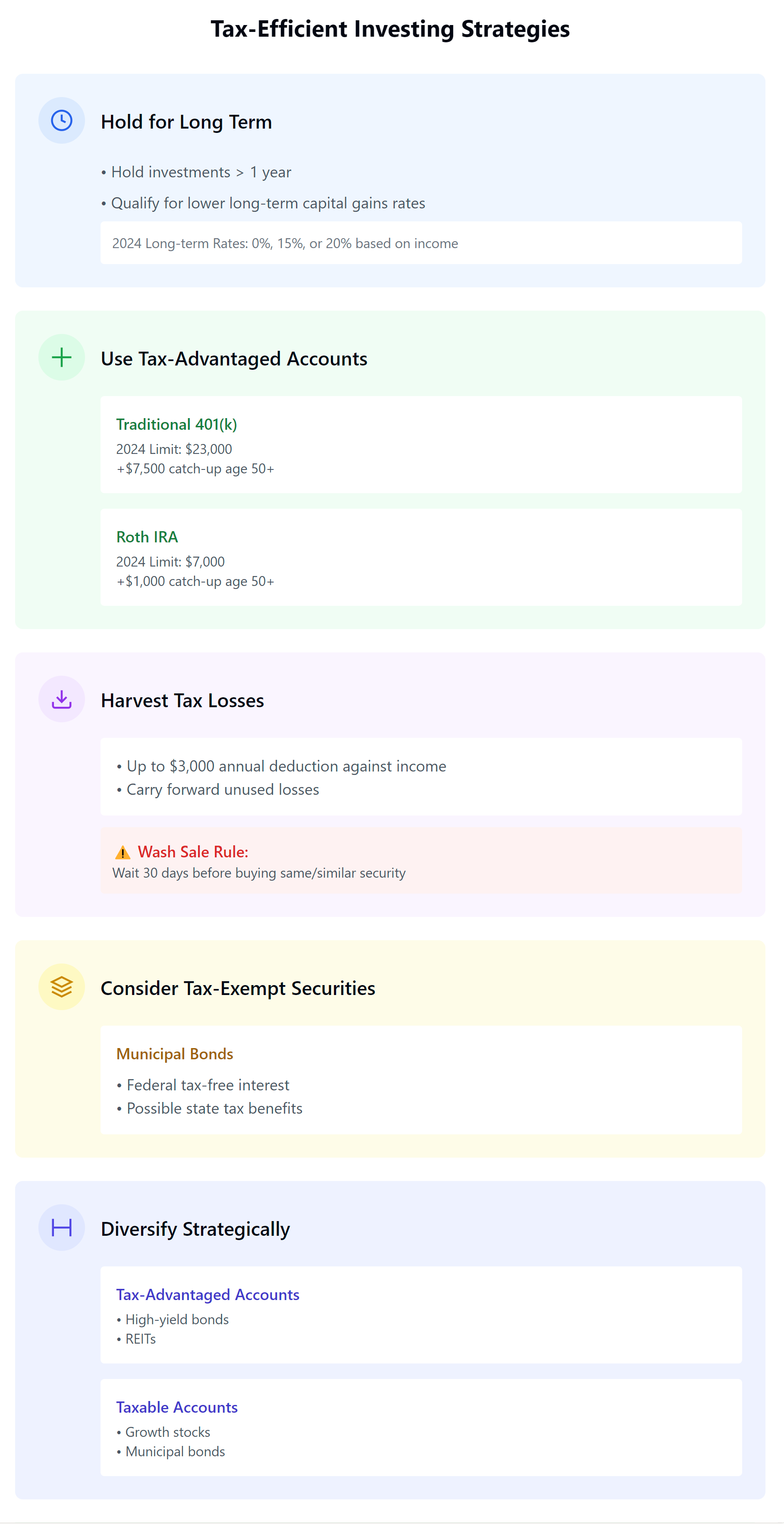

Tips for Tax-Efficient Investing

Here are some strategies to help you reduce your tax liability and keep more of your hard-earned money:

- Invest for the Long Term: As mentioned earlier, holding investments for longer than a year can qualify you for lower long-term capital gains tax rates.

- Consider Tax-Advantaged Accounts: Retirement accounts like 401(k)s and IRAs offer tax benefits that can significantly boost your savings. For 2024, you can contribute up to $23,000 to your 401(k) and $7,000 to your IRA, with catch-up contribution limits of $7,500 for 401(k)s and $1,000 for IRAs if you’re 50 or older.

- Traditional vs. Roth: With Traditional accounts, your contributions are tax-deductible now, but you’ll pay taxes on withdrawals in retirement. With Roth accounts, you contribute after-tax money, but qualified withdrawals in retirement are tax-free.

- Roth IRA Income Limits: There are income limits to contributing to a Roth IRA. If your income exceeds these limits, consider a “backdoor Roth IRA” strategy (but be sure to consult with a tax professional first!).

- Harvest Your Losses: If you have investments that have lost value, consider selling them to offset capital gains. This can reduce your overall tax liability. Just remember the $3,000 annual limit on capital losses that can be used to offset ordinary income and the “wash sale” rule, which prevents you from repurchasing the same or a substantially identical security within 30 days of selling it at a loss. Any losses exceeding the annual limit can be carried forward to future tax years.

- Invest in Tax-Exempt Securities: Municipal bonds, for example, can provide tax-free interest income.

- Diversify Your Portfolio: Spreading your investments across different asset classes can help manage risk and potentially reduce your tax burden.

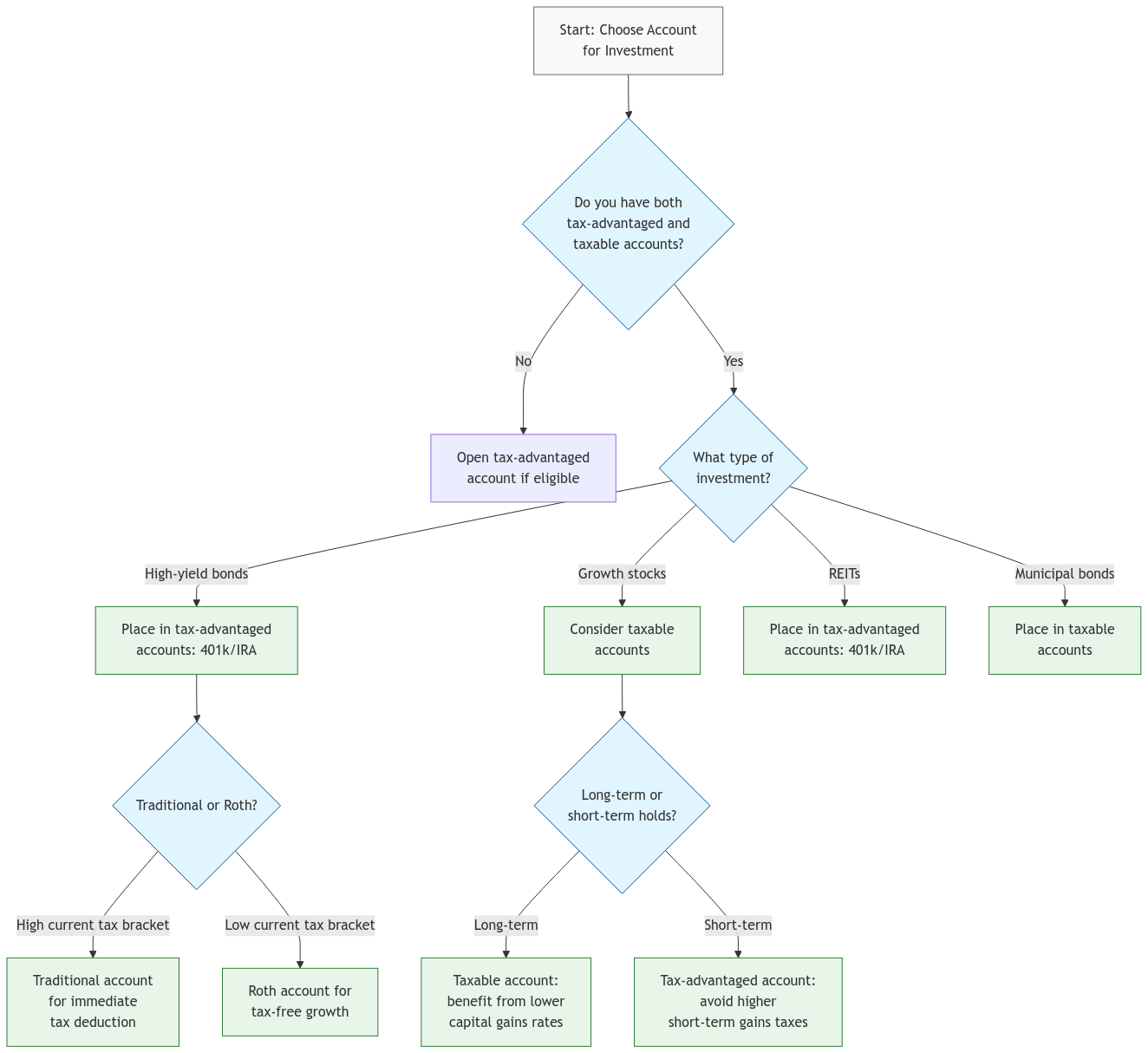

Strategic Asset Location

Think of your investment accounts like different neighborhoods, each with its own tax rules. To maximize your after-tax returns, consider placing:

- High-yield bonds: In tax-advantaged accounts like 401(k)s and IRAs to shelter the interest income from taxes.

- Growth stocks: In taxable accounts since they tend to generate capital gains, which are taxed more favorably than interest income.

- Municipal bonds: In taxable accounts to take advantage of their tax-free interest.

- REITs (Real Estate Investment Trusts): In tax-advantaged accounts, as they often generate high levels of taxable income.

Example: Tax-Free vs. Tax-Deferred vs. Taxable

Let’s compare three scenarios with a $5,000 initial investment over 30 years at 7% growth:

- Taxable Account:

- Initial: $5,000

- After 30 years (assuming 25% tax rate): ~$28,000

- Traditional 401(k):

- Initial: $5,000

- After 30 years: $38,061

- After taxes (22% bracket): ~$29,688

- Roth IRA:

- Initial: $5,000

- After 30 years: $38,061 (all tax-free)

(Note: This is a simplified example and doesn’t account for factors like varying tax rates over time or specific investment choices.)

Investment Growth Comparison

Initial Investment

$5,000

Time Period

30 Years

Annual Growth Rate

7%

Taxable Account

$28,000

After annual taxes on gains

Traditional (Tax-Deferred)

$29,688

After taxes on withdrawal

Roth (Tax-Free)

$38,061

No taxes on qualified withdrawals

Assumptions: 7% annual return, 25% tax rate for Traditional withdrawal, numbers rounded for illustration

State Tax Considerations

Don’t forget about state taxes! They can significantly impact your investment returns.

- State Tax Variations: Some states don’t tax capital gains at all, while others have rates as high as 13.3%.

- Municipal Bonds and State Taxes: Municipal bonds issued by your home state may offer double tax-free benefits – exempt from both federal and state taxes.

- High-Tax vs. Low-Tax States: If you live in a high-tax state, tax-efficient investing strategies become even more crucial.

FAQs

What are the current capital gains tax rates?

Capital gains tax rates vary depending on your income level and how long you’ve held the asset. For 2024, the long-term capital gains rates are 0%, 15%, and 20%, while short-term gains are taxed as ordinary income. You can find the updated 2024 tax brackets for single filers, married couples filing jointly, and heads of household on the IRS website [link to IRS website].

How can I learn more about tax-efficient investing strategies specific to my situation?

We recommend consulting with a qualified financial advisor who can help you create a personalized plan based on your individual needs and goals.

How do state taxes affect investment returns?

State tax implications vary significantly. For example, some states don’t tax capital gains, while others may tax them at rates up to 13.3%. Additionally, municipal bonds from your home state may offer double tax-free benefits (exempt from both federal and state taxes).

What is the Net Investment Income Tax (NIIT)?

The NIIT is an additional 3.8% tax that applies to investment income for individuals with modified adjusted gross income above $200,000 (single) or $250,000 (married filing jointly) in 2024.

Annual Tax-Efficient Investing Checklist

- Review contribution limits for retirement accounts

- Evaluate opportunities for tax-loss harvesting

- Check state tax implications of investments

- Assess asset location strategy

- Review income thresholds for NIIT

Connecting with XOA TAX

We understand that navigating the complexities of tax-efficient investing can be challenging. If you have any questions or need personalized guidance, please don’t hesitate to reach out to us at XOA TAX. Our team of experienced professionals is here to help you make informed decisions and achieve your financial goals.

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Investing involves market risk, including the potential loss of principal. Laws, regulations, and tax rates can change often and vary significantly by state and locality. Past performance does not guarantee future results. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. Individual circumstances vary; what works for one investor may not be appropriate for another. Keep detailed records of all investment transactions for tax purposes. For further guidance, refer to IRS Circular 230. Please consult a qualified professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime