Tax season is here, and we know it can be a busy time. Between gathering all your documents and making sure everything is accurate, it’s easy to feel a bit overwhelmed. But don’t worry—if you need more time to file, you’re not alone! The IRS offers a tax extension that gives you until October 15, 2025, to submit your 2024 tax return.

Think of a tax extension as hitting the ‘pause’ button on tax season. It gives you a chance to catch your breath and provides six extra months to file your federal income tax return. Instead of the standard April 15 deadline, you’ll have until October 15, 2025, to file your 2024 taxes. This option is available to both individuals and many businesses.

Key Deadlines to Remember

- April 15, 2025: The regular deadline to file your 2024 tax return and pay any taxes owed.

- October 15, 2025: The extended deadline if you’ve filed for an extension.

To get this extra time, make sure to submit Form 4868, “Application for Automatic Extension of Time To File U.S. Individual Income Tax Return,” by the regular tax deadline. Keep in mind that if April 15 falls on a weekend or holiday, the deadline might shift to the next business day.

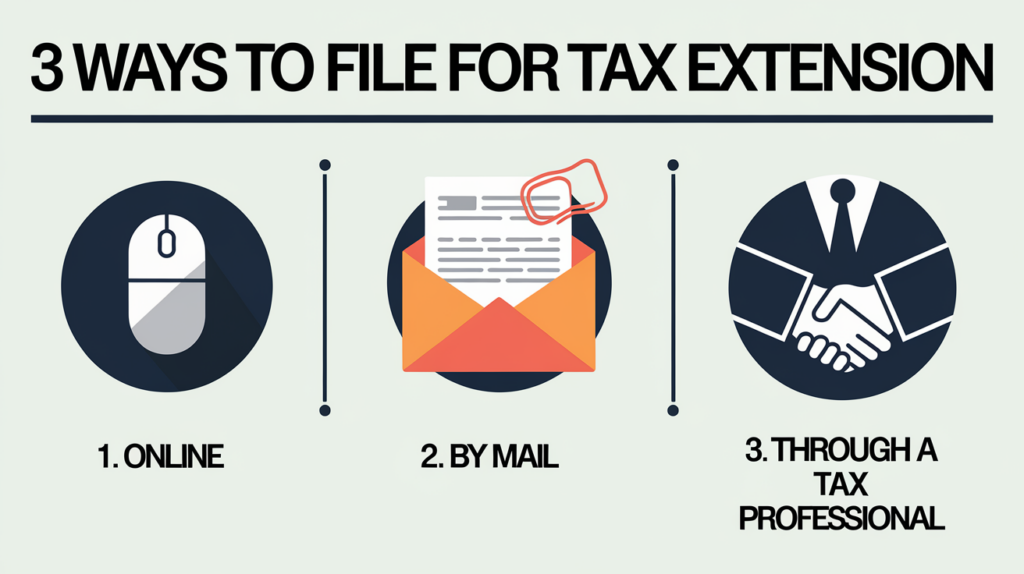

How to File for a Tax Extension

Filing for an extension is easier than you might think. Here are your options:

- Online: The quickest way is to file electronically. You can use the IRS Free File program if you qualify or tax preparation software. Filing online is free, and you’ll get immediate confirmation that your form was received.

- By Mail: If you prefer paper, download Form 4868, fill it out, and mail it to the IRS. Be sure it’s postmarked by April 15, 2025. Consider using certified mail to have proof of mailing.

- With a Tax Professional: At XOA TAX, we can handle the extension process for you. Working with a professional ensures everything is completed accurately and submitted on time.

Important Reminders

- Pay Your Taxes on Time: The extension gives you more time to file your return, but any taxes owed are still due by April 15, 2025. If you think you’ll owe money, estimate the amount and pay it by the deadline to avoid interest and penalties.

- Avoid Late Filing Penalties: Filing by the extended deadline of October 15, 2025, is crucial. Missing this date can result in additional penalties, which can add up quickly.

- Estimate Carefully: When paying estimated taxes, try to be as accurate as possible. Underpaying can lead to penalties, while overpaying ties up your money until you receive a refund.

- Check Your Work: Use the extra time to ensure your return is complete and accurate. Double-check numbers, and make sure you’ve included all income, deductions, and credits.

- Communicate with the IRS if Necessary: If you can’t pay the full amount owed, consider contacting the IRS to discuss payment options, such as installment agreements.

Frequently Asked Questions (FAQ)

What if I can’t pay the full amount I owe by April 15th?

If you can’t pay the full amount by April 15, you should still file your return or extension and pay as much as you can. The IRS offers payment plans that allow you to pay off your tax debt over time. This can help you avoid additional penalties and interest.

How can I estimate my tax liability?

You can use last year’s tax return as a starting point or use the IRS’s Tax Withholding Estimator. Tax preparation software can also help you estimate your tax liability based on your current income and deductions.

Will filing an extension increase my chances of an audit?

No, filing an extension does not increase your chances of being audited. The IRS doesn’t penalize taxpayers for taking the extra time allowed by law to file a complete and accurate return.

What happens if I don’t file my taxes by the extended deadline?

Failing to file by October 15 can lead to penalties, including late filing fees and interest on any unpaid taxes. The late filing penalty is usually 5% of the unpaid taxes for each month or part of a month your return is late, up to a maximum of 25%.

Can I get an extension to pay my taxes as well?

While an extension gives you more time to file, it doesn’t extend the deadline to pay your taxes. However, the IRS offers payment plans for those who can’t afford to pay their full tax liability by the April deadline.

Do I need to provide a reason for requesting an extension?

No, the IRS grants automatic extensions to taxpayers who request them by the April 15 deadline. You don’t need to provide a reason.

Can I file an extension if I’m out of the country?

Yes, U.S. citizens and residents living abroad are generally allowed an automatic two-month extension to file their tax returns until June 15. You can also request an additional extension until October 15 by filing Form 4868. Remember, any taxes owed are still due by April 15.

What are the penalties for not paying taxes owed by April 15?

If you don’t pay the taxes you owe by April 15, interest will accrue on the unpaid amount, and you may be subject to a failure-to-pay penalty, usually 0.5% of the unpaid taxes for each month or part of a month the tax remains unpaid, up to a maximum of 25%.

How do state tax deadlines align with federal deadlines?

State tax filing deadlines and extension rules can differ from federal ones. Check with your state’s tax agency to confirm their deadlines and procedures.

Tips for a Smooth Tax Season

- Organize Your Documents Early: Start gathering W-2s, 1099s, receipts, and other financial records as soon as they become available.

- Set Aside Time for Tax Preparation: Don’t wait until the last minute. Set aside dedicated time to work on your taxes or consult with a professional.

- Use Reliable Tax Software or Professionals: Consider using reputable tax software or working with a tax professional to help you navigate complex tax situations.

- Stay Informed About Tax Law Changes: Tax laws can change from year to year. Make sure you’re aware of any new deductions, credits, or regulations that might affect your return.

- Consider Adjusting Your Withholding: If you owed a significant amount or received a large refund last year, you might want to adjust your withholding to better match your tax liability.

Need Help?

Feeling stressed about tax season? Let XOA TAX help! We can assist with filing an extension, estimating your tax liability, and ensuring your return is accurate and complete. Contact us today for a free consultation.

- Website: https://www.xoatax.com/

- Phone: +1 (714) 594-6986

- Email: [email protected]

- Contact Page: https://www.xoatax.com/contact-us/

Don’t wait until the last minute! Gather your tax documents and either file for an extension or submit your return by the April 15th deadline.

Disclaimer: This post is intended for informational purposes only and does not constitute legal, tax, or financial advice. Laws, regulations, and tax rates are subject to change. Readers are encouraged to consult professional advisors to address their specific circumstances.

anywhere

anywhere  anytime

anytime