As a CPA at XOA TAX, I often guide clients on maximizing their investment returns while minimizing their tax liability. Tax loss harvesting is a powerful tool to achieve this. It’s a strategy where you sell investments that have declined in value to offset gains in your portfolio. This can significantly reduce your tax bill and potentially boost your overall returns.

Think of it this way: you’re strategically using market fluctuations to your advantage. While the concept is straightforward, the execution can be tricky. That’s why I’ve put together this updated guide to walk you through tax loss harvesting in 2024.

Key Takeaways

- Tax loss harvesting involves selling investments that have lost value to offset capital gains.

- It can reduce your current tax liability and improve after-tax investment returns.

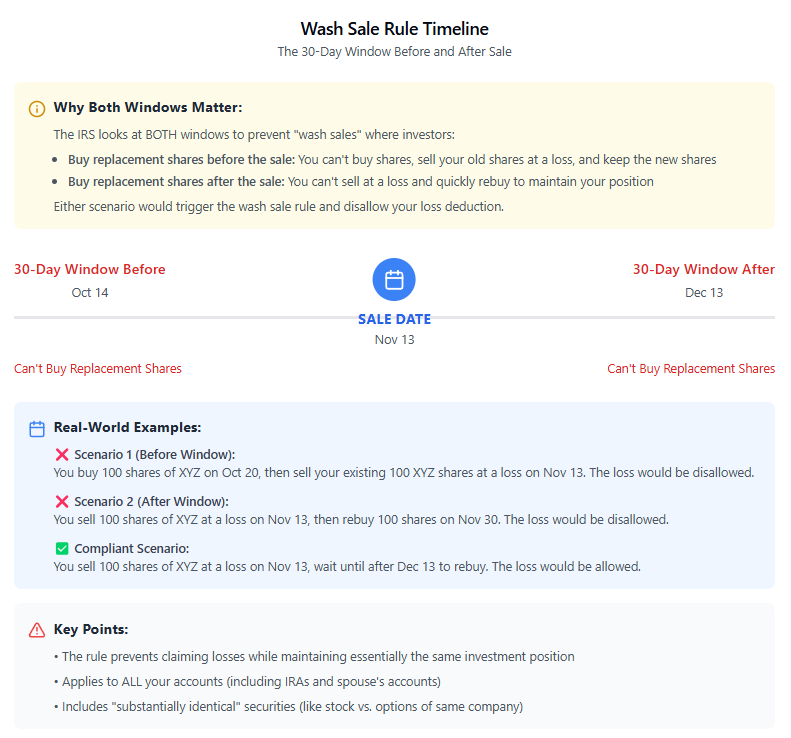

- The wash sale rule prohibits repurchasing the same security within 30 days of selling it at a loss.

- Tax loss harvesting should align with your overall investment goals and risk tolerance.

How Tax Loss Harvesting Works

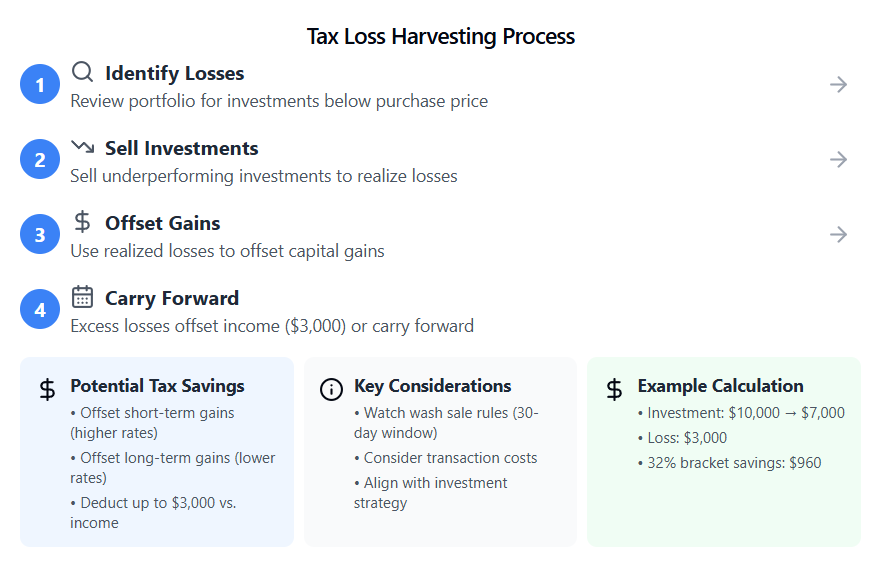

- Identify Losing Investments: Regularly review your portfolio (at least quarterly) to identify investments that have dropped in value. This could include stocks, bonds, mutual funds, Exchange-Traded Funds (ETFs), or even Real Estate Investment Trusts (REITs).

- Sell the Losers: Once you’ve identified these underperforming assets, it’s time to sell them. Timing can be important. Selling towards the end of the year may offer immediate tax benefits when you file your return.

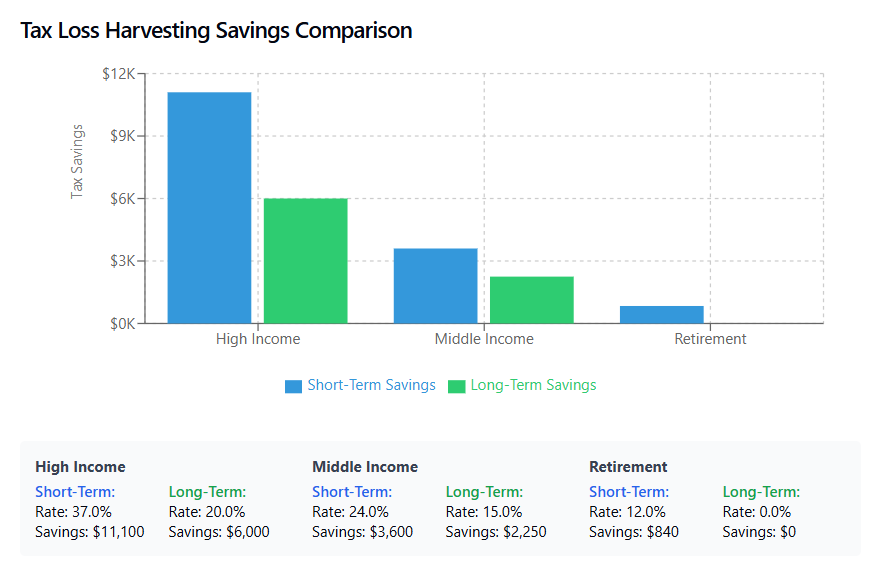

- Offset Gains: Use the losses you’ve realized to offset any capital gains from other investments. Prioritize offsetting short-term gains first, as they’re taxed at higher ordinary income tax rates.

- Carry Forward Losses: If your losses exceed your gains for the year, you can use up to $3,000 to offset ordinary income, such as wages. Any remaining losses can be carried forward indefinitely to future tax years.

Benefits of Tax Loss Harvesting

Reduced Tax Liability: This is the most direct benefit. By offsetting gains, you’ll pay less in taxes. For example, if you have $10,000 in capital gains and a 20% tax rate, you would owe $2,000 in taxes. However, if you realize $5,000 in losses through tax loss harvesting, your taxable gains would be reduced to $5,000, and your tax liability would drop to $1,000.

Improved After-Tax Returns: Lower taxes mean more money stays invested and working for you. Imagine you save $1,000 in taxes through tax loss harvesting. If you reinvest that $1,000 and it earns a 7% annual return, it will grow to over $1,967 in 10 years, thanks to the power of compounding.

Portfolio Rebalancing: Tax loss harvesting presents an opportunity to rebalance your portfolio and ensure it still aligns with your investment goals and risk tolerance. By selling losing investments, you can free up capital to invest in other assets that better fit your current strategy.

Potential Drawbacks to Consider

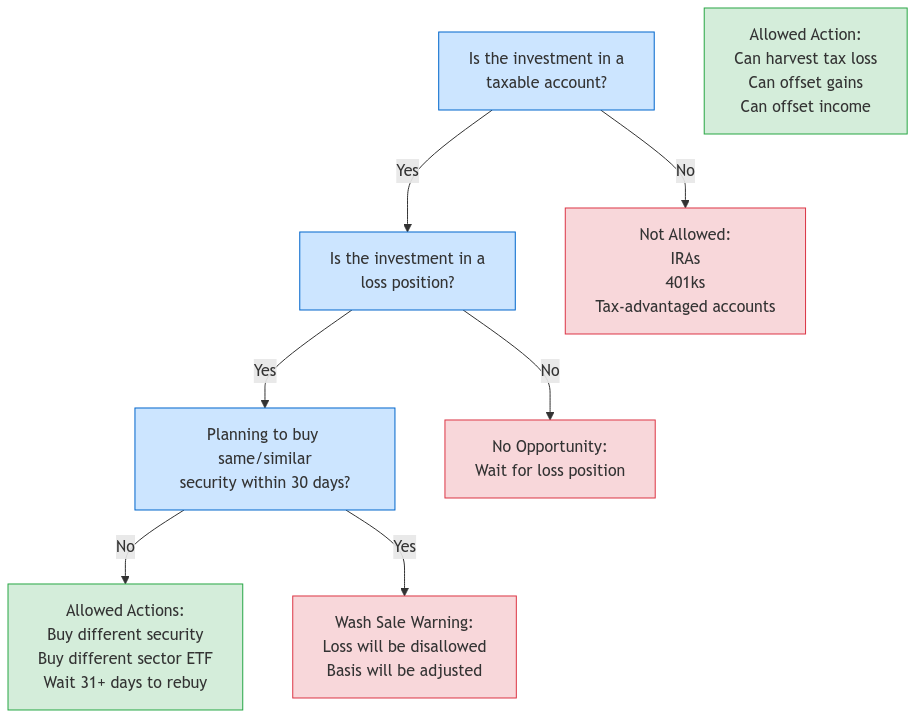

- Wash Sale Rule: You can’t repurchase the same security or a “substantially identical” one within 30 days of selling it at a loss. This is a crucial rule to keep in mind. If you violate the wash sale rule, the IRS will disallow the loss, and you won’t be able to use it to offset gains.

- Transaction Costs: Frequent trading can lead to transaction costs, such as brokerage commissions and bid-ask spreads, which can eat into your returns. Be mindful of these costs and consider whether the potential tax benefits outweigh them.

- Market Timing Risks: Selling an investment for tax purposes might mean missing out if it rebounds in value. It’s essential to balance tax considerations with your long-term investment strategy.

Understanding “Substantially Identical” Securities

The wash sale rule can be tricky. It prohibits buying “substantially identical” securities within 30 days of a sale. But what does that mean exactly? It generally refers to securities with the same fundamental characteristics. For example, selling shares of Apple stock and then immediately buying shares of an Apple exchange-traded fund (ETF) that tracks the stock could trigger the wash sale rule. However, selling shares of a broad market index ETF and buying shares of an ETF that tracks a different index likely wouldn’t. If you’re unsure whether two securities are considered substantially identical, it’s always best to consult with a tax professional.

Advanced Strategies

- Dynamic Harvesting: This involves continuously monitoring your portfolio and harvesting losses as they occur throughout the year, rather than waiting until the end of the year. This approach can be more proactive and potentially capture more tax benefits.

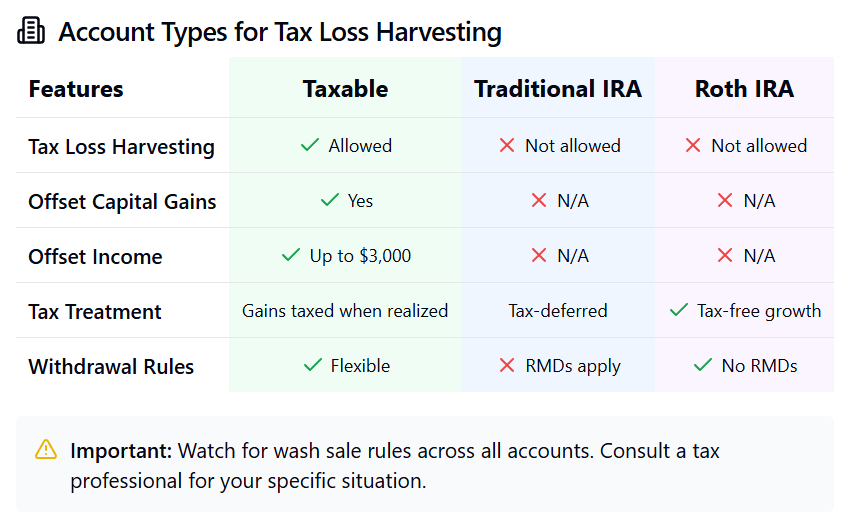

- Tax-Advantaged Accounts: While you can’t harvest losses in accounts like Roth IRAs and Traditional IRAs, consider other strategies like Roth conversions to optimize your overall tax efficiency.

Tax Loss Harvesting in Different Account Types

- Taxable Brokerage Accounts: This is where tax loss harvesting is most effective. Losses realized in taxable accounts can directly offset both capital gains and ordinary income.

- Traditional and Roth IRAs: Tax loss harvesting generally doesn’t apply to these accounts because they are tax-advantaged. Any investment gains and losses within these accounts are not taxed until retirement (Traditional IRA) or are tax-free (Roth IRA).

- 401(k) Plans: Similar to IRAs, you can’t harvest losses in 401(k)s. These are also tax-advantaged retirement accounts, and gains are not taxed until withdrawn in retirement.

Case Studies

- High-Net-Worth Individual: Emily, in the 35% tax bracket, realizes $50,000 in short-term capital gains from selling stock. This means her gains are taxed at her ordinary income tax rate of 35%. She offsets $30,000 of these gains by selling other investments that have declined in value, saving $10,500 in taxes ($30,000 loss x 35% tax rate).

Note: The $3,000 loss limit against ordinary income is per tax year for married filing jointly and single filers. The limit is $1,500 for married filing separately.

- Retiree: Robert, in the 12% tax bracket, realizes $5,000 in long-term capital gains from selling a bond. He also has $7,000 in losses from underperforming stocks. He sells the stocks, offsetting the $5,000 gain and using $2,000 of the remaining loss to offset ordinary income. This results in tax savings of $990 ($5,000 gain x 15% long-term capital gains rate + $2,000 loss x 12% ordinary income rate).

Important: Wash sale rules apply across all your accounts, including your spouse’s accounts and IRAs. This means that if you sell a security at a loss in your taxable brokerage account and your spouse repurchases the same security in their IRA within 30 days, the wash sale rule will be triggered, and the loss will be disallowed.

State Tax Implications

It’s important to remember that state tax laws regarding capital gains and losses can differ from federal laws. Here are a few examples:

- California: California does not conform to the federal treatment of capital gains and losses. It taxes long-term capital gains at the same rate as ordinary income, which can make tax loss harvesting less beneficial for California residents.

- New York: New York allows you to deduct capital losses against ordinary income, but it limits the deduction to $10,000 per year.

- Pennsylvania: Pennsylvania does not allow you to deduct capital losses.

Be sure to consult your tax advisor or research your state’s specific regulations to understand how tax loss harvesting may apply to your situation.

Documentation is Key

Maintaining detailed records of your tax loss harvesting transactions is crucial. This includes:

- Trade confirmations: Keep records of all buy and sell orders, including dates, quantities, and prices.

- Account statements: Regularly review and save your brokerage account statements.

- Worksheet: Consider using a spreadsheet or tax software to track your gains, losses, and wash sales.

Proper documentation will not only help you accurately report your gains and losses on your tax return but also support your claims in case of an IRS audit.

![]()

Working with a Tax Professional

Tax loss harvesting can be complex, especially if you have a large portfolio or engage in frequent trading. Consider consulting with a qualified tax professional, like the CPAs at XOA TAX. We can help you:

- Develop a personalized tax loss harvesting strategy.

- Navigate the wash sale rule and other tax regulations.

- Identify potential tax-saving opportunities.

- Ensure proper documentation and compliance.

Coordinating with a Financial Advisor

While we at XOA TAX can provide expert tax guidance, coordinating with a financial advisor can be beneficial for a holistic approach. They can help ensure your tax loss harvesting strategy aligns with your overall investment goals and risk tolerance. A financial advisor can also help you identify other potential tax-saving opportunities and develop a diversified portfolio that minimizes risk and maximizes returns.

Alternative Investment Considerations

Tax loss harvesting isn’t limited to stocks and bonds. It can also apply to alternative investments, such as real estate, collectibles, and precious metals. However, the rules and regulations for these investments can be complex. It’s essential to consult with a tax professional to understand the tax implications of selling alternative investments and how they may impact your overall tax liability.

Portfolio Rebalancing Strategies

Tax loss harvesting can be a valuable tool for rebalancing your portfolio. When you sell losing investments, you can use the proceeds to purchase other assets that better align with your target asset allocation. This can help you maintain a diversified portfolio and manage risk effectively. For example, if your portfolio has become overweighted in technology stocks due to recent market gains, you could sell some of those stocks at a loss and use the proceeds to purchase bonds or stocks in other sectors.

International Investment Considerations

If you invest in international securities, you may be subject to foreign taxes on any capital gains you realize. However, you may be able to claim a foreign tax credit on your U.S. tax return to offset these taxes. It’s important to understand the tax laws of the countries where you invest and how they may impact your overall tax liability.

Behavioral Considerations

Emotions can sometimes get in the way of sound investment decisions. Be aware of biases such as:

- Fear and Regret: Investors may be hesitant to sell losing investments due to fear of missing out on a potential rebound or regret over past decisions.

- Overconfidence: Overconfidence can lead to excessive trading or holding onto losing investments for too long, hoping to “time the market.”

- Anchoring: Investors may anchor to the original purchase price of an investment, making it difficult to objectively assess its current value and potential.

Having a well-defined investment strategy and sticking to it can help you stay disciplined and avoid making emotional decisions.

Conclusion

Tax loss harvesting is a valuable strategy for investors seeking to minimize their tax liability and potentially improve their returns. By understanding the mechanics, benefits, and potential drawbacks, you can make informed decisions that align with your financial goals.

FAQs

What is the wash sale rule?

Can I harvest losses in my IRA?

Where can I learn more about tax loss harvesting?

Get Professional Guidance for Your Tax Planning Needs

At XOA TAX, we understand that managing your taxes can be complicated. We’re here to simplify the process and provide expert advice tailored to your unique circumstances. Whether you’re looking to optimize your investment portfolio, plan for retirement, or simply ensure you’re paying the right amount of taxes, our team can help.

Website: https://bwgv2xepn2kgo7imbfjg-production-sites.xoatax.net/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://bwgv2xepn2kgo7imbfjg-production-sites.xoatax.net/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.