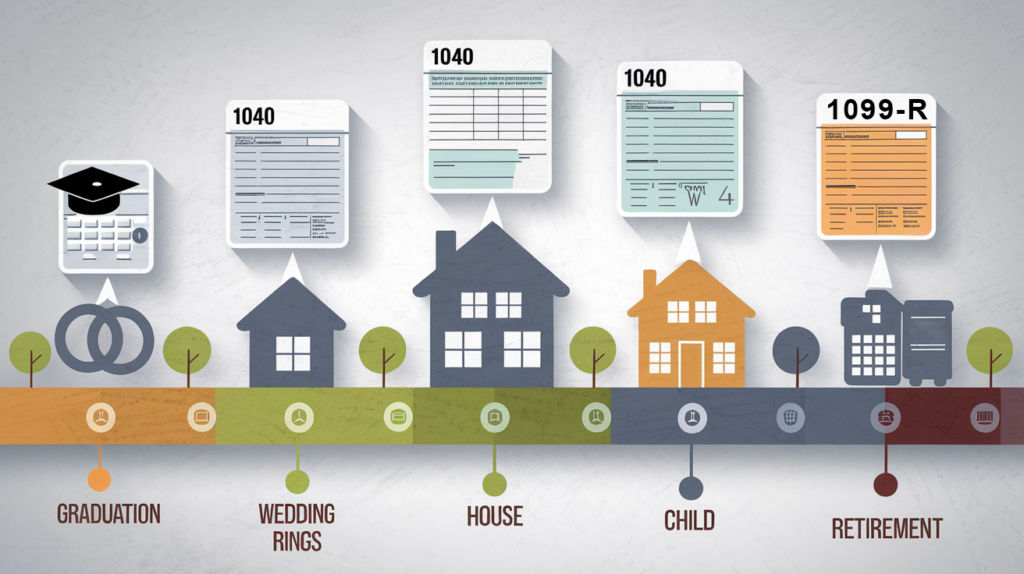

Taxes are a fact of life, but they don’t have to be a constant source of stress. Just like life itself, your tax situation evolves as you move through different stages. This blog post will be your roadmap, outlining key tax considerations for each decade of your adult life, from your adventurous 20s to your well-deserved retirement.

Key Takeaways

- Your tax obligations change as your life unfolds.

- Understanding the tax implications at each stage empowers you to plan proactively.

- Early and consistent tax planning paves the way for long-term financial well-being.

Your 20s: Launching into Adulthood

Your 20s are a time of new beginnings – starting your career, gaining independence, and perhaps even starting a family. While taxes might not be at the forefront of your mind, building good habits now sets the foundation for a secure financial future.

Filing Status

Are you single, married filing jointly, or head of household? Your filing status significantly impacts your tax liability. For example, married couples filing jointly often benefit from a lower tax bracket compared to single filers.

W-4 and Withholding

Make sure your employer withholds the correct amount of taxes from your paycheck. This helps you avoid a surprise tax bill in April and potentially penalties for underpayment. You can adjust your withholding by submitting a new Form W-4 to your employer.

Student Loan Interest Deduction

If you’re paying off student loans, you may be able to deduct up to $2,500 in interest paid. This deduction can help reduce your taxable income, leading to a lower tax bill. (See IRS Publication 970: Tax Benefits for Education for details)

Retirement Savings

Start saving for retirement early! Contributions to a traditional IRA may be tax-deductible, lowering your taxable income now. Remember, the earlier you start saving, the more time your money has to grow. For 2024, the maximum contribution limit for traditional and Roth IRAs is $7,000 ($8,000 if you’re age 50 or older). (For more information, visit the IRS website section on IRA contributions)

Your 30s & 40s: Building Your Nest Egg

As you navigate your 30s and 40s, your career likely progresses, your family might expand, and homeownership may become a reality. These milestones bring new and important tax considerations.

Homeownership

Owning a home comes with potential tax advantages. Mortgage interest and property taxes are often deductible, potentially leading to significant savings. However, with the increase in the standard deduction in recent years, itemizing these deductions might not always be the most beneficial approach. It’s crucial to compare the standard deduction to your potential itemized deductions to determine the best strategy for your situation. (For more information, refer to IRS Publication 530: Tax Information for Homeowners)

Dependents

Children and other qualifying dependents can unlock valuable tax credits and deductions. For the 2024 tax year, the Child Tax Credit is worth up to $2,000 per qualifying child under 17. Keep in mind that many tax benefits, including the Child Tax Credit, are subject to income limitations and phase-outs.

Education Savings

Saving for your children’s education is a priority for many families. Consider opening a 529 plan, a tax-advantaged savings plan specifically designed for education expenses. Contributions grow tax-free, and withdrawals are tax-free when used for qualified education expenses.

Your 50s & 60s: Approaching the Horizon

Retirement may seem distant, but your 50s and 60s are a critical period for fine-tuning your retirement savings and minimizing your future tax burden.

Catch-Up Contributions

Once you reach age 50, the IRS allows you to make “catch-up” contributions to your retirement accounts. This means you can contribute more than the usual limit, helping you boost your retirement savings as you get closer to retirement. For 2024, the catch-up contribution limit for 401(k), 403(b), and most 457 plans is $7,500, and for SIMPLE plans, it’s $3,500.

Tax Diversification

Diversifying your retirement savings across different account types (traditional IRA, Roth IRA, 401(k)) is essential for managing your tax liability in retirement. Each account type has different tax implications for contributions and withdrawals.

Estate Planning

It’s wise to consult with an estate planning attorney to ensure your assets are distributed according to your wishes while minimizing potential estate taxes. The federal estate tax exemption for 2024 is $12.92 million per individual. Remember that estates exceeding this amount may be subject to federal estate tax, and many states also have their own estate tax laws.

Your 70s and Beyond: Enjoying the Fruits of Your Labor

Congratulations! You’ve reached the stage where you can finally relax and enjoy the retirement you’ve worked so hard for. However, taxes don’t disappear entirely, and understanding the rules can help you make the most of your golden years.

Required Minimum Distributions (RMDs): Thanks to recent changes, you have more flexibility with your retirement funds. If you reach age 72 in 2023 or later, you won’t need to start taking required minimum distributions (RMDs) from your traditional IRAs and 401(k)s until age 73. This gives your savings more time to grow tax-deferred. And if you participate in a workplace retirement plan, you might be able to delay RMDs even longer – until you actually retire (unless you’re a 5% owner of the business). Remember that Roth IRAs generally don’t require withdrawals until after the death of the owner.

Social Security Benefits: Social Security benefits are a significant source of income for many retirees. However, a portion of your benefits may be taxable depending on your total income. It’s a good idea to understand how your Social Security benefits might affect your tax liability.

Healthcare Costs: Medical expenses can increase as you age. Keep accurate records of your healthcare costs, as you may be able to deduct qualified medical expenses that exceed a certain percentage of your adjusted gross income.

Charitable Giving: If you’re charitably inclined, consider making qualified charitable distributions (QCDs) directly from your IRA. QCDs can be a tax-efficient way to support causes you care about while satisfying your RMD requirements (once you reach the RMD age).

International Tax Considerations

If you have financial interests abroad or generate income from foreign sources, be aware of these additional reporting requirements:

Foreign Bank Account Report (FBAR)

If you have a financial interest in or signature authority over foreign financial accounts, including bank accounts, securities accounts, and other types of accounts, and the aggregate value of these accounts exceeds $10,000 at any time during the calendar year, you must file an FBAR (FinCEN Form 114) electronically with the Financial Crimes Enforcement Network (FinCEN).

Foreign Trust and Estate Reporting

If you have an ownership interest in a foreign trust or are a beneficiary of a foreign estate, you may have reporting requirements on Form 3520, Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts, and/or Form 3520-A, Annual Information Return of Foreign Trust With a U.S. Owner.

Foreign Tax Credit

If you paid income taxes to a foreign country, you might be able to claim a foreign tax credit on your U.S. tax return to avoid double taxation.

FAQ Section

1. What if I don’t have all my tax documents by April 15th?

If you need more time to gather your tax documents, you can file for an automatic six-month extension using Form 4868. This gives you until October 15th to file your return. However, remember that an extension to file is not an extension to pay. You’ll still need to estimate your tax liability and pay any taxes owed by the original April deadline to avoid penalties.

2. I’m starting a small business. What are my tax obligations?

Congratulations on your new venture! As a small business owner, you’ll have various tax obligations, including:

- Estimated Taxes: You’ll likely need to pay estimated taxes quarterly to cover your income tax and self-employment tax obligations.

- Self-Employment Tax: This tax covers Social Security and Medicare taxes and is calculated on your net self-employment income.

- Business Deductions: Keep thorough records of your business expenses, as many are deductible, such as office supplies, travel expenses, and advertising costs.

3. How can I avoid an audit?

While no one can guarantee avoiding an audit, here are some tips to reduce your risk:

- File accurately and on time. Double-check your return for errors and file by the deadline or request an extension if needed.

- Keep good records. Maintain organized records of your income and expenses to support the information on your tax return.

- Report all income. Ensure you report all income from all sources, including wages, interest, dividends, and capital gains.

- Be reasonable with deductions. Only claim deductions you’re entitled to and have documentation to support.

4. What should I do if I receive a notice from the IRS?

Don’t panic! Read the notice carefully to understand the reason for the correspondence. It might be a simple request for information or clarification. Respond promptly to the notice, providing any requested documentation. If you’re unsure how to proceed, consider seeking assistance from a tax professional.

Connecting with XOA TAX

Taxes can be complicated, no matter your age or stage of life. At XOA TAX, we’re here to guide you through the complexities and help you make informed decisions. Our team of experienced CPAs can provide personalized advice and support, ensuring you meet your tax obligations and achieve your financial goals.

Whether you’re just starting out, raising a family, or enjoying your retirement, we can help you navigate the tax landscape with confidence.

Contact us today for a consultation:

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often, and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime