Waiting for your tax refund can feel like watching a pot of water boil – you know it’s coming, but when? The IRS uses Tax Topic 152 to keep you informed about your refund’s journey. At XOA TAX, we understand that navigating the tax world can be confusing, so let’s break down what this topic means and how you can track your refund like a pro.

Key Takeaways

- Tax Topic 152: simply means the IRS is processing your return.

- Most refunds: are issued within 21 days for e-filed returns, and six weeks for paper returns.

- Several factors: can affect your refund timing, including errors, claiming certain credits, or having your return flagged for review.

- You can track your refund status: online using the IRS’s “Where’s My Refund?” tool or by calling the IRS directly.

What Does Tax Topic 152 Actually Mean?

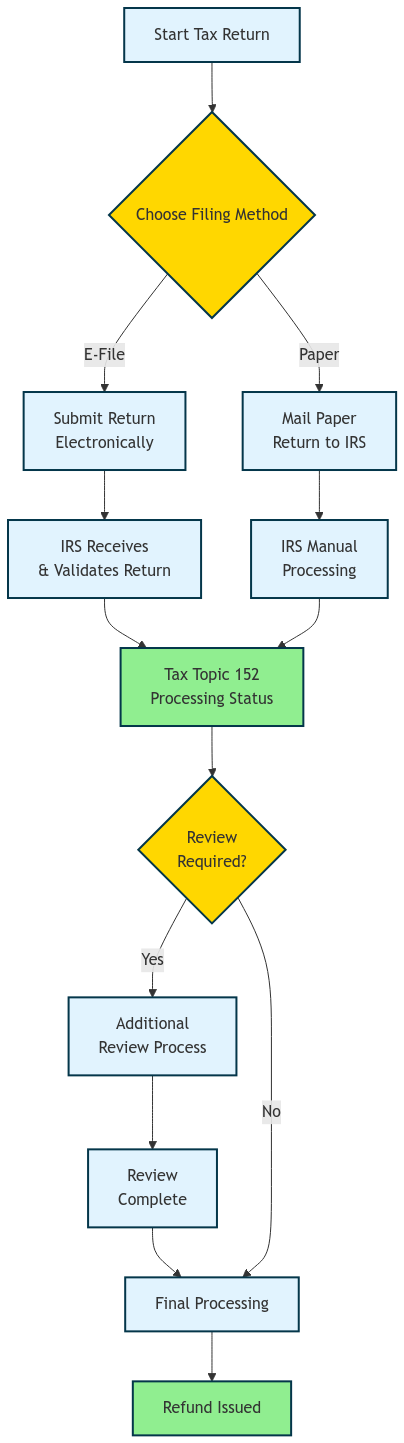

Think of Tax Topic 152 as a general status update from the IRS. It signals that your tax return has been received and is currently being processed. It’s not a cause for concern, but it does mean you’ll need a little patience while the IRS works its magic.

Why Might My Refund Be Delayed?

While the IRS aims to issue refunds promptly, several factors can influence the timeline:

- Errors on your return: Even small mistakes can cause delays. Double-check all information before filing.

- Claiming certain credits: By law, the IRS cannot issue refunds for returns claiming the Earned Income Tax Credit (EITC) or Additional Child Tax Credit (ACTC) before mid-February. This is a federal requirement designed to help prevent fraud.

- Return flagged for review: Your return might be selected for a more detailed review, which can extend the processing time. This could be due to an Injured Spouse claim, an Individual Taxpayer Identification Number (ITIN) application, or other factors.

Track Your Refund Like a Pro

The IRS offers a couple of handy tools to keep tabs on your refund:

- “Where’s My Refund?” Tool: This online tool provides up-to-date information on your refund status. You’ll need your Social Security number or ITIN, filing status, and the exact refund amount to access your information.

- IRS2Go Mobile App: Download the IRS2Go app for easy access to your refund status, tax tools, and helpful resources, right from your smartphone.

Tips to Avoid Refund Delays

No one likes waiting longer than necessary. Here are a few tips from your friends at XOA TAX to help ensure a smooth refund process:

- File electronically and choose direct deposit: This is the fastest and most secure way to file and receive your refund. The IRS generally processes e-filed returns within 21 days.

- Double-check your return for accuracy: Errors can lead to significant delays, so review your information carefully before submitting.

- Keep organized records: Maintain copies of all tax-related documents, including W-2s, 1099s, and your previous tax return. This will make it easier to address any questions or discrepancies that may arise.

What if My Refund Isn’t Issued Within 21 Days?

While the IRS typically processes e-filed returns within 21 days, various factors can affect this timeline. If 21 days have passed and you haven’t received your refund, don’t panic! Continue to monitor your refund status using the “Where’s My Refund?” tool or the IRS2Go app. You can also contact the IRS directly for assistance.

Amended Returns and Processing Times

If you’ve filed an amended return (Form 1040-X), the processing time is generally longer than for original returns. It can take up to 16 weeks to receive a refund from an amended return.

IRS Backlogs and Current Processing Times

The IRS occasionally experiences backlogs, especially during peak tax season. You can check the IRS website for updates on current processing times and any potential delays.

Beware of Tax Scams

Remember, the IRS will never initiate contact with you through email or social media. Be cautious of any unsolicited messages or phone calls requesting personal information or claiming to be from the IRS. If you suspect a scam, report it to the IRS immediately.

Documents Needed for Filing

Before starting your tax return, make sure you have all the necessary documents ready:

Essential Tax Documents Checklist

Keep track of your important tax documents with this interactive checklist

Income Documents

Healthcare Documents

Personal Information

Reference Documents

Having these documents organized and ready will help ensure a smooth filing process.

FAQs

What is the typical timeframe for receiving a refund after seeing Tax Topic 152?

While it varies, most refunds are issued within 21 days for e-filed returns or six weeks for paper returns. However, it may take longer if your return requires further review due to factors like claiming the EITC or ACTC.

Can I expedite my refund after seeing Tax Topic 152?

Unfortunately, there’s no way to directly speed up the IRS processing time. However, filing electronically and choosing direct deposit is the fastest way to receive your refund.

Does Tax Topic 152 mean there’s a problem with my return?

Not necessarily. It simply means your return is being processed. The IRS will contact you separately by mail if they require additional information or find any issues.

What if my refund amount is less than expected?

This could happen for a few reasons. The IRS might have used your refund to offset outstanding debts, such as unpaid taxes or student loans. It’s also possible there was an error on your return. If you receive a notice from the IRS explaining the discrepancy, review it carefully and follow their instructions.

What are some common reasons for a tax return to be flagged for review?

Several factors can trigger a review, including claiming the EITC or ACTC, filing an amended return, or applying for an ITIN.

Where can I find more information about Tax Topic 152 and other tax-related topics?

The IRS website (IRS.gov) is an excellent resource for tax information. You can also find helpful resources and personalized guidance on the XOA TAX website.

What should I do if I have questions or need help with my taxes?

Don’t hesitate to contact a tax professional! At XOA TAX, we’re here to provide expert guidance and support. You can reach us through our website, phone, or email.

Will I be notified if there’s a problem with my return after seeing Tax Topic 152?

Yes, absolutely. While Tax Topic 152 itself just means your return is being processed, the IRS will reach out to you by mail if they need more information or if there’s an issue with your return. Be sure to keep an eye on your mailbox for any official correspondence from the IRS.

Does Tax Topic 152 affect my refund amount?

Not at all. Tax Topic 152 simply indicates that the IRS is processing your return. The actual amount of your refund is determined by your income, deductions, and any tax credits you claimed on your return.

Can I speed up my refund after seeing Tax Topic 152?

While you can’t directly speed up the IRS, there are a few things you can do to help ensure a smooth and timely refund:

• Double-check your return before filing: Errors can cause delays, so accuracy is key.

• File electronically and choose direct deposit: This is the fastest and most secure way to get your refund.

• Be patient: The IRS needs time to process returns, especially during peak season.

How can I avoid Tax Topic 152 altogether?

There’s no guaranteed way to avoid it, as it’s simply a processing status. However, following these best practices can help minimize the chances of delays or issues:

• File accurately: Double-check all information for errors before submitting.

• File electronically and use direct deposit: This is the IRS’s preferred method for faster processing.

• Keep organized records: Maintain good records throughout the year, making it easier to address any IRS questions.

• Stay updated on tax laws: Tax laws can change, so ensure your return is compliant with the latest regulations.

Can Tax Topic 152 appear for both e-filed and paper returns?

Yes, it can. Tax Topic 152 simply indicates that your return is being processed, regardless of how you filed it.

Why should I e-file and use direct deposit?

E-filing with direct deposit is the fastest, most secure, and most accurate way to file your return and receive your refund. It’s also the IRS’s preferred method, as it helps reduce errors and speeds up processing times.

How often does the IRS update the status for Tax Topic 152?

The IRS typically updates the status daily, usually overnight. You can check your refund status anytime using the “Where’s My Refund?” tool on the IRS website or through the IRS2Go mobile app.

What are the different ways to get my refund?

You have two main options for receiving your refund:

• Direct deposit: This is the fastest and most secure method. Your refund is deposited directly into your bank account.

• Paper check: This method takes longer, as the check has to be mailed to you.

Why might my return need further review?

There are several reasons why the IRS might select a return for further review, including:

• Injured Spouse claims

• ITIN applications

• Amended returns

• Form 1040-NR filings

• EITC or ACTC claims

How long will it take to get my refund after seeing Tax Topic 152?

It’s tough to give an exact timeframe, as it depends on individual circumstances. However, most refunds are issued within 21 days for e-filed returns and six weeks for paper returns. If your return requires further review, it might take a bit longer.

What documents do I need to gather before filing my taxes?

Here are some essential documents to have on hand:

• Income-related forms: W-2s, 1099s, etc.

• Form 1095: If applicable (for health insurance through the marketplace)

• Previous tax return: This can be helpful for reference.

• ITIN: If you have one

• Personal information: Social Security numbers, birth dates, etc., for yourself, your spouse, and any dependents

How does the IRS processing timeline generally work?

E-filed returns are typically processed within 21 days, while paper returns take around six weeks. However, keep in mind that factors like errors, claiming certain credits, or needing further review can cause delays.

Why is accuracy so important when filing my tax return?

Accuracy is crucial to avoid processing delays, potential penalties, and extra scrutiny from the IRS. Using tax software, double-checking your information, and keeping organized records can help ensure accuracy.

Any other tips for a smooth tax filing process?

Absolutely! Here are some key takeaways:

• Be prepared: Gather all necessary documents beforehand.

• File accurately: Errors can lead to delays and complications.

• Use technology: E-file and choose direct deposit for faster processing.

• Stay informed: Understand the IRS processing timelines and be aware of potential delays.

Need Help with Your Taxes?

We understand that taxes can be complex. If you have questions or need assistance with your tax return, don’t hesitate to reach out to the experienced professionals at XOA TAX. Our team of CPAs and Enrolled Agents is here to provide personalized guidance and support every step of the way.

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime