The Child Tax Credit is a valuable tax credit that helps many families reduce their tax burden. For the 2024 tax year, the maximum credit is $2,000 per qualifying child and $500 for other dependents. Additionally, the refundable portion, known as the Additional Child Tax Credit (ACTC), is up to $1,500 for 2024.

Key Takeaways

- Credit Amounts for 2024: $2,000 per qualifying child and $500 for other dependents.

- Refundable ACTC: Up to $1,500, calculated as 15% of earned income above $2,500.

- Phase-Out Thresholds: $200,000 for single/HOH and $400,000 for MFJ, reducing by $50 per $1,000 over.

- Sunset of TCJA Changes: Starting 2026, credit amounts and phase-out thresholds may revert to pre-TCJA levels unless extended by Congress.

- Preparation Strategies: Adjust withholdings, make estimated tax payments, explore other tax credits and deductions, consider Roth conversions, and optimize deductions.

- State Credits: Additional support may be available through state-specific child tax credits.

- Filing Status: Special rules apply for divorced/separated parents and HOH qualifications.

- Common Errors: Avoid mistakes like incorrect age calculations, multiple claims, and misreporting income.

- Documentation: Maintain thorough records to support your Child Tax Credit claim.

Qualifying Child Requirements

- Age Requirement: The child must be under 17 years old at the end of the tax year.

- Dependency: The child must be claimed as a dependent on the taxpayer’s return.

- Citizenship: The child must be a U.S. citizen, U.S. national, or a resident alien.

- Residency: The child must have lived with the taxpayer for more than half of the tax year.

- Support: The child cannot have provided more than half of their own support during the tax year.

- Social Security Number (SSN): The child must have a valid SSN.

Child Tax Credit Details for 2024

For the 2024 tax year (filed in 2025), the Child Tax Credit includes:

- Non-Refundable Credit: Up to $2,000 per qualifying child and $500 for other dependents.

- Refundable Portion (ACTC): Up to $1,500, which allows families to receive a refund even if their tax liability is reduced to zero. The refundable portion (ACTC) is calculated as 15% of earned income above $2,500, up to the maximum of $1,500.

- Earned Income Requirement: To qualify for the refundable ACTC, taxpayers must have earned income of at least $2,500.

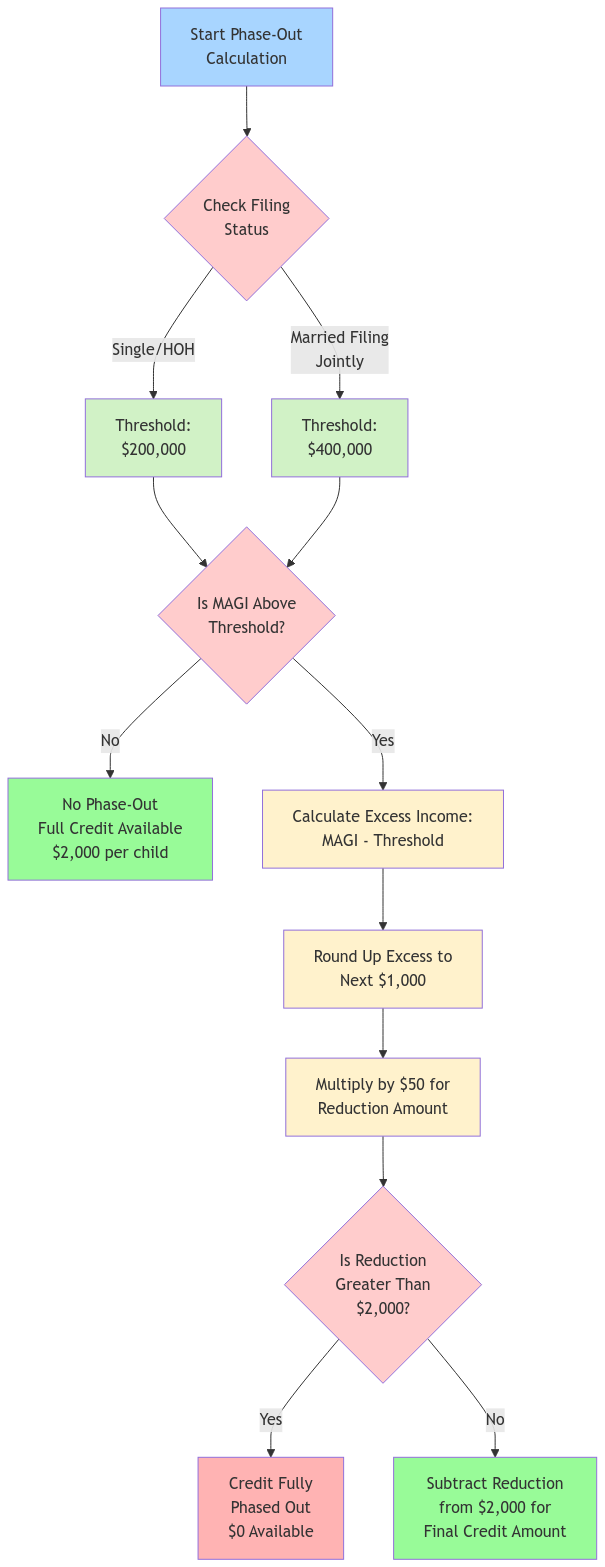

- Phase-Out Thresholds: The credit begins to phase out based on Modified Adjusted Gross Income (MAGI):

- $200,000 for single filers and head of household (HOH).

- $400,000 for married filing jointly (MFJ).

The credit reduces by $50 for each $1,000 (or fraction thereof) by which the taxpayer’s MAGI exceeds these thresholds.

Below is a visual guide to help you understand how the Child Tax Credit phase-out is calculated:

Understanding MAGI vs. AGI:

- Adjusted Gross Income (AGI): Your total gross income minus specific deductions.

- Modified Adjusted Gross Income (MAGI): AGI plus certain deductions, such as foreign earned income exclusion and housing exclusion.

For the purposes of the Child Tax Credit, MAGI is used to determine phase-out thresholds. It’s important to calculate MAGI accurately to understand how it affects your eligibility and credit amount.

Child Tax Credit Calculator 2024

Your Estimated Child Tax Credit

Base Credit

Child Credit: $0 (0 × $2,000)

Other Dependents: $0 (0 × $500)

Total Base Credit: $0

Income Reduction

Amount reduced based on your income

$0Your Final Credit

The actual credit you may be eligible for

$0Example of Phase-Out Calculation:

For example, a single parent with one child earning $205,000 would see their credit reduced by $250:

Reduction = (($205,000 – $200,000)/$1,000) × $50 = ($5,000/$1,000) × $50 = 5 × $50 = $250

Another example for a married couple filing jointly earning $405,000 with two qualifying children:

Reduction per child = (($405,000 – $400,000)/$1,000) × $50 = ($5,000/$1,000) × $50 = 5 × $50 = $250 per child

Total credit reduction would be $500.

Additional Example for Head of Household:

A Head of Household filer with one child earning $205,000:

Reduction = (($205,000 – $200,000)/$1,000) × $50 = 5 × $50 = $250

Credit per Child: $2,000 – $250 = $1,750

Tax Cuts and Jobs Act (TCJA) Updates

The Tax Cuts and Jobs Act (TCJA) introduced several changes to the Child Tax Credit, including increasing the credit amount and making a portion of the credit refundable. However, many of these changes are scheduled to sunset at the end of 2025. It is important to note that the specific changes to the Child Tax Credit for the 2026 tax year have not been officially confirmed. Congress may choose to extend some or all of the current provisions.

Specifically, starting with the 2026 tax year, the following changes may occur if no legislative action is taken:

- Credit Amount: The Child Tax Credit could revert to its pre-TCJA amount of $1,000 per qualifying child. The $500 credit for other dependents may also be eliminated.

- Phase-Out Thresholds: The income thresholds at which the credit begins to phase out could be lowered.

- Refundability Rules: Changes to the refundability of the credit might revert to prior rules, potentially reducing the refundable portion.

These potential changes mean that taxpayers will need to stay informed and adjust their tax planning strategies accordingly to account for any reduced benefits of the Child Tax Credit starting in 2026.

How to Prepare

Taxpayers can prepare for the reduced Child Tax Credit in several ways:

- Adjust Tax Withholding: Consider filing a new W-4 with your employer to adjust your tax withholding for 2026, ensuring that sufficient taxes are withheld to cover any potential liabilities.

- Adjust Estimated Tax Payments: If you are self-employed or receive significant income not subject to withholding, you may need to make estimated tax payments throughout the year to avoid penalties.

- Explore Other Tax Credits and Deductions: Review and take advantage of other available tax credits and deductions to maximize your tax benefits.

- Consult a Tax Professional: Given the upcoming changes, consulting with a tax professional can help tailor strategies specific to your financial situation.

Roth Conversions

Another strategy to consider is converting some of your retirement savings to a Roth IRA. While this is a taxable event, it offers several benefits:

- Tax-Free Growth: Qualified distributions from a Roth IRA are tax-free, which can reduce taxable income in future years.

- Income Limitations: Be aware of income limitations for Roth conversions, as higher incomes may increase your tax liability during the conversion year.

- Tax Implications: Converting to a Roth IRA can impact other credits and deductions, so it’s essential to evaluate how this fits into your overall tax strategy.

Who It Benefits: Roth conversions can be particularly beneficial for taxpayers who expect to be in a higher tax bracket in retirement or those who want to manage their taxable income more effectively.

Itemized Deductions

Planning to itemize deductions can also be advantageous. The TCJA made several changes to itemized deductions, including:

- Suspending the Deduction for Miscellaneous Itemized Deductions: These were subject to the 2% floor and are no longer deductible.

- Limiting the Itemized Deduction for State and Local Taxes (SALT): The deduction is capped at $10,000, reducing its overall benefit.

These changes are set to sunset at the end of 2025. Starting in 2026, taxpayers will once again be able to:

- Deduct Miscellaneous Itemized Deductions: Subject to prior rules.

- Increase SALT Deductions: Removing the cap, allowing for greater deductions of state and local taxes.

Bunching Deductions

Consider bunching your deductions by timing certain payments, such as charitable contributions, to maximize your deductions in a single year. This strategy involves:

- Concentrating Deductions: Make larger charitable donations or pay property taxes in one year to exceed the standard deduction threshold.

- Offsetting Credit Reductions: By increasing itemized deductions in a particular year, you can partially offset the loss of the enhanced Child Tax Credit.

Who It Benefits: This strategy is particularly useful for taxpayers whose itemized deductions are close to the standard deduction limit, allowing them to exceed it in a chosen year.

Tax Planning Strategies

Effective tax planning can further mitigate the impact of these changes:

- Accelerate Income: Shift income into 2024 and 2025 when tax rates are lower to take advantage of the higher Child Tax Credit benefits.

- Defer Deductions: Delay taking certain deductions until 2026 when they may be more valuable due to the potential return to prior deduction limits.

- Multi-Year Planning: Implement strategies that consider multiple tax years to optimize your overall tax liability and maximize available credits and deductions.

Impact on Other Credits and Deductions: Adjusting your income and deductions can influence eligibility and amounts for other tax credits and deductions, making comprehensive planning essential.

Withholding Adjustments

- Update W-4 Form

- Review Tax Brackets

- Calculate Annual Tax

- Monitor Changes

Roth Conversions

- Evaluate Tax Brackets

- Consider Timing

- Assess Future Benefits

- Plan Conversion Amount

Deduction Bunching

- Charitable Giving

- Medical Expenses

- Property Taxes

- State Tax Payments

Income Timing

- Bonus Deferrals

- Investment Sales

- Business Income

- Retirement Distributions

Documentation

- Tax Forms

- Receipt Records

- Support Evidence

- Financial Statements

Important Documentation

Maintain records to support your Child Tax Credit claim:

- Birth Certificates or SSN Documentation: Proof of your child’s identity and eligibility.

- School or Medical Records Showing Residency: Evidence that the child lived with you for more than half the year.

- Support Documentation: Records demonstrating that the child did not provide more than half of their own support.

- Income Documentation for ACTC Claims: Proof of earned income to qualify for the refundable portion.

State Credits

In addition to the federal Child Tax Credit, some states offer their own child tax credits or similar benefits. These state-level credits can help offset the federal changes and provide additional financial support to families. Here are a few notable examples:

- New York’s Empire State Child Credit: Provides additional credits to eligible families, enhancing the federal Child Tax Credit benefits. New York State Department of Taxation and Finance

- California’s Young Child Tax Credit: Offers refundable credits for families with young children, helping to further reduce state tax liabilities. California Franchise Tax Board

- Massachusetts’ Dependent Care Credit: Assists families with the cost of dependent care, complementing federal credits and providing additional financial relief. Massachusetts Department of Revenue

Note: State-specific credits can change frequently. It’s advisable to check with your state’s tax agency or consult a tax professional to understand the specific credits available in your state.

Filing Status Clarifications

Understanding how your filing status affects your eligibility and credit amounts is crucial, especially in special circumstances:

- Divorced/Separated Parents: Only one parent can claim the Child Tax Credit for each child. Typically, the custodial parent (the one with whom the child lived for the greater part of the year) has the right to claim the credit, unless otherwise agreed upon.

- Non-Custodial Parent Agreements: In cases where parents are divorced or separated, specific agreements or court orders may allow the non-custodial parent to claim the Child Tax Credit. It’s important to have proper documentation to support such claims.

- Head of Household Qualification: To qualify for the Head of Household (HOH) filing status, you must be unmarried or considered unmarried on the last day of the tax year, have paid more than half the cost of maintaining a home, and have a qualifying child or dependent. This status can affect the phase-out thresholds and overall tax liability.

Common Errors and Misconceptions

Understanding common pitfalls can help taxpayers avoid mistakes when claiming the Child Tax Credit:

- Incorrect Age Calculation: Some taxpayers mistakenly calculate the child’s age based on the current date rather than the end of the tax year.

- Multiple Claims: Attempting to claim the credit for the same child on multiple tax returns.

- Misreporting Income: Not accurately reporting earned income, which affects the refundable portion of the credit.

- Overlooking Phase-Outs: Failing to account for income phase-outs, leading to incorrect credit amounts.

- Documentation Shortcomings: Not maintaining adequate records to substantiate claims, which can lead to disallowed credits during an audit.

Additional Examples of Phase-Out Calculations

Example 1: Single Filer

- Income: $210,000

- Threshold: $200,000

- Excess Income: $10,000

- Reduction: ($10,000/$1,000) × $50 = 10 × $50 = $500

- Credit per Child: $2,000 – $500 = $1,500

Example 2: Married Filing Jointly

- Income: $420,000

- Threshold: $400,000

- Excess Income: $20,000

- Reduction: ($20,000/$1,000) × $50 = 20 × $50 = $1,000

- Credit per Child: $2,000 – $1,000 = $1,000

Example 3: Head of Household

- Income: $205,000

- Threshold: $200,000

- Excess Income: $5,000

- Reduction: ($5,000/$1,000) × $50 = 5 × $50 = $250

- Credit per Child: $2,000 – $250 = $1,750

These examples illustrate how different incomes and filing statuses affect the Child Tax Credit through phase-outs.

Reference to IRS Publication

For more detailed rules and comprehensive information, refer to IRS Publication 972: Child Tax Credit.

Mitigating the Impact

By taking proactive steps to prepare for the reduced Child Tax Credit, taxpayers can significantly mitigate the financial impact of these changes. Implementing strategies such as adjusting withholdings, converting to Roth IRAs, optimizing deductions, maintaining thorough documentation, exploring other tax credits and deductions, and understanding state credits will help maintain your tax efficiency and overall financial health.

FAQs

Can I claim the Child Tax Credit for a child who is a U.S. citizen but lives in another country?

No. The child must have lived with you in the U.S. for more than half of the tax year to qualify.

If I have a child who turned 17 during the year, can I still claim the full $2,000 credit?

No. The child must be under 17 at the end of the tax year. However, you may be able to claim the $500 credit for other dependents if the child meets the other qualifying criteria.

Can I claim the Child Tax Credit if I am not the child’s biological parent?

Yes, as long as the child meets the qualifying child requirements and you claim them as a dependent on your tax return. This could include foster children, stepchildren, or siblings.

What if my child was born during the tax year? Can I still claim the credit?

Yes, you can claim the full credit for a child born during the tax year, as long as they meet the other qualifying child requirements.

My MAGI is slightly above the phase-out threshold. Should I still claim the credit?

Yes. The credit doesn’t disappear immediately once you’re a dollar over the limit. It phases out gradually, so you’ll still likely receive a partial credit.

Connecting with XOA TAX

Navigating the complexities of the Child Tax Credit, especially with potential changes on the horizon, can feel overwhelming. At XOA TAX, we’re here to help you understand your options and maximize your benefits. Our team of experienced CPAs can provide personalized guidance tailored to your unique financial situation.

Whether you need assistance with adjusting your withholdings, exploring Roth conversions, or optimizing your deductions, we’re just a phone call away. Contact us today for a free consultation and let us help you achieve your financial goals.

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime