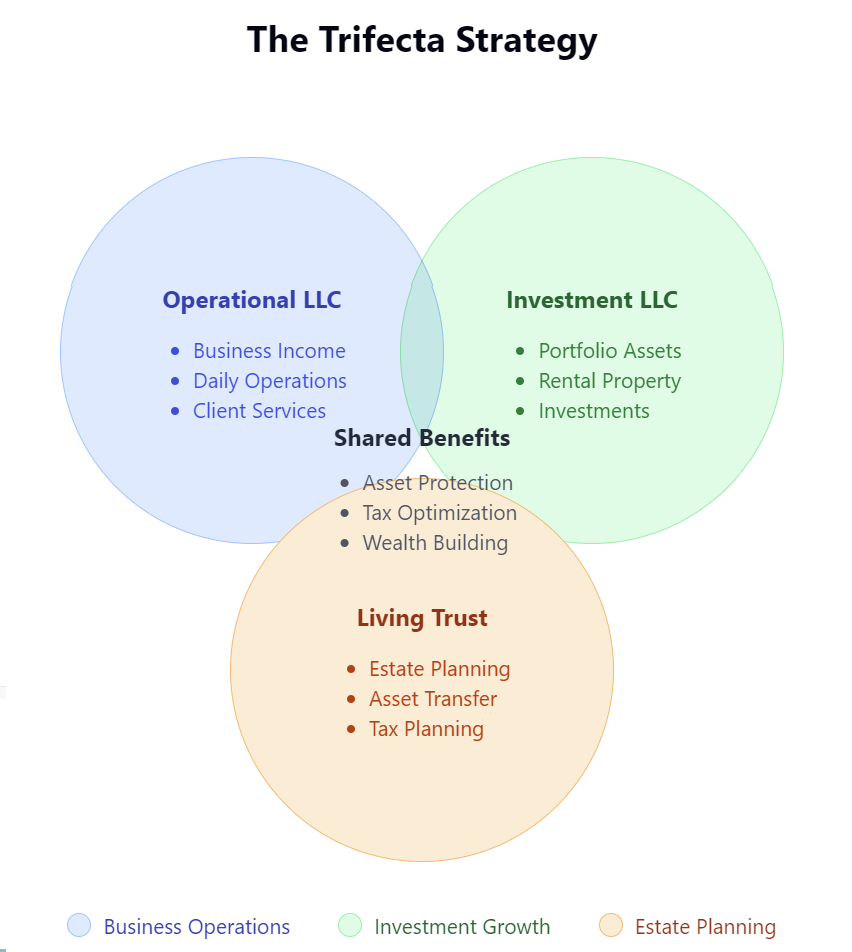

Have you ever wondered how some entrepreneurs seem to effortlessly build wealth while keeping their tax bills low? The secret often lies in smart financial planning and strategic structuring. Today, we’re going to explore the trifecta strategy—a powerful framework championed by CPA and attorney Mark J. Kohler—that can help you take control of your financial future.

The trifecta strategy brings together three essential components:

- Your Operational Business (LLC)

- Your Investment Entity (LLC)

- Your Revocable Living Trust

By integrating these elements, you can protect your assets, optimize your taxes, and set the stage for long-term wealth.

1. Setting Up Your Operational Business (LLC)

Starting with your business, structuring it as a Limited Liability Company (LLC) offers several benefits:

- Protecting Your Personal Assets: An LLC separates your personal assets from your business liabilities. This means that if your business faces lawsuits or debts, your personal savings and property are generally shielded. Just remember to keep business and personal finances separate to maintain this protection.

- Flexible Tax Options: With an LLC, you have choices in how you’re taxed. You can stick with the default pass-through taxation, where profits and losses show up on your personal tax return, or you can choose to be taxed as an S-corporation or C-corporation, depending on what’s best for your situation.

- Ease of Management: Compared to corporations, LLCs come with fewer formalities and compliance requirements, making them easier to run while still providing legal protections.

Real-Life Example: Imagine you’re a freelance graphic designer operating as an LLC. If a client sues you over a project dispute, only your business assets are at risk—not your personal bank account or home.

2. Creating an Investment Entity (LLC)

Next, consider setting up a separate LLC to hold your investments. Here’s why:

- Additional Asset Protection: By keeping your investments in their own LLC, you shield them from any issues that might arise in your operational business. This is especially important if your business activities carry higher risks.

- Tax Advantages: Managing investment income and expenses separately can help reduce your overall tax bill. You can offset investment losses against gains within the investment LLC and explore strategies that offer tax benefits.

- Simplified Finances: Separating your business and investment activities makes it easier to keep track of finances and simplifies your record-keeping.

Real-Life Example: Suppose you own a small marketing agency and you also invest in rental properties. By placing the properties in an investment LLC, you protect them from any liabilities related to your marketing business.

3. Establishing a Revocable Living Trust

Lastly, a revocable living trust is a key piece of the puzzle when it comes to estate planning:

- Avoiding Probate: Assets in a trust bypass the often lengthy and costly probate process when you pass away. This means your beneficiaries can receive their inheritance more quickly and privately.

- Reducing Estate Taxes: A well-structured trust can help minimize estate taxes, allowing you to pass on more of your wealth to your loved ones.

- Control Over Asset Distribution: You can specify how and when your assets are distributed, which is helpful if you have specific wishes or want to set conditions.

Real-Life Example: An entrepreneur sets up a revocable living trust to ensure their business and investments are smoothly transferred to their children, avoiding probate delays and expenses.

Cutting Taxes with the S-Corporation Election

If your business is doing well, you might benefit from electing S-corporation (S-Corp) status for your operational LLC. Here’s how it works:

- What Is an S-Corp? It’s a tax status that allows profits and losses to pass through to your personal tax return, avoiding double taxation.

- Why Consider It?

- Save on Self-Employment Taxes: As an S-Corp owner, you can pay yourself a reasonable salary and take the rest of the profits as distributions. Only the salary is subject to self-employment taxes, potentially saving you money.

- Boost Retirement Savings: Distributions aren’t considered earned income, which can open up opportunities for larger retirement contributions.

Important Note: The IRS expects you to pay yourself a reasonable salary based on industry standards and your role in the company. Skimping on your salary to avoid taxes can lead to penalties.

Real-Life Example: A consultant elects S-Corp status, pays herself a salary of $70,000, and takes an additional $30,000 as distributions. Only the $70,000 is subject to self-employment taxes, resulting in savings.

Is S-Corp Status Right for You?

Choosing S-Corp status depends on factors like your business income and willingness to handle extra paperwork. It’s wise to consult a tax professional to see if it makes sense for you.

Building Wealth Through Smart Investments

Now that your business and investments are properly structured, it’s time to focus on growing your wealth:

- Diversify Your Investments: Spread your investments across different asset classes to manage risk and enhance returns.

- Real Estate: Invest in properties for rental income and potential appreciation. Benefits include tax deductions like depreciation and strategies like 1031 exchanges to defer capital gains taxes.

- Self-Directed IRAs: These allow you to invest in alternative assets like real estate or private companies within your retirement accounts, offering more flexibility.

- Stocks and Bonds: Traditional investments still play a crucial role in diversification. Consider index funds for broad market exposure or dividend-paying stocks for income.

- Create a Plan: Define your financial goals, assess your risk tolerance, and develop an investment strategy that aligns with both.

Real-Life Example: A small business owner uses profits to invest in a mix of rental properties, stocks, and a self-directed IRA holding real estate, creating multiple income streams.

Self-Directed IRA Investment Options

Real Estate

- Residential & Commercial Properties

- Real Estate Investment Trusts (REITs)

- Mortgage Notes

- Undeveloped Land

Private Equity

- Private Companies

- Limited Partnerships

- Joint Ventures

- Startups

Precious Metals

- Gold

- Silver

- Platinum

- Palladium

Commodities

- Energy Resources

- Oil & Gas

- Agricultural Products

- Timber

Tax Liens & Deeds

- Tax Lien Certificates

- Property Tax Liens

- Tax Deeds

Cryptocurrency

- Bitcoin

- Ethereum

- Digital Assets

Important Considerations

Prohibited Investments

- Life Insurance Contracts

- Collectibles (Art, Antiques)

- Certain Coins

Prohibited Transactions

- Self-Dealing

- Transactions with Family

- Personal Use of Assets

Requirements

- Qualified Custodian

- IRS Compliance

- Due Diligence

*Consult with a financial advisor or tax professional to determine suitable investments for your SDIRA and ensure compliance with IRS regulations.

Staying Proactive and Informed

Financial success isn’t a set-it-and-forget-it deal. Here’s how to stay on top:

- Regular Check-Ins: Review your financial plan and investments at least once a year, or when significant life changes occur.

- Continuous Learning: Stay informed about financial trends, tax laws, and investment opportunities.

- Automate Where Possible: Set up automatic investments and savings to keep your wealth-building on track without constant effort.

Finding the Right Professionals to Help You

Navigating the complexities of taxes, business structures, and investments can be overwhelming. Working with experienced advisors can make a big difference:

- Tax Professionals (CPAs, EAs): They can help you optimize your tax strategy and ensure compliance.

- Financial Planners: They provide guidance on investments, retirement planning, and overall financial health.

- Estate Planning Attorneys: They assist in setting up trusts and other estate planning tools.

When choosing an advisor, consider their credentials, experience, and whether their communication style meshes with yours.

Adopting the Right Mindset

Beyond strategies and structures, your attitude towards money plays a significant role:

- Think Long-Term: Focus on strategies that build wealth over time rather than quick fixes.

- Stay Disciplined: Consistent saving and investing are key. Stick to your plan even when markets are volatile.

- Be Adaptable: Life changes, and so should your financial plan. Be ready to adjust as needed.

State-Specific Considerations

Keep in mind that laws can vary by state:

- LLC Laws: Formation fees, annual requirements, and regulations differ from state to state.

- Tax Laws: State income taxes, franchise taxes, and other regulations may impact your strategy.

Always check with local professionals to ensure you’re in compliance with your state’s laws.

Putting the Trifecta Strategy into Action

Ready to get started? Here’s a simple roadmap:

- Form Your Operational LLC: Register your business, set up your operating agreement, and get any necessary licenses.

- Consider S-Corp Election: If beneficial, file Form 2553 with the IRS to elect S-Corp status.

- Set Up Your Investment LLC: Create a separate LLC for your investments.

- Establish a Revocable Living Trust: Work with an attorney to set up your trust and transfer assets into it.

- Develop Your Investment Plan: Decide where to invest based on your goals and risk tolerance.

- Consult Professionals: Get advice from tax experts, financial planners, and attorneys to ensure everything is set up correctly.

Estimated Costs:

- LLC Formation: $50–$500, depending on your state.

- Registered Agent Fees: $100–$300 per year.

- S-Corp Election: Generally free, but may increase accounting costs.

- Living Trust: $1,000–$5,000, depending on attorney fees.

- Professional Fees: Varies based on services.

Ready to Take the Next Step?

At XOA TAX, we’re here to help you navigate this journey. Our team offers personalized guidance on tax planning, business structuring, investments, and estate planning.

How We Can Support You:

- Tailored Tax Strategies: We’ll help you find ways to minimize your tax bill.

- Business Setup Assistance: We’ll guide you through setting up your LLCs and making the right elections.

- Investment Advice: We’ll help you create an investment plan that suits your goals.

- Estate Planning: We’ll assist in setting up a trust to protect your assets.

Frequently Asked Questions

What exactly is the trifecta strategy?

It’s a comprehensive approach to financial planning that involves structuring your business, investments, and estate using three key components: an operational business LLC, an investment LLC, and a revocable living trust.

How do I know if electing S-Corp status is right for my business?

It depends on your business income and specific circumstances. Generally, if your business is profitable, an S-Corp election can save you money on self-employment taxes. Consult a tax professional to make an informed decision.

What are the benefits of a revocable living trust?

A revocable living trust helps you avoid probate, offers privacy, and allows you to control how your assets are distributed after your death. It can also help reduce estate taxes.

Why should I have a separate investment LLC?

A separate investment LLC provides an extra layer of protection for your investment assets and can offer tax advantages. It also simplifies management by separating your investments from your operational business.

How often should I revisit my financial plan?

At least once a year, or whenever you experience significant life changes like marriage, the birth of a child, or a major career shift.

Conclusion

The trifecta strategy offers a practical roadmap for building wealth and reducing taxes. By structuring your business and investments wisely and planning your estate thoughtfully, you’re setting yourself up for long-term success.

Remember, achieving financial freedom is a journey. It requires planning, discipline, and sometimes the guidance of seasoned professionals.

Take Action Now

Ready to explore how the trifecta strategy can work for you? Contact XOA TAX today, and let’s build the future you’ve envisioned. We’re here to help you every step of the way.

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime