Annuities can be a helpful tool for retirement planning, providing a steady stream of income during your golden years. But what happens when you need to transfer ownership of an annuity held within an IRA? This seemingly simple action can lead to unexpected tax consequences if not handled correctly. Let’s break down the intricacies of this process and how XOA TAX can help you navigate these complexities.

Key Takeaways

- Transferring ownership of an annuity within an IRA can be a taxable event.

- Direct trustee-to-trustee transfers are generally not taxable.

- Early withdrawals from an annuity, even within an IRA, may be subject to a 10% penalty.

- Consulting a tax professional is crucial for navigating annuity transfers within an IRA.

Understanding the Tax Implications

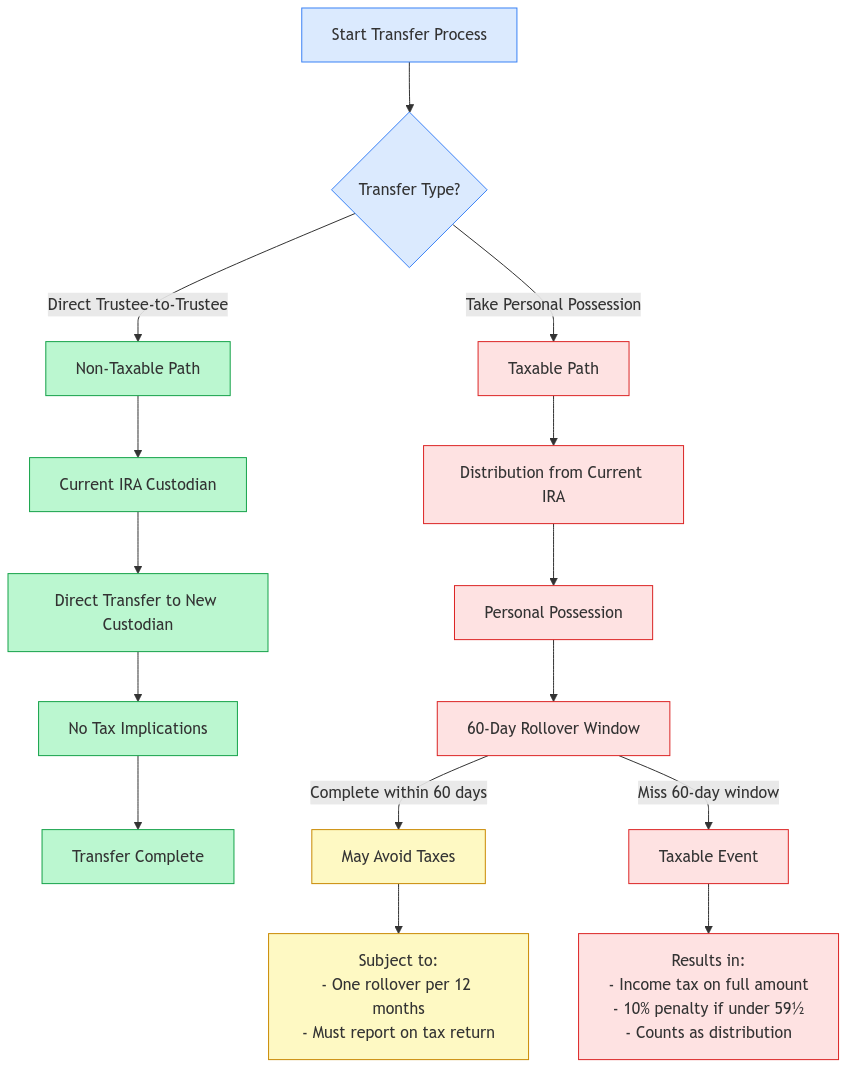

The IRS generally views the transfer of ownership of an annuity as a distribution. If you, as the account holder, take ownership of the annuity from the custodian within your IRA, this could trigger a taxable event. Why? Because the IRS might consider this a distribution from your IRA, and distributions are typically subject to income tax.

Avoiding Taxable Events: Trustee-to-Trustee Transfers

The good news is that there’s a way to avoid immediate taxation when transferring annuity ownership within an IRA. This involves a direct trustee-to-trustee transfer. In this scenario, the annuity is moved directly from the current custodian to another IRA custodian without you, the account holder, taking possession of the funds. This type of transfer is generally not considered a taxable event by the IRS.

Distributions and Early Withdrawal Penalties

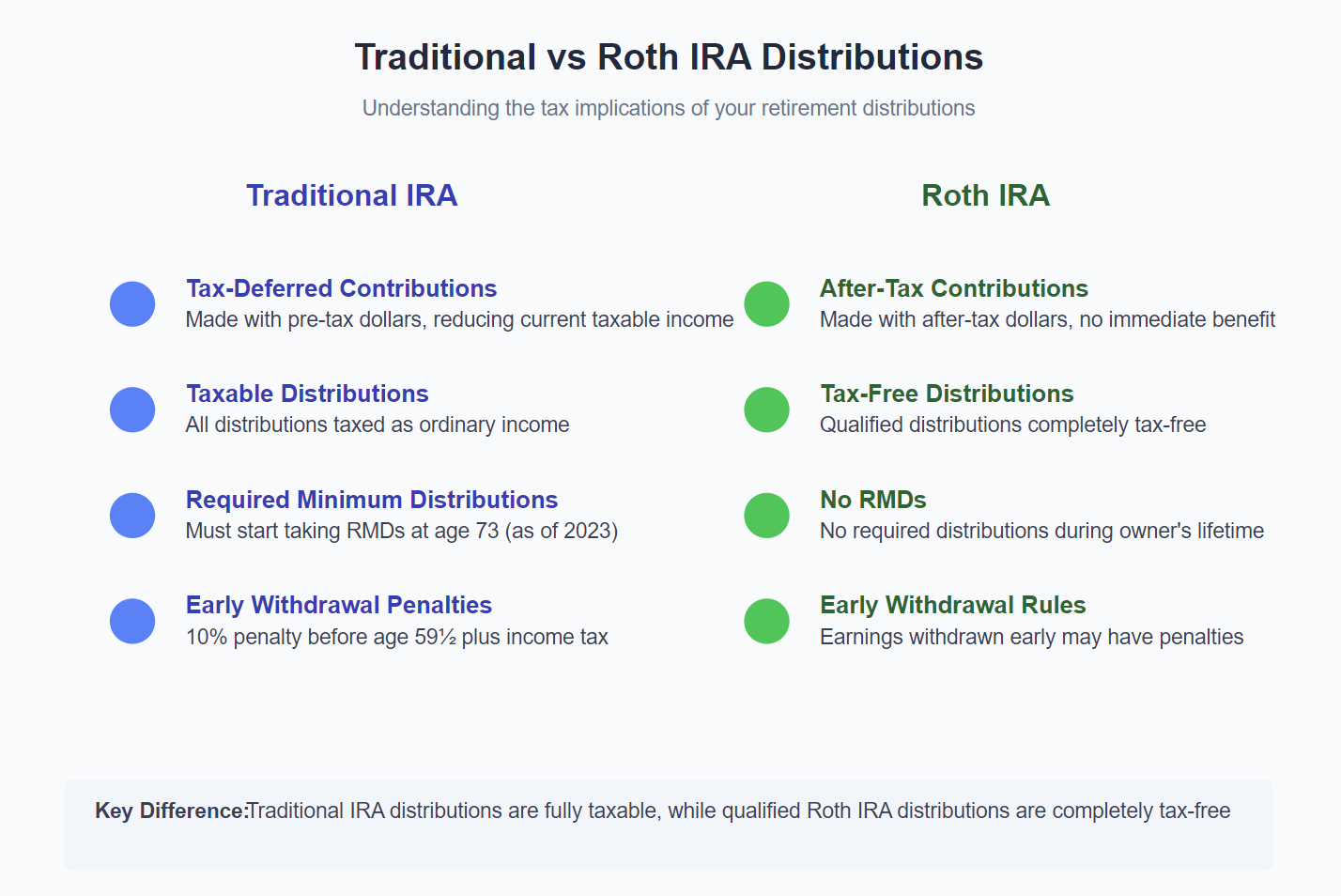

It’s important to remember that even when an annuity is held within an IRA, any distributions you take from it will be subject to ordinary income tax. Furthermore, if you’re under the age of 59 ½, you may also incur a 10% early withdrawal penalty. For example, if you withdraw $10,000 early from your annuity, you could face a $1,000 penalty (10% of the withdrawal) on top of your regular income tax.

There are some exceptions to this penalty, such as disability, certain medical expenses, first-time home purchases, and setting up Substantially Equal Periodic Payments (SEPPs). However, these exceptions have specific requirements, so it’s best to consult with a tax professional.

Required Minimum Distributions (RMDs)

If your annuity is held within a traditional IRA, you’ll need to start taking Required Minimum Distributions (RMDs) once you reach age 73 (as of 2023). RMDs are the minimum amount you must withdraw from your IRA each year. Failing to take your RMDs can result in a hefty penalty on the amount not withdrawn.

While the penalty for missing an RMD is generally 25%, the SECURE Act 2.0 reduced this penalty to 10% if the missed RMD is corrected in a timely manner. It’s also important to be aware of the “lookback rule,” which allows you to base your RMD for the current year on the account balance from the previous year.

Navigating the Complexities with XOA TAX

Transferring ownership of an annuity within an IRA can be a complex process with potential tax pitfalls, especially when considering factors like state taxes and surrender charges. It’s crucial to have a clear understanding of the rules and regulations to avoid unintended consequences.

At XOA TAX, we have extensive experience guiding clients through these types of transactions. Our team of CPAs can help you determine the most tax-efficient way to transfer annuity ownership and ensure you remain compliant with IRS regulations (Section 408 governs these types of transactions). We can also provide personalized advice on managing your IRA and planning for your retirement.

State Tax Implications

While the federal tax rules regarding IRA distributions and annuity transfers are generally consistent, state tax rules can vary significantly. Some states may not recognize certain exceptions to early withdrawal penalties or may have different rules regarding RMDs. It’s essential to consult with a tax professional who understands the specific laws in your state.

Surrender Charges

Many annuities have surrender charges, which are fees you incur if you withdraw money from the annuity within a certain period. These charges can be significant, sometimes reaching as high as 10% or more of the contract value, especially in the early years of the contract. If you’re considering transferring ownership of an annuity, it’s crucial to understand the surrender charges that may apply and how they might affect your decision.

Annuity Riders and IRA Rules

Annuities often come with various riders, which are optional features that provide additional benefits. Some common riders include death benefit riders and long-term care riders. It’s important to understand how these riders might interact with IRA rules and regulations.

For example, a death benefit rider might guarantee a certain minimum payout to your beneficiaries upon your death. However, this could affect the RMD rules for your beneficiaries, as they may need to take distributions based on the guaranteed death benefit amount rather than the remaining value of the annuity.

Similarly, a long-term care rider could provide benefits to cover long-term care expenses, but these benefits might be subject to IRA distribution rules and taxation.

Qualified vs. Non-Qualified Annuities

| Feature | Qualified Annuities | Non-Qualified Annuities |

|---|---|---|

| Funding Source | Pre-tax dollars Traditional IRA funds 401(k) rollovers Other qualified retirement plans | After-tax dollars Personal savings Inheritance Other post-tax funds |

| Tax Treatment of Contributions | Tax-deductible in most cases Reduces current taxable income Subject to annual contribution limits May be limited by income level | No tax deduction Contributions made with after-tax money No annual contribution limits No income restrictions |

| Tax Treatment of Distributions | 100% taxable as ordinary income Subject to RMDs at age 73 10% early withdrawal penalty before 59½ Must begin RMDs even if not needed | Only earnings are taxable No RMDs required LIFO taxation method (last in, first out) Exclusion ratio applies to regular payments |

| Early Withdrawal Rules | 10% IRS penalty on full amount Exceptions for disability, death SEPPs available under 72(t) Additional tax on entire withdrawal | 10% penalty only on earnings Principal can be withdrawn penalty-free SEPPs available under 72(q) Tax only on earnings portion |

| Death Benefits | Fully taxable to beneficiaries Subject to inherited IRA rules 10-year distribution rule may apply No step-up in basis | Only earnings taxable to beneficiaries More flexible distribution options Possible step-up in basis No mandatory distribution period |

Note:

- Tax treatments may vary by state

- Consult with a tax professional for specific advice

- Rules and limits subject to change based on tax law updates

Annuities can be classified as either qualified or non-qualified. Qualified annuities are purchased with pre-tax dollars, like those in a traditional IRA, while non-qualified annuities are purchased with after-tax dollars. This distinction can impact the tax treatment of distributions. With a qualified annuity, your distributions will be taxed as ordinary income. With a non-qualified annuity, only the earnings portion of your distributions will be taxed.

Common Mistakes to Avoid When Transferring Annuity Ownership

- Not Initiating a Trustee-to-Trustee Transfer: Directly transferring the annuity between custodians is crucial to avoid tax consequences.

- Misunderstanding Surrender Charges: Be aware of potential surrender charges and how they might impact your decision to transfer.

- Overlooking State Tax Implications: Remember that state tax rules can differ from federal rules and may affect your transfer.

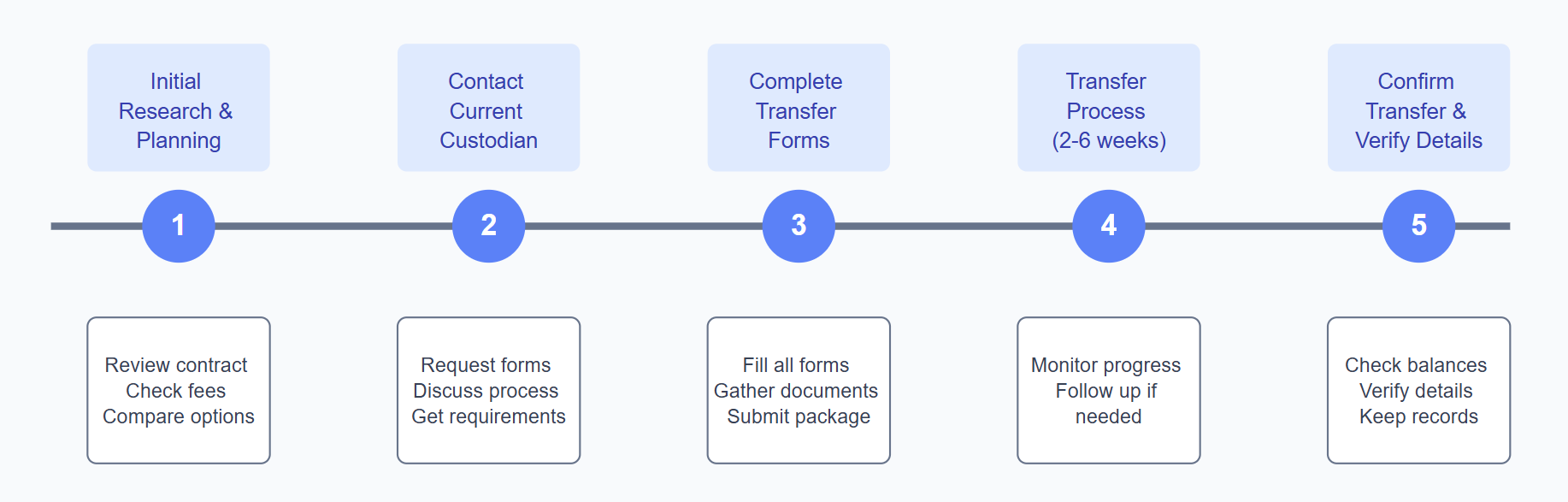

Pre-Transfer Checklist

- Review your annuity contract thoroughly.

- Understand the surrender charges that may apply.

- Compare fees between potential custodians.

- Consult with a tax professional to discuss the tax implications.

Important Forms and Publications

- Form 5498: IRA Contribution Information

- Form 5329: Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts

- Form 1099-R: Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

- IRS Publication 590-B: Distributions from Individual Retirement Arrangements (IRAs)

Potential Future Changes

It’s important to stay informed about potential changes to the laws and regulations governing IRA transfers and annuity ownership. Congress is currently considering several proposals that could impact these rules, so it’s advisable to consult with a tax professional for the latest updates.

FAQs

Can I transfer my annuity from a traditional IRA to a Roth IRA?

Yes, you can. However, this is considered a Roth conversion and will be a taxable event. You’ll need to pay income tax on the amount converted in the year of the transfer.

Are there any exceptions to the early withdrawal penalty for annuities within an IRA?

Yes, there are some exceptions, such as disability, certain medical expenses, first-time home purchases, and setting up Substantially Equal Periodic Payments (SEPPs). However, these exceptions have specific requirements, so it’s best to consult with a tax professional.

What happens to my annuity if I die before taking distributions?

The annuity will pass to your beneficiaries, who will need to follow certain rules for taking distributions and paying taxes.

Can I transfer my annuity to a family member?

Transferring an annuity to a family member outside of a qualified transfer (like a divorce settlement) is generally considered a taxable event.

What documentation do I need to transfer ownership of my annuity?

Typically, you’ll need your account statements, the annuity contract, and identification. You may also need to complete transfer forms provided by the custodians.

How long does it take to transfer ownership of an annuity?

The transfer process can take several weeks to a few months, depending on the custodians involved and the complexity of the transfer. The method of transfer can also impact the timeframe. Digital transfers, where forms and documents are submitted electronically, are generally faster than traditional paper-based transfers.

While processing times vary, you can typically expect a trustee-to-trustee transfer to take anywhere from 4 to 12 weeks. Some custodians, like major brokerage firms, may have faster processing times due to their automated systems. It’s also important to confirm with both the sending and receiving custodians that they offer online access to accounts, as this can streamline the process and provide greater transparency.

Connecting with XOA TAX

Have more questions about transferring annuity ownership within your IRA? Don’t hesitate to reach out to the experienced team at XOA TAX. We’re here to help you navigate the complexities of tax planning and ensure you make informed decisions about your financial future.

Contact XOA TAX Today!

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime