Many people see “FICA” on their paychecks and wonder what it means. In a nutshell, the Federal Insurance Contributions Act funds important programs like Social Security and Medicare, impacting almost every working American. Let’s break down how FICA works and what it means for you.

Key Takeaways

- FICA taxes fund Social Security and Medicare.

- Both employers and employees contribute to FICA.

- Self-employed individuals pay both the employer and employee portions.

- Staying informed about FICA changes is important for both employers and employees.

A Brief History of FICA

FICA was born in 1935 as part of President Roosevelt’s New Deal, with the goal of creating a safety net during the Great Depression. It originally funded Social Security to help retirees, survivors, and those with disabilities. Medicare was added in 1965 under President Johnson, expanding FICA to include health insurance for the elderly.

FICA: The Basics

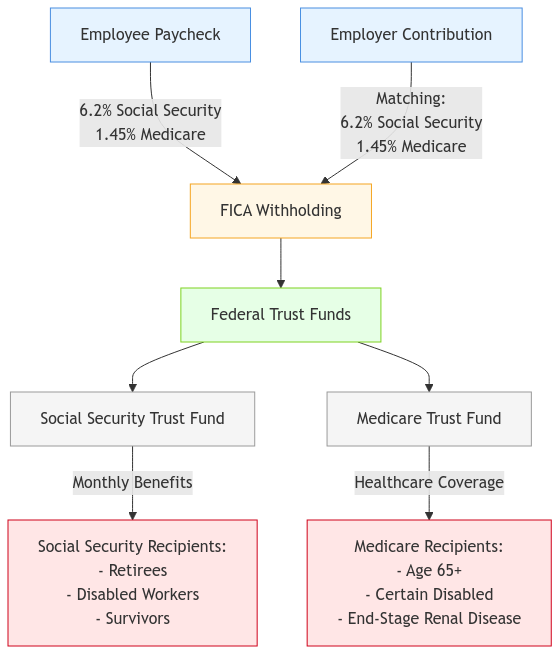

Simply put, FICA payroll taxes fund Social Security and Medicare, providing crucial support for retirees, people with disabilities, and families who have lost loved ones. Both employers and employees contribute to these programs, ensuring consistent funding.

The Roles of Employers and Employees

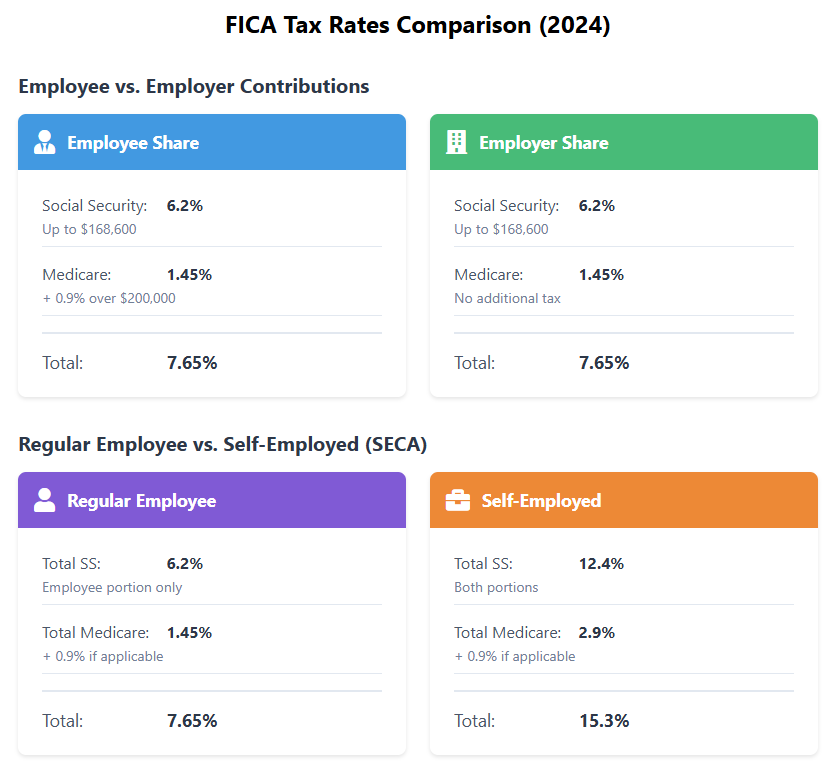

Below is a detailed comparison of FICA tax responsibilities for different employment types:

What Employers Need to Know

As an employer, you’re responsible for withholding your employees’ share of FICA taxes from their wages and matching those contributions. This shared responsibility ensures that everyone contributes to the system. You’ll typically report and pay these taxes each quarter using Form 941 – and paying on time is essential to avoid penalties. Need help navigating the complexities of payroll taxes? A qualified tax professional can help ensure accurate calculations and timely filings, especially with the added complexities of digital payment systems and remote work.

What Employees Need to Know

If you’re an employee, you’ll see FICA taxes deducted directly from your paycheck. This money funds the Social Security and Medicare benefits you’ll be eligible for later in life.

FICA Rates and Limits

Social Security Tax

For 2024, the Social Security tax rate is 6.2% of your wages, up to an annual limit of $168,600. Both you and your employer contribute this amount, for a total of 12.4%.

Use the calculator below to estimate your FICA tax contributions for 2024:

FICA Tax Calculator (2024)

Social Security Tax

$0.00

6.2% up to $168,600Medicare Tax

$0.00

1.45% + 0.9% for high earnersTotal FICA Tax

$0.00

Medicare Tax

The Medicare tax rate is 1.45% on all your earned income. If you’re a high earner (over $200,000 for individuals or $250,000 for married couples filing jointly), there’s an additional 0.9% Medicare tax, bringing the total to 2.35%. Keep in mind that your employer doesn’t have to match this extra amount.

Self-Employment and FICA: The SECA Tax

If you’re self-employed, the Self-Employment Contributions Act (SECA) requires you to cover both the employer and employee shares of Social Security and Medicare taxes. This means you’ll pay 12.4% for Social Security and 2.9% for Medicare, totaling 15.3%. Don’t worry, though! You can deduct the employer-equivalent portion of your SECA tax when calculating your net income, which helps offset the cost. Just remember that complying with SECA is vital to avoid penalties and ensure you can receive Social Security and Medicare benefits in the future.

This infographic provides a clear visual representation of the SECA tax obligations for self-employed individuals.

Recent Changes and Discussions around FICA

It’s important to stay informed about the ongoing dialogue surrounding FICA. Currently, there are discussions about potential reforms to address the long-term solvency of Social Security. These may include adjustments to the retirement age, benefit formulas, or even the payroll tax rate itself. Staying current on these discussions can help you anticipate future changes and plan accordingly. You can find detailed information and updates on the IRS website (https://www.irs.gov/).

Exempt Workers and FICA

Even if you’re an exempt worker who doesn’t have federal income tax withheld from your paycheck, you still need to pay your share of FICA taxes. This applies if you received a full refund on your federal income taxes last year and expect to have no federal income tax liability this year.

Other Payroll Taxes to Keep in Mind

Besides FICA, there are a few other payroll taxes that employers and employees should know about:

- Federal Unemployment Tax Act (FUTA): This employer-only tax funds unemployment benefits for workers who have lost their jobs. See IRS Publication 15 (Circular E, Employer’s Tax Guide) for details.

- State Unemployment Tax Act (SUTA): Similar to FUTA, SUTA taxes fund state-level unemployment programs. Again, this is paid by the employer. Check your state’s website for specific rates and requirements.

Understanding all these obligations can help you manage your payroll taxes effectively. A tax professional can provide valuable guidance on these matters.

Calculating FICA: Some Examples

Let’s see how FICA works in practice:

Example 1: Employee Earning $50,000

In 2024, an employee earning $50,000 will pay $3,100 for Social Security ($50,000 x 6.2%) and $725 for Medicare ($50,000 x 1.45%), totaling $3,825 in FICA contributions. Their employer will contribute the same amount.

Example 2: High-Earning Employee

An employee earning $250,000 and filing as single in 2024 will pay $9,932.40 for Social Security (based on the wage base limit) and $3,350 for Medicare, including the additional Medicare tax. This totals $13,282.40. Their employer will contribute a slightly lower amount, as they don’t pay the additional Medicare tax.

Example 3: Part-Time Employee

A part-time employee earning $20,000 per year will pay $1,240 for Social Security ($20,000 x 6.2%) and $290 for Medicare ($20,000 x 1.45%), for a total FICA contribution of $1,530.

FICA and the Digital Landscape

With the rise of remote work and digital payment systems, it’s important to understand how FICA applies in these situations. Generally, the same rules apply, but there may be specific considerations for:

- International employees: Tax treaties and special rules may apply.

- Electronic payments: Employers must ensure timely and accurate electronic deposits of FICA taxes, typically through the Electronic Federal Tax Payment System (EFTPS).

- State-specific variations: Some states have unique rules or reciprocal agreements that may affect FICA withholding.

Consulting a tax professional can help you navigate these complexities and ensure compliance.

Common FICA Mistakes to Avoid

Even with the best intentions, mistakes can happen. Here are some common FICA pitfalls to watch out for:

- Misclassifying employees: Properly classifying workers as employees or independent contractors is crucial for accurate FICA withholding.

- Incorrectly calculating wages: Ensure all taxable wages are included in FICA calculations, including bonuses, commissions, and fringe benefits.

- Missing deadlines: Failing to deposit and report FICA taxes on time can lead to penalties. Remember that deposits are typically made quarterly, with varying deadlines depending on your payroll schedule.

- Overlooking exemptions: Be aware of any exemptions that may apply to your employees or your business.

- Not keeping accurate records: Maintain detailed payroll records to support your FICA calculations and filings.

By being mindful of these common errors, you can ensure compliance and avoid unnecessary headaches.

FAQs

What happens if I overpay FICA taxes?

Don’t worry! You can typically claim a credit for any overpaid FICA taxes on your federal income tax return.

Are there any exceptions to FICA taxes?

Yes, certain types of income, like some foreign wages and certain religious exemptions, may be exempt from FICA taxes.

How can I learn more about my Social Security benefits?

You can create an account on the Social Security Administration website (ssa.gov) to view your earnings history and estimated benefits.

What are some of the challenges facing Social Security?

Social Security faces long-term funding challenges due to factors like increasing life expectancy and a declining birth rate. Policymakers are exploring various options to address these issues and ensure the program’s sustainability.

Can XOA TAX help me with my business’s payroll taxes?

Absolutely! We offer a full range of payroll tax services, including calculating, filing, and depositing taxes, to help your business stay compliant. Contact us today to learn more.

Need Help with FICA or Other Tax Matters?

Navigating the complexities of FICA and other payroll taxes can be confusing. At XOA TAX, we’re here to help! Our team of experienced CPAs can provide expert guidance and support to ensure you meet your tax obligations and plan for a secure financial future.

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime