Cash flow is the lifeblood of any business. Understanding how to calculate and interpret it is crucial for success. One of the most important metrics in this regard is net cash flow. Think of it as the bottom line of your cash flow statement, revealing the overall movement of cash both in and out of your business. At XOA TAX, we often find that business owners who keep a close eye on their net cash flow are better equipped to make informed decisions and ensure long-term sustainability.

Key Takeaways

- Net cash flow shows the overall change in your business’s cash balance over a period.

- It’s calculated by subtracting total cash outflows from total cash inflows.

- Positive net cash flow indicates more cash came in than went out.

- Negative net cash flow signals a potential need to address spending or boost income.

- Monitoring net cash flow is essential for financial health and informed decision-making.

What is Net Cash Flow?

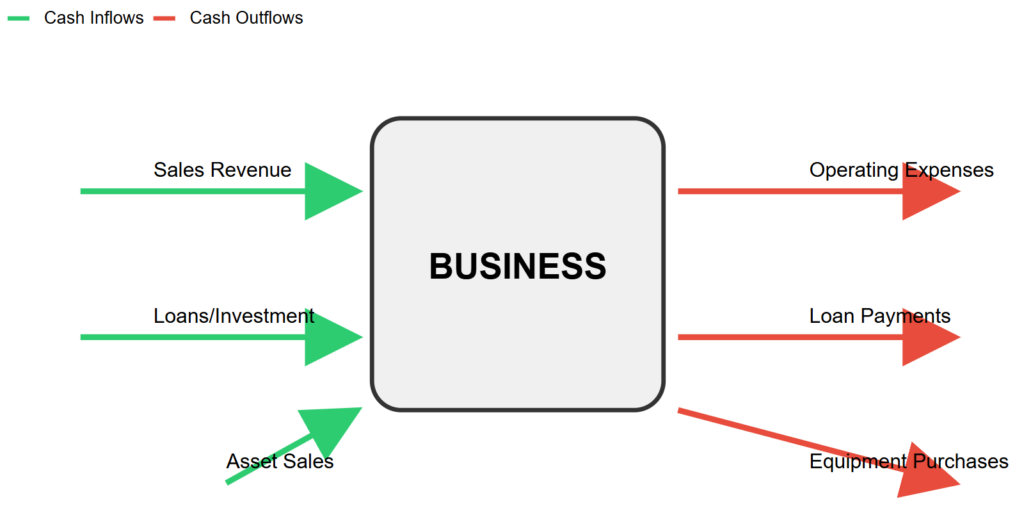

Simply put, net cash flow represents the difference between the cash coming into your business and the cash going out during a specific period. Calculated in accordance with Generally Accepted Accounting Principles (GAAP), net cash flow provides a standardized and reliable measure of a company’s liquidity and its ability to meet its financial obligations.

How to Calculate Net Cash Flow under US GAAP

The basic formula for calculating net cash flow is straightforward:

Net Cash Flow = Total Cash Inflows – Total Cash Outflows

To elaborate further, we can break down net cash flow into its core components, as outlined in the Statement of Cash Flows (FASB ASC 230):

Net Cash Flow = Operating Cash Flow + Investing Cash Flow + Financing Cash Flow

Let’s take a closer look at each component:

- Operating Cash Flow: This reflects the cash generated from your core business operations, such as sales revenue, payments from clients, and the cash used to cover expenses like salaries and rent. GAAP allows for two methods for calculating operating cash flow: the direct method (tracking all cash inflows and outflows) and the indirect method (starting with net income and adjusting for non-cash items like depreciation). The indirect method is more commonly used in practice. (See FASB ASC 230-10-45-17 through 45-20 for more details.)

- Investing Cash Flow: This involves cash flows related to investments, such as buying or selling property, plant and equipment (PP&E), or securities. (See FASB ASC 230-10-45-2 for more details.)

- Financing Cash Flow: This encompasses cash flows from financing activities, including debt, equity, and dividends. For instance, taking out a loan would be a cash inflow, while loan repayments would represent cash outflows. (See FASB ASC 230-10-45-3 for more details.)

| Cash Flow Component | Cash Inflows (+) | Cash Outflows (-) |

|---|---|---|

| Operating Activities | • Customer payments • Interest received • Royalty income • Rent received | • Supplier payments • Employee wages • Tax payments • Operating expenses |

| Investing Activities | • Sale of equipment • Sale of investments • Asset disposal • Investment returns | • Equipment purchases • Property acquisition • Investment in securities • R&D expenditure |

| Financing Activities | • Bank loans received • Share issuance • Bond issuance • Owner investment | • Loan repayments • Dividend payments • Share repurchases • Interest paid |

Example:

Let’s say “ABC Company” has the following cash flows for the year:

- Operating Activities: Cash received from customers: $500,000; Cash paid for operating expenses: $300,000; Depreciation expense: $20,000 (This would be added back to net income under the indirect method)

- Investing Activities: Purchased new equipment: $50,000; Sold old equipment: $10,000

- Financing Activities: Received a bank loan: $100,000; Repaid a portion of the loan: $20,000; Paid dividends to shareholders: $5,000

Here’s how to calculate their net cash flow:

- Operating Cash Flow: $500,000 – $300,000 = $200,000 (using the direct method for simplicity)

- Investing Cash Flow: $10,000 – $50,000 = -$40,000

- Financing Cash Flow: $100,000 – $20,000 – $5,000 = $75,000

Net Cash Flow: $200,000 + (-$40,000) + $75,000 = $235,000

Why is Net Cash Flow Important?

Liquidity: It reveals your ability to meet short-term obligations.

Financial Planning: A healthy net cash flow allows for investments, expansion, and weathering economic downturns.

Profitability vs. Cash Flow: While profitability (net income) is important, it doesn’t always equate to having cash on hand. Net cash flow provides a more accurate picture of your financial situation.

Investor Appeal: Positive net cash flow is attractive to potential investors and lenders.

Analyzing Your Net Cash Flow

Trends over time: Is your net cash flow consistently positive? Is it growing or declining?

Comparison to industry benchmarks: How does your net cash flow compare to others in your industry? For example, the average net cash flow margin for the retail industry is typically around 5-10%, while for the software industry it can be as high as 20-25%. You can find industry benchmark data from sources like the Risk Management Association (RMA) or industry-specific publications.

Factors influencing changes: Can you identify specific events or decisions that have impacted your net cash flow?

By analyzing these aspects, you can gain valuable insights into your business’s performance and identify areas for improvement.

Key Cash Flow Ratios

Operating Cash Flow Ratio: This ratio measures a company’s ability to cover its current liabilities with cash generated from operations. A higher ratio indicates better short-term liquidity.

Operating Cash Flow Ratio = Operating Cash Flow / Current Liabilities

Cash Flow Coverage Ratio: This ratio assesses a company’s ability to meet its long-term debt obligations with cash flow from operations. A higher ratio indicates a stronger financial position.

Cash Flow Coverage Ratio = Operating Cash Flow / (Long-term Debt + Interest)

Free Cash Flow: This represents the cash flow available to the company after accounting for capital expenditures (investments in fixed assets). It’s often used to assess a company’s ability to pay dividends, reduce debt, or reinvest in growth.

Free Cash Flow = Operating Cash Flow – Capital Expenditures

FAQs about Net Cash Flow

What’s the difference between net cash flow and net income?

While both are important financial metrics, they differ in what they measure. Net income, calculated using accrual accounting, considers revenues and expenses regardless of when cash is actually exchanged. Net cash flow, on the other hand, focuses solely on the actual cash moving in and out of your business.

What if my business has a negative net cash flow?

A negative net cash flow isn’t always a cause for alarm, especially for new businesses or those investing heavily in growth. However, if it persists, it could indicate underlying issues that need to be addressed, such as excessive spending, slow-paying customers, or inadequate sales.

How can I improve my business’s net cash flow?

Improving collections: Send invoices promptly and follow up on overdue payments. Consider offering early payment discounts.

Negotiating better payment terms with suppliers: Extending payment deadlines can free up cash.

Controlling expenses: Identify areas where you can reduce costs without sacrificing quality. For example, explore options for reducing energy consumption or renegotiating contracts.

Increasing sales: Explore new marketing initiatives or expand your product/service offerings. Consider offering promotions or loyalty programs to incentivize repeat business.

What are some common mistakes businesses make regarding net cash flow?

Overlooking operating cash flow: Focusing solely on profit margins while neglecting the cash flow generated from day-to-day operations.

Poor inventory management: Tying up too much cash in excess inventory. Implement just-in-time inventory systems or explore drop-shipping options.

Inadequate cash reserves: Not having enough cash on hand to cover unexpected expenses. Aim to maintain a cash reserve that can cover at least 6-12 months of operating expenses.

Managing Cash Flow Risks

Cash Flow Stress Testing: This involves creating “what-if” scenarios to assess your business’s resilience in the face of potential challenges. For example, you might model the impact of a sudden drop in sales, an increase in material costs, or a major customer defaulting on payment. This helps you identify vulnerabilities and develop contingency plans.

Seasonal Variation Management: Businesses with seasonal revenue cycles need to carefully manage their cash flow throughout the year. During peak seasons, focus on efficient collection practices and securing sufficient inventory. During slower periods, consider cost-cutting measures, negotiating extended payment terms with suppliers, or exploring alternative revenue streams.

Working Capital Optimization: Efficient working capital management is crucial for healthy cash flow. This involves striking a balance between current assets (like inventory and accounts receivable) and current liabilities (like accounts payable). Strategies for optimization include:

- Inventory Management: Implement just-in-time inventory systems to minimize storage costs and reduce the risk of obsolescence.

- Receivables Management: Offer early payment discounts, send invoices promptly, and follow up diligently on overdue accounts.

- Payables Management: Negotiate favorable payment terms with suppliers and take advantage of early payment discounts when possible.

Tools for Managing and Forecasting Cash Flow

- Accounting Software: Popular platforms like QuickBooks Online, Xero, and FreshBooks offer features for tracking income and expenses, generating cash flow statements, and creating budgets.

- Cash Flow Forecasting Apps: Tools like Float, Pulse, and CashFlowTool provide real-time insights into your cash position and allow you to model different scenarios.

- Spreadsheets: While less sophisticated, spreadsheets like Microsoft Excel or Google Sheets can be used to create basic cash flow projections and track key metrics.

By leveraging these tools, you can gain a clearer understanding of your cash flow patterns and make proactive decisions to optimize your financial health.

Connecting with XOA TAX

At XOA TAX, we understand that managing cash flow can be complex. Our team of experienced CPAs can provide you with personalized guidance and support to help you optimize your cash flow, make informed financial decisions, and achieve your business goals.

Contact us today for a consultation:

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

We’re here to help you navigate the intricacies of cash flow management and ensure your business thrives.

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. It is presented in accordance with Generally Accepted Accounting Principles (GAAP) in the United States. Any deviations from GAAP should be disclosed. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime