Running a business can be a rollercoaster, with highs and lows along the way. Some years bring profits, while others may result in losses. Fortunately, the IRS offers a valuable tool to help businesses navigate those less profitable periods: the Net Operating Loss (NOL).

At XOA TAX, we understand the complexities of NOLs and how they can impact your business. This blog post will break down the essentials of NOLs, including how they work, how to calculate them, and how they can benefit your business.

Key Takeaways

- An NOL occurs when your business deductions exceed your taxable income.

- You can carry NOLs forward to offset future taxable income, reducing your tax liability.

- Specific rules and limitations apply to NOLs, including how much you can deduct each year.

What is a Net Operating Loss (NOL)?

Simply put, an NOL arises when your allowable business deductions are greater than your business income in a tax year. This can happen for various reasons, such as unexpected expenses, economic downturns, or startup costs.

Imagine your business had a total income of $100,000 this year, but your deductible expenses amounted to $120,000. This results in a $20,000 NOL.

How Can an NOL Benefit Your Business?

An NOL can be a valuable asset for your business. Instead of simply accepting a loss in a bad year, you can use the NOL to offset taxable income in future profitable years. This reduces your tax liability and helps you recover from previous losses.

Think of it as a tax credit that you can carry forward. In our previous example, the $20,000 NOL could be used to reduce your taxable income in future years, resulting in tax savings.

NOL Rules and Limitations

While NOLs offer significant benefits, it’s important to understand the rules and limitations:

- Carryforward: You can generally carry NOLs arising in tax years beginning after December 31, 2017, forward indefinitely. This means you can use the NOL to offset income in future years until it’s fully utilized.

- Deduction Limit: The amount you can deduct each year is limited to 80% of your taxable income.

- Special Cases: Some exceptions to these rules exist, such as those for farming losses or losses from federally declared disasters.

Impact of Business Structure on NOLs

The way Net Operating Losses are handled can vary depending on your business structure. Understanding these differences is crucial for effective tax planning.

Sole Proprietorships and Single-Member LLCs

- For sole proprietors and single-member LLCs taxed as sole proprietorships, NOLs are reported on the owner’s personal tax return. The loss can offset other personal income, such as wages or investment income, potentially reducing your overall tax liability.

Partnerships and S-Corporations

- In partnerships and S-corporations, NOLs pass through to individual partners or shareholders based on their ownership percentage. Each partner or shareholder reports their share of the loss on their personal tax return. However, there are limitations:

- At-Risk Rules: Loss deductions are limited to the amount you have at risk in the business.

- Passive Activity Loss Rules: Losses from passive activities can only offset income from passive activities.

C-Corporations

- C-corporations can use NOLs to offset taxable income in future years, just like individuals. However, NOLs remain within the corporation and do not pass through to shareholders. This means shareholders cannot use the corporation’s NOLs to offset their personal income.

NOL Treatment by Business Structure

| Business Structure | NOL Treatment | Key Considerations |

|---|---|---|

|

Sole Proprietorship |

• Reports on personal tax return • Can offset personal income |

• Immediate personal benefit • Subject to personal tax rates |

| S-Corporation |

• Passes through to shareholders • Pro-rata allocation |

• At-risk limitations apply • Passive activity rules |

| Partnership |

• Passes through to partners • Based on partnership share |

• Partner basis limitations • Special allocations possible |

| C-Corporation |

• Remains within corporation • 80% taxable income limit |

• No shareholder benefit • Indefinite carryforward |

Note: Rules and limitations may vary by jurisdiction and specific circumstances.

State Tax Considerations

While we’ve discussed federal NOL rules, it’s important to note that state tax laws may differ significantly.

- Variations in Conformity: Some states fully conform to federal NOL provisions, while others have their own rules.

- Carryforward Periods: States may have different limits on how long you can carry forward an NOL.

- Deduction Limits: The percentage of taxable income that NOLs can offset may vary by state.

- No NOL Provisions: A few states do not allow NOL deductions at all.

Before applying an NOL on your state tax return, consult with a tax professional familiar with your state’s laws.

Special Circumstances and Recent Updates

CARES Act Modifications

- Carryback Provision Restored: NOLs arising in tax years 2018, 2019, and 2020 could be carried back up to five years.

- Suspension of 80% Limit: The 80% taxable income limitation was temporarily removed for tax years before 2021.

These provisions were designed to provide immediate tax relief. If your business incurred losses during these years, you might still benefit from these changes.

Consolidated Corporate Returns

- Intercompany Transactions: Losses and gains between group members affect the consolidated NOL.

- Separate vs. Consolidated NOLs: Regulations determine whether NOLs are calculated on a consolidated basis or separately.

Consulting a tax professional with experience in consolidated returns is advisable.

International Considerations

- Foreign Losses: NOLs from foreign operations may have different treatment.

- Tax Treaties: International tax treaties can impact how NOLs are utilized.

How to Calculate an NOL

Calculating an NOL might seem complicated, but it follows a general formula:

- Start with your gross income. This includes all income from your business operations.

- Subtract your allowable deductions. This includes expenses such as operating costs, salaries, rent, and depreciation.

- Common Business Deductions:

- Cost of Goods Sold

- Salaries and Wages

- Rent and Utilities

- Depreciation

- Interest Expense

- Advertising and Marketing Costs

- Repairs and Maintenance

- Bad Debts

- Common Business Deductions:

- If your deductions exceed your income, you have an NOL.

It’s crucial to accurately calculate your NOL and maintain proper documentation to support your deductions. This is where working with an experienced CPA can be invaluable.

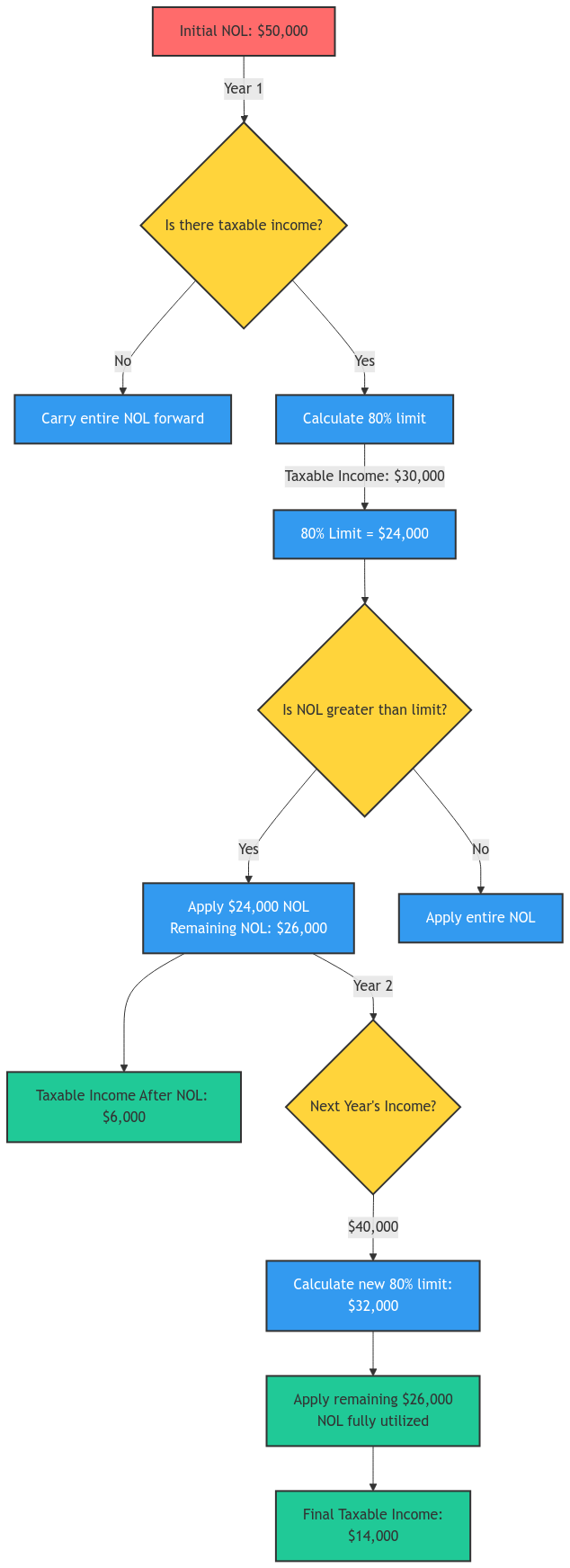

Visualizing NOL Calculations

Here’s a breakdown of the NOL carryforward example with the updated 80% limitation:

Year 1: Initial NOL

- Income: $0

- Expenses: $50,000

- NOL Created: $50,000

Year 2: Applying NOL

- Taxable Income: $30,000

- Maximum NOL Allowed: $24,000 (80% of $30,000)

- NOL Applied: ($24,000)

- Remaining NOL: $26,000 ($50,000 – $24,000)

- Taxable Income After NOL: $6,000 ($30,000 – $24,000)

Year 3: Continuing NOL

- Taxable Income: $40,000

- Maximum NOL Allowed: $32,000 (80% of $40,000)

- NOL Applied: ($26,000 remaining NOL, limited to $32,000 but only $26,000 available)

- Remaining NOL: $0 ($26,000 – $26,000)

- Taxable Income After NOL: $14,000 ($40,000 – $26,000)

Documentation Requirements for NOLs

When claiming an NOL, it’s essential to maintain thorough records to support your calculations. This includes:

- Income Statements: Showing your gross income and expenses.

- Balance Sheets: To provide an overall picture of your financial position.

- Supporting Documentation: Such as receipts, invoices, and bank statements for all deductible expenses.

📌 Tip: Keeping organized records is not only crucial for claiming an NOL but also for demonstrating compliance during a potential IRS audit.

Common Pitfalls to Avoid When Claiming NOLs

- Incorrect Calculations: Ensure all income and deductions are accurately reported.

- Documentation Gaps: Keep thorough records to substantiate your NOL.

- Ignoring Limitations: Be aware of limitations like the at-risk and passive activity loss rules.

- State Law Oversight: Don’t assume state NOL rules mirror federal rules.

🚨 Important: Failing to adhere to IRS regulations when claiming NOLs can result in penalties or disallowed deductions.

FAQ Section

Q: Can I carry back an NOL to previous tax years?

A: Generally, no. The Tax Cuts and Jobs Act (TCJA) of 2017 eliminated the carryback provision for most NOLs. However, the CARES Act temporarily reinstated the carryback for NOLs arising in 2018, 2019, and 2020 tax years.

Q: How long can I carry an NOL forward?

A: You can generally carry an NOL arising in tax years beginning after December 31, 2017, forward indefinitely until it is fully used to offset taxable income.

Q: What if I don’t use the entire NOL in one year?

A: Any unused portion of the NOL can be carried forward to future years until it is fully exhausted.

Q: How do state taxes affect my NOL?

A: State NOL rules may differ from federal rules. Some states have different carryforward periods or may not allow NOL deductions at all.

Q: What forms do I need to file to claim an NOL?

A: If you are an individual, you will generally use Form 1040X for amended returns or Form 1045 for quick refunds. Corporations use Form 1139 for tentative refunds.

Conclusion

Understanding and effectively utilizing Net Operating Losses can provide significant tax relief for your business during challenging times. By staying informed about federal and state regulations, and considering how your business structure affects NOL treatment, you can make strategic decisions that benefit your financial future.

Connecting with XOA TAX

Navigating NOLs and their implications for your business can be complex. At XOA TAX, we have a team of experienced CPAs who can help you understand the rules, calculate your NOL, and develop tax planning strategies to maximize its benefits.

Contact us today for a consultation:

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. Please consult a professional advisor for advice specific to your situation. It is essential to maintain proper documentation for all tax purposes, including NOLs. Always consult with a qualified tax professional before making any decisions based on the information in this blog post.

anywhere

anywhere  anytime

anytime