At XOA TAX, we regularly guide individuals on maximizing their retirement savings. Converting a traditional IRA to a Roth IRA is a popular tactic, but it’s crucial to understand the implications of the pro rata rule before you begin. This rule can significantly impact your tax liability, especially for high earners considering conversions in 2024. Let’s explore the key details.

Key Takeaways

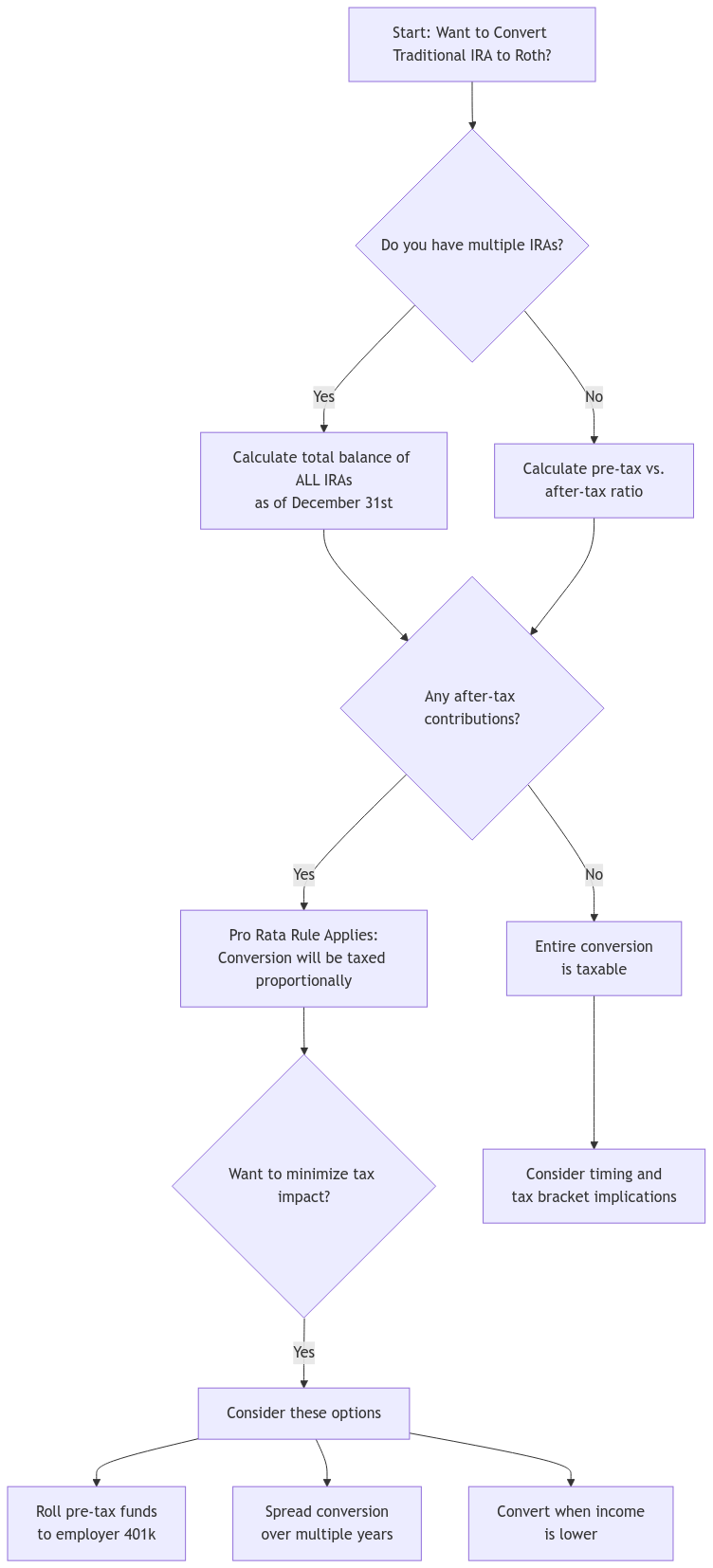

- The pro rata rule applies when converting funds from a traditional IRA containing both pre-tax and after-tax contributions.

- It dictates that conversions are taxed proportionally based on the overall composition of your traditional IRAs as of December 31st of the conversion year.

- Strategies exist to minimize the tax implications of this rule.

- Careful planning and accurate record-keeping are crucial for successful Roth conversions.

What is the Pro Rata Rule?

The pro rata rule comes into play when you convert funds from a traditional IRA to a Roth IRA that holds a mix of pre-tax and after-tax dollars. This rule prevents you from selectively converting only the after-tax contributions to avoid taxes.

Imagine your traditional IRA as a bowl of mixed nuts. Some are pre-tax (peanuts), and some are after-tax (cashews). When you grab a handful to convert to a Roth IRA, the IRS views it as containing both types of nuts in the same proportion as the entire bowl.

Example:

Let’s say your traditional IRA has $80,000 in pre-tax contributions and earnings and $20,000 in after-tax contributions, totaling $100,000. This means 80% of your IRA is pre-tax, and 20% is after-tax. If you convert $50,000 to a Roth IRA, 80% of that conversion ($40,000) will be considered pre-tax and taxed as ordinary income.

Why Does the Pro Rata Rule Matter in 2024?

For high earners, the pro rata rule can result in a hefty tax bill if not carefully managed, especially with the 2024 income limits for direct Roth IRA contributions. Conversions of pre-tax money are treated as ordinary income, potentially pushing you into a higher tax bracket.

Strategies for Minimizing Taxes

- Roll Over to a 401(k): If your employer offers a 401(k) plan that accepts rollovers, consider moving the pre-tax funds from your traditional IRA into your 401(k). This isolates your after-tax contributions in the IRA, allowing for a more tax-efficient Roth conversion.

- Incremental Conversions: Instead of converting a large sum at once, spread your Roth conversions over several years. This can help manage your tax liability and may be particularly beneficial if you anticipate being in a lower tax bracket in future years.

Key Considerations for 2024

- Scope of the Pro Rata Rule: Remember that the pro rata rule calculation considers the balance of all your traditional IRAs as of December 31st of the conversion year. This includes SEP and SIMPLE IRAs, not just the one being converted.

- Contribution Limits: The maximum contribution to a Roth IRA for 2024 is $7,000, or $8,000 if you’re 50 or older. These limits don’t apply to conversions.

- Income Limits: Direct contributions to a Roth IRA are subject to income limits. For 2024, the phase-out range for single filers is $146,000 to $161,000, and for married couples filing jointly, it’s $230,000 to $240,000. High earners exceeding these limits often explore backdoor Roth conversions.

- Accurate Record-Keeping: Meticulous record-keeping is vital. Maintain detailed records of all your IRA contributions, specifying the tax status of each, to ensure accurate calculations when performing conversions and filing IRS Form 8606.

Planning Ahead is Key

The pro rata rule underscores the importance of proactive tax planning, especially for high earners considering Roth conversions in 2024. By understanding this rule and implementing appropriate strategies, you can minimize your tax liability and maximize the benefits of a Roth IRA.

The 5-Year Rule for Roth Conversions

When converting to a Roth IRA, be aware of the 5-year rule. Each conversion has its own 5-year waiting period before you can withdraw the converted amounts penalty-free if you’re under 59½. This is separate from the 5-year rule for Roth IRA earnings.

Timing Your Roth Conversion

When considering a Roth conversion, timing matters. Converting later in the year allows you to have a clearer picture of your overall income for the year. This helps you assess the potential tax impact and make informed decisions.

State Tax Implications of Roth Conversions

While federal tax laws apply to everyone, it’s important to remember that state tax rules regarding Roth conversions can vary. Some states may not recognize Roth IRAs as tax-free, while others might have different income limits or tax rates. Be sure to research your state’s specific regulations or consult with a tax professional for guidance.

Impact of Recent Tax Law Changes

Tax laws are subject to change, and staying informed about recent updates is crucial. New legislation could impact Roth conversions, income limits, or contribution rules. It’s always advisable to stay current on any tax law changes that may affect your retirement planning.

Common Mistakes to Avoid

- Overlooking the Pro Rata Rule: Failing to consider the pro rata rule can lead to unexpected tax liabilities. Always assess the composition of your traditional IRAs before initiating a conversion.

- Poor Record-Keeping: Inaccurate or incomplete records can complicate the conversion process and make it difficult to determine the taxable portion of your conversion.

- Ignoring State Tax Implications: Not understanding your state’s tax treatment of Roth conversions can result in unforeseen tax burdens.

Backdoor Roth and the Pro Rata Rule

For high earners exceeding the income limits for direct Roth IRA contributions, the “backdoor Roth” strategy is a popular workaround. This involves contributing to a traditional IRA and then converting it to a Roth IRA. However, the pro rata rule still applies if you have existing traditional IRAs with pre-tax funds. Careful planning is essential to minimize the tax implications of this strategy.

Required Documentation for Conversions

- Form 8606 for reporting non-deductible IRA contributions

- Records of all IRA balances as of December 31st

- Documentation of any previous conversions

- Statements showing the tax status of all contributions

FAQ Section

Does the pro rata rule apply to all IRA distributions?

No. It specifically applies to conversions from traditional IRAs containing both pre-tax and after-tax contributions.

Where can I find information about my IRA contributions and their tax status?

Your IRA custodian provides annual statements detailing your contributions and their tax status. You can also consult with a tax professional for assistance.

When is the best time of year to do a Roth conversion?

It’s generally best to convert later in the year when you have a clearer picture of your total income and tax bracket.

Do all states treat Roth conversions the same way?

No. State tax laws regarding Roth conversions can differ significantly. Some states may not recognize them as tax-free, while others might have different rules.

Connecting with XOA TAX

Converting your IRA to a Roth IRA can be complex. At XOA TAX, our experienced CPAs can help you navigate the pro rata rule and develop a personalized strategy to meet your financial goals. Contact us today for a consultation:

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime