Welcome! We’re diving into a specialized yet increasingly important form of equity compensation: profit interest units (PIUs). Primarily used by partnerships and LLCs, PIUs attract, retain, and reward key contributors—employees, investors, and partners. Unlike stock options (granting the right to buy company stock), PIUs offer a share in future profits. Think of it as a slice of a growing pie – your slice only gains value as the pie expands beyond its current size. Let’s unpack how PIUs work and what you need to know.

How Profit Interest Units (PIUs) Function

A PIU grants a stake in future company profitability above a predetermined hurdle rate. This hurdle, set at the grant date, represents the benchmark the company must surpass before PIUs hold value. The PIU’s value isn’t tied to the company’s present worth but to its future performance relative to this hurdle. If the company thrives and profits exceed the hurdle, your PIU value rises. Conversely, if the company struggles to meet the hurdle, the value may stagnate or decline.

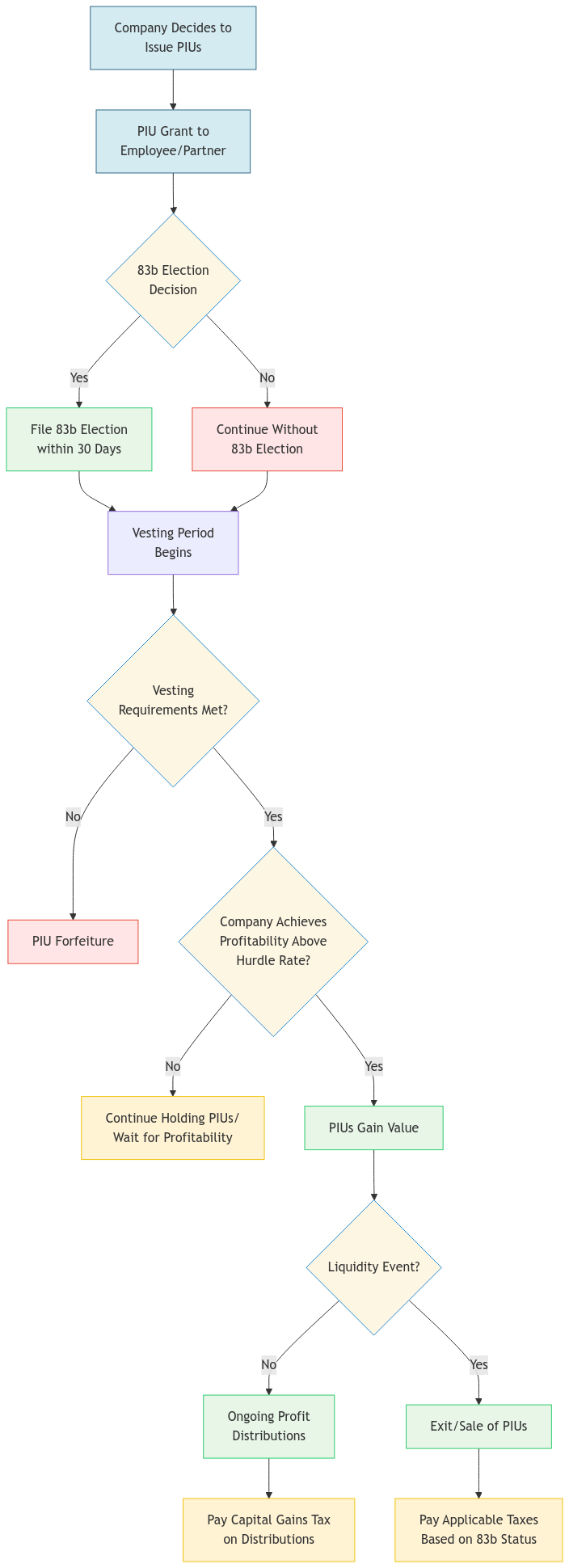

Following this lifecycle visualization, let’s examine each stage in detail…

Understanding Your PIU Value

Understanding the potential value of your PIUs is crucial for making informed decisions about your equity compensation. The value of PIUs depends on several key factors:

- Initial Company Value: The company’s value when your PIUs were granted, which establishes your hurdle rate baseline.

- Current/Projected Company Value: The company’s current value or projected future value, which determines if you’re above the hurdle rate.

- Your PIU Allocation: The number of PIUs you received relative to the total PIUs outstanding.

- Participation Rate: Your percentage share of profits above the hurdle rate, which may vary by tier.

To help you estimate the potential value of your PIUs under different scenarios, use our interactive calculator:

PIU Value Calculator

Estimate potential returns from your Profit Interest Units based on company performance

Results

The calculator helps you:

- Determine if your PIUs are “in the money” (above the hurdle rate)

- Calculate your potential share of company profits

- Understand how different growth scenarios affect your PIU value

- Plan for various exit scenarios

Remember that PIU values are typically:

- Zero at grant (by design)

- Dependent on company performance

- Subject to vesting requirements

- Impacted by waterfall provisions

- Affected by tax considerations

Key Characteristics of PIUs

- No Initial Intrinsic Value: PIUs typically have no immediate value because they only participate in profits above the hurdle rate.

- Vesting Schedules: Like stock options, PIUs often have vesting schedules, earning ownership incrementally:

- Time-Based Vesting: Ownership accrues over a set period (e.g., 25% annually for four years).

- Performance-Based Vesting: Ownership is contingent upon achieving specific company performance goals (e.g., revenue targets).

- Profit Sharing Mechanism: PIUs entitle you to a portion of profits exceeding the hurdle rate, usually distributed in cash, but potentially as additional equity, governed by the partnership or LLC operating agreement. Waterfall provisions within this agreement dictate the distribution hierarchy among different classes of partners or members.

PIU Profit Allocation Waterfall

Initial Value

Base company value before profit allocation

Hurdle Rate

Minimum return before PIU participation

Distribution Tiers

Varying allocations based on return multiples

- Liquidation Thresholds: This is the minimum company value required before PIU holders receive distributions in a liquidity event (sale or dissolution). PIU holders share profits only after this threshold is met.

- Forfeiture Provisions: PIU agreements often include forfeiture clauses, outlining conditions under which PIUs (vested or unvested) might be forfeited (e.g., termination of employment, unmet performance goals). Understanding these provisions is crucial for assessing the true value and risk.

Tax Implications of PIUs: A Closer Look

PIUs offer potential tax advantages, but careful consideration and professional advice are essential:

- Tax Deferral: Taxes are often deferred until PIUs are sold or disposed of, unlike non-qualified stock options, frequently taxed upon exercise.

- Capital Gains Treatment: Profits (amount received above the hurdle rate at grant) are typically taxed as capital gains (split between short-term and long-term based on holding period), generally more favorable than ordinary income rates.

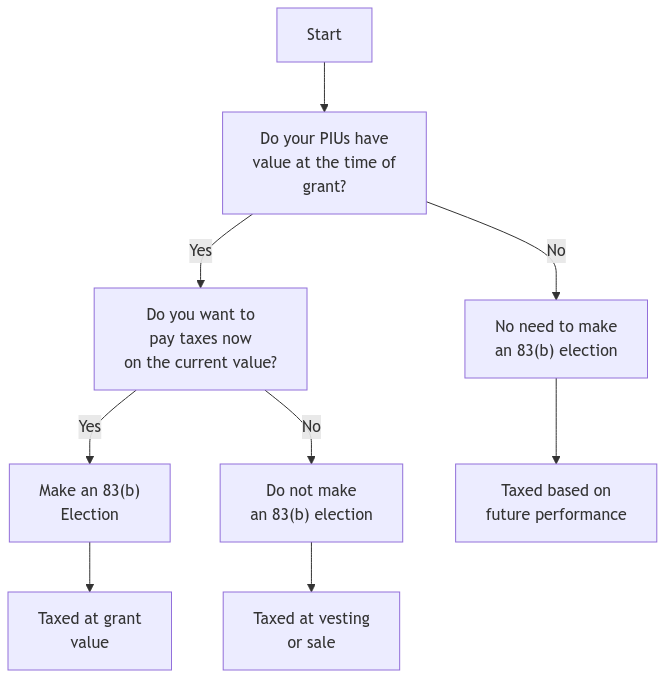

- Importance of Section 83(b) Election: This critical, irrevocable election allows recipients to pay taxes on the PIU’s fair market value at the grant date (often zero or low) rather than at vesting, when the value might be significantly higher. Failing to make this election could lead to higher ordinary income tax and withholding complications. Consult a tax professional within 30 days of the grant to determine if an 83(b) election is suitable for your circumstances.

- Unvested Profit Interests and Rev. Proc. 2001-43: This Revenue Procedure provides guidance on taxing unvested profit interests, clarifying valuation and other aspects. Consult a tax advisor to understand its application to your situation, especially concerning potential partnership audits.

- Partnership Audits and PIUs: The IRS may scrutinize PIU valuation and tax treatment during partnership audits. Keeping really good records is super important when you’re dealing with PIUs. This includes things like how much the PIUs are worth and having clear agreements in place. This helps prevent any disagreements and makes sure everyone’s on the same page when it comes to taxes. Having thorough documentation helps ensure a smooth process and prevents potential headaches with the IRS.

PIUs vs. Stock Options: Clearing Up the Confusion

- Stock Options: Grant the right to purchase company stock at a preset price (strike price). Value hinges on the stock price rising above the strike price.

- PIUs: Grant a share of future profits above a predetermined hurdle rate. Value depends on company performance exceeding the hurdle.

This visual comparison highlights the fundamental differences between these two forms of equity compensation. Let’s explore each of these distinctions in more detail…

Benefits of Utilizing PIUs

- Attracting and Retaining Top Talent: Effective in competitive industries for rewarding future contributions.

- Aligning Interests: Unites the financial interests of employees, investors, and partners with company success, encouraging collaboration.

- Tax Advantages: Potential tax deferral and capital gains treatment.

- Flexibility: Customizable vesting schedules, performance hurdles, and distribution waterfalls to suit specific company needs.

- Partnership Capital Account Implications: PIUs affect your partnership capital account (reflecting your equity share), impacting profit/loss/distribution allocation among partners. Section 704(b) governs this allocation, requiring substantial economic effect. Understanding PIUs’ impact on your capital account is crucial for tax planning.

Types of Profit Interests

- Time-Based PIUs: Vest over a defined period.

- Performance-Based PIUs: Vest upon achieving specific company performance targets.

State and International Tax Considerations

- State Taxes: State tax treatment varies; consult a tax professional familiar with your state’s laws.

- International Tax Implications: International operations introduce tax complexities (treaties, foreign tax credits, country-specific regulations); seek specialized advice.

Examples to Illustrate PIU Concepts

Example 1: Time-Based Vesting with 83(b) Election

Jane receives 1,000 PIUs (vesting 25% annually over four years) in an LLC with a $1 million hurdle rate. At grant, the company is valued at $800,000 (PIUs have no immediate value). She makes a timely 83(b) election. Three years later, the company sells for $5 million. Her vested PIUs represent a share of the $4 million profit (above the hurdle). She pays long-term capital gains tax on her portion. Without the 83(b) election, she would likely face higher ordinary income tax on the value at the sale/vesting date.

Example 2: Performance-Based Vesting Without 83(b) Election

John receives 500 PIUs (vesting upon reaching a revenue target within three years). The hurdle rate is set at grant. John doesn’t make an 83(b) election. The target is met in two years; his PIUs vest with a value above the hurdle. A year later, the company sells. John owes ordinary income tax on the difference between the sale and vesting values, likely higher than the grant date value.

Valuation Methodologies for PIUs

Determining fair market value is complex and often involves professional expertise, particularly for 83(b) elections and liquidity events. Methods include:

- Discounted Cash Flow (DCF): Projects and discounts future PIU-attributable cash flows.

- Market Approach: Compares PIUs to similar, publicly traded instruments (if available).

- Option Pricing Models: Adapts models like Black-Scholes to estimate future profit potential.

FAQs

What is the main difference between PIUs and stock options?

Stock options grant the right to buy company *stock* at a set price. PIUs grant a share of *future profits* above a set hurdle rate.

Can anyone receive PIUs, or just partners?

PIUs can be granted to employees, investors, and partners, though common in partnerships and LLCs.

What is a Section 83(b) election, and why is it important for PIUs?

This irrevocable election lets you pay taxes on the PIU value at grant (often low) rather than at vesting (potentially much higher). Consult a tax professional within 30 days of the grant.

How are PIUs taxed?

Complex, but generally, with a proper 83(b) election, you’ll pay taxes at the grant date value (often $0), and profit above the hurdle is taxed as capital gains upon sale/distribution. Without the election, expect ordinary income tax on the value at vesting/sale, potentially significantly higher.

Where can I find the specific terms of my PIUs?

Your company’s operating agreement or a separate grant agreement details the specifics of your PIUs.

Are PIUs subject to state taxes?

Yes, and rules vary significantly by state. Consult a tax professional.

What IRS codes and regulations govern PIUs?

Key guidance comes from Sections 708 and 83 of the Internal Revenue Code, along with Revenue Procedures 93-27 and 2001-43. Professional consultation is recommended.

How is the value of my PIUs determined?

Valuation can be complex, often involving professionals using methods like discounted cash flow analysis, market comparisons, and adapted option pricing models.

Connecting with XOA TAX

Navigating PIUs can be complex. XOA TAX specializes in guiding individuals and businesses through equity compensation. Whether you’re granting, receiving, or planning taxes related to PIUs, our experienced professionals offer personalized support. We can help you:

- Understand your PIU grant terms

- Evaluate tax implications (including state and international)

- Make informed 83(b) election decisions

- Develop a comprehensive equity compensation tax strategy

Contact us for a consultation:

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

Quick Reference Guide: Key Deadlines and Decisions Related to PIUs

- 83(b) Election: File within 30 days of grant (irrevocable).

- Vesting Dates: Refer to your PIU agreement.

- Tax Filing Deadlines: Standard deadlines apply; consult a tax advisor.

- Consultations: Consult a tax advisor before accepting PIUs and for ongoing planning.

Questions to Ask Before Accepting PIUs (Checklist)

Questions to Ask Before Accepting PIUs

Glossary of Key Terms

- PIU: Profit Interest Unit

- Vesting: Gradually earning PIU ownership.

- Hurdle Rate: The profit threshold for PIUs to gain value.

- Liquidation Threshold: Minimum company value for PIU distributions.

- 83(b) Election: Tax election for paying taxes on PIUs at grant.

- Capital Account: Partner’s ownership interest in the partnership.

- Section 704(b): Governs partnership income/loss allocation.

- Waterfall Provision: Rules for distributing profits to partners.

anywhere

anywhere  anytime

anytime