Retirement is a time to enjoy the fruits of your labor, but it also comes with certain financial obligations. One such obligation is taking Required Minimum Distributions (RMDs) from your tax-deferred retirement accounts. While RMDs provide a steady income stream, they also have tax implications that can be confusing. At XOA TAX, we understand the intricacies of RMDs and are here to help you navigate these requirements with ease.

Key Takeaways

- RMDs are mandatory withdrawals from certain retirement accounts after a certain age.

- Accurate tax withholding on RMDs is crucial to avoid penalties.

- Custodians sometimes make errors in calculating or withholding taxes.

- Proactive measures can ensure you meet your RMD obligations and optimize your tax situation.

When Do RMDs Start?

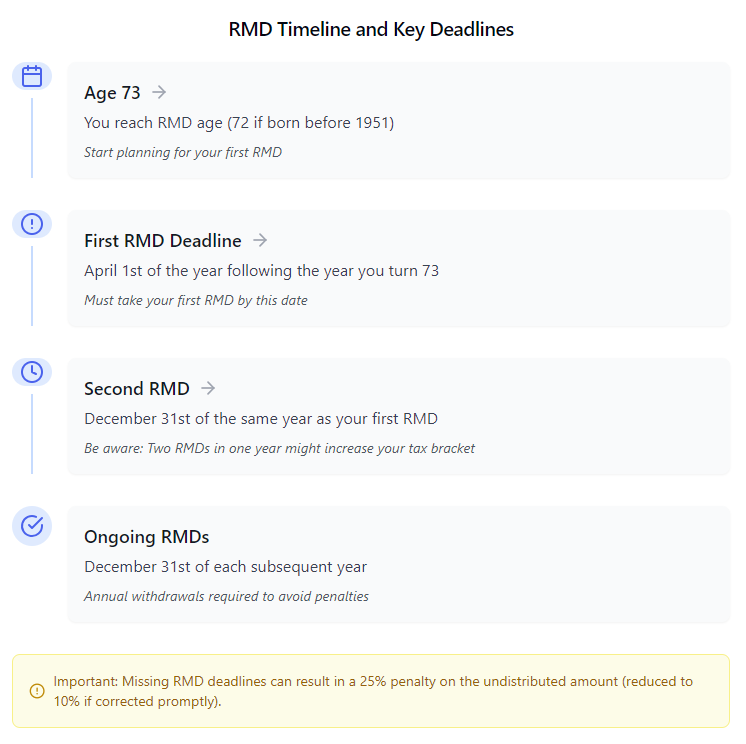

The age at which RMDs begin has recently changed thanks to the SECURE 2.0 Act. Here’s a quick reference:

| Birth Year | RMD Starting Age | First RMD Due Date |

|---|---|---|

| Pre-1951 | 72 | April 1, 2023 |

| 1951+ | 73 | April 1 after turning 73 |

How Are RMDs Calculated?

The IRS provides a Uniform Lifetime Table that factors in your age and account balance at the end of the previous year to determine your RMD amount. You can find this table and detailed instructions on the IRS website.

Sample RMD Calculation

Let’s look at a practical example:

- Account value (Dec 31 of the previous year): $500,000

- Your age this year: 75

- Distribution period (from IRS table): 22.9

- RMD calculation: $500,000 ÷ 22.9 = $21,834

This means you must withdraw at least $21,834 this year to satisfy your RMD requirement.

Withholding Taxes on Your RMDs

When you take an RMD, you have the option to have taxes withheld, similar to withholding from your paycheck. You can choose to have no taxes withheld, but it’s important to remember that your RMDs are considered taxable income. Without adequate withholding, you could end up with a large tax bill at the end of the year.

Common Issues with Custodians

While custodians (banks, brokerage firms, etc.) are generally reliable, errors can occur. We often see discrepancies in:

- RMD Calculation: The custodian may miscalculate your RMD amount, leading to under- or over-withdrawal.

- Withholding: The custodian might withhold an incorrect amount for taxes, potentially resulting in penalties or a large tax due.

Tips to Double-Check Your RMD Withholding

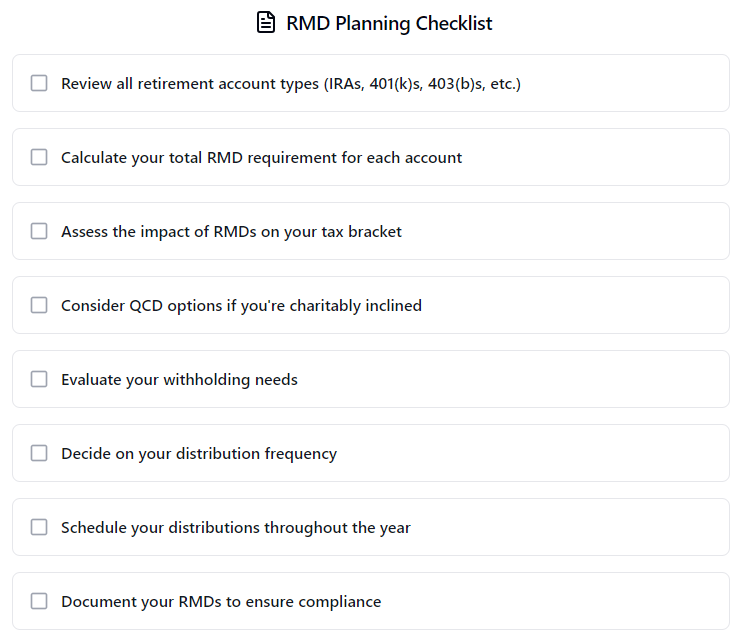

- Review Your Statements: Carefully examine your quarterly or annual statements to verify the RMD amount and tax withheld.

- Contact Your Custodian: If you spot any discrepancies, promptly contact your custodian to rectify the issue.

- Consult with XOA TAX: Our experienced CPAs can help you calculate your RMDs accurately and ensure the correct tax withholding.

Avoiding IRS Penalties

Failing to take your full RMD can result in a 25% penalty on the undistributed amount (reduced from the previous 50% penalty under the SECURE 2.0 Act). This penalty may be further reduced to 10% if you correct the error in a timely manner. This is a costly mistake that can be easily avoided with proper planning and oversight.

Common RMD Mistakes to Avoid

Missing the first RMD deadline: Remember that your first RMD has a different deadline (April 1st of the year after you turn 73 or 72, depending on your birth year) than subsequent RMDs (December 31st of each year).

Forgetting to aggregate IRA RMDs: If you have multiple traditional IRAs, you must calculate the RMD for each account separately. However, you can generally total these amounts and withdraw the aggregate from any combination of your IRAs.

Overlooking inherited IRA requirements: Inherited IRAs have unique RMD rules that differ from those for traditional IRAs. Be sure to understand these rules to avoid penalties.

Not coordinating spouse’s RMDs: If you and your spouse both have RMDs, coordinate your withdrawal strategies to optimize your tax situation.

Miscalculating year-end account values: Your RMD is calculated based on your account balance at the end of the previous year. Ensure you use the correct value to avoid under- or over-withdrawal.

Special Circumstances to Consider

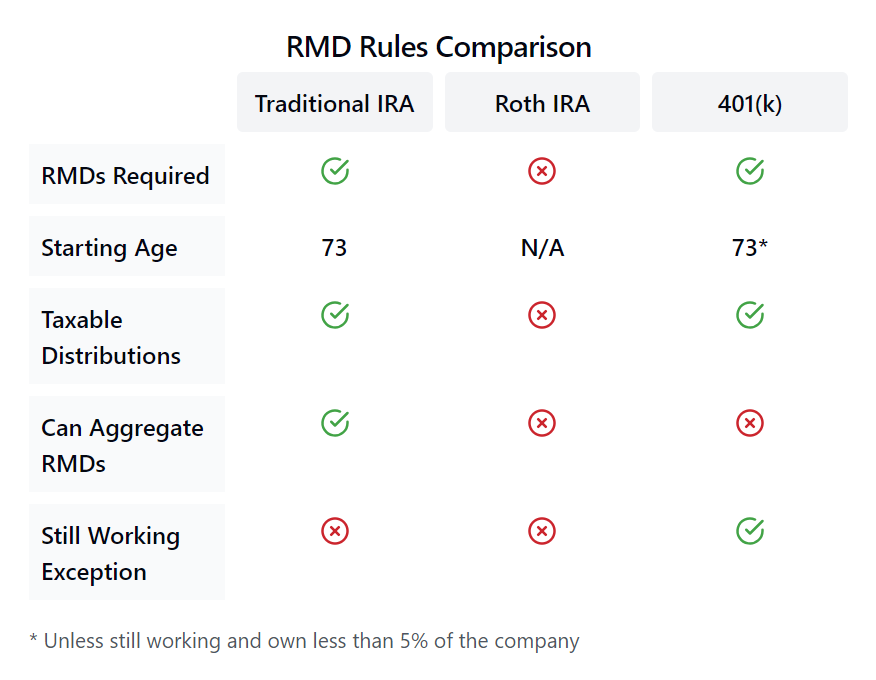

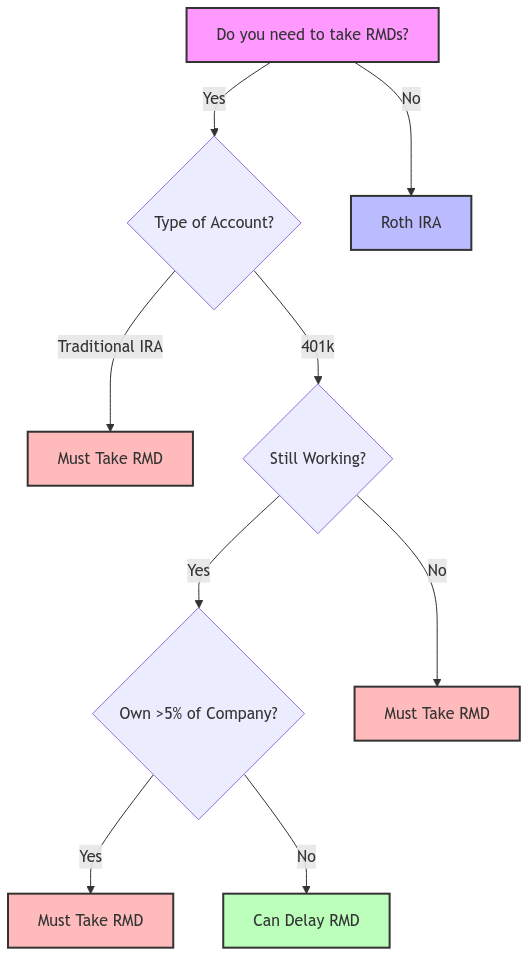

Still Working Past RMD Age: If you’re still working past age 73 (or 72, depending on your birth year) and own less than 5% of the company sponsoring your 401(k) or similar plan, you might be able to delay RMDs from that specific employer’s plan until you retire. This exception generally does not apply to IRAs.

Multiple Retirement Accounts: If you have multiple retirement accounts, you’ll need to calculate the RMD for each account separately. However, you can generally take the total RMD amount from any combination of your IRAs.

Inherited IRAs: Inherited IRAs have different RMD rules depending on your relationship to the original account holder and whether the account was inherited before or after 2020.

- Spouse Beneficiary Exception: If you inherit an IRA from your spouse, you generally have more options. You can treat it as your own IRA, roll it over into your own IRA, or take distributions under the beneficiary rules. This flexibility allows for greater control over your retirement funds and tax planning.

State Tax Implications: State tax rules on RMDs vary. Some states don’t tax retirement income, while others have different rules for different types of plans.

Impact on Social Security Benefits: RMDs can potentially increase the taxable portion of your Social Security benefits.

Cost Basis for Non-Deductible Contributions: If you’ve made non-deductible contributions to your traditional IRA, part of your RMD may be tax-free. Keep records of Form 8606 to track your cost basis and avoid paying taxes twice on these contributions. This is particularly important when calculating the taxable portion of your RMDs.

Tax Planning Strategies for RMDs

Qualified Charitable Distributions (QCDs): If you’re charitably inclined, consider QCDs. These allow you to directly transfer up to $100,000 annually from your IRA to a qualified charity, tax-free. This limit applies per taxpayer, so if you and your spouse both have IRAs, you can each contribute up to $100,000. This can be an excellent way to satisfy your RMD while reducing your taxable income. This limit is subject to change based on inflation adjustments, so be sure to check for the most up-to-date figure.

Strategic Withholding: Work with a tax professional to determine the appropriate amount of tax to withhold from your RMDs. This will help you avoid penalties and minimize your tax liability.

Coordinating RMDs with Other Retirement Income

It’s important to coordinate your RMDs with other sources of retirement income, such as:

- Social Security Benefits

- Pensions

- Annuities

RMD Frequency and Timing

You have flexibility in how you take your RMDs. You can choose to:

- Take them annually

- Take them quarterly

- Take them monthly

The key is to ensure you withdraw the full RMD amount by the deadline, which is generally December 31st of each year.

Market Volatility and RMDs

Market fluctuations can impact your RMD amount. If your account balance declines, your RMD will be lower. However, if the market performs well, your RMD could increase. Here are some strategies to consider in volatile markets:

- Partial Roth Conversions: Consider converting a portion of your traditional IRA to a Roth IRA during years when the market is down. This can help reduce your future RMDs and potentially lower your overall tax liability.

- Dollar-Cost Averaging: Consider spreading your RMD withdrawals throughout the year, rather than taking a lump sum. This can help average out your cost basis and potentially reduce the impact of market volatility.

Required Beginning Date (RBD)

The Required Beginning Date (RBD) is the deadline for taking your first RMD. It’s generally April 1 of the year following the year you turn 73 (or 72 if you reached age 72 in 2022 or earlier). You can take your first RMD anytime between turning 73 (or 72) and your RBD. However, keep in mind that you’ll also have to take your second RMD by December 31st of the same year, which could push you into a higher tax bracket.

RMD Planning Checklist

FAQs

What exactly are RMDs?

Can I roll over my RMD?

What happens to my RMDs if I die?

Can I take my RMD in installments?

Do Roth IRAs have RMDs?

How XOA TAX Can Help

At XOA TAX, we provide personalized guidance on all aspects of RMDs, including:

- RMD Calculation

- Tax Planning

- Withholding Optimization

- Retirement Planning

Understanding and managing your RMDs is vital for a smooth and financially secure retirement. If you have any questions or need assistance with RMD calculations, tax planning, or any other tax-related matter, please don’t hesitate to contact XOA TAX. Our team of experienced CPAs is here to provide you with personalized guidance and support.

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. This content is not intended to provide investment advice. XOA TAX is a CPA firm, not a registered investment advisor. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime