Hey there, fellow entrepreneurs! Thinking of expanding your business across the border to Canada? That’s awesome! The U.S. and Canada are like best buddies in the business world, but setting up shop in a different country can be a bit tricky. One of the biggest puzzles is figuring out the right business structure – it’s super important for both legal stuff and those taxes we all love (or maybe not!).

At XOA TAX, we’re Certified Public Accountants (CPAs), and we’re all about helping you navigate these challenges. So, grab a cup of coffee (or a double-double if you’re feeling Canadian!), and let’s break down some key things you need to know when teaming up with our friends up north.

Key Takeaways

- Picking the right business structure is like choosing the right pair of shoes for a hike – it can make all the difference!

- You gotta think about taxes on both sides of the border, in the U.S. and Canada.

- Our Canadian pals have some special tax rules for money they make in the U.S.

- Getting advice from a tax pro is like having a map and compass for your business journey – it keeps you on track!

Understanding Your Options: Business Entities

1. C-Corporation (C-Corp)

Think of a C-Corp as a sturdy house. It’s a common choice in the U.S., and it gives you something called “limited liability protection.” This means your personal stuff (like your car or house) is separate from the business’s stuff. If the business runs into trouble, your personal things are safe.

But here’s a little catch: C-Corps face something called “double taxation.” Imagine paying taxes twice on the same money! First, the corporation pays taxes on its profits at the corporate tax rate, which can be up to 21% at the federal level. Then, when those profits are shared with the owners (shareholders) as dividends, they have to pay taxes on them again at their individual income tax rates. For our Canadian friends, this can get even trickier because the U.S. might hold back some taxes from those shared profits (dividends). And don’t forget about taxes in Canada too!

2. Limited Liability Company (LLC)

LLCs are like the cool, flexible cousin of the C-Corp. They also offer that “limited liability protection,” but they have something called “pass-through taxation.” This means the profits and losses go straight to the owners’ personal tax returns – no double taxation!

However, Canada and the U.S. don’t always agree on how LLCs should be treated. This can sometimes lead to double taxation for Canadians who are part of an LLC. It’s important to figure out how Canada sees your LLC – is it a “see-through” entity or a corporation? This depends on how you choose to classify it by filing Form 8832 with the IRS. You can choose to have it treated as a disregarded entity, a partnership, or a corporation for U.S. tax purposes.

3. Partnership

Partnerships are like a team effort. You’ve got two main types: general and limited. In a general partnership, everyone shares the profits and losses, but they also share the risks. Limited partnerships let some partners have less risk and less control. But just like with LLCs, taxes can get complicated for Canadians in a U.S. partnership.

4. S-Corporation

S-Corps are kind of like a special club with some strict rules. They offer “pass-through taxation” like LLCs, but they have rules about who can be an owner. This can make them tricky for cross-border businesses with Canadian partners. For example, non-resident aliens generally can’t be shareholders in an S-Corp.

Business Entity Decision Tree

Answer a few questions to find the right business structure for your needs.

Are all owners U.S. residents or citizens?

Do you prefer pass-through taxation?

Is limited liability protection important?

How will the business be funded?

How many owners will the business have?

What is your estimated annual revenue?

What are your long-term growth plans?

Recommended Business Entities:

This tool provides general guidance only. Please consult with legal and tax professionals before making any decisions about your business structure.

Navigating Ownership for Canadian Partners

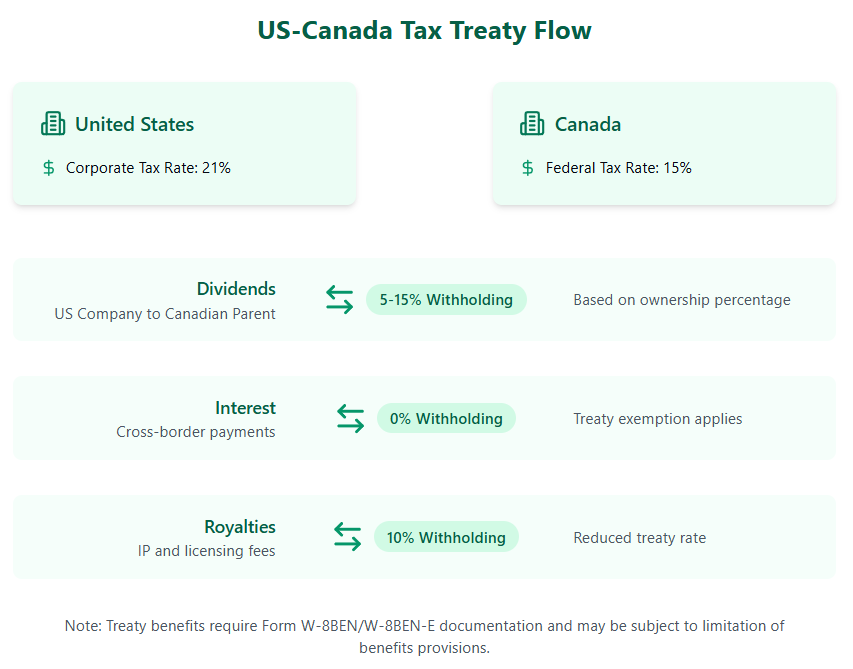

Withholding Taxes

Imagine the U.S. taking a small slice of your pie before you get to enjoy it. That’s kind of what withholding taxes are like. The U.S. usually has a 30% withholding tax on things like dividends, interest, and royalties paid to folks in other countries.

But here’s the good news! The Canada-U.S. Tax Treaty (specifically, Article X) is like a special agreement that can lower those taxes:

- Dividends: The usual treaty rate is 15%, but it can go down to 5% if the Canadian company owns a decent chunk (at least 10%) of the voting stock in the U.S. company.

- Interest: The treaty often says “no withholding tax” on interest payments – yay!

- Royalties: The treaty usually sets the rate for royalties at 10%.

Important Note: To get these lower rates, our Canadian friends need to fill out a form called Form W-8BEN. It’s like a little passport for their taxes. Sometimes, they might need to fill out Form 8833 to disclose their position on a tax treaty benefit.

Canadian Taxation

Canada wants its residents to pay taxes on all the money they make, even if it’s made in the U.S. But don’t worry, there’s something called a “foreign tax credit” to help avoid paying taxes twice on the same income. It’s like getting a discount on your Canadian taxes because you already paid some in the U.S. You’ll use Form T2209 to figure out this credit.

Branch Profits Tax

If your U.S. business is set up as a branch of a Canadian company, you might have to deal with the “branch profits tax.” It’s like an extra tax on the profits that are sent back to Canada. This tax is 30% and applies to the “dividend equivalent amount,” which is basically the after-tax earnings of the U.S. branch that are considered repatriated to Canada.

Permanent Establishment (PE)

Permanent Establishment (PE) Decision Tree

Determine if your business activities create a Permanent Establishment in the U.S.

Do you have a fixed place of business in the U.S.?

You likely have a Permanent Establishment (PE).

Do you provide services in the U.S. for more than 183 days in a 12-month period?

You may have a Permanent Establishment (PE).

Do you have an independent agent in the U.S.?

No Permanent Establishment (PE), provided the agent acts in the ordinary course of their business.

You likely do not have a Permanent Establishment (PE).

This one can be a bit tricky. If your Canadian business has a strong presence in the U.S., it might be considered a “permanent establishment.” This can affect how you’re taxed in the U.S. Article V of the Canada-U.S. Tax Treaty defines what creates a PE. Here are some examples:

- Fixed Place of Business: A fixed place of business, like an office, factory, or warehouse, can create a PE. The key is whether your business has a fixed spot where it does its thing in the U.S.

- Service PE: If a Canadian company provides services in the U.S. for more than 183 days within a 12-month period, it might create a service PE. This can be a bit complicated, and the details of what you’re doing really matter.

- Construction Site Rules: A building site or construction project that lasts for more than 12 months will usually create a PE.

Exceptions:

There are some exceptions to the PE rules. For example:

- Independent Agent: If you have an independent agent in the U.S. who’s acting in the ordinary course of their business, it usually won’t create a PE for you.

- Preparatory or Auxiliary Activities: Things like storing inventory, maintaining a display, or having an office just for gathering information are usually considered “preparatory or auxiliary” and don’t create a PE.

- Specific Exemptions: The treaty also lists some specific exemptions, like having a purchasing office or using a facility for advertising.

It’s always best to check the treaty and talk to a tax pro to be sure whether your activities create a PE.

Finding Solutions

Holding Strong

One option is to create a Canadian holding company. Think of it as a parent company that holds your shares in the U.S. company. This can help you save on taxes and make things easier when it’s time to file. But watch out for the “thin capitalization” rules – they can limit how much money you borrow to fund your U.S. business.

The ULC Advantage

Sometimes, using an Unlimited Liability Corporation (ULC) might be a good idea. These are usually formed in places like Nova Scotia, Alberta, or British Columbia. Here’s the interesting part: Canada sees ULCs as corporations, but the U.S. might see them differently if you make a special choice on Form 8832. This can open up some cool tax planning possibilities. But be careful – there might be some double taxation issues under Article IV(7)(b) of the Canada-U.S. Tax Treaty if both countries see the ULC as a resident.

State and Provincial Taxes

Remember those state and provincial taxes we mentioned? Yeah, those can be a bit of a maze. Most U.S. states and Canadian provinces have their own income taxes for businesses. And here’s the thing: you don’t necessarily need a physical office to be on the hook for these taxes.

Nexus:

This magic word, “nexus,” basically means having a significant connection with a state or province. It can be triggered by things like:

- Physical Presence: Having an office, warehouse, or employees in a state.

- Economic Activity: Making a certain amount of sales in a state, or having customers there.

- Online Activity: Even having a website that targets customers in a state can sometimes create nexus.

The rules for nexus are different in every state and province, so it’s important to check the specific requirements where you’re doing business.

Economic Nexus Lookup Tool

Find your state’s economic nexus requirements for sales tax collection. Enter your state name below to see threshold amounts, transaction limits, and registration deadlines.

State Name

Threshold:

Transactions:

Sales Included:

Registration Deadline:

Transfer Pricing

If your U.S. and Canadian businesses do any deals with each other (like buying or selling stuff), you need to know about “transfer pricing.” This means you have to treat each other fairly, like you would with any other business. Both countries have rules about this, so make sure you’re keeping good records. In Canada, if your cross-border transactions are worth more than $50 million CAD, you need to have proof that your pricing is fair.

Controlled Foreign Corporations (CFCs) and GILTI

If you own more than half of a company in another country, you might have to deal with the CFC rules. These rules can be a bit complex, but basically, they might make you pay taxes on some of that company’s income even if you haven’t received it yet. This includes something called GILTI (Global Intangible Low-Taxed Income), which was added by the Tax Cuts and Jobs Act (TCJA) of 2017. It’s best to chat with a tax pro to make sure you’re handling this correctly.

Recent Tax Legislation Impacts

Speaking of the TCJA, there have been some big changes in U.S. tax law lately that can affect your cross-border business. Here are a few key things to keep in mind:

- Lower Corporate Tax Rate: The TCJA lowered the top corporate tax rate from 35% to 21%. This is good news for C-Corps!

- Deductions for Business Expenses: There are new rules for deducting things like meals, entertainment, and interest expenses. Some deductions have been limited or eliminated, while others have been expanded.

- Pass-Through Deduction: The TCJA created a new deduction for owners of pass-through businesses (like LLCs and partnerships). This deduction can be worth up to 20% of your qualified business income.

- International Tax Changes: The TCJA made some big changes to international tax rules, including the CFC rules and GILTI.

It’s important to stay up-to-date on these changes, as they can significantly impact your tax bill.

Why You Need a Tax Pro in Your Corner

Cross-border business stuff can feel like a jungle sometimes. The best path for you depends on things like what your business does, how much money you make, and what your goals are.

That’s where we come in! XOA TAX has helped tons of businesses navigate the twists and turns of U.S. and Canadian tax laws. We can help you build a structure that keeps your taxes low and makes sure you’re following the rules in both countries. Think of us as your cross-border tax guides! We can help you with:

- Choosing the right business structure: We’ll consider your specific needs and goals to recommend the best option for you.

- Navigating tax treaties: We’ll help you understand the benefits of the Canada-U.S. Tax Treaty and how to claim them.

- Meeting all the filing requirements: We’ll ensure you’re compliant with all the tax laws in both countries.

- Minimizing your tax liability: We’ll help you develop a tax strategy that minimizes your taxes and maximizes your profits.

- Staying up-to-date on tax law changes: We’ll keep you informed about any new legislation that could affect your business.

FAQs

I’m a U.S. citizen with a Canadian business partner. Do these same things apply?

Absolutely! These things are important for everyone involved in a cross-border business, no matter where they’re from. U.S. citizens also have reporting requirements to be aware of, like the FBAR (Foreign Bank Account Report) if they have financial interests in foreign accounts that total over $10,000 at any time during the year.

What are some common mistakes people make when setting up a cross-border business?

One big mistake is forgetting to plan for taxes in both countries. This can lead to surprise tax bills and even penalties. Another mistake is not getting advice from a tax pro early on.

Besides the business structure, are there other tax things I should know about?

You bet! Things like sales tax, payroll tax, and those “transfer pricing” rules we talked about can also be important. It’s best to get a good understanding of all the tax laws that might affect you.

When are my taxes due?

That depends on what kind of business you have. Here’s a general idea:

U.S. Tax Deadlines:

• C-Corps: Usually April 15th

• Partnerships and LLCs: Usually March 15th

• Individuals: Usually April 15th

Canadian Tax Deadlines:

• Corporations: Six months after the end of the tax year

• Individuals: April 30th

Keep in mind that you can usually get an extension if you need more time.

Ready to Simplify Your Cross-Border Business?

Don’t let taxes be a roadblock on your business adventure! At XOA TAX, we’re experts in both U.S. and Canadian tax laws. We can help you find the perfect business structure, keep your taxes low, and make sure you’re following all the rules. Think of us as your cross-border tax guides!

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and should not be considered as legal, tax, or financial advice. Laws and regulations are complex, can change frequently, and vary significantly by location. This post is not a solicitation, and XOA TAX does not provide legal advice. XOA TAX is not responsible for updating this information to reflect future changes. For details on the scope of our services, please refer to IRS Circular 230. For advice tailored to your specific situation, please consult with a qualified professional.

anywhere

anywhere  anytime

anytime