The US tax system can feel like an overwhelming puzzle, especially for non-residents. This guide is here to simplify the tax filing process, providing clear insights into filing requirements, deductions, credits, and unique considerations for non-residents, such as having US citizen children. Let’s make navigating these complexities easier.

💡 Pro Tips

Important Notice: Non-residents should pay special attention to treaty benefits and FBAR requirements, as these are common areas of confusion.

Quick Started

Understanding Resident vs Non-Resident Tax Status

Before diving into the specifics of non-resident tax filing, it’s important to understand the key differences between resident and non-resident tax obligations. The following comparison highlights the main distinctions in taxable income, deductions, and filing requirements:

- Worldwide income taxable

- All foreign income must be reported

- Foreign tax credits available

- Investment income fully taxable

- Social Security benefits may be taxable

- Only US-source income taxable

- Foreign income generally exempt

- Limited foreign tax credits

- Special rules for investment income

- Social Security may be exempt under treaties

- Standard deduction available

- All itemized deductions allowed

- Full range of tax credits

- IRA contributions deductible

- Education credits available

- Limited standard deduction

- Limited itemized deductions

- Restricted tax credits

- IRA deductions may be limited

- Limited education benefits

- Form 1040 series

- Joint filing with spouse allowed

- Multiple filing statuses available

- E-filing generally available

- Estimated tax payments required

- Form 1040-NR required

- Joint filing restricted

- Limited filing status options

- Paper filing often required

- Special withholding rules apply

Note: This is a general comparison. Individual circumstances, tax treaties, and specific IRS rules may affect these requirements. Consult with a tax professional for advice specific to your situation.

Now that you understand the key differences between resident and non-resident tax status, let’s explore the specific requirements for non-resident tax filing in detail.

Tax Filing Basics for Non-Residents

1. Filing Requirements

If you are a non-resident alien in the US, you must file a tax return if you earn US-sourced income above a certain threshold. The income threshold depends on your filing status and type of income. For details on thresholds, consult IRS Publication 519 or seek professional advice.

2. Tax Forms

Non-residents generally use Form 1040-NR, U.S. Nonresident Alien Income Tax Return. This form differs from the standard Form 1040 used by residents and includes sections specifically tailored to non-residents’ unique tax situations.

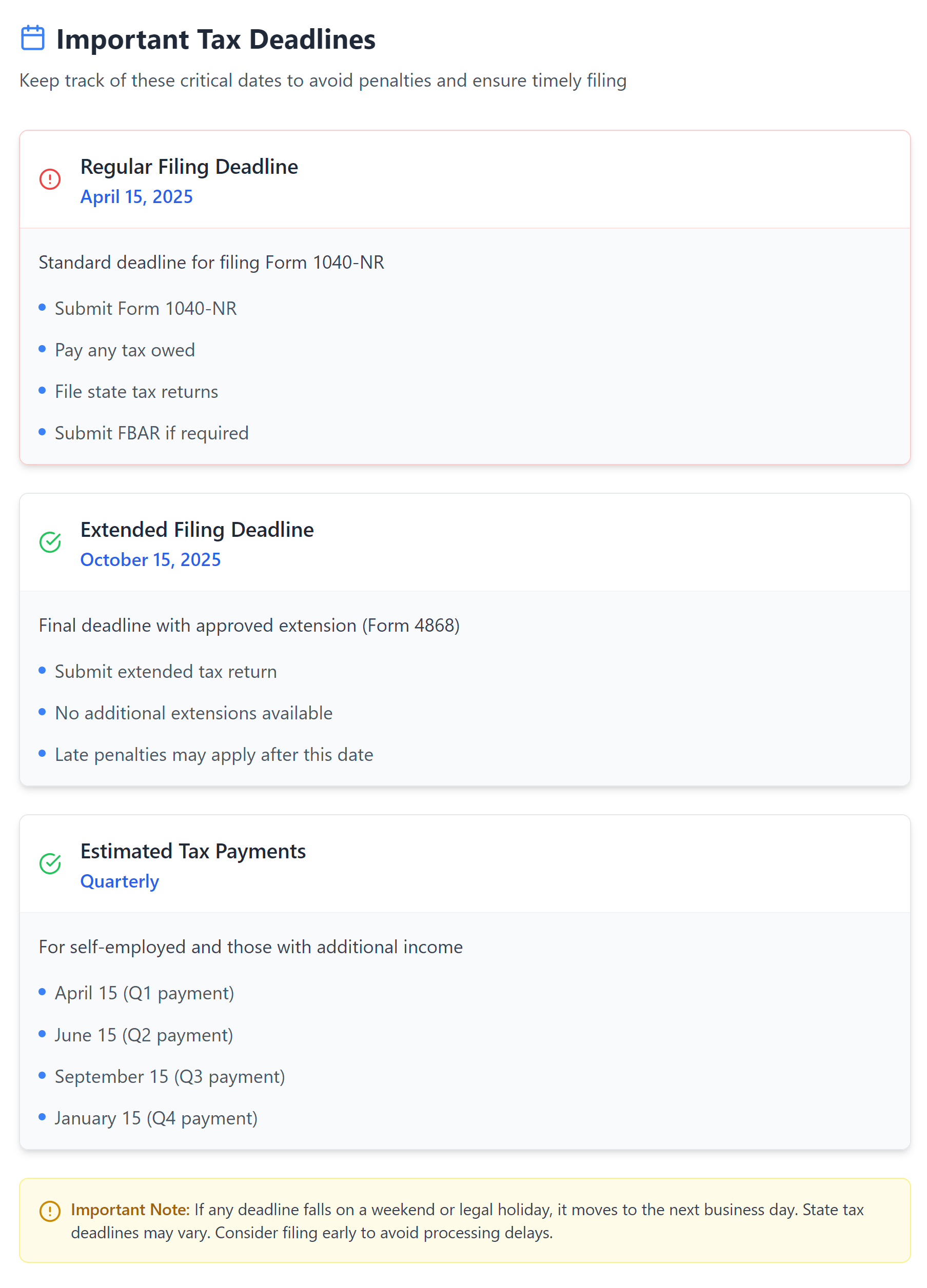

3. Tax Deadlines

The tax filing deadline for non-residents is typically April 15th, the same as for residents. If necessary, you can request an extension until October 15th. Be sure to file on time to avoid penalties.

Understanding Filing Statuses

Your filing status determines your tax liability. Here are the primary statuses for non-residents:

- Single: Unmarried individuals who do not qualify for another status.

- Married Filing Separately: Married non-residents filing separately from their spouse.

- Married Filing Jointly: Non-residents married to a US citizen or resident may elect to file jointly by making a Section 6013(g) election.

- Head of Household: Available if you are unmarried, maintain a home for a qualifying dependent, and meet specific criteria.

Deductions and Credits for Non-Residents

1. Standard Deduction

Non-residents are generally not eligible for the standard deduction unless:

- They are from India (under the US-India tax treaty), or

- They are a US national (e.g., from American Samoa).

2. Itemized Deductions

Non-residents may claim itemized deductions, such as:

- Medical Expenses: Deductible if they exceed a percentage of your Adjusted Gross Income (AGI).

- State and Local Taxes: Deductible up to specific limits.

- Charitable Contributions: Deductible if made to qualified US charities.

3. Tax Credits

- Child Tax Credit: Non-residents may qualify if:

- They are from Canada, Mexico, or South Korea, or

- They are married to a US citizen/resident and file jointly.

- Child and Dependent Care Credit: Available to eligible non-residents meeting specific requirements.

Unique Tax Situations for Non-Residents with US Citizen Children

- Dual Citizenship: US citizen children of non-residents are subject to US tax laws and may need to file their own returns.

- Filing as Qualifying Widow(er): If your spouse passes away and you care for a qualifying child, you may file as a qualifying widow(er) for two years, with benefits similar to filing jointly.

- Child’s Earned Income: If your child earns income, they may need to file a separate tax return, depending on the amount and type of income.

Additional Considerations for Non-Residents

1. Tax Treaties

The US has tax treaties with many countries, which may reduce or exempt specific types of income from taxation. Treaties often apply to:

- Wages, dividends, interest, or royalties.

- Avoidance of double taxation.

If claiming treaty benefits, you may need to file Form 8833 for treaty-based positions. Refer to IRS Publication 901 for treaty specifics. Note that Form 8833 is not required for all treaty benefits.

Treaty Benefits Example: A graduate student from India earning $25,000 as a teaching assistant might be exempt from US tax on $5,000 of this income under Article 21(2) of the US-India tax treaty.

- Benefits may vary based on visa type and specific circumstances

- Form 8833 may be required for certain treaty positions

- Consult a tax professional for detailed guidance

2. FBAR (Foreign Bank Account Reporting)

If the aggregate maximum value of all your foreign accounts exceeds $10,000 at any time during the year, you must file an FBAR (FinCEN Form 114).

- Deadline: April 15th, with an automatic extension to October 15th.

- Failure to file can lead to significant penalties.

3. State Taxes

State tax rules often differ from federal regulations. For instance:

- Some states, like California, define residency differently and may tax worldwide income.

- Federal treaty benefits may not be recognized by certain states, potentially leading to double taxation.

State Tax Example: A non-resident working in New York but living in New Jersey may need to file tax returns in both states, with New Jersey providing a credit for taxes paid to New York to avoid double taxation.

Income Reporting Requirements

Non-residents must understand the different categories of US-sourced income, as each may have different tax implications and reporting requirements. Here’s a breakdown of the main income categories:

- Wages from US employment

- Self-employment income

- Business income

- Personal services

- Partnership income

- Interest income

- Dividend payments

- Rental income

- Royalties

- Pension payments

Note: Different tax rates and withholding requirements may apply to each income category. Consult with a tax professional for specific guidance.

Understanding these categories is crucial as they determine:

- Tax rates

- Withholding requirements

- Reporting obligations

Non-residents must report US-sourced income, classified as:

- Effectively Connected Income (ECI): Income tied to a US trade or business, such as wages or self-employment income.

- Fixed, Determinable, Annual, or Periodical (FDAP) Income: Passive income, such as:

- Dividends

- Interest

- Royalties

- Rents

Important Tax Forms

- Form W-8BEN: Used to claim foreign status for tax withholding purposes.

- Form W-4: Used by employees to determine correct withholding.

- Form 8843: Required for exempt individuals like students and scholars.

Note: Incorrect completion of these forms may result in overwithholding or underwithholding of taxes.

Electronic Filing

Most non-residents cannot e-file Form 1040-NR. Common restrictions include:

- First-time ITIN applications

- Certain treaty-based return positions

- Some types of income reporting

Paper filing may be required in these situations.

Required Documentation

Before starting your tax filing process, ensure you have all necessary documents ready. The following checklist will help you track your document preparation:

Ensure you gather and retain the following:

- Income Forms: W-2, 1042-S, 1099.

- Taxpayer ID: ITIN or SSN documentation.

- Treaty Benefits Documentation: Supporting evidence for treaty claims.

- Record Retention: Maintain records for at least three years after filing.

Tax Filing Checklist

Required Documents

- Identification (passport, visa documentation)

- Income statements (W-2, 1042-S, 1099)

- ITIN or SSN documentation

- Previous years’ tax returns (if applicable)

- Treaty benefit documentation

- State tax forms (if applicable)

Social Security and Medicare Taxes

Non-residents on specific visa types (e.g., F-1, J-1) are typically exempt from Social Security and Medicare taxes. Employers must properly apply these exemptions. Check IRS Publication 519 for additional details.

Important: Some tax treaties modify these exemptions. For example, under the US-China tax treaty, Chinese scholars/researchers may be exempt from these taxes for up to 2 years.

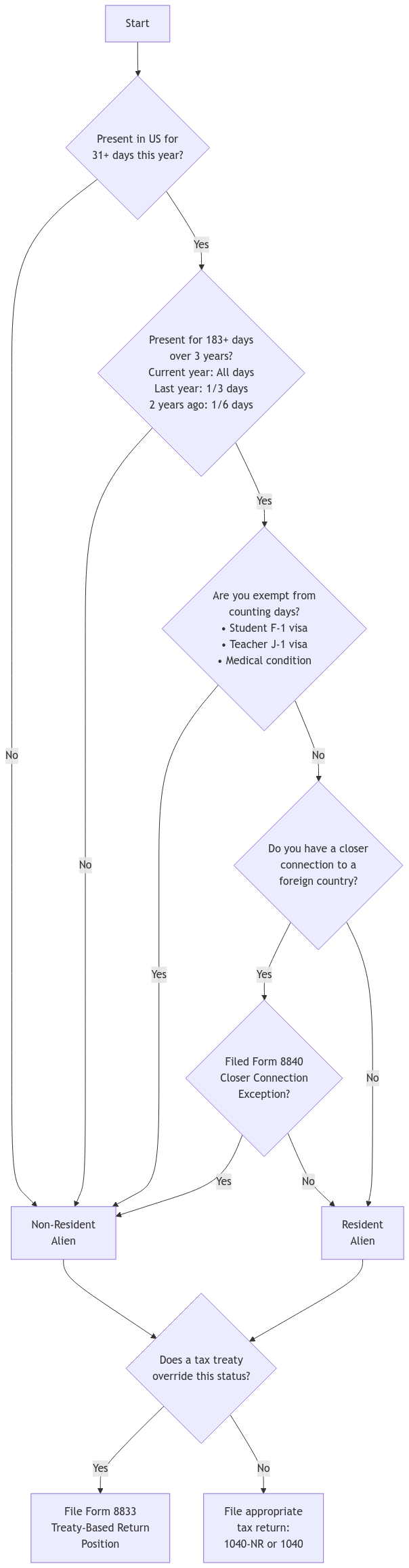

Substantial Presence Test

The Substantial Presence Test determines residency for tax purposes.

- You are a resident alien if you are physically present in the US for:

- 31 days in the current year, and

- 183 days over the past three years, calculated as:

- All days in the current year,

- 1/3 of the days in the previous year,

- 1/6 of the days two years ago.

If you meet these criteria but maintain closer ties to your home country, file Form 8840 to claim a closer connection exception.

Note: Certain days of presence in the United States do not count toward the Substantial Presence Test, such as:

- Days you commute from Canada or Mexico

- Days you are in the United States for less than 24 hours while in transit

- Days you could not leave due to a medical condition that arose while in the United States

Common Pitfalls

- Misclassifying residency status or failing the Substantial Presence Test.

- Overlooking FBAR filing requirements.

- Incorrectly claiming treaty benefits.

- Missing state tax obligations.

FAQs

Can I file my tax return electronically?

Most non-residents cannot e-file Form 1040-NR. You might need to file a paper return if you are:

Applying for an ITIN for the first time

Claiming certain treaty benefits

Reporting specific types of income

What if I can’t meet the April 15th deadline?

You can request an automatic extension to file your return until October 15th. However, this only extends the filing deadline, not the payment deadline. You’ll still need to estimate your tax liability and pay any taxes owed by April 15th to avoid penalties.

I’m a student here on an F-1 visa. Do I need to file a tax return?

Even if you’re a student, you may still need to file a tax return. You are generally required to file if your income exceeds certain thresholds or if you have any tax withheld from your wages. You might also need to file Form 8843, Statement for Exempt Individuals.

I received a tax form with an incorrect name or taxpayer identification number. What should I do?

Contact the issuer of the tax form (your employer, bank, etc.) immediately and request a corrected form. Do not file your tax return with incorrect information.

I’m leaving the US permanently. Do I need to file a tax return before I leave?

Yes, if you earned income while in the US, you are generally required to file a final tax return before departing. You may also need to file Form 1040-C, U.S. Departing Alien Income Tax Return.

Where can I get help with my tax return if I don’t understand the instructions?

The IRS offers various resources for taxpayers, including free publications, online tools, and telephone assistance. You can also seek help from a qualified tax professional, such as a CPA or Enrolled Agent.

Can I claim a foreign tax credit for taxes I paid to my home country?

You may be able to claim a foreign tax credit on your US tax return to avoid double taxation on the same income. This credit is subject to certain limitations and restrictions.

What happens if I make a mistake on my tax return?

If you discover an error after filing your return, you can file an amended return using Form 1040-X, Amended U.S. Individual Income Tax Return.

How long do I need to keep my tax records?

It’s generally recommended to keep your tax records for at least three years from the date you filed your return or the date the tax was paid, whichever is later. However, in some cases, you may need to keep records for a longer period.

What is the difference between a resident and a non-resident for tax purposes?

Residents are taxed on worldwide income, while non-residents are taxed only on US-sourced income.

Do I need an ITIN?

Non-residents without a Social Security Number (SSN) need an ITIN to file taxes. Use Form W-7 to apply.

What are the penalties for non-compliance?

Late filing or payment can result in fines. Missing FBAR reporting may result in severe penalties.

Professional Tax Assistance

Consider seeking professional help if you:

- Have income from multiple sources

- Claim treaty benefits

- Own US or foreign businesses

- Have complex investment income

- Need to file in multiple states

Additional Resources

- IRS Publication 519: U.S. Tax Guide for Aliens

- IRS Publication 901: U.S. Tax Treaties

- IRS Publication 515: Withholding of Tax on Nonresident Aliens

- Your country’s embassy or consulate tax resources

- State tax department websites

Connecting with XOA TAX

We understand that tax filing can be confusing, especially for non-residents. XOA TAX specializes in non-resident taxation and can assist with:

- Tax return preparation

- Treaty benefit analysis

- ITIN applications

- State tax compliance

- Prior year returns

- Tax planning

If you have questions or need assistance, contact us:

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime