At XOA TAX, we often get questions about W-4s, especially the “exempt” status. It sounds pretty great, right? No taxes withheld from your paycheck! However, claiming exempt when you shouldn’t can lead to some unpleasant surprises come tax time. Let’s break down what it really means to be exempt and how to avoid making a costly mistake.

Key Takeaways

- “Exempt” on your W-4 means you had no federal income tax liability last year and expect none this year.

- Getting a refund doesn’t automatically qualify you to claim exempt.

- Incorrectly claiming exempt can result in penalties, including interest and restrictions on future withholding.

- Adjust your W-4 if you realize you’ve made a mistake to minimize potential penalties.

- State tax rules may differ from federal regulations.

What Does “Exempt” Mean on a W-4?

Tax Liability Estimator

Estimate if you might qualify for exempt status based on your expected income and deductions.

Results

Qualification Status

This is a simplified estimation tool. Actual tax liability may vary based on additional factors. Consult a tax professional for accurate advice.

When you start a new job, you fill out a W-4 form to tell your employer how much federal income tax to withhold from your paycheck. Choosing "exempt" means zero tax will be withheld.

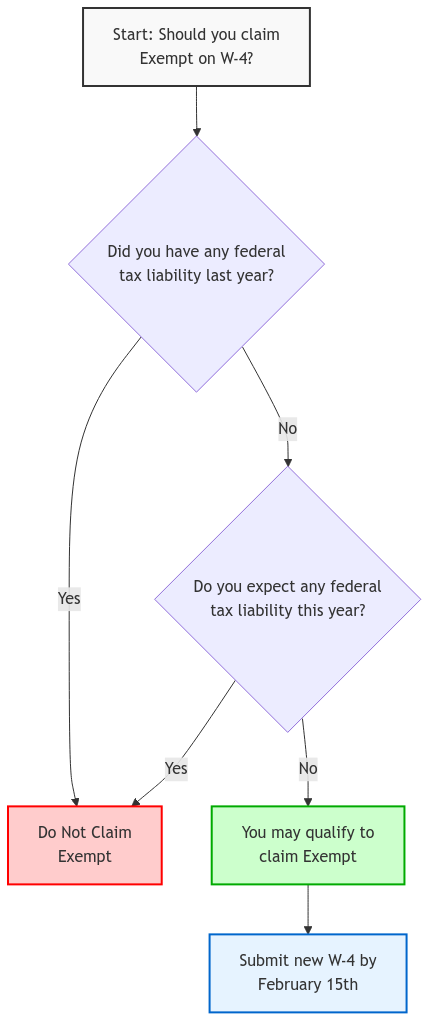

Now, here's the crucial part: you can only claim exempt if you meet both of these conditions:

- You had no federal income tax liability the previous year.

- You expect to have no federal income tax liability in the current year.

It's important to understand that this isn't about getting a big refund; it's about whether you actually owe taxes.

Why a Tax Refund Doesn't Mean Exemption

Many people mistakenly believe that receiving a tax refund means they don't owe any taxes. Not necessarily! A refund often just means you overpaid throughout the year and the IRS is returning the extra money.

Think of it like this: you go to the store and pay for a $5 item with a $10 bill. You get $5 back, but that doesn't mean the item was free. You still had a tax liability; you simply overpaid through your withholding.

Risks of Incorrectly Claiming Exempt

Claiming exempt when you don't qualify can have serious consequences. The IRS may impose penalties for underpayment, including:

- Penalty Interest: You could be charged interest, currently at 8% (subject to change quarterly) per year, on the unpaid taxes.

- "Lock-in" Letters: The IRS might send you a "lock-in" letter, requiring you to have a specific amount of tax withheld from your paycheck. These lock-in letters can be difficult to change and may result in excessive withholding that's hard to adjust.

Consequences of Incorrect Exemption

Incorrect Exemption Filed

Employee claims exempt status on W-4 without meeting requirements

No Tax Withholding

No federal income tax is withheld from paychecks

Tax Filing Season

Large tax bill due + Penalties

IRS Lock-in Letter

IRS requires specific withholding rate

- Employer must comply with IRS withholding rate

- Employee cannot decrease withholding without IRS approval

- May take months to modify

Long-term Consequences

Financial and administrative burden

- Restricted future withholding choices

- Potential payment plan needed

- Impact on credit and financial decisions

How Misusing the Exemption Affects Finances

Incorrectly claiming exempt is essentially like taking out a high-interest loan from the IRS, complete with penalty fees. This can create a significant financial burden when it's time to file your return. Imagine expecting a refund and instead getting hit with a large tax bill plus penalties!

Don't Forget State Taxes!

While the "exempt" status on your W-4 applies to federal income tax withholding, it's important to remember that state tax rules may differ. Some states may not have an "exempt" option or may have different requirements for claiming exemption from state income tax withholding.

To ensure you're meeting your state tax obligations, be sure to check your state's specific guidelines or consult with a tax professional for clarification.

FAQ Section

Q: Can I claim exempt if I'm a dependent?

A: Generally, no. Dependents usually have a lower income threshold for tax liability, but it's not always zero. For 2024, a dependent who can be claimed on someone else's return can only earn up to $14,600 before being required to file.

Q: What if I have a side hustle?

A: Income from a side hustle, or any other source, counts towards your overall tax liability. You need to consider all income when determining if you qualify for exempt status.

Q: How do I know my tax liability for the current year?

A: Estimating your tax liability can be tricky. You can use your prior year's return as a starting point, but consider any major life changes (like a new job or marriage) that might affect your income. The IRS also provides withholding calculators and worksheets to help you estimate. You can find these resources on the IRS website (link to IRS withholding calculator).

Q: Do I have to submit a new W-4 every year to claim exempt?

A: Yes. The exempt status on your W-4 is not permanent. You'll need to submit a new W-4 claiming exemption each year by February 15th if you continue to meet the requirements.

Steps to Correct Withholding if You Made a Mistake

If you realize you shouldn't have claimed exempt, don't panic! You can usually correct your withholding by submitting a new W-4 to your employer. To avoid penalties, aim to withhold at least:

- 100% of the tax liability shown on your prior year's tax return (110% if your adjusted gross income was over $150,000).

- 90% of your estimated current year tax liability.

These are known as "safe harbor" rules and can help you avoid underpayment penalties.

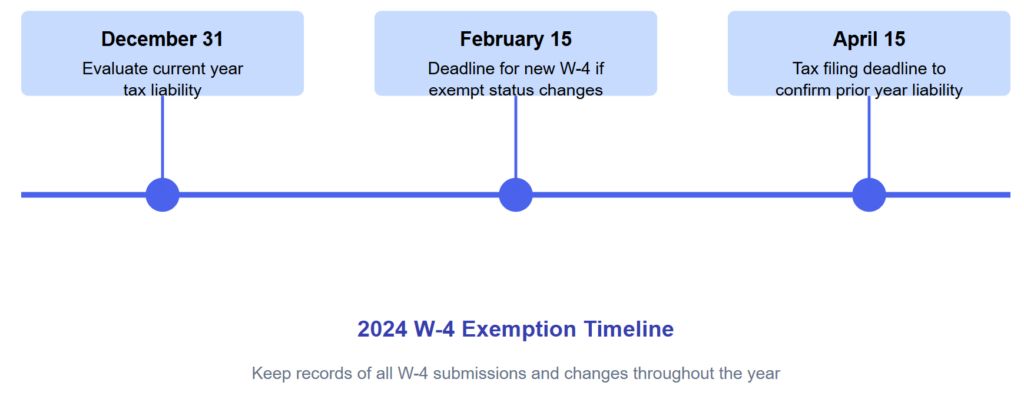

Important Dates for W-4 Exemptions:

- December 31: Deadline to evaluate current year tax liability

- February 15: Deadline for new W-4 if exempt status no longer applies

- April 15: Tax filing deadline that confirms prior year liability

Example Scenarios:

- Full-time student with a part-time job making under $14,600 (2024 standard deduction)

- Recent graduate starting their first job mid-year

- Multiple job situations

Before Claiming Exempt Checklist

Submitting Your W-4

Many employers now offer online portals for employees to complete and submit their W-4s electronically. Be sure to check with your employer for their preferred submission method. You may need to provide a digital signature when submitting your W-4 online.

Special Situations

Please note that special rules may apply for non-resident aliens and military personnel. If you fall into one of these categories, refer to the IRS website or consult with a tax professional for guidance on completing your W-4.

Connecting with XOA TAX

Understanding your W-4 and withholding is an important part of tax planning. If you have any questions or need assistance with your tax situation, the team at XOA TAX is here to help. We can guide you through the process, ensure you're withholding correctly, and help you avoid potential penalties.

Need help with your taxes? Contact us today!

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. Please consult a professional advisor for advice specific to your situation. It is also important to keep records of your W-4 submissions and be aware of any digital signature requirements when submitting your forms electronically.

anywhere

anywhere  anytime

anytime