The general ledger. It might sound like a relic from an ancient accounting society, but it’s actually the beating heart of your business’s financial story. At XOA TAX, we believe that understanding your general ledger is essential for making informed decisions and steering your business towards financial success.

Think of it like this: your general ledger is a centralized hub where every financial transaction your business makes is meticulously recorded, organized, and summarized. From a simple sale to a complex expense, it’s all captured within this vital system.

In this guide, we’ll break down the essentials of the general ledger, shedding light on its inner workings and demonstrating why it’s so crucial for your business.

Key Takeaways

- The general ledger is the foundation of your company’s financial record-keeping.

- It uses the double-entry bookkeeping system to ensure accuracy and balance.

- The general ledger provides the raw data for generating key financial statements like the balance sheet and income statement.

- Understanding your general ledger can help you make better financial decisions.

What is a General Ledger?

Simply put, a general ledger is a complete record of all financial transactions throughout the life of your company. These transactions are categorized into accounts – think of them like buckets – that represent different aspects of your business’s finances:

Accounts within the General Ledger

- Assets: What your company owns (e.g., cash, accounts receivable, equipment).

- Liabilities: What your company owes to others (e.g., loans, accounts payable).

- Owner’s Equity: The owner’s stake in the company.

- Revenue: Income generated from your business activities.

- Expenses: Costs incurred in running your business.

Each of these accounts lives within your general ledger, providing a comprehensive overview of your financial health.

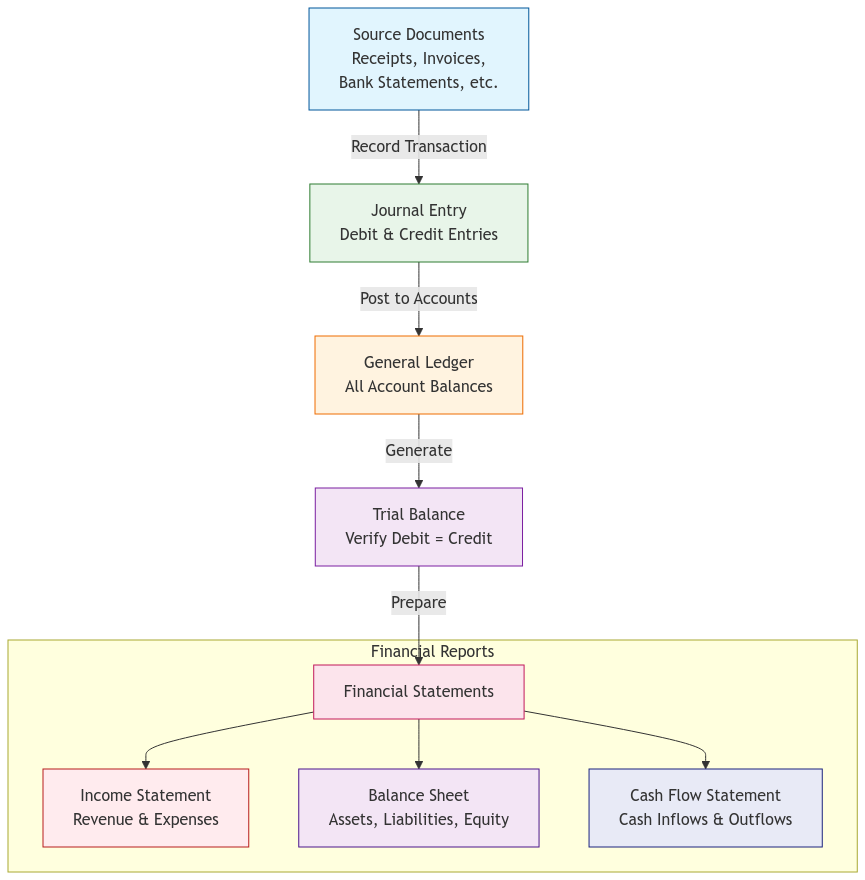

How Does a General Ledger Work?

The general ledger operates on the principle of double-entry bookkeeping. This means that for every transaction, there are at least two entries – a debit and a credit – ensuring that the accounting equation (Assets = Liabilities + Owner’s Equity) always remains balanced.

Let’s illustrate this with a simple example. Imagine you sell a product to a customer for $100. In your general ledger, you would:

- Debit: Increase your cash account by $100.

- Credit: Increase your sales revenue account by $100.

This ensures that the equation stays balanced, as both sides increase by the same amount.

Why is the General Ledger Important?

The general ledger isn’t just about recording numbers; it plays a vital role in understanding your business’s financial performance and making informed decisions. Here’s how:

- Creating Financial Statements: The data within your general ledger is used to generate crucial financial reports, such as:

- Income Statement: Shows your business’s profitability over a specific period.

- Balance Sheet: Provides a snapshot of your company’s assets, liabilities, and equity at a given point in time.

- Statement of Cash Flows: Tracks the movement of cash in and out of your business.

- Tracking Financial Health: By analyzing your general ledger, you can identify trends, spot potential problems, and track key performance indicators (KPIs).

- Facilitating Audits: A well-maintained general ledger makes the auditing process smoother and more efficient.

- Ensuring Compliance: The general ledger helps you meet regulatory requirements and maintain accurate financial records.

General Ledger and Sub-ledgers: A Deeper Dive

While the general ledger provides a high-level overview of your finances, sub-ledgers offer a more granular view. Think of sub-ledgers as supporting documents that provide detailed information for specific general ledger accounts.

For instance, your “Accounts Receivable” account in the general ledger might have a corresponding sub-ledger that tracks individual customer invoices and payments. This level of detail can be invaluable for managing customer relationships and tracking outstanding payments. Similarly, an “Accounts Payable” sub-ledger would track individual vendor bills and payments.

The Trial Balance: Ensuring Accuracy

Before financial statements are prepared, a trial balance is created. This is a list of all the accounts in the general ledger with their respective debit or credit balances. The purpose of the trial balance is to ensure that the total debits equal the total credits, confirming that the accounting equation is in balance. If there are discrepancies, they must be investigated and corrected before proceeding.

The Role of Accounting Software

In today’s digital age, most businesses utilize accounting software to manage their general ledger. Software like QuickBooks Online, Xero, and FreshBooks automates many of the manual tasks associated with bookkeeping, reducing errors and providing real-time insights into your financial data.

These software solutions offer features like:

- Automated data entry

- Bank reconciliation

- Financial reporting

- Cloud-based access

- Data security

If you’re feeling overwhelmed by the prospect of managing your general ledger, investing in accounting software can be a game-changer.

Internal Controls and the General Ledger

Strong internal controls are essential to safeguard the accuracy and integrity of your general ledger. These controls can include:

- Segregation of duties: Different individuals are responsible for recording, authorizing, and reviewing transactions.

- Regular reconciliations: Accounts are reconciled with external sources (bank statements, vendor invoices) on a regular basis.

- Access controls: Limit access to the general ledger to authorized personnel only.

- Data backups: Regularly back up your financial data to prevent loss.

By implementing these controls, you can minimize the risk of errors, fraud, and data breaches.

Digital Security in the Cloud Age

With the rise of cloud-based accounting software, ensuring the security of your financial data is more critical than ever. Choose software providers that offer robust security measures, such as:

- Data encryption

- Multi-factor authentication

- Regular security audits

- Compliance with industry standards (e.g., SOC 2)

By prioritizing digital security, you can protect your business from financial losses and reputational damage.

Month-End Closing Procedures

At the end of each month, it’s crucial to perform a series of steps to “close the books” and ensure the accuracy of your financial records. These steps typically include:

- Reconciling all accounts: Compare your general ledger balances to bank statements, vendor invoices, and other supporting documentation.

- Posting accruals and deferrals: Account for revenues earned but not yet received and expenses incurred but not yet paid.

- Making adjusting entries: Record any necessary adjustments to ensure that revenues and expenses are recognized in the correct period.

- Preparing closing entries: Transfer the balances of temporary accounts (revenue, expenses) to retained earnings.

These procedures ensure that your financial statements accurately reflect your business’s performance for the month.

Audit Trails: Maintaining Accountability

An audit trail is a record of all changes made to transactions within the general ledger. It tracks who made the changes, when they were made, and what the changes were. This provides a valuable tool for:

- Identifying errors: If a mistake is made, the audit trail can help you pinpoint the source and correct it.

- Preventing fraud: By tracking who has access to the general ledger and what changes they make, you can deter fraudulent activity.

- Meeting regulatory requirements: Many industries have regulations that require maintaining audit trails for compliance purposes.

General Ledger and Tax Reporting

The general ledger plays a critical role in tax preparation. The information within your general ledger is used to determine your taxable income and prepare various tax forms and schedules. For example:

- Income Statement: Used to report your business’s revenues and expenses on your tax return.

- Balance Sheet: Provides information about your assets, liabilities, and equity, which may be relevant for certain tax calculations.

- Specific GL Accounts: Certain accounts in your general ledger, such as depreciation expense or charitable contributions, have direct implications for your tax liability.

Frequently Asked Questions (FAQ)

What is the process of creating a general ledger?

Creating a general ledger involves a systematic approach to recording and organizing your financial data:

• Record each transaction: Start by recording every business transaction in a journal or log.

• Categorize transactions: Assign each transaction to the appropriate account (e.g., sales, cash, expenses).

• Reconcile regularly: Periodically review and reconcile your accounts to ensure accuracy.

• Transfer to the general ledger: Once reconciled, transfer the information from your journal to the general ledger.

What is a general ledger reconciliation process?

General ledger reconciliation is the process of comparing your internal financial records with external sources (like bank statements) to ensure accuracy. This helps identify any discrepancies or errors that need to be corrected.

How are discrepancies in a general ledger addressed during reconciliation?

If you find discrepancies during the reconciliation process, it’s important to investigate the cause. This may involve reviewing transactions, checking for errors, and making correcting entries in your general ledger.

What does the reconciliation process in a general ledger involve?

The reconciliation process typically involves gathering account information, verifying entries and corrections, comparing balances with external records, and investigating any discrepancies.

How can a general ledger be both a physical and digital record?

While traditionally maintained in physical books, general ledgers are now primarily digital. However, some businesses may choose to keep physical backups for added security.

What are general ledger codes and how are they used?

General ledger codes (GL codes) are numerical identifiers assigned to different accounts in your chart of accounts. These codes help streamline data entry and reporting by providing a standardized way to categorize and track transactions.

What is a typical numbering system for GL accounts?

While numbering systems can vary, a common convention is to use:

• 1000s for Assets

• 2000s for Liabilities

• 3000s for Equity

• 4000s for Revenue

• 5000s for Expenses

This helps organize the chart of accounts and makes it easier to identify the type of account.

Need Help with Your General Ledger?

Feeling overwhelmed by the complexities of your general ledger? Contact XOA TAX today! Our team of experienced CPAs can help you ensure accuracy, efficiency, and clarity in your financial record-keeping.

We offer a range of services, including:

- Bookkeeping

- Financial statement preparation and analysis

- Tax planning and preparation

- Business consulting

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime