At XOA TAX, we often find ourselves helping clients understand the story their financial data is telling. One of the most useful tools in our arsenal is Year-Over-Year (YOY) growth analysis. It’s like looking at your business’s performance through a magnifying glass, allowing you to spot trends and make informed decisions.

Key Takeaways

- YOY growth compares financial data to the same period in the previous year: It helps identify trends, track performance, and make forecasts.

- It helps identify trends, track performance, and make forecasts: Calculating YOY growth is simple, but understanding its implications is key.

- Calculating YOY growth is simple, but understanding its implications is key: XOA TAX can help you leverage YOY analysis for better business decisions.

What is YOY Growth?

Imagine comparing your company’s revenue from this quarter to the same quarter last year. That’s essentially what YOY growth is all about. It involves tracking a specific metric – be it revenue, profit, or customer count – and comparing it to the same period the year before. This comparison provides valuable context and reveals how your business is performing over time.

Why is YOY Growth Important?

Think of YOY growth as a scorecard for your business. It helps you answer questions like:

- Are we improving? YOY growth shows whether your key metrics are increasing, decreasing, or remaining stagnant.

- Are there hidden trends? Analyzing YOY growth can reveal patterns in your sales, expenses, or customer acquisition costs.

- How can we plan for the future? Past YOY trends can inform your forecasts and help you make better business decisions.

For example, let’s say you run an e-commerce store. By analyzing YOY growth for different product categories, you might discover that sales of winter apparel consistently spike in November. This insight can help you optimize your inventory and marketing efforts for the upcoming season.

Calculating YOY Growth

Calculating YOY growth is fairly straightforward:

- Choose a metric: Select the financial data you want to analyze (e.g., revenue, profit).

- Gather data: Obtain the value of the metric for the current period and the same period last year.

- Calculate: Use the following formula:

YOY Growth Rate = ((Current Year’s Value – Previous Year’s Value) / Previous Year’s Value) x 100

Example

If your company generated $1.5 million in revenue this quarter and $1.2 million in the same quarter last year:

YOY Growth Rate = (($1,500,000 – $1,200,000) / $1,200,000) x 100 = 25%

This means your company experienced a 25% increase in revenue compared to the same quarter last year.

What is a Good YOY Growth Rate?

There’s no magic number for a “good” YOY growth rate. Year-over-year (YOY) growth rates vary significantly across industries, company sizes, and economic conditions. While higher growth rates are generally favorable, they should be evaluated in context. For instance, a lower growth rate might still indicate a healthy business if accompanied by improved profitability or increased customer retention.

According to Deloitte’s “Global Powers of Retailing 2023” report, the top 250 retailers achieved an average YOY retail revenue growth of 8.5% in FY2021, up from 5.2% in the previous year. Deloitte

This data reflects the performance of large retailers globally and may not directly represent small businesses in the retail sector.

Specific data on the average YOY revenue growth for small businesses in the retail sector is limited. However, it’s important to note that growth rates can vary widely based on factors such as market dynamics, operational efficiency, and strategic initiatives. Therefore, when assessing your company’s performance, it’s crucial to consider these contextual elements alongside YOY growth rates.

YOY Growth in Action

YOY analysis can be applied to various time frames (monthly, quarterly, annually) and across different departments within your company. For example, you can use it to:

- Track the effectiveness of a new marketing campaign.

- Monitor the performance of your sales team.

- Evaluate the impact of cost-cutting measures.

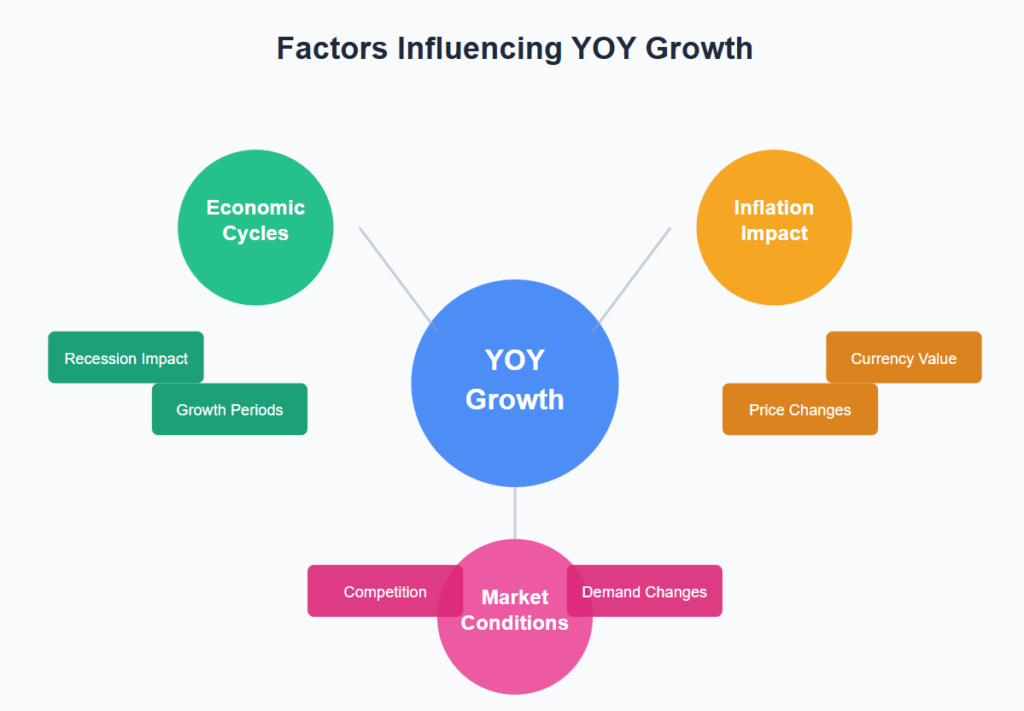

Factors Influencing YOY Growth

It’s important to remember that YOY growth can be influenced by various external factors, such as:

- Economic cycles: A recession can significantly impact YOY growth, even for healthy businesses. For example, during the 2008 financial crisis, many businesses experienced negative YOY growth due to the economic downturn.

- Inflation: High inflation can artificially inflate YOY growth figures. If your revenue increased by 10% YOY, but inflation was 8%, your real growth is only 2%.

- Market conditions: Changes in consumer demand, competition, and industry trends can all affect YOY growth. The rise of e-commerce has significantly impacted brick-and-mortar retailers, affecting their YOY growth.

Industry Benchmarks (2024)

-

Retail: The National Retail Federation (NRF) forecasts a 2.5% to 3.5% increase in retail sales for 2024, reaching between $5.23 trillion and $5.28 trillion. SCMR

-

Technology: Deloitte’s 2023 Technology Fast 500™ rankings highlight the fastest-growing technology companies in North America, with growth rates varying significantly among firms. Deloitte

-

Healthcare: The U.S. healthcare industry’s profits are projected to grow approximately 5% annually through 2024, with the fastest growth in medical technology and healthcare IT sectors. Statista

-

Manufacturing: The U.S. manufacturing sector has experienced a compound annual growth rate (CAGR) of -0.6% over recent years, indicating a slight decline. NIST Publications

These figures provide a general overview; actual growth rates can vary based on specific industries and market conditions.

Making YOY Growth More Meaningful

While basic YOY growth calculations are useful, there are ways to make this analysis even more insightful:

- Adjusting for seasonality: If your business experiences seasonal fluctuations, you can adjust your YOY calculations to account for these patterns.

- Accounting for one-time events: If your business had a one-time event that significantly impacted your financials (e.g., a large acquisition), you may need to adjust your YOY calculations to get a more accurate picture of underlying growth.

- Using rolling averages: Calculating YOY growth over rolling periods (e.g., a 12-month rolling average) can help smooth out short-term fluctuations and provide a clearer picture of long-term trends.

- Considering statistical significance: When comparing YOY growth rates, it’s important to consider whether the differences are statistically significant or simply due to random variation.

FAQs about YOY Growth

Q: Can YOY analysis be used for non-financial metrics?

A: Absolutely! While commonly used for financial data, YOY analysis can be applied to any metric you track over time, such as website traffic, social media engagement, or employee satisfaction.

Q: How can I use YOY analysis to improve my business?

A: By identifying trends and areas for improvement, YOY analysis can inform your strategic decisions. For example, if you notice a consistent decline in YOY sales for a particular product, you might investigate the cause and adjust your strategy accordingly.

Q: Where can I find reliable data for my YOY analysis?

A: Your company’s financial statements, accounting software, and internal reports are excellent sources of data for YOY analysis. You can also find industry benchmarks and economic data from sources like the U.S. Census Bureau and the Bureau of Economic Analysis

Need help with your financial analysis? Understanding your financial data can be complex. At XOA TAX, we’re here to help you make sense of it all. Contact us today for expert guidance on YOY analysis and other financial matters.

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime