At XOA TAX, we understand the desire to minimize expenses, especially for small businesses and startups. Bookkeeping often seems like an area ripe for cost-cutting. However, what appears to be a bargain can often evolve into a costly mistake. Let’s explore why investing in a qualified bookkeeper is crucial for your business’s financial health.

Key Takeaways

- Inexperienced bookkeepers can make costly errors.

- Accurate bookkeeping is essential for tax compliance and financial planning.

- Missed deadlines and penalties can far outweigh the savings from cheap bookkeeping.

- A qualified bookkeeper can provide valuable insights and save you money in the long run.

The Hidden Costs of Cheap Bookkeeping

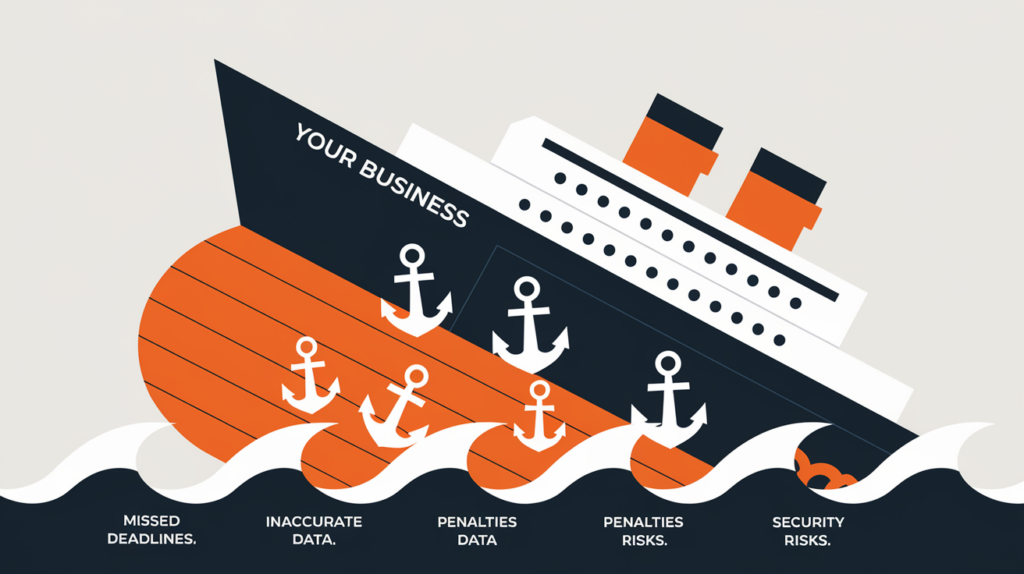

While a low hourly rate might seem appealing, consider these potential consequences:

- Errors and Inaccuracies: Inexperienced or unqualified bookkeepers are more prone to errors in data entry, reconciliation, and financial reporting. These mistakes can lead to cash flow problems, poor financial decisions, and even legal issues.

- Missed Deadlines and Penalties: Tax deadlines are non-negotiable. Late filings or inaccurate tax returns due to poor bookkeeping can result in hefty penalties and interest from the IRS.

- Lack of Financial Insight: A qualified bookkeeper does more than just record transactions. They can provide valuable analysis, identify trends, and offer proactive advice for improving your financial performance. This level of insight is often lacking with cheaper options.

- Security Risks: Entrusting your sensitive financial data to unqualified individuals can increase the risk of fraud, data breaches, and identity theft.

Financial Risks of Cheap Bookkeeping

To further illustrate the potential pitfalls, let’s examine specific areas where bookkeeping errors can have a significant impact:

| Area | Potential Errors | Impact on Taxes | Impact on Business Decisions |

|---|---|---|---|

| Expense Categorization | Misclassifying expenses as personal or business, incorrectly assigning expenses to categories | Overstated or understated deductions, leading to incorrect tax liability, potential audits | Inflated or deflated profit margins, distorting the true financial health of the business |

| Income Recording | Missing or double-counting invoices, incorrect recording of payments | Inaccurate income reporting, leading to incorrect tax liability, potential audits | Skewed revenue figures, making it difficult to assess sales trends and performance |

| Inventory Management | Inaccurate tracking of inventory levels, incorrect valuation of inventory | Overstated or understated cost of goods sold, impacting profitability and tax calculations | Poor inventory control, leading to stockouts, overstocking, and inefficient use of capital |

| Payroll | Incorrect calculation of wages, taxes, and benefits | Incorrect payroll tax filings, leading to penalties and interest, potential legal issues | Employee dissatisfaction, potential compliance violations |

These are just a few examples, and the specific risks will vary depending on your business and industry. The key takeaway is that inaccurate bookkeeping can create a domino effect, leading to both short-term and long-term financial consequences. It’s worth investing in a qualified bookkeeper who can provide accurate, reliable financial information to guide your business toward success.

Investing in Quality: The Long-Term Benefits

- Accuracy and Reliability: Accurate financial records are the foundation of a healthy business. They enable informed decision-making, facilitate compliance, and provide a clear picture of your financial standing.

- Tax Optimization: A skilled bookkeeper can help you maximize deductions, claim appropriate credits, and minimize your tax liability, ultimately saving you money.

- Time Savings: By efficiently managing your financial records, a good bookkeeper frees up your time to focus on core business activities and strategic growth.

- Peace of Mind: Knowing your finances are in capable hands reduces stress and allows you to concentrate on what you do best – running your business.

Choosing the Right Bookkeeper

- Experience: Look for a bookkeeper with relevant experience in your industry or a similar business size. Experience working with businesses like yours often means they understand the unique challenges and opportunities you face.

- Accounting Knowledge: A strong understanding of accounting principles and practices is essential. They should be familiar with industry-standard software like QuickBooks and Xero, and be comfortable with tasks like bank reconciliations, accounts payable/receivable, and financial reporting.

- Certifications: While not always mandatory, certifications like Certified Public Bookkeeper (CPB) or Certified Bookkeeper (CB) demonstrate a commitment to professional standards and ongoing education.

- References: Don’t hesitate to ask for references. Speaking with other business owners who have worked with the bookkeeper can give you insight into their professionalism, reliability, and communication skills.

Staying Ahead of the Curve: Bookkeeping Technology Trends

In today’s digital age, bookkeeping is more than just manual data entry. Cloud-based solutions, automation, and real-time data analysis are transforming the field. A qualified bookkeeper should be proficient in these technologies to ensure efficiency and accuracy. For example, cloud-based accounting software allows for seamless collaboration and access to financial information from anywhere, at any time. This not only streamlines processes but also enhances security and reduces the risk of data loss.

FAQ

Q: How much should I expect to pay for a qualified bookkeeper?

A: Bookkeeping rates vary based on experience, location, the complexity of your needs, and the specific services required. It’s important to consider the value a qualified bookkeeper brings to your business, including improved efficiency, accuracy, and potential tax savings.

Q: How can I find a trustworthy bookkeeper?

A: Seek recommendations from other business owners, your accountant, or professional organizations. Look for certifications, experience in your industry, strong communication skills, and proficiency in relevant software.

Q: Can I just use bookkeeping software instead of hiring someone?

A: While software can be helpful, it’s not a substitute for professional expertise. A qualified bookkeeper understands the nuances of accounting principles and tax laws, ensuring accurate and compliant financial management.

Connecting with XOA TAX

Navigating the complexities of bookkeeping and tax compliance can be challenging. At XOA TAX, our team of experienced CPAs can provide expert guidance and support tailored to your business needs. Whether you need help with bookkeeping, tax planning, or financial analysis, we’re here to help you achieve your financial goals.

Contact us today for a consultation:

- Website: https://www.xoatax.com/

- Phone: +1 (714) 594-6986

- Email: [email protected]

- Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often, and vary significantly by state and locality. This communication is not intended to be a solicitation and XOA TAX does not provide legal advice. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime