The holidays are approaching, and while you’re busy making plans for festive celebrations and well-deserved time off, don’t forget about your year-end tax planning! At XOA TAX, we believe that a little proactive planning can go a long way in maximizing your tax savings.

Think of us as your friendly financial coaches, here to guide you through some key strategies to help you keep more money in your pocket and start the new year strong.

1. Time Your Income and Expenses Like a Pro

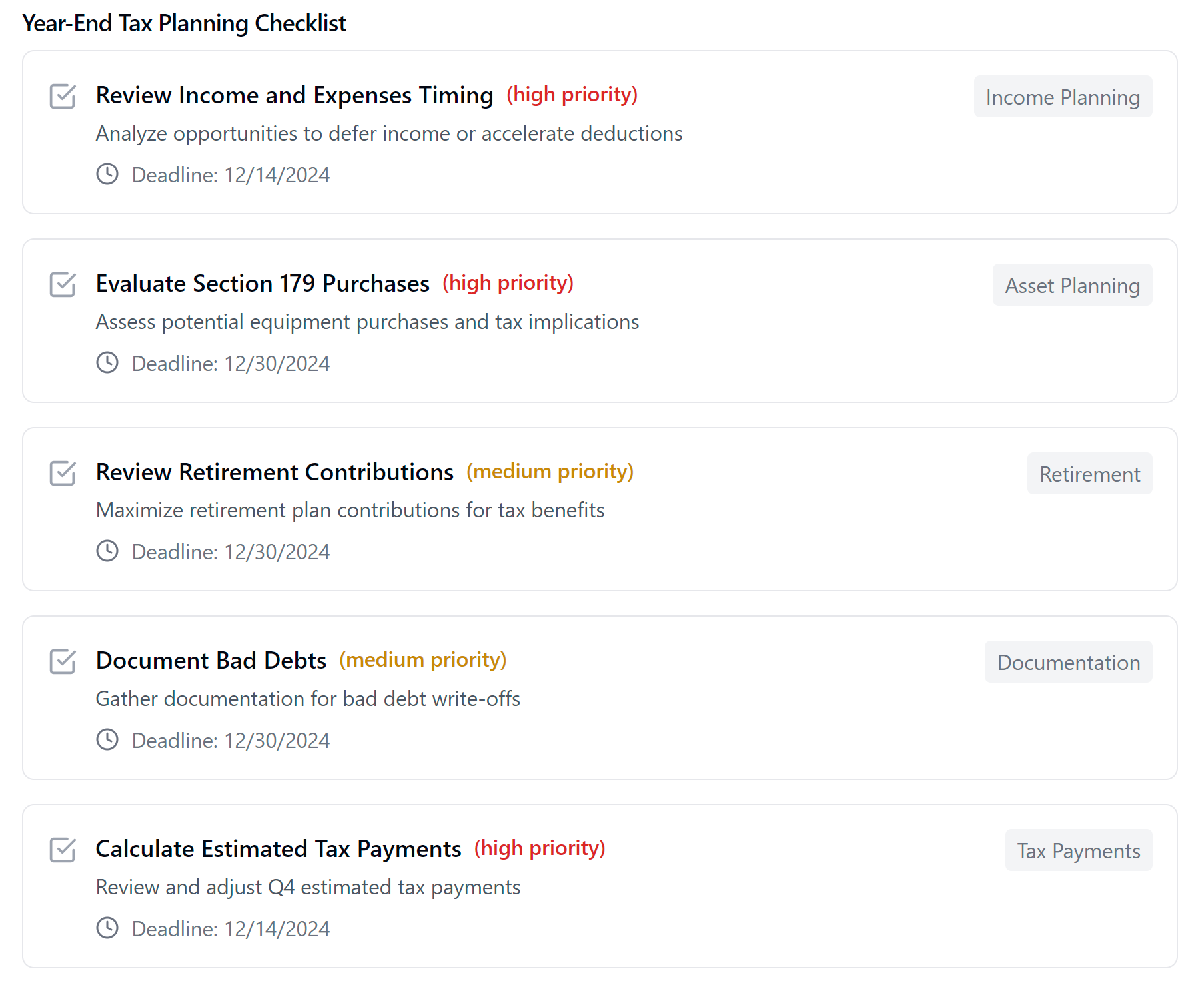

One of the most effective tax planning strategies is to strategically time your income and expenses. The basic idea? Defer income to push it into the next tax year and accelerate deductions to claim them in the current year.

Deferring Income:

- Cash Method: If you use the cash method of accounting, delaying invoices until late in the year can shift income to the next tax year. For example, a freelance graphic designer could send invoices for December projects in early January instead.

- Accrual Method: Accrual-basis businesses can sometimes defer income from advance payments for services to be performed in the following year. Think of a subscription service that receives payments in December for services that will be provided throughout the next year.

Accelerating Deductions:

- Prepay Expenses: Consider prepaying expenses like rent, insurance, or office supplies to accelerate deductions into the current year. For instance, a small business owner could prepay a portion of their rent for the next year. Keep in mind: The IRS generally allows you to prepay expenses only up to 12 months in advance.

- Accrued Expenses: If you use the accrual method, you might be able to deduct year-end bonuses accrued this year, even if they’re not paid out until early next year.

Important Note: This strategy works best if you expect to be in the same or a lower tax bracket next year.

2. Invest in Your Business and Reap the Tax Benefits

Investing in new equipment, machinery, or other fixed assets for your business can not only improve your operations but also provide valuable tax deductions. Let’s explore some powerful depreciation methods:

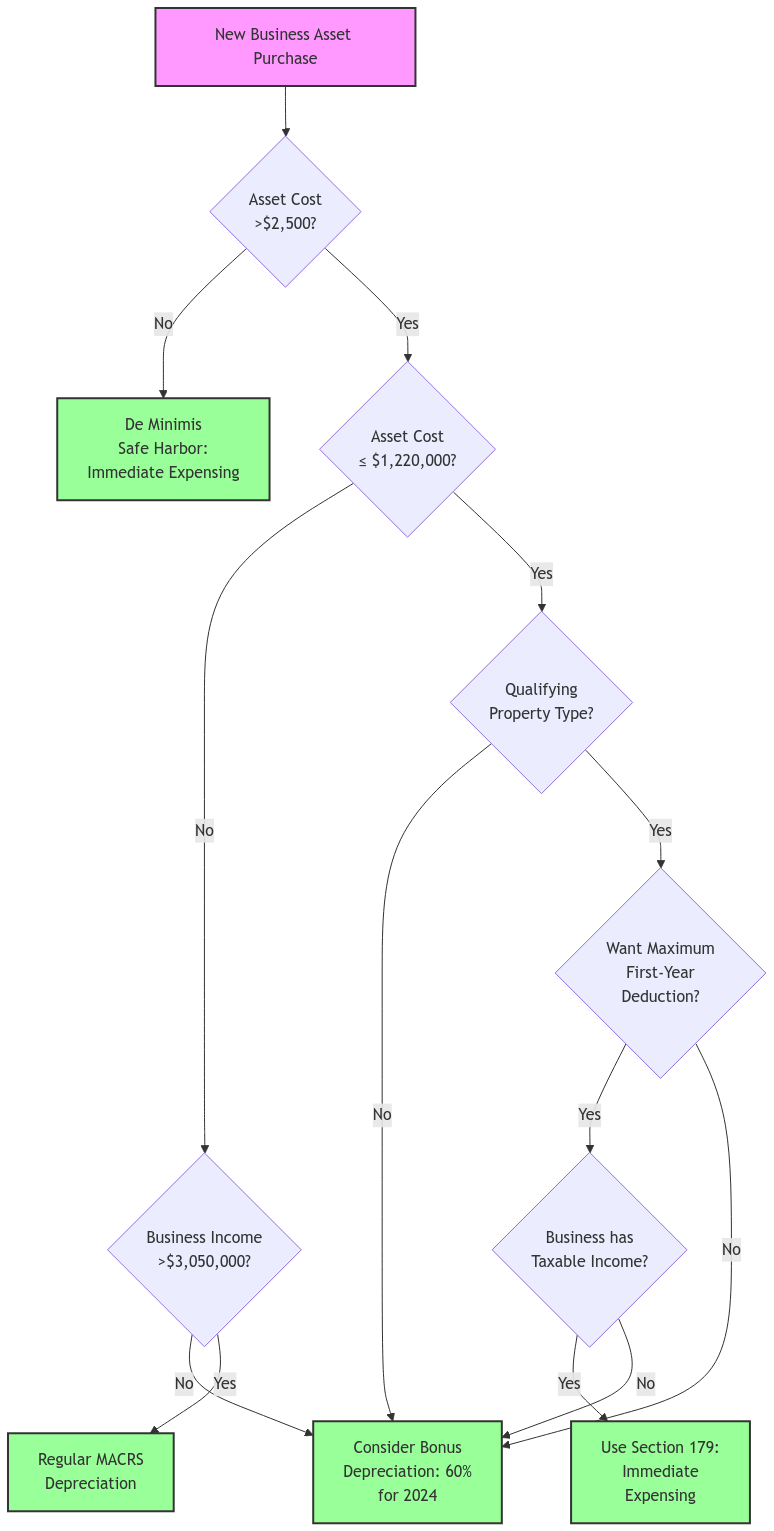

- Section 179 Expensing: This allows you to deduct a significant portion of the cost of qualifying equipment and software purchased in the current year, up to a certain limit. For 2024, that limit is $1,220,000. This is a fantastic opportunity to immediately write off a large chunk of your investment! However, keep in mind: This deduction begins to phase out if your total equipment purchases for the year exceed $3,050,000.

- Bonus Depreciation: Take advantage of bonus depreciation to deduct a percentage of the cost of eligible assets in the first year they are placed in service. For 2024, you can deduct 60% of the cost! But don’t wait too long, as this percentage is scheduled to decrease in the coming years.

- De Minimis Safe Harbor: This allows you to immediately expense low-cost items that you might typically have to depreciate over several years.

3. Plan for Retirement and Reduce Your Tax Bill

Offering a retirement plan is a win-win for both you and your employees. It can help attract and retain top talent, and it also comes with attractive tax benefits.

- Employer Contributions: Depending on the type of plan you choose, you may be able to deduct contributions made to the plan.

- Variety of Plans: There are various retirement plan options available for small businesses, including SEP IRAs, SIMPLE IRAs, and 401(k)s. Each plan has different contribution limits and rules, so it’s important to choose the one that best suits your business needs.

4. Don’t Forget About Bad Debts

As you review your year-end financials, take a close look at your accounts receivable. If you have any outstanding invoices that are unlikely to be collected, you may be able to write them off as bad debts and claim a deduction. Important: This deduction is generally available only to businesses using the accrual method of accounting.

- Documentation is Key: To claim a bad debt deduction, you’ll need proper documentation to prove that the debt is indeed uncollectible. This might include evidence of the debtor’s insolvency or bankruptcy, or records of your collection efforts.

5. Maximize the Qualified Business Income Deduction

The qualified business income deduction (Section 199A) allows eligible self-employed individuals and owners of pass-through entities (like partnerships and S corporations) to deduct up to 20% of their qualified business income. This can significantly reduce your taxable income! However, it’s important to understand how other tax strategies, such as bonus depreciation, can impact this deduction.

6. Mind Your Vehicle Depreciation Limits

If your business purchases vehicles, be aware of the depreciation limits set by the IRS. These limits can vary depending on the type of vehicle and its weight. There are also special rules for “luxury” automobiles and heavy SUVs or trucks.

7. Don’t Get Caught Off Guard: Make Estimated Tax Payments

To avoid penalties, make sure you’re making estimated tax payments throughout the year. These payments help cover your tax liability and prevent a big tax bill come April. We can help you calculate the right amount to pay each quarter.

To help you stay on track with your year-end tax planning, here’s an interactive checklist of key tasks to complete:

Now that you have a clear action plan, let’s discuss how to navigate potential risks…

8. Navigating the Risks: Smart Moves to Protect Your Business

While year-end tax planning offers fantastic opportunities to save money, it’s important to be aware of potential pitfalls and take steps to mitigate risks. Here’s how to stay on the safe side:

Common Pitfalls to Avoid:

- Missing Deadlines: Keep track of important tax deadlines, including deadlines for making estimated tax payments, filing returns, and making elections like Section 179. Missing deadlines can result in penalties and interest.

- Overlooking State Tax Implications: Remember that state tax laws can differ from federal regulations. Failing to consider state tax implications can lead to unexpected tax liabilities.

- Inadequate Documentation: Maintain thorough and organized records to support your deductions and credits. Poor documentation can make it difficult to substantiate your claims in case of an audit.

- Misclassifying Workers: Properly classify your workers as employees or independent contractors. Misclassification can lead to significant tax liabilities and penalties.

- Ignoring Changes in Tax Laws: Tax laws are constantly evolving. Stay informed about any changes that might affect your business and adjust your tax planning strategies accordingly.

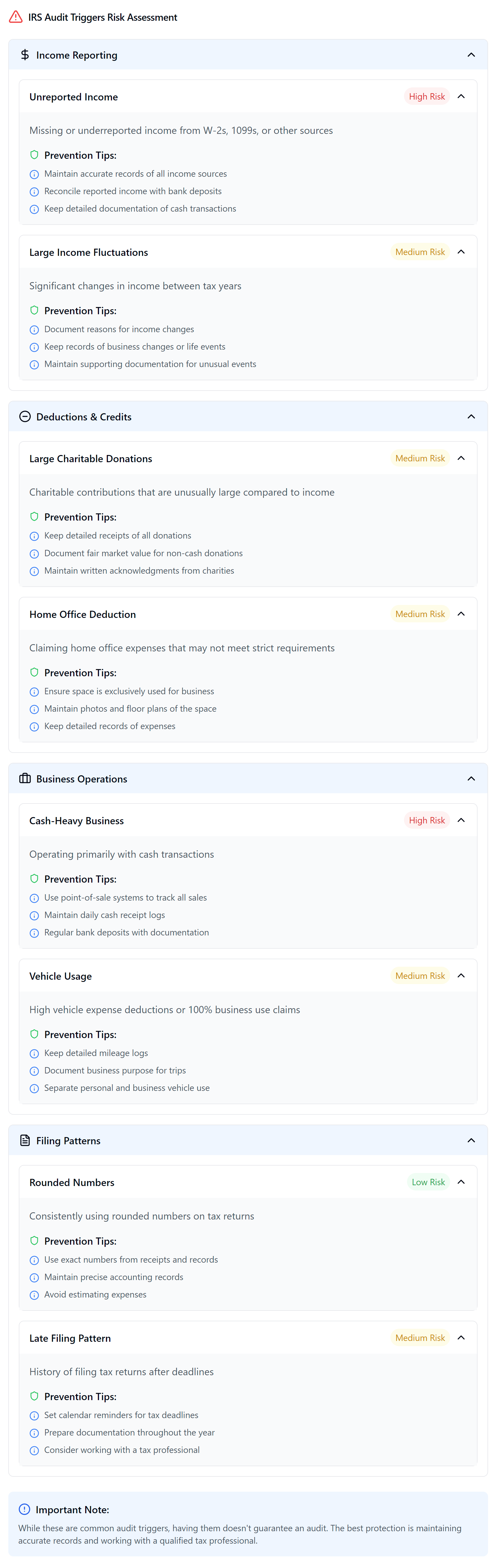

Audit Triggers:

- High Income: Businesses with high gross receipts are more likely to be audited.

- Large Deductions: Claiming unusually large deductions, especially for travel, meals, or home office expenses, can raise red flags.

- Industry-Specific Issues: Some industries, such as construction and restaurants, are inherently more prone to audits.

- Round Numbers: Using round numbers on your tax return can appear suspicious. Be precise and accurate in your reporting.

- Losses: Consistently reporting losses can attract attention from the IRS.

Documentation Best Practices:

- Maintain a Dedicated System: Use a dedicated system, whether paper-based or digital, to organize your tax records.

- Keep Detailed Records: Track all income and expenses with supporting documentation, such as receipts, invoices, and bank statements.

- Document Business Use: If you’re deducting expenses related to mixed-use assets, such as a vehicle or home office, keep detailed records to support the business use percentage.

- Store Records Securely: Protect your tax records from damage or loss by storing them in a safe and secure location.

Compliance Checklist:

- Obtain an EIN: If you haven’t already, obtain an Employer Identification Number (EIN) from the IRS.

- Classify Workers Correctly: Determine whether your workers are employees or independent contractors and comply with relevant tax withholding and reporting requirements.

- Make Estimated Tax Payments: Calculate and make estimated tax payments throughout the year to avoid penalties.

- File all Required Returns: File all necessary tax returns on time, including federal, state, and local returns.

- Stay Informed: Keep up-to-date on tax law changes and seek professional guidance when needed.

9. Develop a Customized Tax Strategy

We understand that navigating the tax code can feel overwhelming. That’s why we encourage you to reach out to XOA TAX for personalized guidance. Our team of experienced CPAs can help you develop a comprehensive year-end tax plan that takes into account your specific business circumstances and goals.

We’ll work with you to:

- Identify the best strategies: We’ll analyze your situation and recommend the most effective strategies for your business, whether it’s timing income and deductions, maximizing depreciation, or choosing the right retirement plan.

- Navigate complex rules: We’ll help you understand the rules and limitations of each strategy, ensuring you remain compliant with tax laws.

- Maximize your savings: Our goal is to help you minimize your tax liability and keep more of your hard-earned money in your business.

FAQs

What is the deadline for making Section 179 elections?

Generally, you must make the Section 179 election by the tax return due date (including extensions) for the year the property is placed in service. So, for equipment purchased in 2024, you’d typically have until the extended due date of your 2024 tax return to make this election.

Can I claim bonus depreciation on used equipment?

Yes, you can generally claim bonus depreciation on both new and used equipment, as long as it meets certain requirements. The key is that the property must be “new to you,” meaning you haven’t previously used it in your business.

How do I know which depreciation method is best for my business?

The best depreciation method depends on a variety of factors, including the type of asset, your business’s financial situation, and your overall tax goals. It’s best to consult with a tax professional to determine the most advantageous strategy for your specific circumstances.

What are the contribution limits for different retirement plans?

Contribution limits vary depending on the type of retirement plan.

- SEP IRA: For 2024, the contribution limit is the lesser of 25% of your compensation or $69,000.SIMPLE IRA: For 2024, the employee contribution limit is $16,000, with an additional $3,500 catch-up contribution allowed for those aged 50 and over.401(k): In 2024, the employee contribution limit is $23,000, with a catch-up contribution limit of $7,500 for those aged 50 and over.

We can help you understand the specific limits for your chosen plan and keep in mind these limits are subject to change annually.

What if I miss the deadline for making estimated tax payments?

If you miss an estimated tax payment deadline, you may be subject to penalties. However, there are some exceptions and waivers available. It’s best to contact the IRS or a tax professional as soon as possible to discuss your options and minimize any potential penalties.

Can I deduct my home office expenses?

If you use a portion of your home exclusively and regularly for business, you may be able to deduct certain home office expenses. These expenses can include a portion of your rent or mortgage interest, utilities, property taxes, and depreciation. We can help you determine if you qualify and calculate the deductible amount.

Are there any special tax considerations for businesses operating in specific industries?

Absolutely! Many industries have unique tax rules and regulations. For example, restaurants may have special rules for deducting food expenses, while construction companies might have specific depreciation rules for their equipment. We have expertise in various industries and can provide tailored guidance based on your specific business needs.

What records do I need to keep for year-end tax planning?

It’s crucial to maintain accurate and organized records throughout the year. This includes receipts for all business expenses, invoices, bank statements, and any other documentation related to your income and deductions. We recommend using a digital record-keeping system to ensure easy access and organization.

How can XOA TAX help me with my year-end tax planning?

XOA TAX can provide comprehensive tax planning services tailored to your business needs. We’ll work with you to identify the most advantageous strategies, ensure compliance with tax laws, and minimize your tax liability. Our team of experienced CPAs can answer your questions, provide expert advice, and help you achieve your financial goals.

Connect with XOA TAX Today!

Ready to take control of your taxes and start the new year on the right foot? Contact XOA TAX today for a free consultation. We’re here to answer your questions, provide expert advice, and help you achieve your financial goals.

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime