Key Takeaways:

- A balance sheet is a financial statement that shows a company’s assets, liabilities, and shareholders’ equity at a specific date.

- It is crucial for understanding a company’s financial health, including its profitability and stability.

- Externally, banks, investors, and other institutions use balance sheets to evaluate a company’s financial status and risk.

- Comparing balance sheets over different periods, alongside income statements and cash flow statements, provides comprehensive financial insights.

What Is a Balance Sheet?

A balance sheet is a key financial document for any company, providing a detailed overview of what the company owns (assets), what it owes (liabilities), and the value for its shareholders (shareholders’ equity) at a specific point in time. Think of it as a financial snapshot that captures the company’s situation on a particular day, offering insights into its financial performance and structure.

How a Balance Sheet Works

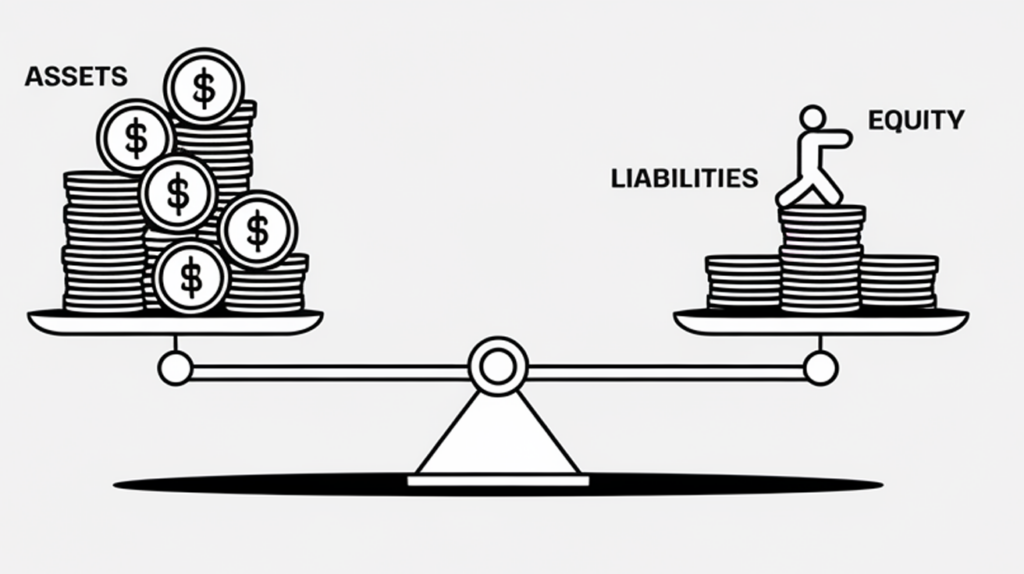

The balance sheet is based on the fundamental accounting equation:

Assets = Liabilities + Shareholders’ Equity

This equation ensures that a company’s assets are financed by either borrowing money (liabilities) or through the owners’ investments (shareholders’ equity). For example, if a company borrows $4,000 from a bank, both its assets and liabilities increase by $4,000, maintaining balance.

Financial ratios derived from the balance sheet, such as the debt-to-equity ratio and the acid-test ratio, provide deeper insights into a company’s financial health. Additionally, comparing balance sheets over different periods alongside income statements and cash flow statements offers a comprehensive view of financial trends and changes.

Benefits and Advantages of a Balance Sheet

Understanding a balance sheet offers numerous benefits:

- Financial Insight: Provides an accurate record of current assets and liabilities, helping assess the ability to cover obligations and manage cash flow.

- Growth Monitoring: Comparing current balance sheets with past records reveals trends and patterns, highlighting areas of growth or stagnation.

- Informed Decision-Making: Offers a reliable foundation for strategic business decisions, whether planning for expansion or cost-cutting.

- Stakeholder Confidence: Regular updates build trust and transparency with investors, creditors, and other stakeholders.

Eligibility Criteria

Understanding who benefits from balance sheets is essential:

- Businesses: All businesses, regardless of size, use balance sheets to monitor financial health and make strategic decisions.

- Investors: Investors analyze balance sheets to assess the financial stability and growth potential of companies.

- Creditors: Banks and lenders use balance sheets to evaluate the creditworthiness of businesses before issuing loans.

- Individuals: While more common in businesses, individuals can use balance sheets to understand their personal financial status.

How to Create a Balance Sheet: A Step-by-Step Guide

- List Your Assets: Start by identifying all assets, categorizing them into current and non-current assets.

- Calculate Total Assets: Sum up the value of all listed assets.

- List Your Liabilities: Identify all liabilities, separating them into current and long-term liabilities.

- Calculate Total Liabilities: Sum up the value of all listed liabilities.

- Determine Shareholders’ Equity: Subtract total liabilities from total assets using the equation: Assets = Liabilities + Shareholders’ Equity.

- Review and Finalize: Ensure that the equation balances and all entries are accurate.

For those who prefer a hands-on approach, download our free, fillable balance sheet template to get started.

Additional Requirements and Considerations

When preparing a balance sheet, keep the following in mind:

- Accrual Accounting: Follow GAAP or relevant accounting standards to ensure consistency and accuracy.

- Regular Updates: Update your balance sheet regularly to maintain an accurate financial picture.

- Use Accounting Software: Utilize accounting software or consult with an accountant to streamline the process.

- Review and Audit: Periodically review your balance sheet for errors and consider external audits for added credibility.

Frequently Asked Questions (FAQs)

Why is it important to regularly update a balance sheet?

Regularly updating your balance sheet is crucial for maintaining an accurate record of your financial health. It helps in assessing your ability to cover obligations, monitor growth trends, make informed business decisions, and build stakeholder confidence.

How is owner’s equity calculated for a business?

Owner’s equity is calculated using the formula: Owner’s Equity = Total Assets – Total Liabilities. For example, if a business has $500,000 in assets and $200,000 in liabilities, the owner’s equity would be $300,000.

How often should a balance sheet be updated for businesses and individuals?

Businesses should update their balance sheets quarterly to maintain accurate financial oversight. Individuals typically update their balance sheets annually or semi-annually to stay informed about their financial position.

How is net worth calculated on a balance sheet?

Net worth is calculated by subtracting total liabilities from total assets using the formula: Net Worth = Assets – Liabilities. This provides a clear indicator of financial health, showing what an individual or business truly owns after debts are accounted for.

What does net worth reveal about an individual’s financial situation?

Net worth provides a comprehensive snapshot of an individual’s financial status by highlighting the difference between total assets and total liabilities. It reveals financial strengths and vulnerabilities, guiding better financial decisions and planning.

anywhere

anywhere  anytime

anytime