Managing hundreds or thousands of monthly transactions can be overwhelming for business owners and investors. To simplify financial analysis, accountants create high-level statements that summarize a company’s activities, enabling informed decision-making. Among these, the cash flow statement stands out as a critical tool for assessing a company’s financial health.

What Is a Cash Flow Statement?

A cash flow statement is a financial document that provides a detailed overview of a company’s cash inflows and outflows over a specific period. It offers a snapshot of how money moves in and out of the business, helping stakeholders understand the company’s liquidity and overall financial health. Unlike the income statement, which focuses on revenues and expenses, the cash flow statement emphasizes actual cash transactions, making it essential for evaluating a company’s ability to meet short-term financial obligations.

Structure of a Cash Flow Statement

The cash flow statement is divided into three main sections:

- Operating Activities: Cash generated from core business operations, including receipts from customers, payments to suppliers, salaries, and other day-to-day transactional activities.

- Investing Activities: Cash flows related to the acquisition and disposition of long-term assets, such as machinery, buildings, or investments in other businesses.

- Financing Activities: Cash flows from and to external sources like lenders and shareholders, including borrowing funds, repaying loans, issuing or buying back stock, and paying dividends.

How to Calculate Bookkeeping Cash Flows

There are two methods for calculating net cash flow from operating activities: direct and indirect.

Direct Method

The direct method lists all cash receipts and payments directly, excluding non-cash activities. It’s suitable for businesses using the cash basis of accounting or those with a limited number of cash transactions. This method provides a clearer picture of where cash is coming from and going to.

Indirect Method

The indirect method starts with net income from the income statement and adjusts for non-cash items (like depreciation) and changes in working capital (such as accounts receivable and inventory). This method is often preferred for businesses using the accrual basis of accounting or those with numerous cash transactions due to its efficiency. It focuses on reconciling net income with actual cash flow.

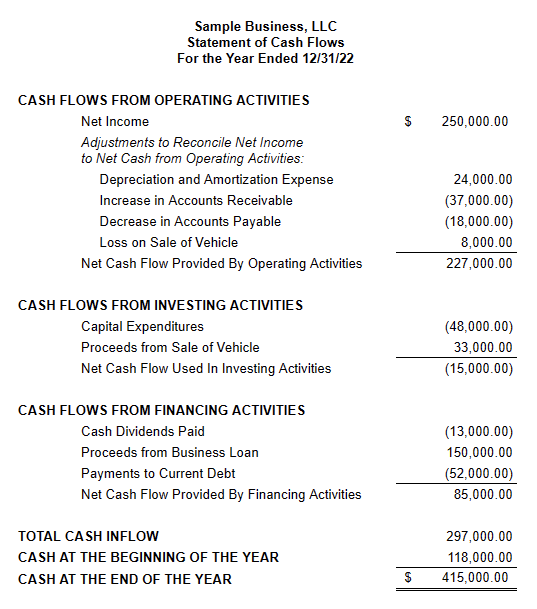

Example Cash Flow Statement (Indirect Method)

Let’s illustrate the indirect method with a simplified example:

Cash Flow from Operating Activities

Net Income: $50,000

Depreciation: $10,000

Increase in Accounts Receivable: -$5,000

Decrease in Inventory: $2,000

Net Cash from Operating Activities: $57,000

Cash Flow from Investing Activities

Purchase of Equipment: -$20,000

Net Cash from Investing Activities: -$20,000

Cash Flow from Financing Activities

Proceeds from Loan: $15,000

Net Cash from Financing Activities: $15,000

Net Increase/Decrease in Cash: $52,000 ($57,000 + (-$20,000) + $15,000 = $52,000)

This example shows how non-cash items and changes in working capital affect net cash flow.

Positive and Negative Bookkeeping Cash Flows

Positive Cash Flow

A positive net cash flow indicates that a company is generating more revenue than it is spending. This is crucial for maintaining operations, scaling the business, and repaying creditors or investors. Sustained positive cash flow allows a company to build cash reserves, which can be reinvested into the business for growth initiatives such as purchasing new equipment, expanding the sales force, or investing in income-generating assets.

Negative Cash Flow

A negative net cash flow signifies that a company is spending more money than it is earning. While this can be a red flag indicating potential financial distress, it is not always detrimental. For example, businesses may experience negative cash flow during periods of significant investment or in the early stages of growth when expenses outpace revenue. It’s essential to monitor negative cash flows closely to ensure they are part of a strategic plan rather than a sign of underlying problems.

Cash Flow Statement and Loans

Lenders frequently examine the cash flow statement when evaluating a business’s loan application. Healthy cash flows demonstrate that the company is making strategic financial decisions and can reduce the perceived risk for lenders. As your business grows, creating accurate cash flow statements may become more complex. Consider hiring a professional bookkeeper or consulting with a Certified Public Accountant (CPA) to ensure your financial statements are precise and comprehensive, thereby enhancing your chances of securing necessary financing.

Using Software for Cash Flow Statements

Creating cash flow statements manually can be time-consuming and prone to errors. Various accounting software solutions, like Xero, QuickBooks, and Zoho Books, can automate the process. These tools integrate with your bank accounts and other financial data sources to generate accurate and up-to-date cash flow statements, saving you time and effort. They also offer features for analyzing and interpreting your cash flow data.

The Bottom Line

The cash flow statement is an indispensable tool for business owners, providing a clear picture of the company’s financial health through its cash inflows and outflows. It not only reflects the current financial status but also plays a critical role in influencing lenders’ decisions when seeking loans. As your business grows, the complexity of creating accurate cash flow statements increases, necessitating expert accounting guidance. In essence, a well-managed cash flow statement is key to ensuring business sustainability and success.

- Single Entry Bookkeeping: An Essential Guide For Beginners

- Cash Basis Accounting: What Is It and How Does It Work?

FAQ

Is a negative cash flow always a bad sign for a business?

Negative cash flow alone is not necessarily bad, especially for growing businesses. However, sustained negative cash flow over extended periods is typically a red flag indicating potential losses and the need for strategic changes. Negative cash flow can result from investments or seasonal fluctuations, which may be normal. Startups often experience initial negative cash flow but must have a plan to reverse it quickly. The impact depends on the context and duration of the negative cash flow.

How can the Cash Flow Statement help with all the transactions?

The Cash Flow Statement offers a comprehensive view of your business’s financial activities by:

- Categorizes operating, investing and financing transactions.

- Tracks total cash inflows and outflows over time.

- Assesses liquidity and ability to meet obligations.

- Evaluates if growth is sustainable from cash generated.

- Gauges working capital and operational efficiency.

- Identifies underlying issues early.

- Informs forecasts and projections of future cash flow.

As my business grows, should I consider professional help for creating cash flow statements?

Yes, as businesses expand, the process of creating cash flow statements can become more complex. It’s advisable to consult with a CPA or hire a bookkeeper to ensure accuracy and comprehensiveness.

Conclusion

In summary, the cash flow statement is an indispensable tool that provides a clear picture of a company’s cash management practices. By breaking down cash flows into operating, investing, and financing activities, it allows stakeholders to evaluate financial health comprehensively. Mastery of this statement can guide management decisions, investment strategies, and overall business planning, ensuring long-term sustainability and success.

anywhere

anywhere  anytime

anytime