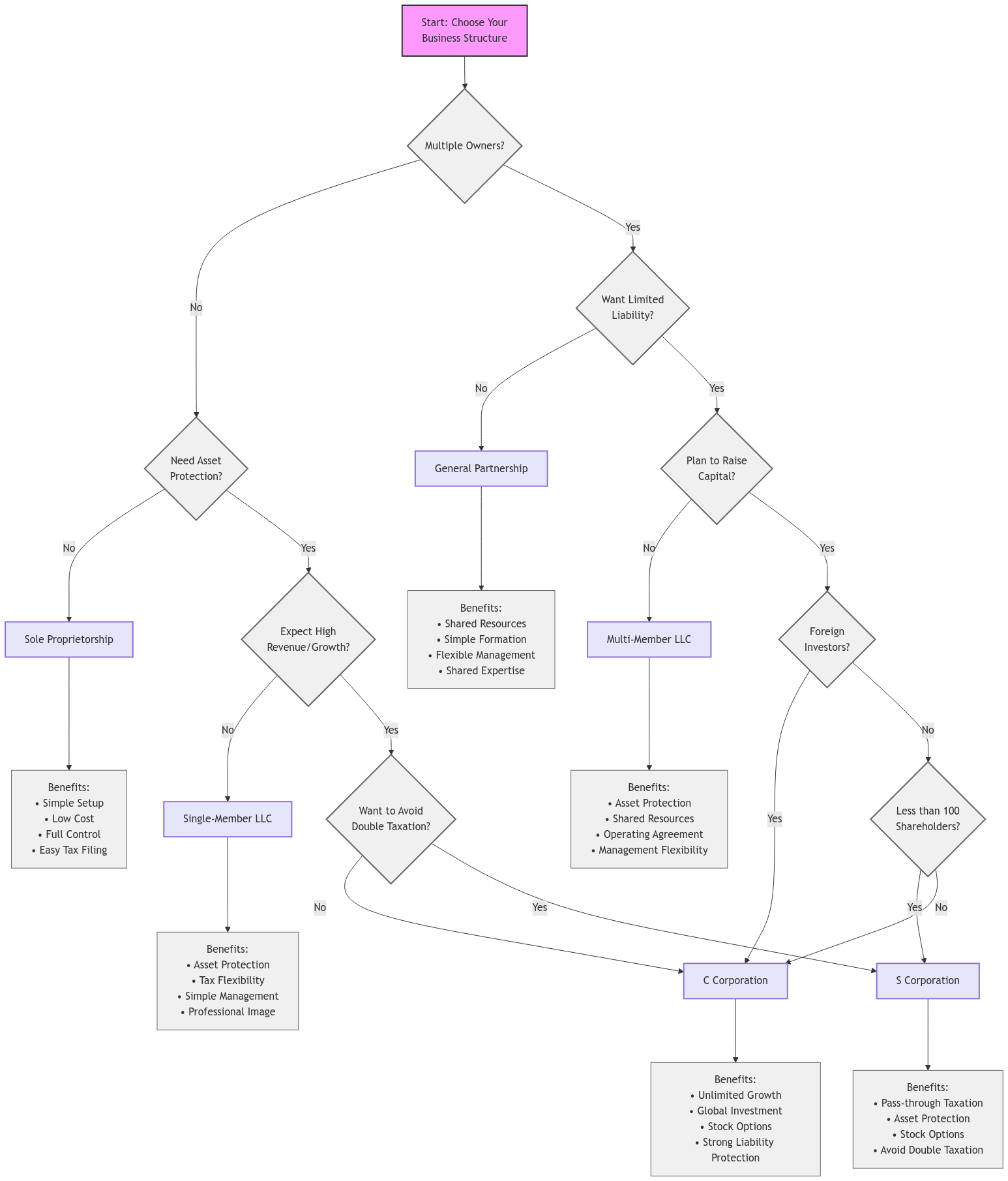

Starting an Amazon business is an exciting venture, filled with possibilities and the potential for significant growth. But before you dive headfirst into listing products and fulfilling orders, there’s a crucial step that can set the stage for your success: choosing the right business structure. This decision impacts how you’re taxed, your personal liability, and even your ability to secure funding in the future.

Key Takeaways

- Sole Proprietorship: Simple to start, but offers no personal liability protection.

- Limited Liability Company (LLC): Provides liability protection and flexible tax options.

- S Corporation: Potential tax benefits, but comes with stricter operational requirements.

- C Corporation: Suitable for larger businesses, but involves double taxation.

- Partnership: Ideal for collaborations, but may come with personal liability.

Understanding Business Structures

Think of your business structure as the foundation of your Amazon empire. It dictates how your business operates legally and how it’s viewed by the IRS. Choosing the right structure is like building your business on solid ground, ensuring stability and protection as you grow.

Sole Proprietorship

This is the simplest form of business structure. You, as the sole owner, are essentially one and the same with your business in the eyes of the law.

Advantages

- Easy Setup: No complex registration or paperwork required. You can often start operating immediately.

- Full Control: You make all the decisions, with no need to consult partners or shareholders.

Disadvantages

- Unlimited Liability: Your personal assets (house, car, savings) are at risk if your business incurs debt or faces lawsuits.

- Funding Challenges: Securing loans or attracting investors can be more difficult as a sole proprietor.

Example: Imagine an Amazon seller who handcrafts artisanal soaps. As a sole proprietor, they enjoy the ease of getting started but risk personal liability if a customer has an adverse reaction to a product.

Limited Liability Company (LLC)

An LLC blends the simplicity of a sole proprietorship with the liability protection of a corporation. It’s a popular choice for small businesses, including Amazon sellers.

Advantages

- Liability Protection: Your personal assets are generally protected from business debts and lawsuits. However, it’s important to note that this protection is not absolute. Personal guarantees on loans or negligent actions can still put your personal assets at risk.

- Tax Flexibility: You can choose to be taxed as a sole proprietor, partnership, or S corporation.

Disadvantages

- Formation Costs: There are fees involved in forming an LLC, which vary by state (typically ranging from $50 to $500).

- Compliance Requirements: LLCs require some paperwork, such as filing Articles of Organization with your state and obtaining the necessary business licenses.

Example: An Amazon seller who sources and resells vintage clothing might choose an LLC. This protects their personal assets if a customer claims a garment was misrepresented.

S Corporation

An S Corporation is a special tax designation that allows profits and losses to pass through directly to your personal income tax return, avoiding the double taxation of a C Corporation.

Advantages

- Tax Benefits: Potential for tax savings by avoiding double taxation.

- Liability Protection: Offers the same personal liability protection as a standard corporation, with the caveats mentioned earlier.

Disadvantages

- Stricter Requirements: S Corporations have more stringent operational rules, including holding regular meetings and maintaining detailed records.

- Shareholder Limit: Limited to 100 shareholders.

Compare S Corp vs. C Corp in detail to see which structure aligns better with your business goals. [Link]

C Corporation

C Corporations are the standard corporate structure, often suitable for larger companies and those seeking to raise capital through the sale of stock.

Advantages

- Capital Raising: Can easily raise funds by issuing stock to investors.

- Liability Protection: Shareholders are not personally liable for the company’s debts, except in cases of personal guarantees or negligence.

Disadvantages

- Double Taxation: Profits are taxed at the corporate level and again on shareholder dividends.

- Complexity: C Corporations involve more complex administrative requirements and paperwork.

Partnership

Partnerships involve two or more individuals who agree to share in the profits or losses of a business.

Advantages

- Shared Resources: Partners can pool their skills, knowledge, and financial resources.

- Easier Setup: Generally less complex to form than a corporation.

Disadvantages

- Potential for Disagreements: Decision-making can be challenging with multiple partners.

- Liability: Depending on the type of partnership, you may be personally liable for your partner’s actions.

Comparing Business Structures

| Structure | Liability Protection | Taxation | Complexity |

|---|---|---|---|

| Sole Proprietorship | No | Personal income tax | Low |

| LLC | Yes, with exceptions | Flexible | Medium |

| S Corporation | Yes, with exceptions | Pass-through taxation | High |

| C Corporation | Yes, with exceptions | Double taxation | High |

| Partnership | Sometimes | Personal income tax | Low |

Factors to Consider When Choosing Your Amazon Business Structure

- Liability: How important is it to protect your personal assets from business risks?

- Taxes: What are the tax implications of each structure, and which is most advantageous for your situation?

- Cost and Paperwork: What are the initial setup costs and ongoing administrative requirements?

- Future Goals: Where do you see your Amazon business in the next few years? Do you plan to expand, seek investors, or eventually sell the business?

Expert Advice from XOA TAX

At XOA TAX, we’ve guided numerous Amazon sellers through this process. We often recommend starting with an LLC, as it offers a good balance between liability protection and simplicity, especially in the early stages of your business. However, the best structure for you will depend on your specific circumstances and goals.

Personal Experience

When I first started helping Amazon sellers, I noticed a common pattern. Many began as sole proprietors, drawn to the ease of setup. However, as their businesses grew and the complexities increased, they often transitioned to an LLC to safeguard their personal assets. This proactive approach provided peace of mind and allowed them to focus on scaling their businesses without the constant worry of personal liability.

Common Mistakes to Avoid

- Skipping Legal Protection: Don’t underestimate the importance of liability protection. Failing to establish an LLC or corporation can put your personal assets at risk.

- Ignoring Tax Implications: Each business structure has different tax implications. Understand these differences to minimize your tax burden and avoid surprises come tax season.

- Not Planning Ahead: Choose a structure that not only suits your current needs but also aligns with your long-term business goals.

Next Steps

- Thorough Research: Dive deep into each business structure option, weighing the pros and cons in relation to your specific circumstances.

- Professional Consultation: Seek guidance from a legal professional or an experienced CPA to discuss the best options for your Amazon business.

- Future-Focused Thinking: Consider your long-term goals for your Amazon business to ensure your chosen structure can adapt and support your growth.

Frequently Asked Questions

Do I need an LLC to sell on Amazon?

No, you’re not legally required to have an LLC to sell on Amazon. You can start as a sole proprietor. However, an LLC provides crucial personal liability protection, shielding your personal assets from business debts and lawsuits.

Which business structure is best for new Amazon sellers?

An LLC is often recommended for new Amazon sellers due to its balance of simplicity and liability protection. It offers a solid foundation for growth while minimizing personal risk.

Can I change my business structure later?

Yes, you can change your business structure as your Amazon business evolves or your needs change. However, it’s important to understand the process and any potential tax implications before making a change. Consulting with a tax professional like those at XOA TAX can help you navigate this transition smoothly.

How much does it cost to set up an LLC?

The cost of forming an LLC varies by state, but typically ranges from $50 to $500. This includes filing fees and other administrative costs. You may also incur ongoing costs, such as annual report fees and registered agent fees. For example, in California, the initial filing fee for Articles of Organization is $70 (as of November 2024), with an annual franchise tax of $800. In contrast, forming an LLC in Delaware, a popular state for business incorporation, has a filing fee of $90 and an annual franchise tax of $300. You can find specific fee schedules on your state’s Secretary of State website.

What’s the difference between an S Corp and a C Corp?

An S Corp avoids double taxation by passing profits and losses through to your personal income tax return, as outlined in Subchapter S of the Internal Revenue Code. However, it has stricter operational rules and limitations on shareholders, such as the 100-shareholder limit and restrictions on the types of shareholders allowed. A C Corp is a separate legal entity, taxed independently from its owners under Subchapter C of the Internal Revenue Code, and is suitable for larger companies and those seeking to raise capital through the sale of stock.

What are the tax obligations for Amazon sellers?

Amazon sellers have various tax obligations, including federal income tax, state income tax (where applicable), and self-employment tax (if you’re not taxed as an S Corporation or C Corporation). You’ll need to report your Amazon income and expenses on Schedule C of your Form 1040.

Additionally, you may need to collect and remit sales tax in states where you have nexus (a significant presence), which can be triggered by having inventory stored in Amazon fulfillment centers (FBA) or exceeding a certain sales threshold in a state. Amazon provides some tools to help with sales tax collection and filing, but it’s crucial to understand your obligations to ensure compliance and avoid penalties. You can find more information in Amazon’s Seller Central Help section and on the IRS website (IRS Publication 334).

For example, if you’re based in California and sell to customers in Texas, and your sales in Texas exceed $500,000, you likely have nexus in Texas and will need to collect and remit Texas sales tax.

Do I need an EIN to sell on Amazon?

While not always required to create a seller account, obtaining an Employer Identification Number (EIN) from the IRS is generally recommended for Amazon sellers. You’ll need an EIN if you:

- Form an LLC taxed as a corporation or partnership

- Hire employees

- Operate as a multi-member LLC

- Open a business bank account

You can apply for an EIN online for free through the IRS website.

What kind of business insurance do I need as an Amazon seller?

Several types of business insurance can protect your Amazon business, including:

- Product Liability Insurance: Protects you against claims of injury or damage caused by your products. This is particularly important if you sell products that could pose a risk to consumers, such as children’s toys or electronics.

- General Liability Insurance: Covers bodily injury, property damage, and personal injury claims that may arise from your business operations, such as a customer getting injured at your warehouse or office.

- Professional Liability Insurance: Protects you against claims of negligence or errors in your professional services, which may be relevant if you offer consulting or other services alongside your product sales.

Amazon requires sellers who use FBA to have certain types of liability insurance, with minimum coverage requirements depending on the product category. For example, sellers of toys and games must have product liability insurance with a minimum coverage limit of $1 million per occurrence and $2 million in the aggregate, as outlined in their Amazon Services Business Solutions Agreement.

The specific insurance needs of your Amazon business will depend on factors such as the types of products you sell, your business operations, and your risk tolerance.

What about selling internationally on Amazon?

Selling internationally on Amazon presents additional complexities, including:

- Tax Compliance: You’ll need to understand and comply with the tax laws of each country where you sell. This may involve registering for tax IDs in foreign countries and understanding any tax treaties that may apply. For example, if you’re a US-based seller selling to customers in the UK, you’ll need to register for a UK VAT number and understand the UK’s VAT regulations.

- Currency Exchange: Fluctuations in currency exchange rates can impact your profitability. It’s essential to monitor exchange rates and factor them into your pricing and financial planning. Using hedging strategies or foreign currency accounts can help mitigate currency risk.

- Logistics and Shipping: International shipping can be more complex and expensive. You’ll need to consider factors such as customs duties, import regulations, and shipping times. Working with experienced freight forwarders and customs brokers can streamline the process.

- Language and Cultural Differences: Adapting your product listings and customer service to different languages and cultures is essential for success in international markets. This may involve translating your product descriptions and providing customer support in multiple languages.

Amazon offers resources and programs to help sellers navigate the challenges of international selling, such as the Amazon Global Selling program.

What are some common compliance pitfalls for Amazon sellers?

- Failure to collect and remit sales tax: This can result in significant penalties and interest.

- Misclassifying workers as independent contractors: This can lead to employment tax liabilities and legal issues.

- Not maintaining proper records: Accurate record-keeping is essential for tax compliance and financial management.

- Ignoring state registration requirements: Failing to register your business in states where you have nexus can result in fines and penalties.

- Not keeping up with changing regulations: Tax laws and Amazon’s policies are constantly evolving, so staying informed is crucial.

Choosing the right business structure is a significant decision for any Amazon seller. By carefully considering your options and seeking professional advice, you can lay a solid foundation for your business and set yourself up for success in the dynamic world of online commerce.

Need help navigating the complexities of business structures and taxes? Contact XOA TAX today for a free consultation. We’re here to guide you through the process and ensure you make the best choices for your Amazon business.

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime