So, you’re starting a business – congratulations! Amidst the excitement of bringing your vision to life, it’s essential to lay a strong foundation with the right legal structure. This decision has a ripple effect on everything from how you’re taxed to your ability to attract investors. Two popular contenders are the S-Corporation (S-Corp) and the C-Corporation (C-Corp).

This guide dives deep into the distinctions between these structures, empowering you to make an informed choice for your business’s success in 2024 and beyond.

Key Takeaways

- Taxation: S-Corps enjoy pass-through taxation, while C-Corps face double taxation.

- Ownership: S-Corps have strict ownership rules, while C-Corps offer more flexibility.

- Compliance: Both structures have requirements, but S-Corps have stricter rules to maintain their status.

- Investment: C-Corps are generally more attractive to investors.

- Decision Time: The best choice depends on your business goals, growth plans, and funding needs.

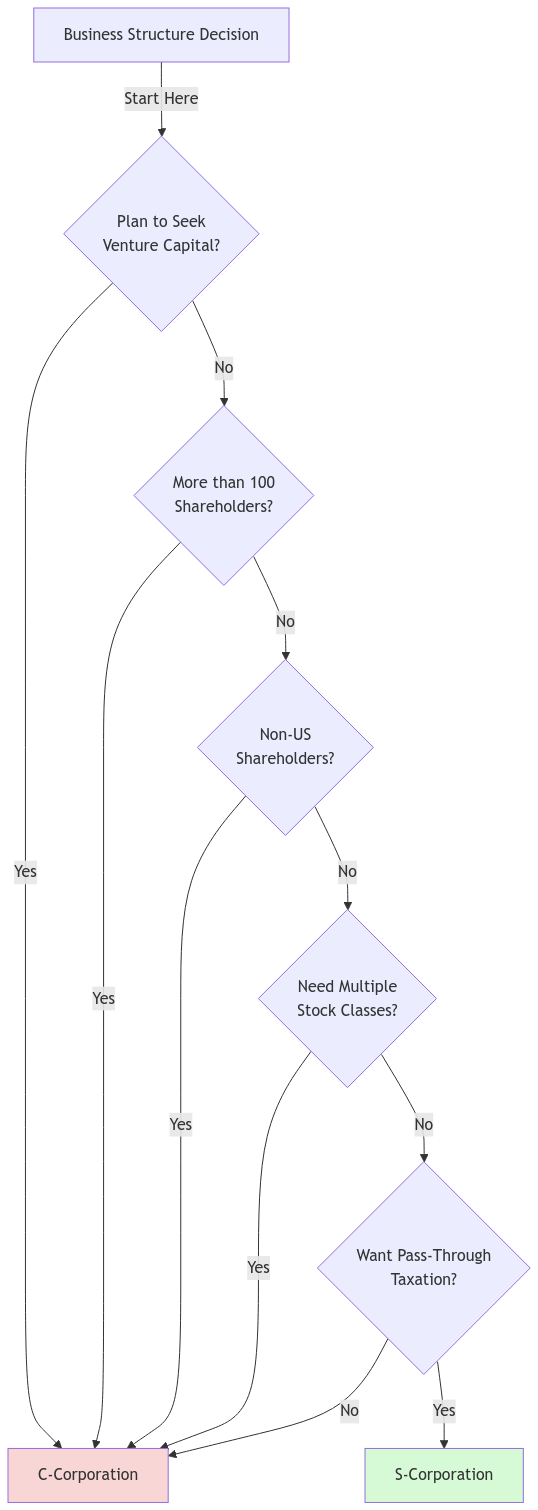

Quick Decision Guide

Understanding Business Structures

Starting a business is exciting, but choosing the right legal structure is a critical first step. This decision impacts how your business is taxed, your ability to raise money, and even your day-to-day operations. Two common options are S-Corporations (S-Corps) and C-Corporations (C-Corps). Let’s break down the differences to help you determine the best fit for your business.

What Is an S-Corporation?

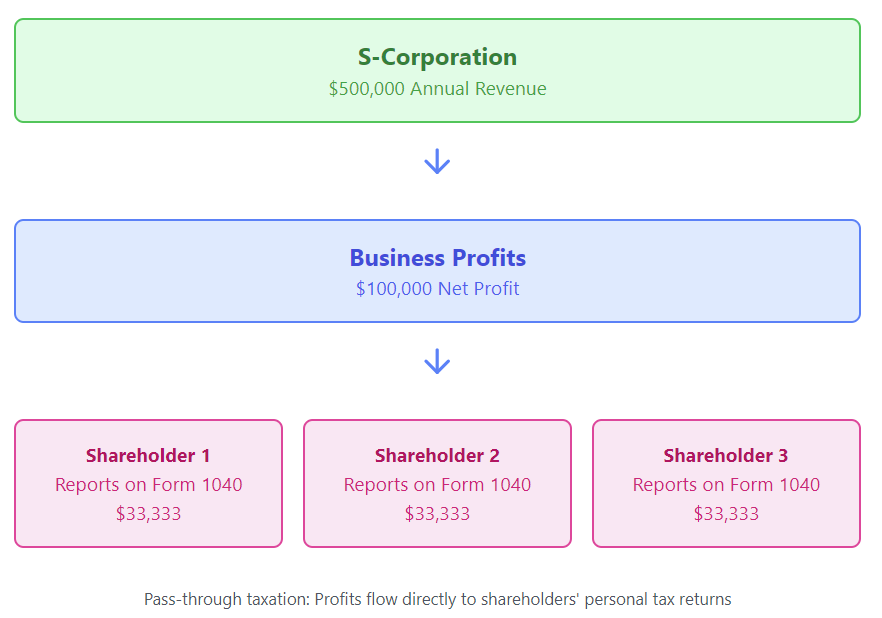

An S-Corp is a special type of corporation that allows income, losses, deductions, and credits to pass through to shareholders. This means the company itself doesn’t pay federal income taxes. Instead, the owners report the company’s income on their personal tax returns.

Want to learn more about different business structures? Check out our comprehensive Business Structure Guide.

What Is a C-Corporation?

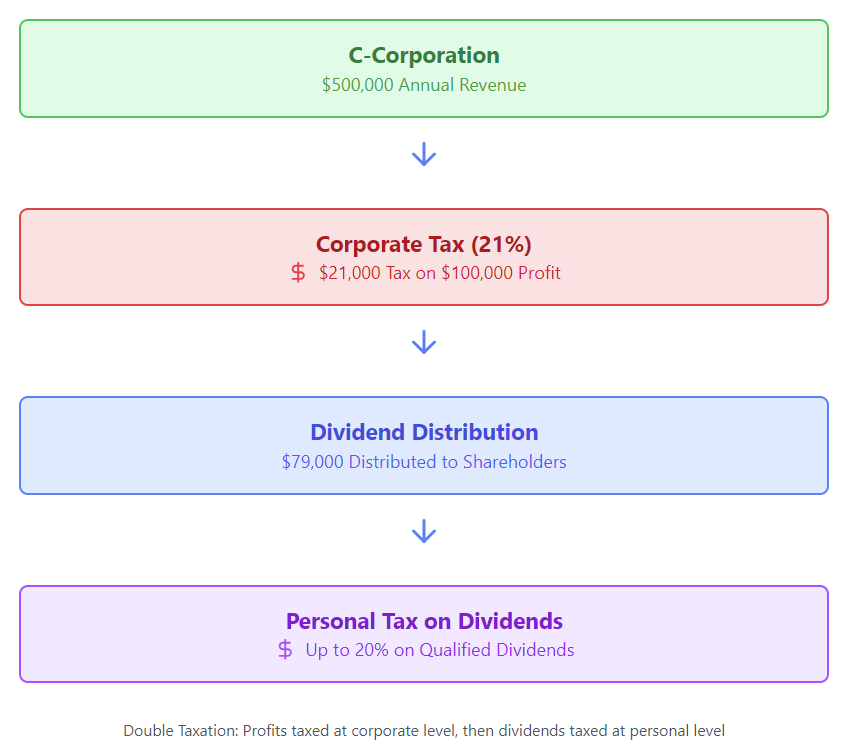

A C-Corp is your standard corporation. It’s considered a separate legal entity from its owners. This means it can make profits, be taxed, and be held legally liable. C-Corps pay taxes on their income, and shareholders also pay taxes on any dividends they receive.

Taxation Differences

S-Corp Taxation

- Pass-Through Taxation: Profits and losses pass directly to shareholders. This is reported on Schedule K-1 of your Form 1040.

- Avoids Double Taxation: Company profits are taxed only once, at the individual level.

- Qualified Business Income Deduction: Eligible for a deduction of up to 20% of qualified business income, thanks to Section 199A of the tax code. This deduction can significantly reduce your tax burden, but it begins to phase out for taxpayers with taxable income above certain thresholds ($195,375 for single filers and $390,750 for married couples filing jointly in 2024) and has limitations for certain types of businesses, such as those involved in specified service trades or businesses (refer to IRS Publication 535 for details).

C-Corp Taxation

- Double Taxation: Profits are taxed first at the corporate level (currently 21% according to Section 11 of the Internal Revenue Code) and again at the individual level when distributed as dividends. Qualified dividends are taxed at lower rates than ordinary income, with the specific rate dependent on your income level (0%, 15%, or 20%).

- Corporate Tax Benefits: C-Corps can deduct employee benefits like health insurance premiums and retirement plan contributions as business expenses. They can also retain earnings within the company for future investments or expansion. However, it’s important to be aware of the potential implications of the accumulated earnings tax, which may apply if the IRS determines that a corporation is accumulating earnings beyond the reasonable needs of the business (see IRS Publication 542 for more information).

Ownership Restrictions

S-Corp Ownership

- Shareholder Limit: Limited to a maximum of 100 shareholders (according to IRS Publication 542).

- Residency Requirement: Shareholders must be U.S. citizens or residents.

- Stock Classes: Can only issue one class of stock.

C-Corp Ownership

- No Shareholder Limit: Can have an unlimited number of shareholders.

- No Residency Restrictions: Shareholders can be from any country.

- Multiple Stock Classes: Can issue various classes of stock with different voting rights and dividend payouts. This flexibility can be crucial for attracting investors.

Compliance Requirements

Both S-Corps and C-Corps share some common compliance obligations:

- File articles of incorporation with the state.

- Create corporate bylaws.

- Hold annual shareholder meetings.

- Maintain detailed corporate records.

S-Corp Specifics

- Must strictly adhere to ownership and stock class rules.

- Risk losing S-Corp status if IRS regulations are violated. For example, if an S-Corp exceeds the 100 shareholder limit or issues more than one class of stock, it could be reclassified as a C-Corp.

- Don’t miss the S-Corp election deadline! To be treated as an S-Corp for the 2024 tax year, you must file Form 2553 with the IRS by March 15, 2024.

C-Corp Specifics

- More flexibility in ownership changes.

- Generally, easier to manage from a compliance perspective due to fewer restrictions.

Ready to register your business? Our Guide to Business Registration can help!

Advantages and Disadvantages at a Glance

| Aspect | S-Corp | C-Corp |

|---|---|---|

| Taxation | Pass-through taxation; avoids double taxation | Subject to double taxation (qualified dividends taxed at lower rates) |

| Tax Benefits | Shareholders may deduct up to 20% of qualified business income (with limitations) | Can deduct employee benefits; retain earnings (subject to potential accumulated earnings tax) |

| Ownership | Up to 100 shareholders; U.S. citizens/residents only | Unlimited shareholders; no residency restrictions |

| Stock Classes | Only one class of stock | Multiple classes allowed |

| Investment | Less attractive to large investors | Preferred by venture capitalists and investors |

| Compliance | Risk losing status if rules are violated | Fewer ownership restrictions |

Making the Right Choice: A Personalized Approach

At XOA TAX, we understand that choosing the right business structure can feel overwhelming. It’s a decision with long-term implications for your business. We encourage you to consider your specific goals and circumstances.

- Think about your long-term vision. If you plan to stay small with primarily U.S.-based owners, an S-Corp might be the ideal choice.

- Factor in your growth trajectory. For attracting investors and scaling your business quickly, a C-Corp offers more flexibility.

- Don’t forget the tax implications. Each structure has a different impact on your tax liability. For example, with an S-Corp, you’ll need to pay yourself reasonable compensation as an employee, which is subject to self-employment taxes. Understanding these nuances is key.

If you’re considering converting from a C-Corp to an S-Corp, it’s also important to be aware of the potential built-in gains tax. This tax may apply if the C-Corp has appreciated assets at the time of conversion.

Ultimately, the best way to make an informed decision is to seek personalized advice from a qualified tax professional.

State Tax Considerations

Keep in mind that state tax laws can vary significantly. Some states don’t recognize S-Corps, while others have different tax rates or filing requirements for S-Corps and C-Corps. It’s essential to research the specific rules in your state to understand the full tax implications of each structure.

Don’t forget about incorporation fees! These also vary by state. You can usually find this information on your state’s Secretary of State website.

Does your state even recognize S-Corps? Not all states allow businesses to elect S-Corp status. Check with your Secretary of State’s office or consult a tax professional to confirm the rules in your state.

Understanding Self-Employment Taxes

If you’re considering an S-Corp, it’s crucial to understand how self-employment taxes work. As an S-Corp owner, you’ll wear two hats: employee and owner. You’ll need to pay yourself a reasonable salary as an employee, and this salary is subject to self-employment taxes (Social Security and Medicare). The remaining profits distributed to you as an owner are not subject to self-employment taxes.

Calculating self-employment taxes can be complex, and it’s often beneficial to work with a tax professional to optimize your compensation and minimize your tax liability.

Exploring Nonprofit Alternatives

While S-Corps and C-Corps are popular choices for businesses, it’s worth considering nonprofit structures if your organization has a mission focused on social good, such as charities, educational institutions, or religious organizations. Nonprofits have distinct legal and tax implications, including tax-exempt status. You can learn more about forming a nonprofit organization here.

Filing Deadlines and Penalties

Meeting filing deadlines is crucial for both S-Corps and C-Corps. Here’s a general overview:

- S-Corps: Generally, S-Corps must file their taxes by the 15th day of the third month after the end of their tax year. For calendar-year taxpayers, this means March 15th.

- C-Corps: C-Corps also typically have a tax deadline of the 15th day of the third month after the end of their tax year. However, C-Corps with a June 30th year-end have a September 15th deadline.

What happens if you miss the deadline? The penalty for failing to file is typically 5% of the unpaid taxes for each month or part of a month that a return is late, up to a maximum penalty of 25%. There are also penalties for failing to pay taxes on time, generally 0.5% of the unpaid amount each month or part of a month, up to a maximum of 25%. It’s best to avoid these penalties by filing and paying on time!

Navigating Payroll and Employment Taxes

Both S-Corps and C-Corps have payroll tax obligations. These include:

- Federal Taxes: Withholding federal income tax, Social Security, and Medicare taxes from employee wages.

- State Taxes: Withholding state and local income taxes, as applicable.

- Unemployment Taxes: Paying federal and state unemployment taxes.

- Other: Depending on your state and industry, you may have other obligations, such as worker’s compensation insurance.

It’s essential to understand these requirements and ensure accurate and timely payroll tax filings.

Legal vs. Tax Advice

While a tax professional can provide guidance on choosing a business structure and fulfilling tax obligations, certain actions may require legal counsel. These include:

- Drafting Contracts: Creating legally sound contracts with customers, vendors, or employees.

- Protecting Intellectual Property: Registering trademarks or patents.

- Handling Legal Disputes: Navigating lawsuits or other legal matters.

Knowing when to seek legal advice can protect your business and ensure compliance with all applicable laws.

State-Specific Compliance: Beyond the Basics

In addition to the general compliance requirements, each state has its own set of rules and regulations for corporations. These may include:

- Annual Reports: Filing annual reports with the state to maintain good standing.

- Franchise Taxes: Paying annual franchise taxes, which can vary significantly by state.

- Registered Agent Requirements: Maintaining a registered agent in the state to receive legal documents.

It’s crucial to research your state’s specific requirements to ensure compliance.

FAQs

Can I switch from an S-Corp to a C-Corp later?

Yes, you can change your corporation’s status, but it involves paperwork and IRS notifications. It’s best to consult with a tax advisor to ensure a smooth transition.

Why do investors prefer C-Corps?

C-Corps allow for multiple stock classes and have no ownership restrictions, making them more attractive to investors, especially venture capitalists.

Do S-Corps pay federal income tax?

No, profits and losses pass through to shareholders, who pay taxes on their personal returns.

Can a non-U.S. citizen own shares in a C-Corp?

Yes, C-Corps have no restrictions on the nationality of shareholders.

Is double taxation always a disadvantage?

Not necessarily. Sometimes the benefits of a C-Corp, like attracting investors and deducting employee benefits, outweigh the drawbacks of double taxation.

Connect with XOA TAX

Choosing between an S-Corp and a C-Corp is a significant decision that affects your taxes, ownership, and growth potential. We’re here to help you navigate this important choice.

Contact XOA TAX today for personalized guidance:

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

We’ll help you evaluate your options, understand the tax implications, and make the best decision for your business.

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime