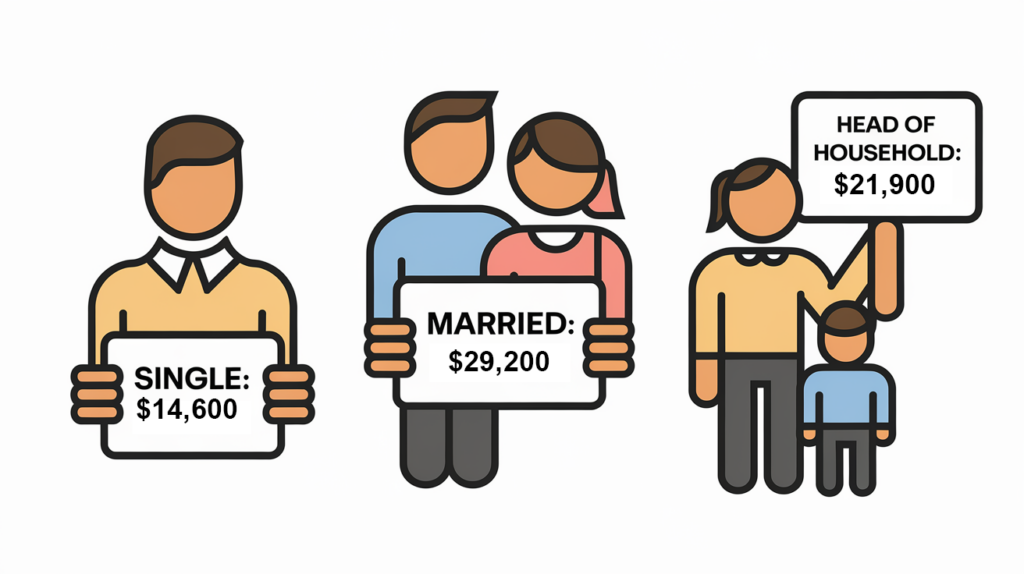

Guide for Standard Deduction 2024-2025: Filing Statuses, Ages, and Dependents

This comprehensive guide explains the 2024 standard deduction, including amounts for various filing statuses, additional deductions for age and blindness, and when itemizing might be more beneficial.

Maximize Your Business Savings: Your Guide to Section 179 Deductions for Vehicles in 2024-2025

Maximize your business’s tax savings in 2024 by understanding and utilizing Section 179 deductions for vehicles, including bonus depreciation and the expanded benefits for used electric vehicles.

Tax Credit vs Tax Deduction: Which is More Beneficial 2024-2025?

Tax season doesn’t have to be a headache. At XOA TAX, we believe that knowledge is power. Understanding the ins and outs of tax credits and deductions can significantly reduce your tax liability and maybe even put some money back in your pocket! Let’s break down these essential tax tools to help you maximize your […]

Understanding Tax Credits vs. Tax Deductions: What’s the Difference?

When tax season rolls around, two terms often cause confusion: tax credits and tax deductions. While both can reduce your tax bill, they do so in different ways. Understanding the distinction between the two can help you maximize your savings and make informed decisions when filing your taxes. What is a Tax Credit? A tax…

13 Homeowner Tax Credits And Deductions You Should Know

Updated on October 7, 2024 Dealing with taxes as a homeowner can be a bit daunting, but it also opens the door to potential savings. It’s important to be aware of tax credits and deductions that can benefit you financially. This guide will walk you through 13 crucial homeowner tax credits and deductions that every…

Is It Worth to Claim Medical Expenses on Taxes in 2024?

When managing your finances, finding ways to save can make a big difference. One area you might not be taking full advantage of is deducting medical expenses on your taxes. In this guide, we’ll explore how medical expense deductions work, what qualifies, and how you can use them to potentially lower your tax bill. Understanding […]

Giving Back and Getting Back: A Guide to Charitable Donations and Your Taxes 2024-2025

Learn how to maximize your charitable giving while minimizing your tax burden with this comprehensive guide to tax-deductible donations, including tips on record-keeping, different donation methods, and the benefits of Qualified Charitable Distributions (QCDs).