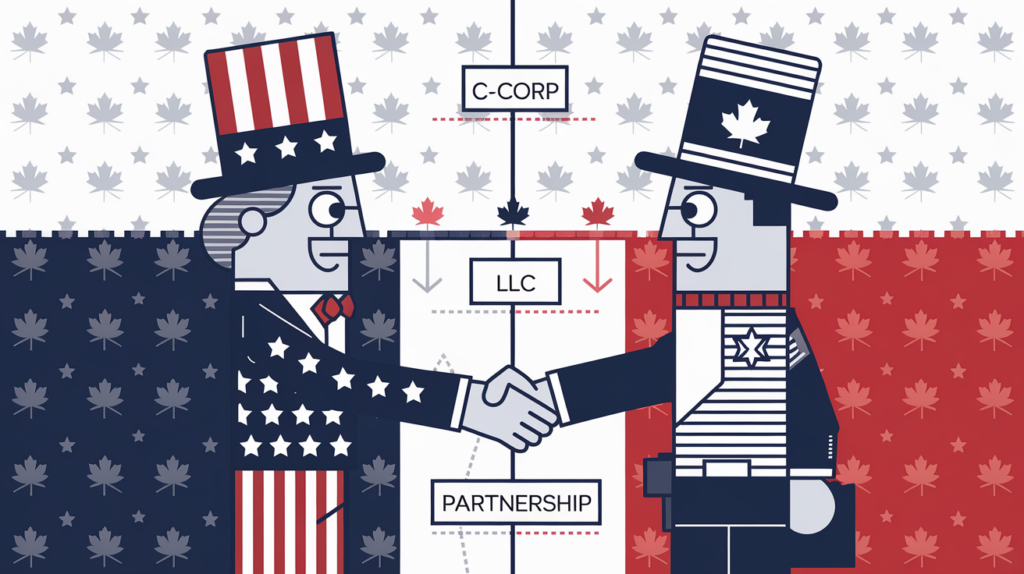

Cross-Border Business Structures: A Guide for U.S. and Canadian Partners

Expanding your business to Canada requires careful consideration of various tax implications and choosing the right business structure—this guide helps navigate these complexities.

Test test test test

Become a Marketing Mastermind: Top Tips From a Shark Tank Investor Marketing is the lifeblood of any successful business. It’s not enough to have a great product or service; you need to know how to get it in front of the right people and convince them why they need it. Think of the Sharks on…