At XOA TAX, we’re dedicated to helping you navigate the complexities of the tax code and keep more of your hard-earned money. While many people are familiar with tax-loss harvesting, fewer know about its counterpart: tax gain harvesting. This strategy can be particularly useful when you anticipate being in a higher tax bracket in the future or want to take advantage of the 0% long-term capital gains bracket. Let’s break down how it works.

Key Takeaways

- Tax gain harvesting involves selling appreciated assets and immediately repurchasing them.

- This strategy allows you to reset your cost basis to the current market price, minimizing potential future taxes.

- Unlike tax-loss harvesting, the wash-sale rule doesn’t apply to gains, providing more flexibility.

- It’s essential to consider factors like the holding period reset, market timing risks, and potential AMT implications.

What is Tax Gain Harvesting?

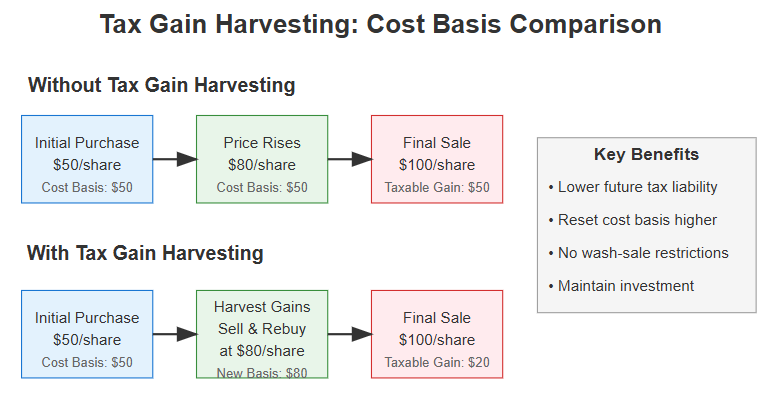

Tax gain harvesting is a strategy where you sell an investment that has appreciated in value and immediately repurchase the same investment. This might seem counterintuitive, but it serves a valuable purpose: resetting your cost basis.

Your cost basis is essentially what you originally paid for an asset. When you sell an asset for more than its cost basis, you realize a capital gain and may owe taxes. By harvesting gains, you increase your cost basis to the current market price, reducing your future tax liability when you eventually sell the asset.

Example:

Let’s say you bought 100 shares of ABC Company at $50 per share. The stock price has now increased to $80 per share. If you sell your shares, you’ll realize a $3,000 capital gain. By immediately repurchasing the same shares, your cost basis is reset to $80 per share. If you later sell those shares at $100, your taxable gain will be calculated based on the new $80 cost basis, not the original $50.

The Wash-Sale Rule and Tax Gain Harvesting

Many investors are familiar with the wash-sale rule, which prevents you from claiming a tax loss if you repurchase the same or a “substantially identical” security within 30 days of the sale. However, this rule only applies to losses. You are free to repurchase shares after harvesting gains without any tax penalties.

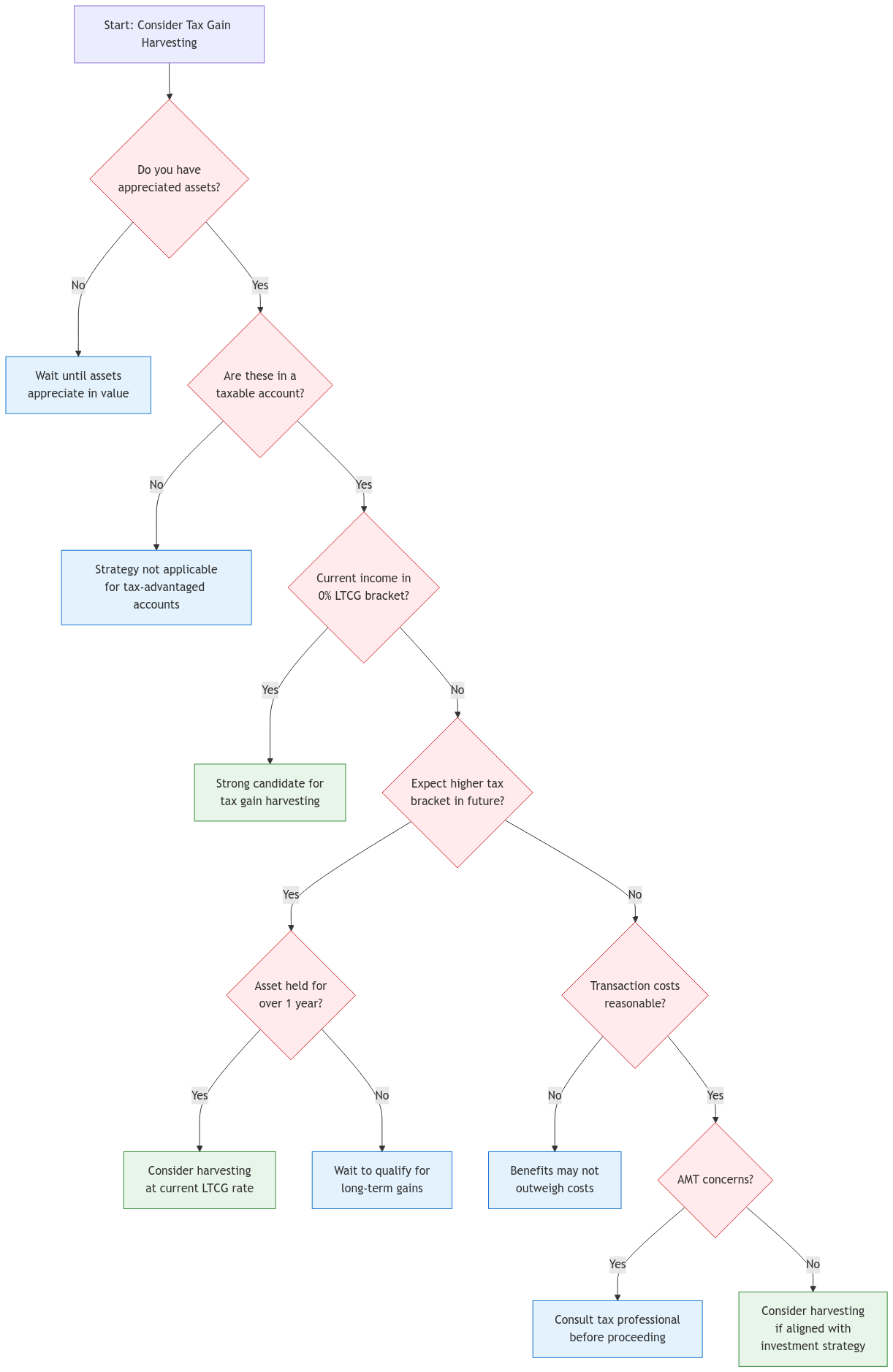

When Does Tax Gain Harvesting Make Sense?

You anticipate being in a higher tax bracket in the future. By realizing gains now at a lower tax rate, you can minimize your tax liability later.

You are currently in the 0% long-term capital gains bracket. If your income falls below a certain threshold, you won’t owe any taxes on long-term capital gains. This presents an excellent opportunity to harvest gains and reset your cost basis without any immediate tax consequences. (For 2024, the 0% long-term capital gains bracket applies to individuals with taxable income below $47,025 and married couples filing jointly with taxable income below $94,050.)

You want to maintain your current investment position. Tax gain harvesting allows you to manage your tax liability without significantly altering your portfolio.

Important Considerations

Short-term vs. Long-term Gains: Remember that short-term capital gains (assets held for less than one year) are taxed at your ordinary income tax rate, which is generally higher than the long-term capital gains rate. Importantly, when you repurchase shares after harvesting gains, the holding period for long-term capital gains resets. You’ll need to hold the repurchased shares for at least one year to qualify for the lower long-term capital gains rate again.

Investment Fees: Be mindful of any transaction fees associated with selling and repurchasing shares. These costs can potentially offset some of the tax benefits, especially for those who engage in frequent trading.

State Taxes: While the federal wash-sale rule doesn’t apply to gains, some states have their own rules. Be sure to research your state’s specific regulations.

Market Timing Risks: It’s important to remember that tax gain harvesting involves selling and buying securities, which means you’re exposed to market fluctuations. If the price drops after you sell, you’ll repurchase at a lower price, potentially negating some of the intended benefits. Conversely, if the price rises significantly, you might miss out on additional gains.

Alternative Minimum Tax (AMT): For some investors, the Alternative Minimum Tax (AMT) can come into play. The AMT is a separate tax calculation that can affect those with significant capital gains, potentially limiting the benefits of tax gain harvesting. Consult with a tax professional to understand how the AMT might impact your situation.

Consult a Professional for Large Transactions: We recommend consulting with a tax advisor before undertaking significant tax gain harvesting transactions, especially those involving substantial amounts or complex securities.

Cost Basis Tracking and Wash Sale Rules

Documentation: Maintaining accurate records of your cost basis is crucial, especially if you engage in multiple tax gain harvesting transactions. Keep thorough records of your purchase dates, prices, and any commissions or fees. Brokerage statements and tax software can be helpful tools for tracking this information.

IRS Reporting: Retain all transaction records, including brokerage statements and Form 8949 (Sales and Other Dispositions of Capital Assets), for accurate reporting on your tax return.

Related Securities: The wash-sale rule isn’t limited to repurchasing the exact same security. It can also apply to securities that are considered “substantially identical,” such as options contracts on the same stock. Be sure to familiarize yourself with the full scope of the wash-sale rule before implementing any tax-loss harvesting strategies.

FAQs

Is tax gain harvesting legal?

Absolutely! It’s a legitimate strategy to manage your tax liability.

Can I harvest gains in my retirement account?

Generally, no. Since retirement accounts like 401(k)s and IRAs are tax-advantaged, tax gain harvesting doesn’t provide the same benefits.

How often should I harvest gains?

This depends on your individual circumstances and investment goals. It’s best to consult with a qualified tax advisor to determine the optimal frequency.

Connecting with XOA TAX

Do you have questions about tax gain harvesting or other tax planning strategies? The experienced CPAs at XOA TAX can help you develop a personalized plan to minimize your tax liability and achieve your financial goals. We can help you integrate tax gain harvesting with other tax-saving measures for optimal results. Contact us today for a consultation.

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime