Pre-Immigration Tax Planning Guide for L1 Visa Holders

Moving to the U.S. on an L1 visa to advance your career is an exciting step! But before you pack your bags, it’s essential to understand the U.S. tax system. It can be pretty complex, especially for newcomers. This guide will walk you through some key tax strategies to consider before you make the move, […]

A Guide to Form 8858 and Foreign Disregarded Entities for U.S. Taxpayers

As a U.S. taxpayer with interests in a foreign business, navigating international tax regulations can be complex. One crucial aspect to understand is Form 8858 and its relevance to foreign disregarded entities (FDEs). At XOA TAX, we often help clients with these matters, and we’ve prepared this guide to shed light on this important topic. […]

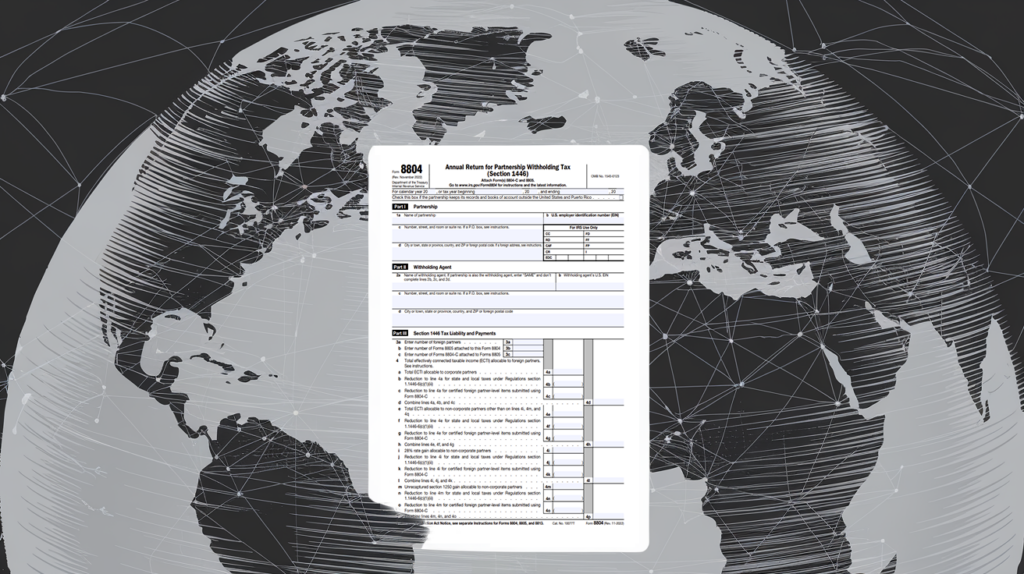

Form 8804 Instructions for Foreign Partner Withholding (Tax Year 2024)

At XOA TAX, we often work with partnerships that have foreign partners. This brings up some unique tax considerations, especially when it comes to withholding taxes. A key form in this process is Form 8804, and we’re going to break it down for you in this blog post. Key Takeaways: Form 8804 summarizes the information […]

Form 8865: What You Need to Know About Reporting Foreign Partnerships

Understand the complexities of Form 8865, the Return of U.S. Persons With Respect to Certain Foreign Partnerships, including filing requirements, deadlines, penalties, and how it relates to GILTI, Subpart F income, and other international reporting forms like Form 8938 and FBAR.