Form 926: Navigating Property Transfers to Foreign Corporations

Understand IRS Form 926 requirements for transferring property to foreign corporations, including who needs to file, exceptions, penalties for non-compliance, and crucial supporting documentation.

US Tax Filing for Non-Residents: A Complete Guide

This comprehensive guide simplifies US tax filing for non-residents, covering filing requirements, deductions, credits, and unique considerations like having US citizen children.

ITIN vs. SSN: What Non-U.S. Residents Need to Know to File Taxes

This guide explains the difference between an ITIN and SSN and helps non-U.S. residents determine which they need for tax filing.

Understanding Tax Obligations When Receiving International Funds

Receiving money from abroad can be exciting, but it’s essential to understand the tax implications. Whether it’s a gift from a loved one, income from a foreign employer, or a reimbursement for expenses, the IRS has rules you need to know. This guide will help you navigate these rules and ensure you’re tax compliant. Use […]

Navigating California Source Income for Non-U.S. Resident LLCs in the Travel Industry

Non-U.S. resident LLCs in the travel industry serving California clients must understand California’s source income rules, including market-based sourcing, economic nexus, and international tax considerations to ensure compliance.

Navigating Tax Obligations for Canadian Students on F-1 Visas in the U.S.

The United States welcomes thousands of Canadian students each year, many of whom arrive on F-1 student visas to pursue their academic dreams. While navigating a new education system and culture can be exciting, it’s essential to understand your tax responsibilities. This guide will help Canadian students on F-1 visas understand their tax obligations in […]

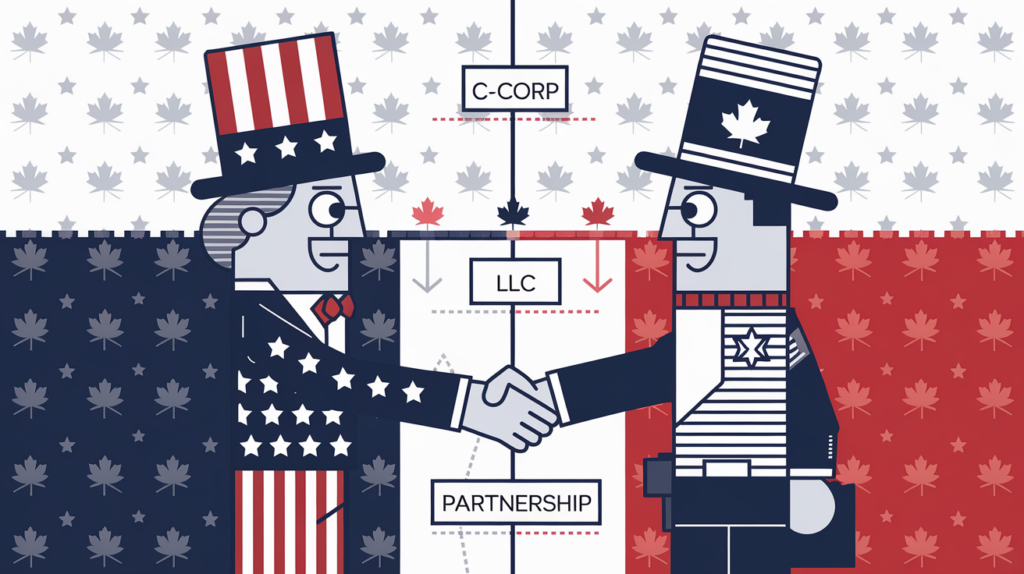

Cross-Border Business Structures: A Guide for U.S. and Canadian Partners

Expanding your business to Canada requires careful consideration of various tax implications and choosing the right business structure—this guide helps navigate these complexities.

Filing Taxes as a U.S. Citizen Married to a Nonresident Alien: A Guide

Getting married is a wonderful milestone, but understanding the intricacies of U.S. tax law when you’re a U.S. citizen married to a nonresident alien can be a challenge. But don’t worry! We’re here to help you navigate these complexities. By understanding your filing options, you can optimize tax benefits and ensure you’re fulfilling all your […]

Foreign Inheritance & US Taxes: A Complete Guide to Property Abroad

Imagine inheriting a charming villa in Tuscany – sounds idyllic, right? But before you start planning your dream vacation, it’s crucial to understand the U.S. tax implications. While the U.S. doesn’t have a federal inheritance tax, inheriting foreign property can still trigger certain reporting requirements and potential tax liabilities. This comprehensive guide will walk you […]

Leveling Up Your Dropshipping Game: A Deep Dive into US Import Rules and Tax Implications

Dropshipping remains a popular business model, especially for entrepreneurs seeking a low-cost entry into e-commerce. But with recent changes to US import rules, staying compliant and profitable requires a deeper understanding of the evolving regulatory landscape. This post builds upon the existing information, addressing key omissions and providing a more comprehensive guide, particularly from a […]