Material Participation for Real Estate: A Complete Guide

At XOA TAX, we often work with real estate professionals seeking to maximize their tax benefits. One common area of confusion is material participation, a critical factor in determining whether rental income is considered passive or non-passive (See IRS Code Section 469). This distinction can significantly impact your tax liability. What is Material Participation? The […]

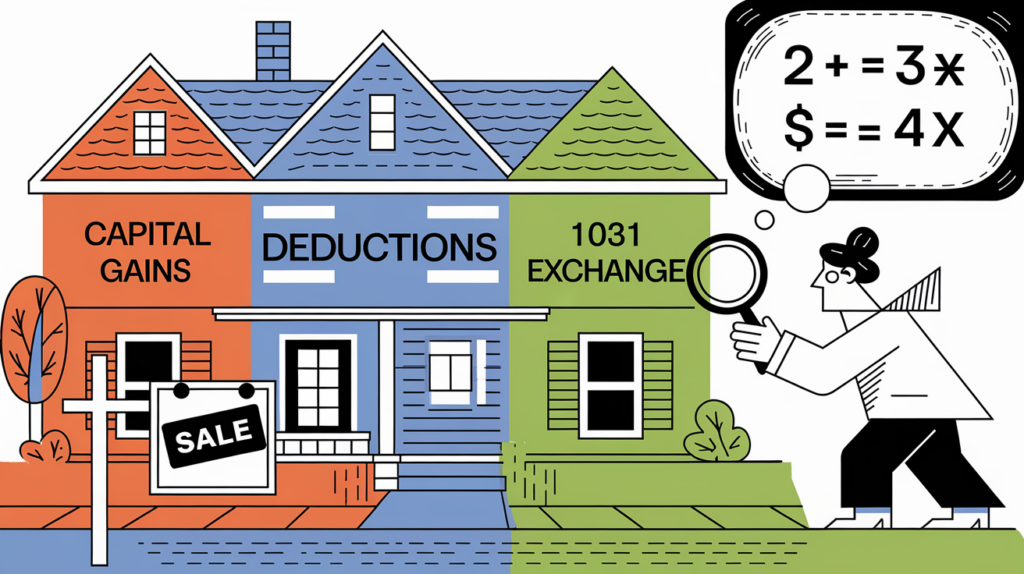

Mastering the Art of House Flipping: Your Tax Roadmap for 2024

Maximize flipping profits with smart tax planning and a knowledgeable tax advisor.

Unlocking the Power of Depreciation: A Real Estate Investor’s Guide for 2024 and Beyond

Maximize depreciation deductions to reduce taxable income and increase cash flow.

Ultimate Guide to 1031 Exchange & Strategies for 2024 & Beyond

Consult qualified professionals for personalized tax and financial advice.

Navigating Real Estate Taxes: Key Strategies for Property Investors

Real estate investment offers the potential for substantial financial rewards, including passive income, property appreciation, and portfolio diversification. However, the complexities of real estate taxation can be daunting for both novice and seasoned investors. Understanding and effectively managing your tax obligations is crucial to maximizing returns and ensuring the long-term success of your investment endeavors. […]

Maximize Your Real Estate ROI with Smart Tax Strategies

Consult a qualified tax professional for personalized real estate investment tax advice.

Unlock Tax Savings with the Short-Term Rental Strategy

Are you a high-income earner or business owner looking for innovative ways to reduce your tax burden and build wealth through real estate? The short-term rental strategy might be the key. This approach allows you to leverage specific tax deductions, similar to those available to real estate professionals, by actively participating in the management of […]

Oregon Property Tax: Comprehensive Guide for Homeowners 2024

This guide explains Oregon’s unique property tax system, detailing Measures 5 and 50’s impact on assessed values, tax rates, exemptions, and the appeals process, helping Oregon homeowners understand and manage their property tax bills.

Understanding Iowa’s Property Tax System: A Friendly Guide 2024

This friendly guide breaks down Iowa’s property tax system, explaining assessment procedures, levy rates, recent legislative changes (including Senate File 2442 and House File 718), and available exemptions to help you understand and manage your tax responsibilities.

Nebraska Property Tax Rates: Comprehensive Guide for 2024

Are you considering buying a home in Nebraska? Before making your decision, it’s essential to understand the state’s property tax landscape. Nebraska ranks among the top ten states with the highest property tax rates in the U.S., boasting a median effective property tax rate of 1.61%. In some larger counties, rates can climb to nearly […]