2024 Real Estate Tax Strategies for Investors

Real estate remains a powerful investment strategy, offering the potential for appreciation, rental income, and significant tax advantages. These tax benefits can even reduce your overall tax burden, including taxes on your W-2 earnings. At XOA TAX, we guide clients through the complexities of real estate taxation to achieve their financial goals. Let’s explore how […]

Real Estate Agent Taxes: Deductions, Filing & 2024 Guide

This comprehensive guide helps real estate agents understand and maximize their tax deductions, navigate filing requirements, and prepare for the 2024 tax year.

Capital Gains Tax When Selling Your Home: What You Need to Know (Updated for 2024)

Selling your home can be a complex process, especially when it comes to understanding the tax implications. Many homeowners are unsure whether they’ll owe capital gains tax on the sale of their primary residence. This post provides clarity on capital gains taxes for home sales, including potential exclusions and how to navigate this often-confusing aspect […]

Rental Property Tax Guide for 2024

Owning rental property can be a lucrative investment, but understanding the tax implications is crucial for maximizing returns. As we approach the end of 2024, it’s essential for rental property owners to be well-informed about tax filing requirements and strategies to optimize their tax situation. This guide provides key insights to help you navigate the […]

LLC for Rental Property in California: A Landlord’s Guide

Owning rental property can be a rewarding investment, but it also comes with its share of complexities. One of the key decisions you’ll face as a landlord, particularly in California, is whether to form an LLC for your rental property. At XOA TAX, we understand the intricacies of real estate taxation and can help you […]

Rental Property Taxes: A Comprehensive Guide for Landlords

Owning rental property can be a rewarding investment, providing a steady stream of income and building long-term wealth. However, it’s essential to understand the tax implications that come with being a landlord. This blog post will guide you through the basic tax laws for landlords, covering key areas like rental income, deductible expenses, and record-keeping […]

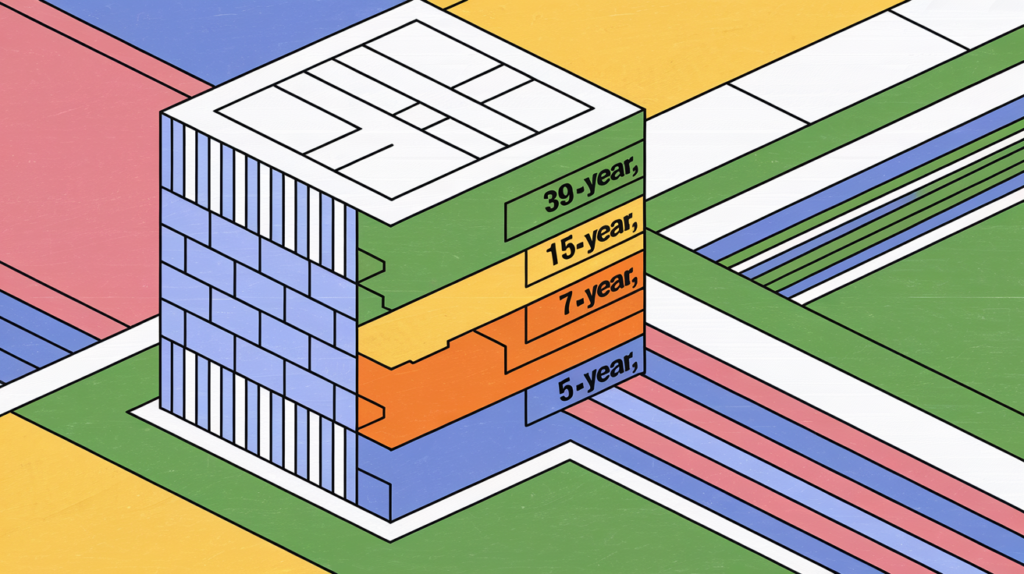

Retroactive Cost Segregation: Recapture Depreciation and Boost Your Bottom Line

Think you’ve missed the boat on depreciation deductions? Think again! Many property owners are unaware that they can still benefit from potential tax savings through a retroactive cost segregation study. Even if you’ve owned a property for years, this strategy can unlock hidden deductions and potentially lead to substantial tax refunds. At XOA TAX, we […]

The Augusta Rule: Tax Loophole or IRS Trap?

Understanding the Nuances of Section 280A(g) As a CPA firm, we often get questions about unique tax strategies, and one that frequently comes up is the “Augusta Rule.” While it may sound like a dream come true for homeowners looking to make some extra cash, it’s crucial to understand the intricacies of this rule to […]

Navigating the Orange County Real Estate Market: A CPA’s Guide

The Orange County real estate market is a hotbed of activity, known for its high property values and competitive landscape. Whether you’re an investor seeking lucrative opportunities, a homeowner looking to maximize tax benefits, or a real estate professional needing specialized guidance, understanding the financial intricacies is crucial. At XOA TAX, we’ve been helping clients […]

Unlocking Wealth: Tax Strategies the Wealthy Use (And You Can Too!…With Careful Planning)

Ever wonder how some of the wealthiest individuals manage to pay a surprisingly small amount of taxes? While it may seem like they possess some secret knowledge, the truth is it’s often about strategic planning and leveraging the tax code to their advantage – strategies that are, in theory, available to everyone. However, it’s important […]