Hey everyone! As the holiday shopping spree winds down and those “thank you” emails start piling up, it’s time to turn our attention to something not quite as exciting – taxes! We know, we know, not the most thrilling topic. But trust us, getting a head start on your year-end tax planning can save you a whole lot of stress (and maybe even some money!) down the road.

At XOA TAX, we’re all about making taxes less scary. Think of us as your friendly neighborhood CPAs, here to guide you through the ins and outs of ecommerce taxes. So grab a cup of cocoa, settle in, and let’s break down this tax puzzle together, piece by piece.

Key Takeaways

- Get Organized: Keeping good records isn’t just a good habit, it’s a must for smooth sailing at tax time.

- Sales Tax Shenanigans: Selling online can mean collecting sales tax in places you’ve never even been! We’ll help you figure that out.

- Deductions are Your Friend: From your home office to your website costs, there are tons of deductions that can shrink your tax bill.

- Year-End Magic: A few smart moves before December 31st can make a big difference come tax season.

- Don’t Forget Uncle Sam: Paying estimated taxes throughout the year can save you from penalties later on.

1. Taming the Paper (or Digital) Trail: Organizing Your Records

Imagine trying to bake a cake without a recipe – that’s what it’s like trying to do your taxes without organized records. It’s a recipe for disaster!

Here’s what you need to keep track of:

- Sales Records: Every sale, refund, discount – you name it, write it down (or save it digitally). Think invoices, receipts, and those handy reports from your ecommerce platform (Shopify, Amazon, eBay, etc.).

- Expense Receipts: Don’t throw those receipts away! Shipping costs, advertising, software subscriptions, website stuff, professional services – keep it all.

- Bank and Credit Card Statements: These are like your financial detectives, helping you spot any errors or unauthorized transactions.

- Inventory Records: Keep tabs on what you buy, what you sell, and what’s still sitting in your warehouse.

Tech Tools to the Rescue!

Luckily, there are tons of tools to make this less of a chore:

- Accounting Software: QuickBooks Online, Xero, Zoho Books – these are your financial superheroes, helping you track everything in one place.

- Inventory Management Systems: TradeGecko (now QuickBooks Commerce), Ordoro – these keep your inventory organized, no matter where you sell.

- Expense Tracking Apps: Expensify, Dext – say goodbye to shoeboxes full of receipts! These apps make tracking expenses a breeze.

2. Decoding Sales Tax: It’s More Than Just a Percentage

Sales tax can be a real head-scratcher for ecommerce businesses. Why? Because you might need to collect it in states where you don’t even have a physical store! Let’s break it down:

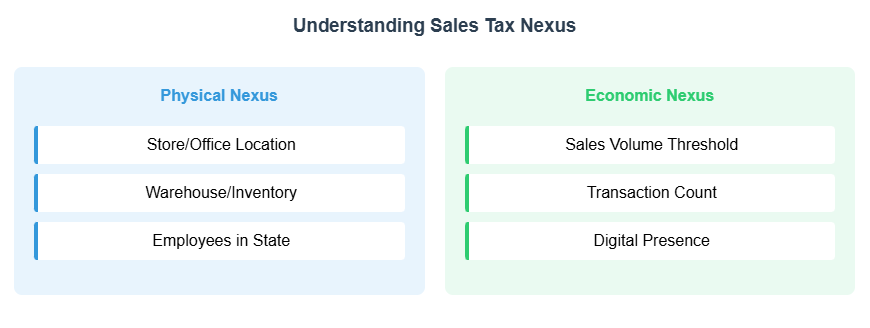

- Nexus: Your Connection to a State: Nexus basically means having a significant presence in a state. This could be a physical presence (like a store, warehouse, or even an employee) or an economic presence (selling a certain amount of goods or services in a state). This is often called “economic nexus.”

- The Wayfair Ruling: A Game Changer: A few years back, a Supreme Court case called South Dakota v. Wayfair, Inc. changed the rules. Now, states can require you to collect sales tax based on how much you sell there, even if you don’t have a physical location in that state.

- Economic Nexus Thresholds: Each state has its own rules about how much you need to sell before you have to collect sales tax. For example, in South Dakota, it’s over $100,000 in sales or 200 transactions. California requires you to collect sales tax if your sales in the state exceed $500,000. It’s important to check each state’s individual rules.

- Marketplace Facilitator Laws: Did you know that if you sell through online marketplaces like Amazon or Etsy, they might actually be responsible for collecting and remitting sales tax on your behalf? These are called marketplace facilitator laws, and they can simplify things for sellers, but it’s important to understand how they work in each state.

- Digital Products and Sales Tax: Oh, and don’t forget about digital products! Some states tax them, some don’t. It’s a bit of a digital maze, but we can help you navigate it.

3. Unlocking Deductions: Lowering Your Tax Bill the Right Way

Deductions are like secret discounts on your taxes. Here are a few favorites for ecommerce businesses:

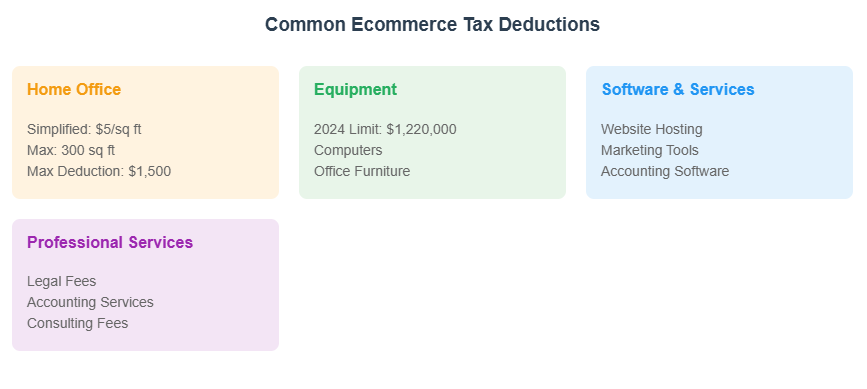

- Home Office Deduction: If you have a dedicated space in your home for your business, you might be able to deduct part of your rent or mortgage, utilities, and other home-related expenses. Just remember, the space needs to be used exclusively and regularly for business. You have two options for calculating this deduction:

- Simplified Method: This is the easy way! You can deduct $5 for every square foot of your home office, up to a maximum of 300 square feet. That means a maximum deduction of $1,500. No need to track all the individual expenses.

- Regular Method: This method involves calculating the actual expenses of your home office based on the percentage of your home used for business. You’ll need to keep detailed records of all your expenses.

- Section 179 Deduction: This allows you to deduct the full purchase price of qualifying equipment, like computers, printers, and machinery, in the year you buy it, rather than depreciating it over time. For 2024, the deduction limit is $1,220,000, with a phase-out threshold of $3,050,000.

- Website Costs: Did you hire someone to design your website? What about those monthly hosting fees or the cost of that fancy new theme? Those are deductible!

- Online Advertising: Those Facebook and Google ads you’re running? Yep, those are deductible too!

- Software Subscriptions: Your email marketing platform, your SEO tools – all deductible.

- Car Expenses: If you use your car for business, you can deduct either your actual expenses (gas, repairs, insurance) or use the standard mileage rate (check the IRS website for the current rate).

- Qualified Business Income Deduction (QBI): This deduction allows eligible self-employed individuals and small business owners to deduct up to 20% of their qualified business income.

4. Year-End Strategies: A Little Planning Goes a Long Way

- Deferring Income: If you’re expecting a big invoice to come in, see if you can delay it until after December 31st. This pushes the income into the next tax year.

- Accelerating Expenses: Need new equipment or supplies? Consider buying them before year-end to increase your deductions for this year.

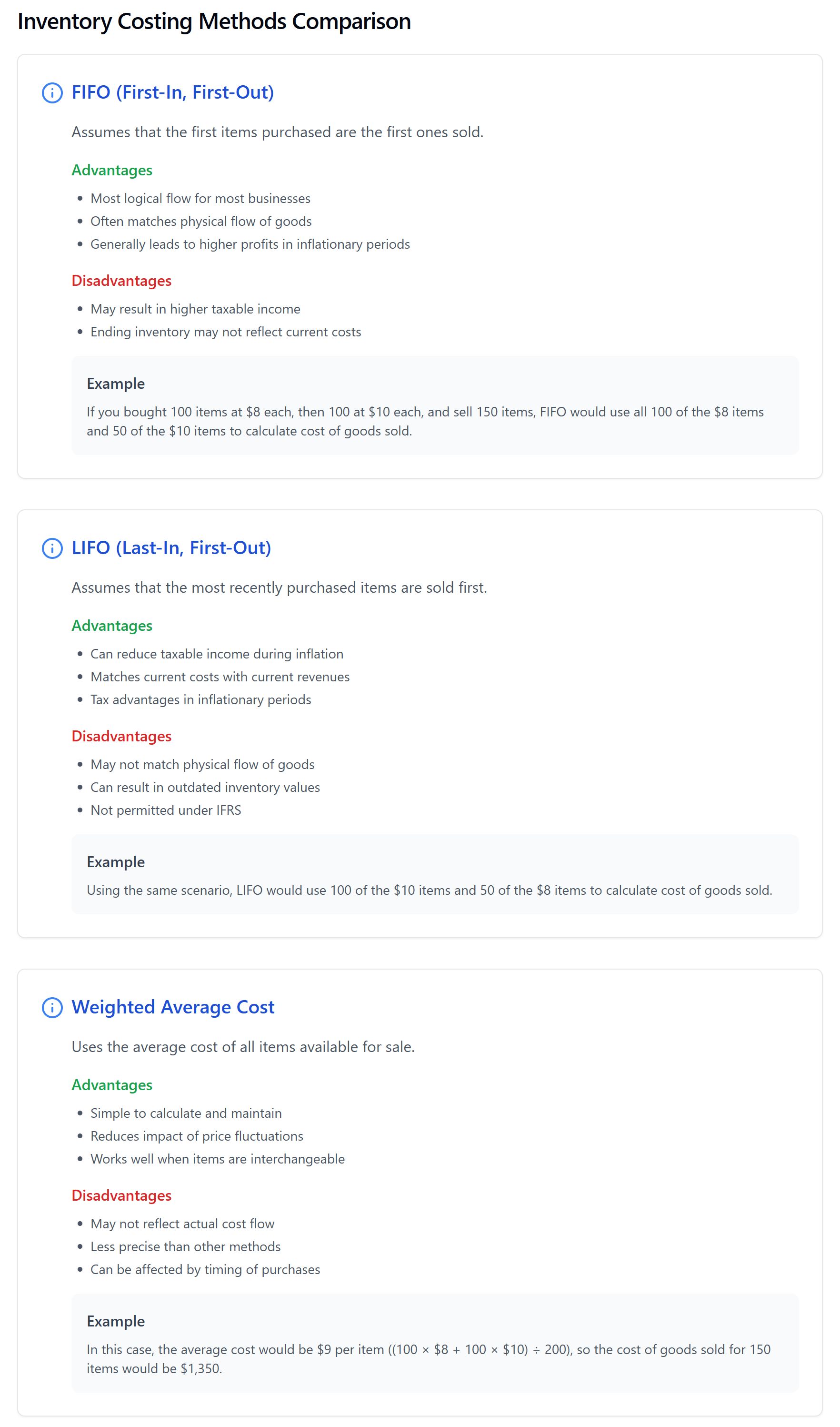

- Inventory Costing Methods: How you value your inventory can affect your taxes. FIFO (First-In, First-Out), LIFO (Last-In, First-Out), and weighted average cost are the most common methods. Talk to your accountant to see which one is best for your business.

Inventory Costing Methods Comparison

FIFO (First-In, First-Out)

Jan 1: $8 × 100 units

Feb 1: $10 × 100 units

Mar 1: $12 × 100 units

Cost of Sale: $1,400

Avg Cost/Unit: $9.33

LIFO (Last-In, First-Out)

Mar 1: $12 × 100 units

Feb 1: $10 × 100 units

Jan 1: $8 × 100 units

Cost of Sale: $1,600

Avg Cost/Unit: $10.67

Weighted Average

All Inventory Combined

Jan: $8 × 100 = $800

Feb: $10 × 100 = $1,000

Mar: $12 × 100 = $1,200

Total: $3,000 ÷ 300 units

Cost of Sale: $1,500

Avg Cost/Unit: $10.00

Key Observations:

- FIFO results in lower COGS ($9.33/unit) and higher taxable income

- LIFO results in higher COGS ($10.67/unit) and lower taxes during inflation

- Weighted Average ($10.00/unit) smooths out price fluctuations

- Choice of method can significantly impact financial statements

- Consider tax implications when selecting a method

5. Estimated Taxes: Paying as You Go

If you’re self-employed (which most ecommerce retailers are), you’ll probably need to pay estimated taxes throughout the year. This is like pre-paying your taxes so you don’t get hit with a huge bill (and potential penalties) come April.

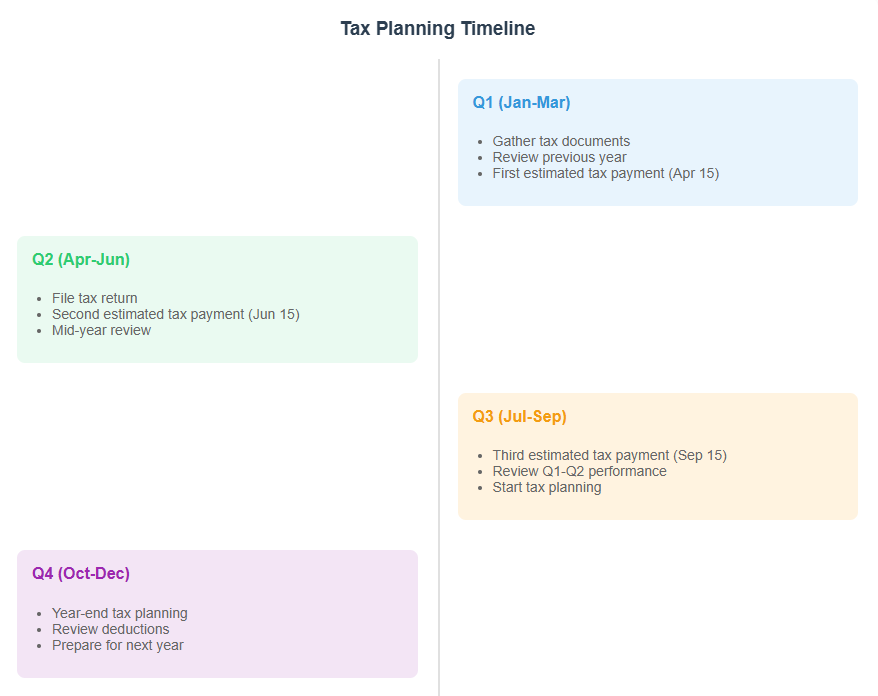

- Quarterly Deadlines: Mark your calendar for April 15th, June 15th, September 15th, and January 15th.

- Calculating Your Payments: The IRS has a handy form called 1040-ES that can help you estimate how much you need to pay. You can also use the “safe harbor” rule, which means paying at least 90% of your current year’s tax liability. If your adjusted gross income (AGI) was over $150,000 last year, you’ll need to pay at least 110% of last year’s tax liability to avoid penalties.

- Payment Options: You can pay your estimated taxes online through IRS Direct Pay, by mail, or even by phone. Just make sure you do it on time to avoid those pesky penalties!

Don’t let estimated taxes sneak up on you! XOA TAX can help you calculate and pay your estimated taxes on time.

6. International Ecommerce: Navigating the Global Marketplace

Selling internationally can be a great way to expand your business, but it also adds another layer of complexity to your taxes. Here are a few things to keep in mind:

- VAT (Value-Added Tax): Many countries have a VAT, which is similar to sales tax but is often included in the price of goods. You may need to register for VAT in countries where you have a significant presence or make a certain amount of sales.

- Cross-Border Transactions: Selling to customers in other countries can involve currency conversions, customs duties, and different tax regulations. It’s important to understand the rules for each country you sell to.

7. Common Ecommerce Tax Pitfalls (and How to Avoid Them)

- Poor Record-Keeping: This is a big one! Without good records, you could miss out on deductions or even face an audit. Use accounting software and keep everything organized.

- Ignoring Sales Tax: Sales tax can be tricky, but ignoring it can lead to big penalties. Stay informed about nexus laws and use tools to help you stay compliant.

- Misclassifying Workers: It’s important to understand the difference between employees and independent contractors. Misclassifying them can have serious tax implications.

- Overlooking Deductions: Don’t leave money on the table! Make sure you’re claiming all the deductions you’re entitled to.

- Missing Deadlines: Whether it’s estimated tax payments or filing your annual return, late filings can result in penalties. Set up a tax calendar and reminders to stay on track.

8. Pro Tips for Ecommerce Success

- Use Tax Automation Tools: There are some amazing tools out there that can automate sales tax calculations, expense tracking, and mileage logging.

- Sales Tax: TaxJar and Avalara AvaTax integrate with popular ecommerce platforms to calculate sales tax in real-time.

- Expense Tracking: FreshBooks and Wave Accounting (which has a free version!) simplify invoicing and expense management.

- Mileage Logging: MileIQ and TripLog automatically track your mileage for accurate record-keeping.

- Set Up a Tax Calendar: Don’t rely on your memory! Use Google Calendar, Outlook, or your tax software to set reminders for upcoming deadlines.

- Stay Informed: Tax laws are constantly changing. Read IRS publications, take online courses, and connect with industry associations like the National Association of Ecommerce Businesses (NAEB). You can find helpful resources on the IRS website (www.irs.gov) and the Small Business Administration website (www.sba.gov).

- Don’t Be Afraid to Ask for Help: Taxes can be confusing, and there’s no shame in seeking professional advice. A good tax advisor can save you time, money, and headaches.

9. Ecommerce Tax Planning Timeline

- Throughout the Year: Keep meticulous records of all income and expenses. Track your mileage and categorize expenses. Make estimated tax payments quarterly.

- October – December: Review your income and expenses for the year. Identify potential deductions. Consider deferring income or accelerating expenses if beneficial.

- January: Gather all necessary tax documents, including 1099s and W-2s. Organize your records and prepare for filing.

- February – April: File your tax return by April 15th. If you need more time, you can file for an extension until October 15th.

To make sure you’re on top of your tax game, here’s a suggested timeline:

10. Risk Management: Staying Ahead of the Game

- Audit Triggers: Certain things can increase your chances of an audit, such as large deductions, inconsistencies in your reporting, or failing to report all your income. Keeping accurate records and following tax laws can help minimize your risk.

- Record Retention: The IRS generally requires you to keep tax records for at least three years, but some records may need to be kept longer. Make sure you have a system for storing and organizing your records.

- Handling Tax Notices: If you receive a notice from the IRS, don’t panic! Read it carefully and respond promptly. If you’re unsure what to do, contact a tax professional for assistance.

11. Digital Payments and Ecommerce: What You Need to Know

- Cryptocurrency Acceptance: Accepting Bitcoin, Ethereum, or other cryptocurrencies can have tax implications. It’s essential to keep accurate records of these transactions and report any gains or losses on your tax return. The IRS treats cryptocurrency as property, so each transaction is a taxable event.

- Payment Processor Requirements: Payment processors like PayPal, Stripe, and Square are required to report transactions to the IRS on Form 1099-K. The reporting threshold for 2023 is $20,000 in gross payments and 200 transactions. However, this threshold is changing to $600 in gross payments with no transaction minimum for transactions occurring after December 31, 2023. Make sure you understand the reporting requirements for your specific payment processor.

12. State-Specific Economic Nexus Thresholds

Navigating sales tax in different states can be tricky. Here’s a quick reference guide for some key states:

| State | Economic Nexus Threshold | Transaction Threshold |

|---|---|---|

| California | $500,000 | None |

| New York | $500,000 | 100 transactions |

| Florida | $100,000 | None |

| Texas | $500,000 | None |

| Washington | $100,000 | None |

| Colorado | $100,000 | 200 transactions |

Remember, these thresholds can change, so it’s always best to check with each state’s tax authority for the most up-to-date information.

FAQs

What are the most common mistakes ecommerce businesses make with their taxes?

Great question! We see a few common pitfalls:

* Not keeping good records. This can lead to missed deductions, inaccurate tax filings, and even an increased risk of an audit.

* Ignoring sales tax obligations. Sales tax can be complex, but failing to collect and remit it correctly can result in penalties and interest.

* Misclassifying workers. It’s important to understand the difference between employees and independent contractors. Misclassifying them can have serious tax implications.

* Missing deadlines. Whether it’s estimated tax payments or filing your annual return, late filings can result in penalties.

I’m confused about sales tax nexus. How do I know where I need to collect sales tax?

Don’t worry, you’re not alone! Sales tax nexus can be tricky. It essentially means having a significant presence in a state, which can be triggered by physical presence (like a store or warehouse) or economic activity (like exceeding a certain amount of sales in a state). The rules vary by state, so it’s important to research the specific requirements for each state where you do business.

What are some resources I can use to learn more about ecommerce taxes?

There are many great resources available! You can check out IRS publications like Publication 334 (Tax Guide for Small Business) and Publication 583 (Starting a Business and Keeping Records). Online courses on platforms like LinkedIn Learning and Coursera can also be helpful. And don’t forget about industry associations like the National Association of Ecommerce Businesses (NAEB).

I’m feeling overwhelmed. Can XOA TAX help me with my ecommerce taxes?

Absolutely! We’d be happy to help. We can assist you with everything from sales tax compliance and maximizing deductions to calculating estimated taxes and planning for the future. Contact us today for a free consultation!

Need Help with Your Ecommerce Taxes?

We get it – taxes aren’t exactly a walk in the park. But with a little planning and the right guidance, you can conquer tax season and keep your ecommerce business thriving.

If you’re feeling overwhelmed or just want some expert advice, the friendly folks at XOA TAX are here to help! We can assist you with everything from sales tax compliance to maximizing deductions and planning for the future.

Contact us today for a free consultation:

Website: https://www.xoatax.com/

Phone: +1 (714) 594-6986

Email: [email protected]

Contact Page: https://www.xoatax.com/contact-us/

Disclaimer: This post is for informational purposes only and does not provide legal, tax, or financial advice. Laws, regulations, and tax rates can change often and vary significantly by state and locality. This communication is not intended to be a solicitation, and XOA TAX does not provide legal advice. XOA TAX does not assume any obligation to update or revise the information to reflect changes in laws, regulations, or other factors. For further guidance, refer to IRS Circular 230. Please consult a professional advisor for advice specific to your situation.

anywhere

anywhere  anytime

anytime