E-commerce Inventory Management: A CPA’s Guide to Success

This comprehensive guide helps e-commerce businesses master inventory management, understand accounting methods like FIFO and LIFO, optimize tax strategies, and leverage technology for success.

Restaurant Inventory Management Best Practices for 2024

Master restaurant inventory management in 2024 with these expert best practices, from implementing inventory management systems (IMS) and FIFO methods to optimizing supplier relationships and reducing food waste, to boost profitability and efficiency.

Restaurant Budgeting Guide: Keep Your Restaurant Financially Healthy

Learn how to create a thriving restaurant budget by mastering key expenses, following a step-by-step guide, leveraging technology, and understanding industry benchmarks, all with expert CPA advice.

10 Bookkeeping Tips for Small Businesses to Thrive in 2024

This blog post provides ten essential bookkeeping tips for small businesses to thrive in 2024, covering automation, financial forecasting, expense tracking, and more, helping owners streamline their finances and make informed decisions.

Why QuickBooks is Still the Go-To for Your Business in 2024

Discover why QuickBooks remains the top choice for small business accounting software in 2024, offering comprehensive features, cloud accessibility, AI automation, and robust reporting to simplify your financial life.

Manufacturing Accounting: Streamline Your Finances for Success

Running a manufacturing business is no easy feat. You’re juggling production, supply chains, and a whole lot of moving parts – literally! But amidst the whirlwind of operations, it’s easy to let your finances take a backseat. That’s where we come in. At XOA TAX, we understand the unique challenges manufacturers face, and we’re here […]

Small Business Accounting: Escape the Chaos & Reclaim Your Time

Running a small business is a thrilling adventure, but let’s face it, the accounting part can be a real drag. Between managing invoices, reconciling accounts, and trying to decipher ever-changing tax laws, it’s easy to feel overwhelmed. You’re passionate about your business, not drowning in spreadsheets! At XOA TAX, we get it. We know your […]

Landscaping Accounting: Avoid Common Mistakes

As a CPA with XOA TAX, I’ve seen firsthand how the right financial strategies can help businesses flourish. And let’s be honest, running a landscaping business is no walk in the park! From managing crews and keeping clients happy to ensuring your equipment is in top shape, there’s a lot on your plate. But amidst […]

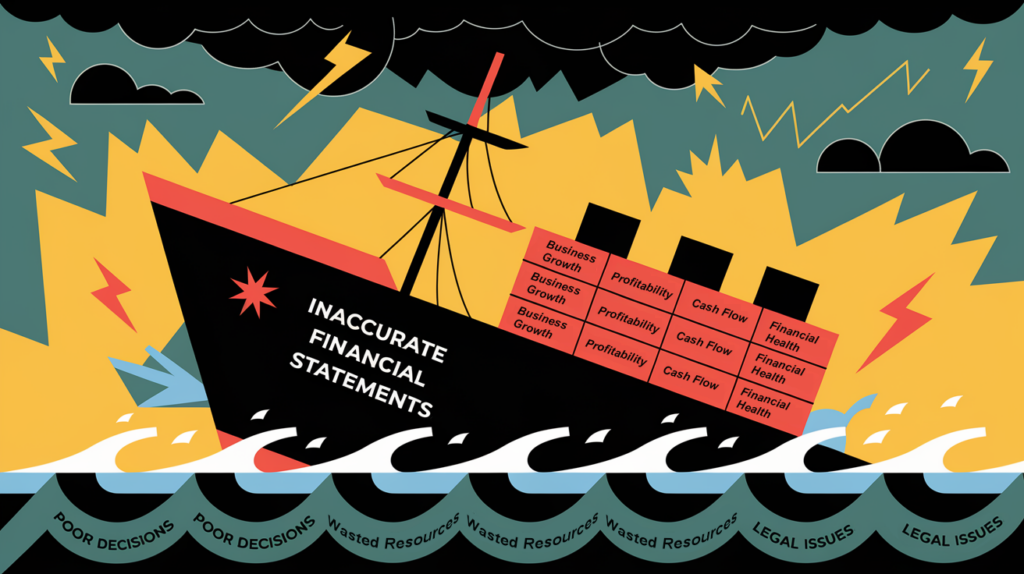

Are Inaccurate Financial Statements Hurting Your Business Growth?

Imagine this: you’re a rapidly growing e-commerce business, and you’re considering securing a significant loan to invest in new inventory and expand your marketing efforts. You pore over your monthly financial statements, confident in the picture they paint of your company’s financial health. But what if those reports are misleading? What if a seemingly minor […]

Streamlining Your Bookkeeping with Square

As a small business owner, you’re always looking for ways to streamline operations and improve efficiency. One area where technology can be a game-changer is bookkeeping. Square, known for its point-of-sale systems, offers a suite of tools that can simplify your financial management and integrate seamlessly with popular accounting software. This post will explore how […]