Comprehensive Guide to New Hampshire Property Taxes in 2024

New Hampshire offers a unique tax environment by not imposing personal income or sales taxes. Instead, the state relies heavily on property taxes to fund local services. In 2024, understanding how property taxes work in New Hampshire is crucial for homeowners and potential buyers alike. How the New Hampshire Property Tax Works Property taxes in […]

Texas Property Tax Rates Explained

Updated Oct 4 2024 Introduction Texas has one of the highest property tax rates in the United States, with an average effective rate of 1.74%, compared to the national average of 0.99%. On average, Texas homeowners pay $3,797 in property taxes each year. Understanding how these taxes are calculated and what influences them can help…

Wisconsin Property Tax Guide: Rates, Calculations, and County Insights

Updated on October 4, 2024 If you’re considering purchasing property in Wisconsin, there is bad news: the Badger State imposes some of the highest property taxes in the United States. With a property tax rate of 1.51%, Wisconsin ranks seventh highest nationwide. This rate is unlikely to rise significantly in the future years. Wisconsin enacted […]

New Mexico Property Tax Guide: Rates, Savings, and FAQs

If you’re considering buying a home in New Mexico, popularly referred to as the Land of Enchantment, you’re in luck: the state offers some of the lowest effective property taxes in the country. Homeowners in New Mexico pay a median annual property tax of $1,557, which is approximately $1,200 less than the US average. Similarly, […]

Nevada Property Tax: Comprehensive Guide for 2024

Are you a homeowner or considering purchasing property in Nevada? Understanding property taxes is crucial for making informed financial decisions. In this guide, we’ll delve into everything you need to know about Nevada property taxes in 2024, including rates, calculations, county comparisons, and expert tips to help you manage your tax obligations effectively. Key Takeaways…

Utah Property Tax: County’s tax rates

Owning real estate in Utah comes with the responsibility of paying property taxes, a crucial source of funding for essential public services. These taxes are levied on land and buildings based on their assessed value. While property taxes are a significant expense for homeowners, it’s important to remember that Utah has relatively low property tax […]

Arizona Property Tax: Get to know your tax

Updated on October 4, 2024 Any person who owns real estate in Arizona is also liable for Arizona property taxes in addition to state income taxes. Real property tax regimes impose financial obligations on land and building owners depending on the value of their properties. State real estate taxes vary across the U.S., with Arizona’s […]

Is Your Family Prepared? The Estate Tax Exemption Is Decreasing in Late 2025

Act now to maximize estate tax exemption before it drops starting in 2026.

Child and Dependent Care Credit: Definition, Eligibility, and FAQs for 2024

Are you making the most of your tax benefits as a parent or caregiver? The Child and Dependent Care Credit (CDCC) isn’t just a line item on your tax return – it’s a potential game-changer for your family’s finances. In this guide, we’ll uncover the benefits of this often-overlooked credit, explaining how it works and…

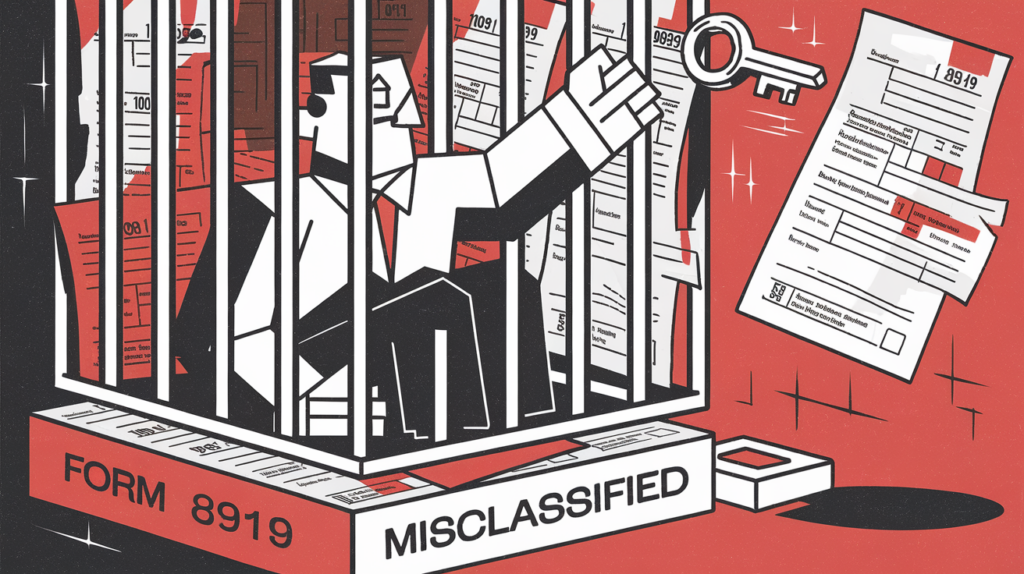

Reclaim Your Unpaid Taxes: A Guide to Form 8919 for Misclassified Workers

Being your own boss as an independent contractor offers freedom and flexibility. But what happens when your employer incorrectly classifies you? This misclassification can lead to significant tax issues, especially concerning unpaid Social Security and Medicare taxes. Don’t worry, though! XOA TAX is here to help you understand your rights and how to rectify this […]