Key Takeaways

- Form 1040 is the primary form used by individual taxpayers to file their federal income taxes with the IRS.

- The form helps determine whether you owe additional taxes or are eligible for a tax refund.

- Personal information such as name, address, Social Security number, and dependents must be included on the form.

- Various types of income, including wages, salary, interest, capital gains, pensions, and Social Security benefits, must be reported.

- Depending on your financial situation, you may need to use supplemental schedules and forms.

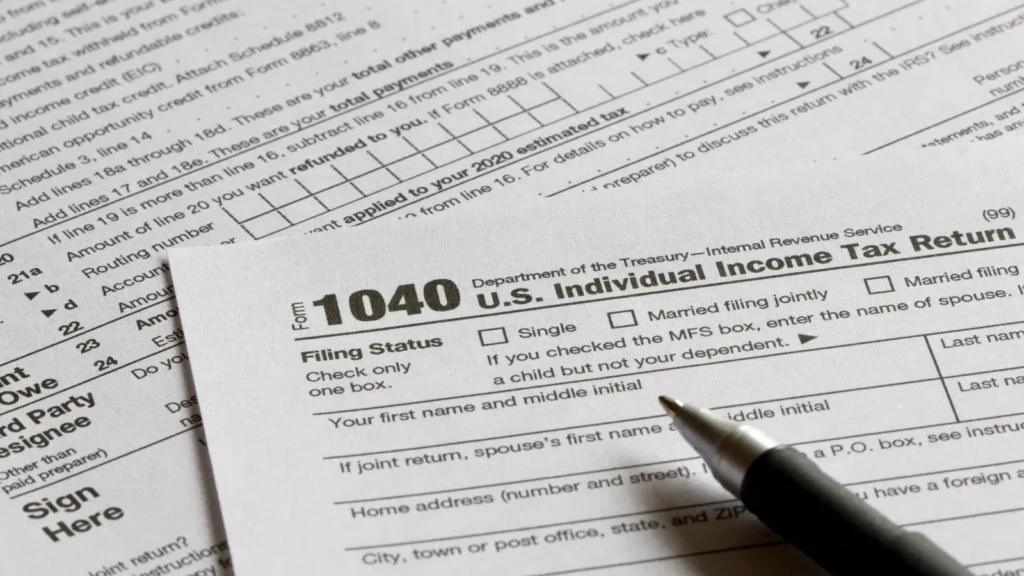

What is IRS Form 1040?

IRS Form 1040 is the standard federal income tax form used by most individual taxpayers in the United States. Each year, you must fill out this form to report your income, claim deductions and credits, and calculate your tax liability. It is essential for both employed and self-employed individuals, as well as those with income from investments or other sources. Ensure you file by the deadline to avoid penalties or interest on unpaid taxes.

Form 1040 Deadline

For the tax year ending December 31, 2023, you must submit Form 1040 to the IRS by April 15, 2024. If you need more time, you can request a filing extension using Form 4868.

Who Needs to File Form 1040?

Form 1040 is required for most individuals in the U.S., whether you are self-employed, work for a company, or earn income from investments. The necessity to file depends on your filing status, age, and gross income. Additionally, if you earned at least $400 in net earnings from self-employment, you are obligated to file a tax return using Form 1040.

| Filing Status | Age at the end of 2023 | Minimum Gross Income to File |

|---|---|---|

| Single | Under 65 | $13,850 |

| 65 or older | $15,700 | |

| Married Filing Jointly | Under 65 (both spouses) | $27,700 |

| 65 or older (one spouse) | $29,150 | |

| 65 or older (both spouses) | $30,600 | |

| Married Filing Separately | Any age | $5 |

| Head of Household | Under 65 | $20,800 |

| 65 or older | $22,700 | |

| Qualifying Widow(er) | Under 65 | $27,700 |

| 65 or older | $29,150 |

Download Form 1040

You can easily access and download the latest version of Form 1040 from the official IRS website or obtain a copy from nearby tax offices. For a seamless and convenient filing experience, the IRS also provides free e-filing options, enabling you to submit your tax return electronically. If you find the paperwork time-consuming, consider using a tax preparation service for a small fee.

How to Fill Out an Income Tax Return

Now, let’s dive into the heart of the matter—filling out Form 1040. We’ll elaborate on each step, ensuring you have a clear understanding of the process:

1. Gather Necessary Documents

- W-2 forms from employers

- 1099 forms for other income sources

- Records of deductions (e.g., mortgage interest, medical expenses)

- Social Security numbers for yourself, your spouse, and dependents

2. Fill in Your Basic Information

On the first page of Form 1040, provide:

- Your name and address

- Social Security number (SSN) for you and your spouse (if filing jointly)

- Filing status (single, married filing jointly, etc.)

- Information about dependents, including their names and SSNs

3. Report Your Income

In this section, report all sources of income:

- Wages: Enter amounts from your W-2 forms.

- Interest and Dividends: Include any income from investments.

- Retirement Income: Report distributions from IRAs or pensions.

Calculate your Adjusted Gross Income (AGI) by summing all income sources and entering it on Line 8b.

4. Claim Your Deductions

You can choose between:

- Standard Deduction: A fixed amount based on your filing status.

- Itemized Deductions: If your deductions exceed the standard deduction, fill out Schedule A to report them. Common itemized deductions include:

- Medical expenses

- State and local taxes

- Mortgage interest

- Charitable contributions

5. Calculate Your Tax

On the second page of Form 1040:

- Use the tax tables provided in the instructions to determine your tax liability based on your taxable income.

- Subtract any tax credits you may qualify for from this amount.

If applicable, report additional taxes such as self-employment tax or alternative minimum tax on Schedule 2.

6. Determine Your Refund or Amount Owed

- If Line 19 (total taxes paid) is less than Line 16 (total taxes owed), calculate the amount you owe.

- If you overpaid, enter your bank details for direct deposit of any refund.

7. Make Tax Payments

If you owe additional taxes, you can make payments using:

- Direct debit from your bank account

- Credit or debit card payments

- Check or money order using Form 1040-V

8. Submit the Return

Before submitting your return, carefully double-check all entries for accuracy. Attach any required schedules or additional forms, such as W-2s, 1099s, or other income statements. Don’t forget to sign the form and keep a copy for your records. You can send your tax return by mail or electronically, depending on your preference.

Please be aware that e-filing a tax return might occasionally face technical issues. Some free tax filing software limits the number of income sources that can be e-filed, which may affect compliance.

Which Schedules Should I Use?

Depending on your specific financial situation, you may need to include additional schedules. These schedules provide more detailed information about certain types of income, deductions, or credits:

Schedule 1: Additional Income and Adjustments to Income

Use Schedule 1 to report extra sources of income or make adjustments to your income not covered on the main Form 1040. Examples include:

- Alimony income or payments

- Business income

- Rental income

- Farm income

- Unemployment income

- Educator expenses

- Deductible moving expenses

- Health savings account deduction

- Student loan interest

- Deductible retirement contributions

For the complete list of items, check the Schedule 1 Form for the current tax year.

Schedule 2: Additional Taxes

Schedule 2 is necessary if you have specific tax situations requiring additional reporting, such as:

- Alternative minimum tax

- Excess advance premium tax credit repayment

- Self-employment tax

- Additional taxes on IRAs or retirement plans

- Household employment taxes

- Repayment of the first-time homebuyer credit

- Additional Medicare tax

- Net investment income tax

For the complete list of items, refer to the Schedule 2 Form for the current tax year.

Schedule 3: Additional Credits and Payments

Use Schedule 3 to claim additional tax credits or report other payments, such as:

- Foreign tax credit

- Credit for child and dependent care expenses

- Education credits

- Retirement savings contributions credit

- Residential energy credit

- General business credit

For the complete list of items, consult the Schedule 3 Form for the current tax year.

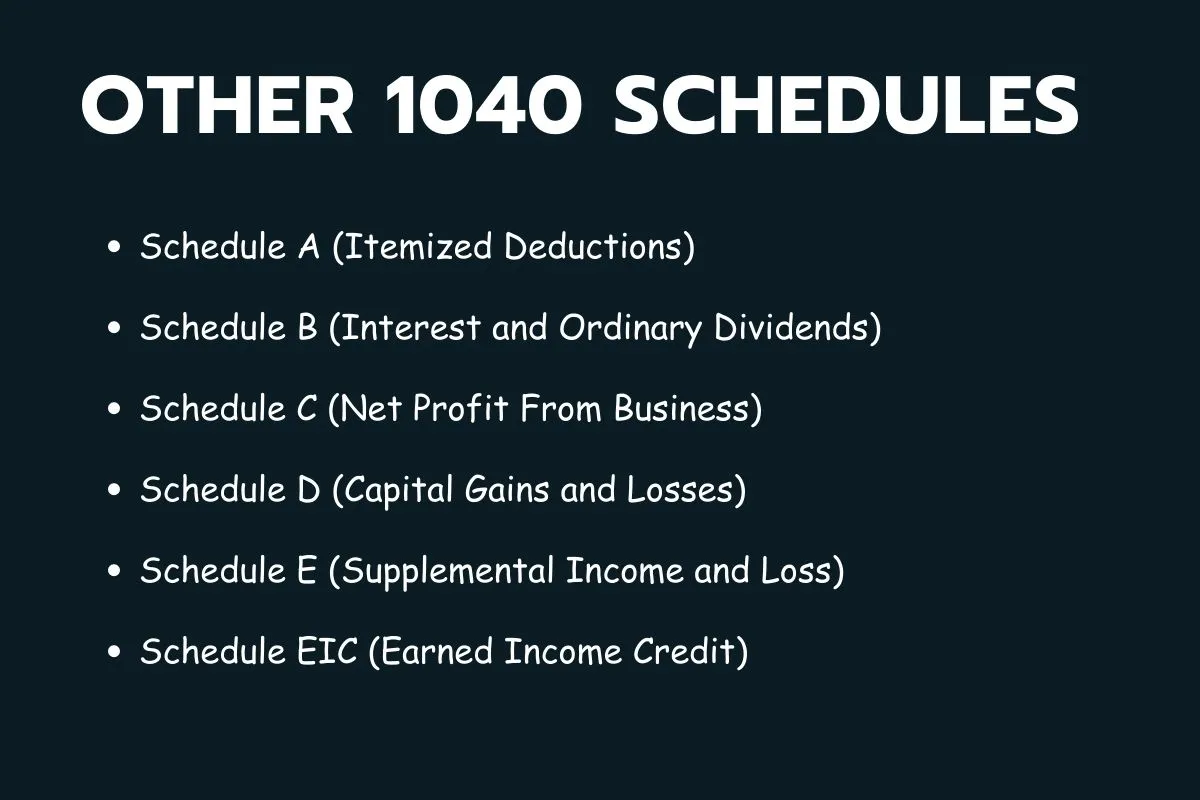

Other Schedules

In addition to Schedules 1, 2, and 3, there are other schedules that cater to specific tax situations, such as:

- Schedule A (Itemized Deductions)

- Schedule B (Interest and Ordinary Dividends)

- Schedule C (Net Profit From Business)

- Schedule D (Capital Gains and Losses)

- Schedule E (Supplemental Income and Loss)

- Schedule EIC (Earned Income Credit)

To learn more about the schedules you might need to submit, read our comprehensive guide on Form 1040: Choosing Appropriate Schedules and Types.

Other Solutions Besides Filing Form 1040 Yourself

If the thought of filling out Form 1040 still feels overwhelming, don’t worry! There are other solutions available:

Tax Software

Using tax software can simplify the process and guide you step-by-step through your tax return. With various reputable options available, you can choose one that fits your needs and budget. At XOA TAX, we offer customized software based on your needs. Book a 30-minute consultation with our experts FOR FREE!

Tax Professionals

Enlisting the help of a tax professional, such as a Certified Public Accountant (CPA) or Enrolled Agent (EA), can provide peace of mind. They have expert knowledge and can ensure accurate and timely tax filing on your behalf.

Volunteer Tax Assistance Programs

For eligible taxpayers with low to moderate incomes, the IRS offers free tax preparation services through Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs. Trained volunteers will provide assistance in person or virtually. To learn more, visit Free Tax Return Preparation for Qualifying Taxpayers.

Frequently Asked Questions (FAQs)

How do I calculate my adjusted gross income (AGI) on Form 1040?

To determine your Adjusted Gross Income (AGI), start by listing all sources of income, including wages, dividends, and any other taxable earnings. Then, make “above-the-line” deductions such as contributions to a traditional IRA, student loan interest, and self-employment tax deductions. Use Schedule 1 and Form SE if necessary. Subtract the total deductions from your total income to arrive at your AGI.

What are above-the-line deductions and how do they affect my AGI?

Above-the-line deductions are specific expenses you can subtract from your gross income to lower your AGI. They include retirement contributions, student loan interest, and self-employment tax. These deductions reduce your taxable income and can make you eligible for other tax benefits, regardless of whether you take the standard deduction or itemize.

What should I do if I’m filing jointly with a spouse on Form 1040?

When filing jointly, include both your and your spouse’s full names and Social Security numbers. Select the “Married Filing Jointly” status, combine your incomes and deductions, and ensure both of you sign the return. This filing status often provides tax benefits, such as higher income thresholds for certain deductions and credits.

What tips are available for managing taxes effectively?

Effective tax management tips include consulting a financial advisor, utilizing tax calculators, keeping impeccable records, maximizing deductions and credits, planning for retirement wisely, and staying updated with tax laws. These strategies can help streamline the tax process and optimize your financial outcomes.

How can I claim above-the-line deductions for self-employment tax on Form 1040?

To claim above-the-line deductions for self-employment tax, complete Schedule 4 and attach Form SE (Self-Employment Tax) to your Form 1040. Calculate your self-employment tax using Form SE and deduct half of this amount on Form 1040 as an above-the-line deduction.

What is Form 1040-SR and who is it designed for?

Form 1040-SR is a tax form introduced by the IRS in 2019, specifically designed for seniors aged 65 and older. It features larger print and a simplified layout to make it easier to read and fill out. It accommodates common sources of income for retirees, such as Social Security benefits, pensions, and investment earnings.

Conclusion

Filing your income tax return using IRS Form 1040 may seem challenging, but this step-by-step guide equips you with the necessary information to tackle the process with confidence. Whether you choose to file on your own, use tax software, or seek professional assistance, understanding the basics of Form 1040 will help you make informed decisions and maximize your tax benefits.

If you find the paperwork too overwhelming, hand it over to our experts and enjoy a stress-free tax season!

You May Also Like:

- What is the Additional Medicare Tax for High Earners?

- How Do I Know If the IRS Received My Tax Returns?

- Tax Credit vs Tax Deduction: Which is More Beneficial?

- Form 1040-V: Everything You Need to Know

- Tax Topic 152: Your Key to Tax Refunds

Contact Us

Have more questions or need personalized assistance? Contact our experts today and make your tax filing process hassle-free!

anywhere

anywhere  anytime

anytime