Filing your income tax return can be complex, especially when considering the various schedules that may apply to your financial situation. To help you navigate through the process with confidence, let’s explore all the schedules you need to know when filling out IRS Form 1040 for the tax year 2024.

Understanding Tax Schedules: What They Are and Why the IRS Requires Them

Tax schedules are essential tools used by taxpayers to calculate their tax obligations based on various types of income and deductions. They provide specific guidelines and rates that help individuals and corporations determine their estimated taxes due. Here’s a deeper dive into what tax schedules are and their importance:

What Are Tax Schedules?

A tax schedule is an additional form that must accompany your tax return when you have specific types of income or deductions that require detailed reporting. These forms allow the IRS to gather extensive information beyond the basic data provided on your main tax return, ensuring all aspects of your financial situation are transparently documented.

Why Does the IRS Require Tax Schedules?

- Detailed Reporting: If you earn significant amounts from interest, have substantial deductions like mortgage interest, or make notable charitable contributions, tax schedules help break down these figures.

- Accuracy in Tax Liability: By detailing these income streams and deductions, the IRS can accurately calculate your tax liability, ensuring you pay what you owe, no more, no less.

- Streamlined Verification: These forms assist the IRS in verifying the numbers on your primary tax return, reducing discrepancies and simplifying audits.

Examples of Tax Schedules

- Schedule A: For itemizing deductions such as medical expenses and gifts to charity.

- Schedule B: For reporting interest and dividend income.

- Schedule C: For detailing profit or loss from business activities, crucial for freelancers and small business owners.

All Form 1040 Schedules You Need to Know

Schedule 1: Additional Income and Adjustments to Income

1040 Schedule 1 is used to report additional sources of income and make adjustments to your total income that are not covered on the main Form 1040. Here are some items that may require you to use Schedule 1:

- Alimony income or payments.

- Business income and expenses for self-employed individuals or sole proprietors.

- Rental income and expenses for landlords.

- Farm income and expenses for farmers.

- Unemployment compensation received during the tax year.

- Educator expenses for teachers.

- Deductible moving expenses.

- Deductible contributions to a Health Savings Account (HSA).

- Deductible expenses for self-employed individuals, such as health insurance premiums.

- Student loan interest deduction.

For the complete list of items, check this form of Schedule 1 for tax year 2024 from the IRS.

Schedule 2: Additional Taxes

Schedule 2 comes into play if you have specific tax situations that require additional reporting. Some situations that may require you to use Schedule 2 include:

- Alternative minimum tax (AMT).

- Excess advance premium tax credit repayment.

- Additional taxes on IRAs or other retirement plans.

- Self-employment tax for self-employed individuals.

- Additional Medicare tax on high earners.

- Net investment income tax for taxpayers with significant investment income.

For the complete list of items, check this form of Schedule 2 for tax year 2024 from the IRS.

Schedule 3: Additional Credits and Payments

1040 Schedule 3 is used to claim additional tax credits or report other payments that may affect your tax liability. Some items covered in Schedule 3 include:

- Foreign tax credit for taxes paid to a foreign country on foreign income.

- Education credits, such as the American Opportunity Credit and the Lifetime Learning Credit.

- Child and dependent care expenses credit.

- Retirement savings contributions credit.

- Residential energy-efficient property credit.

- General business credit for certain business-related expenses.

- Excess Social Security tax withheld.

For the complete list of items, check this form of Schedule 3 for tax year 2024 from the IRS.

See More: How to Quickly Fill Out Form 1040 Schedule 3

Schedule A: Itemized Deductions

Form Schedule A is for taxpayers who choose to itemize their deductions instead of taking the standard deduction. Some common itemized deductions reported on Schedule A include:

- Medical and dental expenses exceeding a certain percentage of your adjusted gross income (AGI).

- State and local income taxes or sales taxes paid.

- Real estate taxes paid on your primary residence and other properties.

- Home mortgage interest on loans up to a certain limit.

- Charitable contributions made to qualifying organizations.

- Casualty and theft losses.

Read More: 4 Tips To Claim Max Donation Deductions for Taxes

For the complete list of items, check this form of Schedule A for tax year 2024 from the IRS.

Schedule B: Interest and Ordinary Dividends

Form 1040 Schedule B is used to report interest and ordinary dividends received during the tax year. You may need to use this schedule if you received interest or dividend income from:

- Bank accounts and certificates of deposit.

- Bonds and other interest-bearing investments.

- Dividend-paying stocks or mutual funds.

For filing requirements, check this article about Schedule B for tax year 2024 from the IRS.

Schedule C: Net Profit From Business

1040 Schedule C is essential for self-employed individuals, sole proprietors, and single-member LLCs (SMLLCs) to report their business income and expenses. Some key points related to Schedule C include:

- Reporting gross income from business activities.

- Deducting eligible business expenses.

- Calculating the net profit or loss from the business.

- Carrying the net profit or loss to the main Form 1040.

Schedule D: Capital Gains and Losses

IRS Schedule D is used to report capital gains and losses from the sale of assets, such as stocks, bonds, real estate, cryptocurrency, and other investments. It helps determine the tax implications of your investment transactions and includes:

- Reporting short-term capital gains and losses (assets held for one year or less).

- Reporting long-term capital gains and losses (assets held for more than one year).

- Calculating the net capital gain or loss.

- Carrying the net capital gain or loss to the main Form 1040.

- Carrying unallowed capital loss from the previous year.

Schedule E: Supplemental Income and Loss

1040 Schedule E is used to report supplemental income and loss from various sources, including:

- Rental income from real estate properties.

- Royalties from intellectual property, such as copyrights or patents.

- Income from partnerships, S corporations, trusts, and estates.

- Certain real estate activities, like real estate professionals reporting rental activities.

Schedule EIC: Earned Income Credit

Schedule EIC is specifically for taxpayers who qualify for the Earned Income Credit (EIC). This credit is designed to benefit low to moderate-income individuals and families. The schedule helps determine the eligibility and amount of the EIC based on your earned income and family size.

Schedule SE: Self-Employment Tax

Schedule SE is essential when you’re reporting self-employment income, as it helps determine your self-employment tax. If you file Schedule C, you might also need to file Schedule SE to calculate the amount of self-employment tax you owe.

- Reporting Business Earnings: Both Schedule C and Schedule SE are used to report your business earnings and deductions.

- Calculating Profit or Loss: These forms work together to calculate your net business profit or loss.

- Integrating with Form 1040: The net profit or loss from these forms is then added to your other income on Form 1040.

This process is crucial for accurately calculating the amount of self-employment tax you owe, ensuring your tax filings reflect your true earnings.

For more details: Form 1040X Instructions: Filling Out Line by Line

Other Specialized Schedules

In addition to the schedules mentioned above, there are other schedules that cater to specific tax situations. Depending on your circumstances, you might need to include one or more of these with your Form 1040:

- Schedule F: For reporting farming income and expenses.

- Schedule H: Used for reporting household employment taxes.

- Schedules 1, 2, and 3: Introduced in recent years to report additional income, taxes owed, and non-refundable credits.

- Schedule K-1: For those involved in partnerships or certain investment activities, reporting each partner’s share of earnings, losses, deductions, and credits.

Understanding and correctly completing these tax schedules is vital for a smooth tax filing process. Each schedule addresses different aspects of your financial situation, making it essential for effective tax planning and compliance.

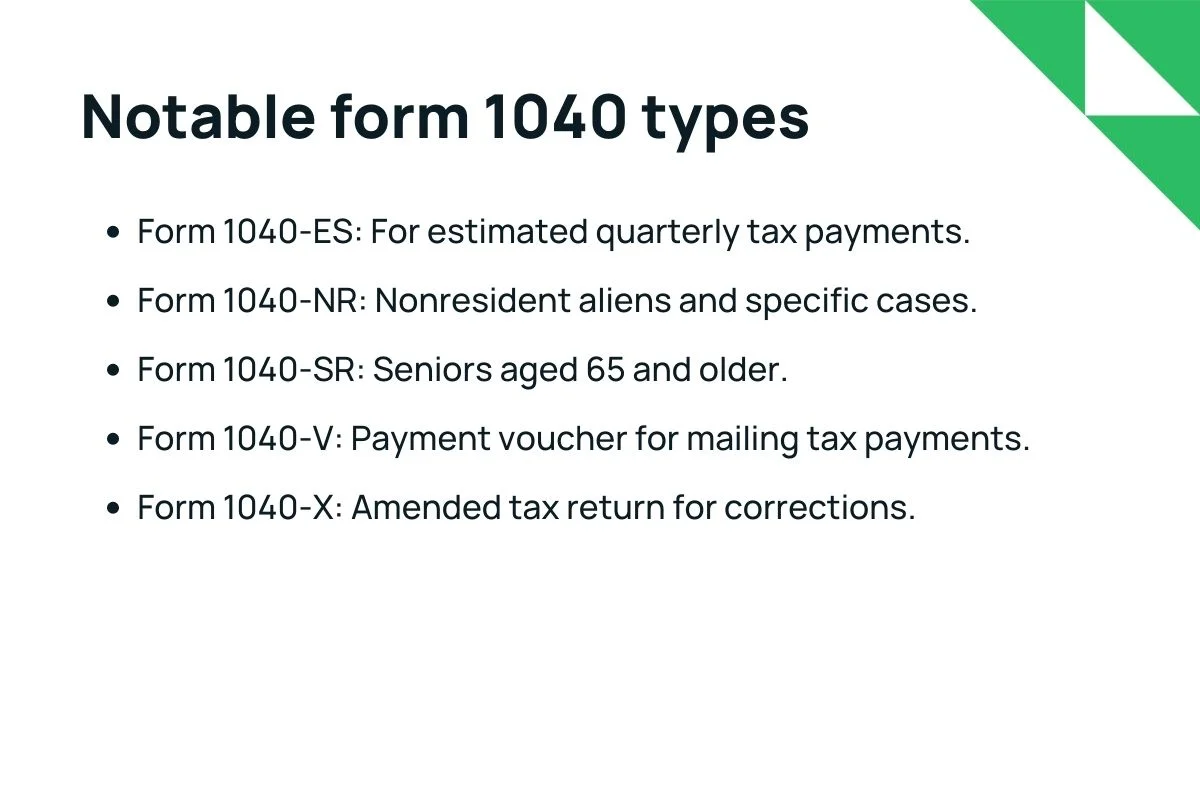

Different Types of Form 1040

IRS Form 1040 comes in different variations, each tailored to meet the needs of different taxpayers. Let’s explore the types:

Form 1040-ES: Estimated Tax for Individuals

Form 1040-ES is essential for freelancers, self-employed individuals, and others who need to calculate their estimated quarterly taxes. These payments are based on your previous year’s income or pro-rated income of the current year. It’s crucial to make the payments on time since you might face a penalty for underpayment of estimated tax.

This form is also used to estimate taxes on income that is not subject to withholding, such as dividends or interest. If you opted not to have taxes withheld from unemployment or Social Security benefits, you’ll also need to complete this form.

Form 1040-NR: U.S. Nonresident Alien Income Tax Return

Form 1040-NR is meant for nonresident aliens who engaged in business or trade within the U.S., representatives of a trust and/or estate that is required to file a 1040-NR, or a representative of a deceased person who would have been obligated to file a 1040-NR.

Read More: Form 1040NR Instructions: Authority On Your Side

Form 1040-SR: U.S. Tax Return for Seniors

Form 1040-SR is a newer version of Form 1040 specifically designed for individuals aged 65 and older. The differences between Form 1040-SR and the regular 1040 tax form are mostly cosmetic. Form 1040-SR features a different color scheme, a larger font, and an embedded standard deduction table, which helps seniors claim their larger standard deduction more easily. Eligible taxpayers can always choose which form (1040 or 1040-SR) to file.

Form 1040-V: Payment Voucher

If you owe the IRS money on your tax return and choose to pay the balance by mail instead of electronically, you’ll need to include Form 1040-V, also known as a “Payment Voucher.” This form allows you to send your payment along with your return. However, many people opt to pay their tax bills online for added convenience.

Read More: Form 1040-V: Everything You Need To Know

Form 1040-X: Amended U.S. Individual Income Tax Return

Form 1040-X is attached to an amended tax return to show adjustments made compared to the original tax return. You’ll need to complete this form if you made a mistake on your original return, such as forgetting to include additional income. It provides a way to correct errors and update information on your previously filed return.

Read More: Form 1040X Instructions: Filling Out Line by Line

Benefits of Using Software to Fill Out Tax Schedules

Navigating the complexities of tax season can be a daunting task. However, tax software offers a structured and efficient approach to ease the process. Here’s why opting for tax software can be beneficial:

Expert Assistance at Your Fingertips

Professional Guidance: Many tax software options provide access to seasoned experts who can assist you throughout the process. Whether you choose a full-service option or simply want advice, you’re covered.

Flexibility and Convenience

Do-It-Your-Way: Whether you need someone to handle the entire process or just need occasional support, there’s an option for you. Guided assistance walks you through each step, ensuring you can handle your taxes confidently.

Accuracy and Maximum Refunds

Guaranteed Precision: Tax software is designed to minimize errors by guiding you comprehensively through the filing process. This accuracy often translates into securing the maximum refund you’re entitled to.

Time and Cost Efficiency

Efficient Process: Using software reduces the time spent on understanding and filling out complex tax schedules. It’s an affordable alternative to traditional tax filing services.

Why Choose Software Over Traditional Methods?

Filing taxes manually or solely relying on a third-party tax preparer can be cumbersome and expensive. Tax software offers a happy medium:

- Ease of Use: User-friendly interfaces make it simple even for beginners to follow complex tax schedules.

- Built-In Error Checking: Most programs offer real-time error detection and correction, significantly reducing mistakes.

- Document Storage: Many solutions store your previous filings, making it easier to access and review past tax information.

By leveraging the right tax software, you equip yourself with the tools to handle your taxes efficiently, accurately, and with peace of mind. Whether you’re a novice or have experience, these solutions offer a tailored approach to meet your needs and ensure your financial well-being.

Frequently Asked Questions (FAQs)

How Do Tax Schedules Relate to Form 1040 in a Tax Return?

Tax schedules are integral forms required by the IRS in addition to your main tax return when you have specific types of income or deductions. These schedules allow you to report detailed financial information, such as significant amounts of interest income, mortgage interest, or charitable contributions. The totals you compute on these schedules are then transferred to your Form 1040, ensuring that all relevant financial data is accurately reflected in your tax return.

The figures calculated on these schedules are carried over to your Form 1040, integrating the additional details into your overall tax return.

When are tax schedules required?

These schedules are required when you have specific income sources or deductions, such as large amounts of interest income, mortgage interest, or charitable donations.

What are tax schedules?

Tax schedules are additional forms that the IRS requires you to complete along with your main tax return to report specific types of income or deductions.

How Does Schedule SE Relate to Self-Employment Tax?

Schedule SE is essential when you’re reporting self-employment income, as it helps determine your self-employment tax. If you file Schedule C, you might also need to file Schedule SE to calculate the amount of self-employment tax you owe.

-

- What information is reported on Schedule SE?

It requires you to detail your business earnings and deductions, ultimately calculating the net business profit or loss.

-

- How does Schedule SE relate to other tax forms?

The net profit or loss calculated on Schedule SE is combined with other income on Form 1040, playing a crucial role in determining your overall taxable income.

-

- What is the purpose of Schedule SE?

Schedule SE is designed to report income earned from self-employment activities.

anywhere

anywhere  anytime

anytime