Key Takeaways

- Form 1040X reports changes or corrections to previously filed tax returns.

- You must file Form 1040X within 3 years from the original filing date or no later than 2 years after you paid the taxes.

- When filling out 1040X, ensure you include all forms and documents supporting your amendment, including W2s and receipts.

What is Form 1040X?

Many individuals make mistakes when filing their original tax returns, resulting in costly errors and potential delays. Form 1040X solves these problems, providing a way to rectify any errors or mistakes before you submit your income tax return.

Form 1040X is an amended form for filing an amended U.S. individual income tax return with the Internal Revenue Service (IRS). You must use it to report corrections, changes, or additional information to fix errors on your original form 1040.

Why Do I Use Form 1040X?

As mentioned above, it can correct any errors or mistakes when filing your federal income tax return. It’s essential to use Form 1040X to ensure accuracy and avoid costly penalties from the IRS.

Now that you know the importance of submitting Form 1040X, it’s also essential to know when to complete it.

Include a copy of your original income tax return when filing a form 1040X, along with its attachments and supporting documentation if necessary.

Deadline for Filing Form 1040X

Note that you must file Form 1040X within three years from when you initially filed your income tax return or two years from when you paid any taxes due as stated on Form 1040X – whichever period is later.

After establishing your deadline, it’s time to look into the purpose of form 1040X and how it can benefit you.

What is Form 1040X used for?

When filing your taxes, use Form 1040X to make corrections or changes to your existing form 1040, including providing extra information. With this form, you can report the following:

- Changes to income, deductions, credits, or filing status;

- Corrections resulting from IRS audit adjustments;

- Claiming refunds from prior tax years; or

- Correcting form 1099 or W-2 form mistakes

All this information is excellent, but completing the form may be intimidating. Don’t worry—we’ve got you covered with our step-by-step guide on how to complete Form 1040X to make it as fast and easy as possible.

Learn more about other form 1040 schedules

Form 1040X Instructions The Step-by-step Guide

For beginners, approaching something new can be a challenge. Filing Form 1040X is no exception; it can be daunting for even the most experienced filers.

Taking the utmost care when preparing and filing this form is critical, as errors can lead to costly consequences. That’s why it’s essential to understand how to fill out form 1040X line by line.

Step 1: Make copies of your original tax return

This includes all documents such as W-2s, 1099s, and any other forms you have included in the initial return. This step allows you to refer to it while completing it quickly and increases the chances of submitting an accurate amended form.

Additionally, if something unexpected occurs or changes since you first filed, having a copy of the previous document can help avoid unnecessary confusion.

Step 2: Get your hands on the suitable version of Form 1040X

Before any of the steps you’re about to do, you have to fix and amend your previously filed return first. Then the last step would be getting a 1040 X and filling it.

Form 1040X has different versions depending on the tax year you want to amend, including versions for 2014 to 2017 and 2019 and later. Download your appropriate form 1040X

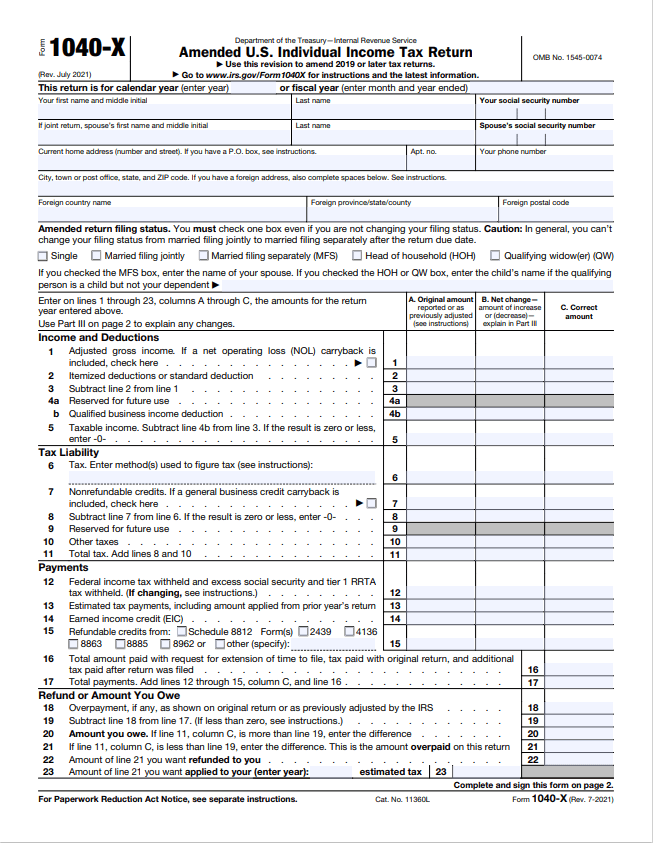

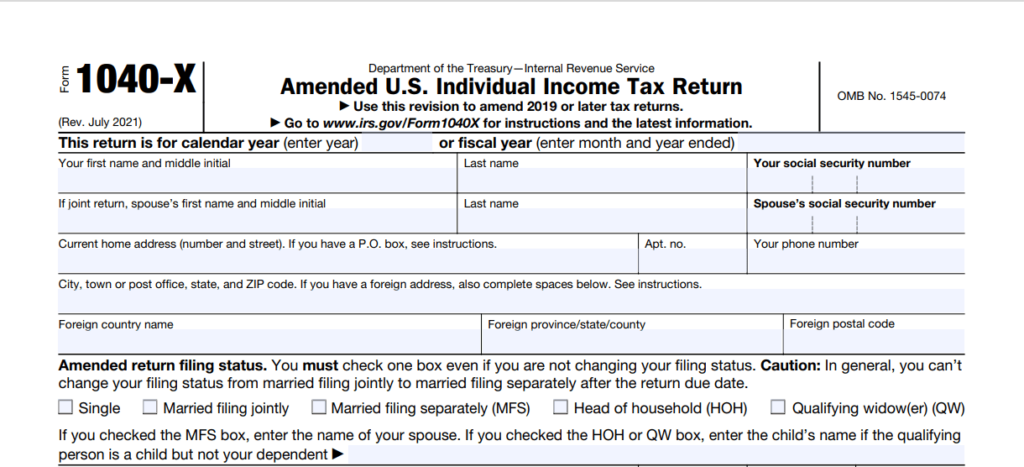

Step 3: Fill out this form

Next, you’ll need to enter your basic information, such as your name and Social Security number. This essential data is necessary for the IRS to track your Form 1040X and ensure it gets processed correctly.

You will also need to provide details about the year of Form 1040 you are amending. Once you have entered all the necessary information, it’s time to complete Form 1040X by filling in its lines.

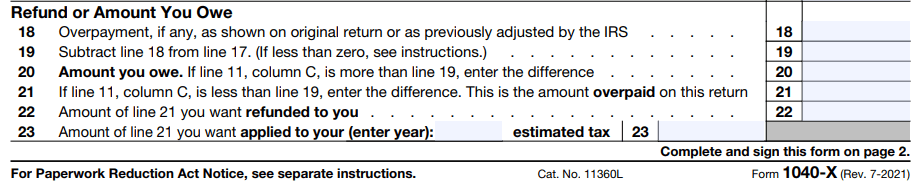

Step 4: Determine what needs to be reported

After you know the purpose of Form 1040X, the following section presents three columns:

Column A

For Form 1040X, enter your original income tax return numbers in Column A. If you are amending a previously amended tax return, employ the numbers from your last amendment instead of those from the filed income tax return.

Keep track of which amendment forms you’ve filed once you submit a Form 1040X for a particular tax year since it replaces the original tax return.

When using Form 1040X, it’s essential to highlight any changes in your Adjusted Gross Income (AGI) and deductions. Depending on your circumstances, you may be able to claim the standard deduction or itemized deductions. Reviewing and updating these figures ensures that your new tax filing is accurate and up-to-date.

Adjusted Gross Income

Knowing your AGI can be instrumental in determining what deductions and credits you may be eligible for. For example, many deductions rely on a percentage of your AGI; if you have an inaccurate estimate of this figure when filing, you could end up paying more or less than you should.

It’s vital to double-check column A before submitting a Form 1040X to ensure accuracy and avoid any unnecessary delays during the review process.

Itemized deductions or standard deduction

They allow taxpayers to reduce their taxable income by taking advantage of tax-deductible expenses such as medical and dental expenses, charitable contributions, and specific state and local taxes.

However, if a taxpayer’s deductions do not exceed the standard deduction amount set by the IRS each year, it may be more beneficial to take it instead. Taking the time to thoroughly understand which option best suits your situation is essential to ensure you receive all the tax benefits possible.

After reviewing the changes to your itemized deductions or the standard deduction, it’s time to move on to column B of Form 1040X. This is where you will make any corrections or adjustments to income, deductions, and credits.

It’s essential to check all figures carefully, as mistakes may result in a processing delay or incorrect tax liability.

Column B

This includes any adjustments or corrections to income, deductions, and credits. For instance, if you must alter your total taxable income, this is the place to do it.

It’s vital to ensure that all changes are accurate—including any arithmetic mistakes—as mistakes can delay processing or incorrect tax liability. Once column B is complete, you can enter the corrected amounts in column C.

Column C

Column C plays an important role in your amended tax return. You can calculate the numbers by adding or subtracting them from Column A and Column B, so it’s vital to ensure they match up with the corresponding figures on your form.

Taking the time to verify these will help you avoid any potential issues when filing your taxes.

Column C plays an important role in your amended tax forms. You can calculate the numbers by adding or subtracting them from Column A and Column B, so it’s vital to ensure they match up with the corresponding figures on your form.

Taking the time to verify these will help you avoid any potential issues when filing your taxes.

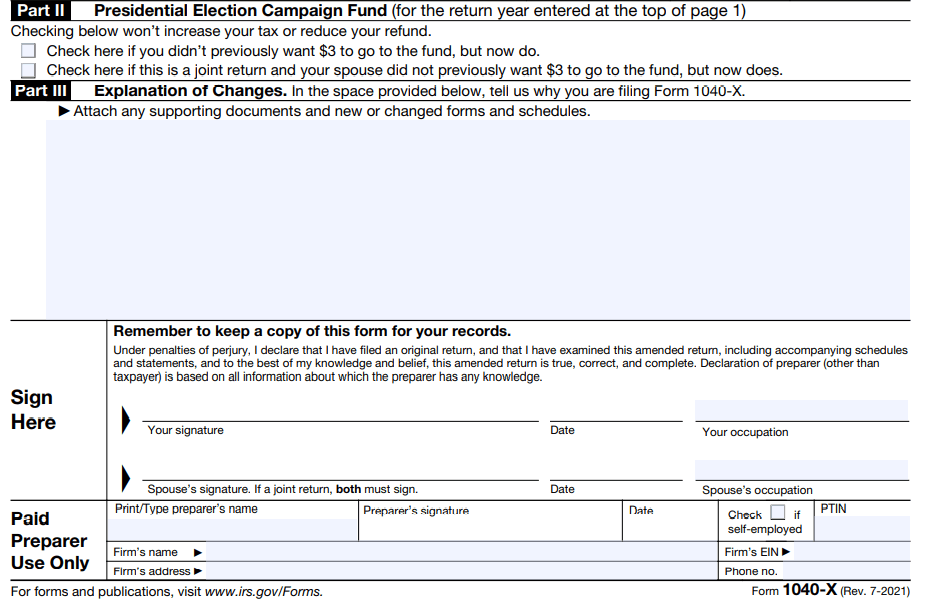

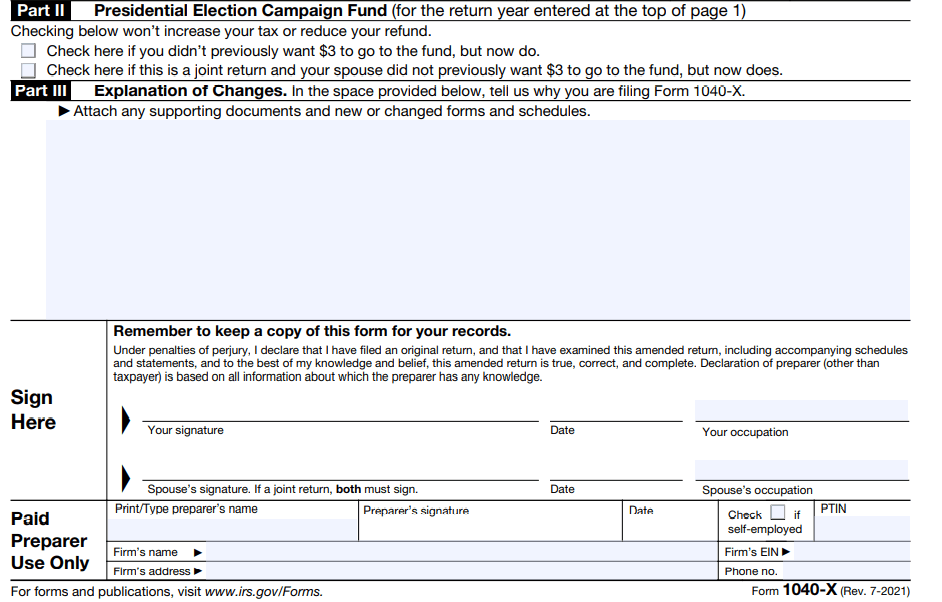

When filing your amended return with Form 1040X, provide detailed information on why you are amending your tax return in Part III.

After you’ve made any necessary adjustments to your income tax return, make sure that Form 1040X is sent off to the appropriate IRS office.

Where to Mail Form 1040X?

When filing form 1040X, the form must be sent to the appropriate IRS office, depending on where you live and what state(s) the amended return covers. You can find the mailing address for form 1040X on the IRS website.

Remember to include copies of any forms and/or schedules you’re changing or didn’t include with your original return.

To avoid delays, file Form 1040-X only after you’ve filed your original income tax return. Generally, for a credit or refund, you must file Form 1040-X within 3 years after the date you timely filed your original income tax return or within 2 years after the date you paid the tax, whichever is later.

Allow the IRS up to 16 weeks to process the amended return. And remember to keep copies of all documents filed with it for at least three years in case you need them.

Wrapping Up Your Tax Return Adjustment with Form 1040X

When you have finished Part II, Part III, and any other required schedules for your tax return adjustment, it’s time to sign your Form 1040X. Mail it to the IRS to make sure your amendment is processed correctly.

Be sure to include all required documentation with the form for your amended return to be processed quickly.

But when it comes to tax season, filing an amended return can be one of the most challenging and time-consuming tasks. Don’t let taxes take over your life! Allow us to help make the process easy and hassle-free. Contact us today, and let us handle all your needs so that filing is quick, efficient, and stress-free.

[formidable id=”42″]

Frequently Asked Questions (FAQs)

Do I need to attach the original return with 1040X?

When submitting an amended income tax return, you must attach your original return with the 1040X form. The package to be sent to IRS should be 1040X, 1040, and other amended and original forms.

It’s essential to verify twice that all attachments and documents are included before you mail or e-file your return.

What attachments are needed for 1040X?

You can file a 1040X form yourself. Ensure you have all necessary information and documents, including the original return, updated figures, and reasons for changes.

Review thoroughly all required fields are filled in before submitting. Once verified, submit your amended return to the IRS electronically.

Attachments needed for 1040X depend on the adjustment made to the original tax return. If income or deductions change, documents like bank statements and proof of payment may be required.

Any applicable forms related to changes must be included with an amended tax return.

Can I file a 1040X myself?

Yes, you can file a 1040X form yourself. Before doing so, it is essential to ensure that you have all the necessary information and documents ready, including your original income tax return, any updated or corrected figures, and explanations for why the changes are being made.

Also, cross-check that all the required fields on the form are filled in accurately before submitting. Once you have verified everything is in order, you can electronically submit your amended tax return directly to the IRS.

How can I keep from missing important deadlines related to filing my taxes?

Create a schedule to avoid missing filing deadlines. Give yourself enough time before the deadline to complete all required steps, verify twice accuracy, and submit before the date due.

How can I complete my tax filing process quickly?

Staying organized and prepared is the key to quickly completing your tax filing process.

Ensure all required documents are ready and accessible, double-check your forms for accuracy before submitting them, and stay on top of any applicable deadlines.

Consider utilizing a qualified tax professional if you feel overwhelmed or need expert guidance. With our expert team at your side, you can finish it quickly and confidently.

What should I do if I don’t have enough time to complete my taxes?

If you do not have enough time to complete your income tax return, filing for an extension using Form 4868 is best. This will allow you to complete the process in six months without incurring late fees or penalties.

Create a schedule to avoid missing filing deadlines. Give yourself enough time before the deadline to complete all required steps, verify twice accuracy, and submit before the date due.

How can I complete my tax filing process quickly?

Staying organized and prepared is the key to quickly completing your tax filing process.

Ensure all required documents are ready and accessible, double-check your forms for accuracy before submitting them, and stay on top of any applicable deadlines.

Consider utilizing a qualified tax professional if you feel overwhelmed or need expert guidance. With our expert team at your side, you’ll be able to finish it quickly and confidently.

What should I do if I don’t have enough time to complete my taxes?

If you do not have enough time to complete your taxes, filing for an extension using Form 4868 is best. This will allow you to complete the process in six months without incurring late fees or penalties.

anywhere

anywhere  anytime

anytime