How to Lock in 0% Long-Term Capital Gains Tax Before a Bracket Increase

Tax planning is a year-round activity. Smart investors are always looking for ways to minimize their tax liability, and with the potential for tax bracket increases, now is the perfect time to explore strategies to lock in favorable rates. Did you know that if your taxable income falls within a certain range, you might qualify […]

Stock Trading Taxes: How Much to Set Aside?

Stock trading can be an exciting way to grow your wealth, but it’s important to remember that Uncle Sam wants his share of your profits. As a CPA, I often see people get caught off guard by the taxes owed on their stock trades, especially if they’ve had a particularly good year. To avoid an […]

Backdoor Roth IRA for High Earners: A Simple Guide (No Traditional IRA Needed)

Bypass Roth IRA income limits with the simple backdoor Roth IRA strategy—ideal for high earners with no existing Traditional IRA—and unlock tax-free retirement growth.

Tax Consequences of IRA Recharacterizations: What to Expect When You Convert

Understand the tax consequences of recharacterizing or converting your IRA contributions to optimize your retirement savings strategy, and learn how XOA TAX can help you navigate these complex transactions.

Avoiding Roth IRA Contribution Surprises: Year-End Bonus Tips

Year-end bonuses can unexpectedly impact your Roth IRA contributions; learn strategies to avoid penalties and maximize your retirement savings with expert tax planning tips.

Understanding the Pro Rata Rule: What High Earners Need to Know About Roth Conversions

At XOA TAX, we regularly guide individuals on maximizing their retirement savings. Converting a traditional IRA to a Roth IRA is a popular tactic, but it’s crucial to understand the implications of the pro rata rule before you begin. This rule can significantly impact your tax liability, especially for high earners considering conversions in 2024. […]

Navigating the Backdoor Roth IRA: A Step-by-Step Guide for High Earners

Roth IRAs offer fantastic tax advantages for retirement savings, but unfortunately, they come with income limitations. For 2024, if your modified adjusted gross income (MAGI) falls within the phase-out range—starting at $146,000 for single filers and $230,000 for those married filing jointly—your ability to contribute directly to a Roth IRA will be reduced or eliminated. […]

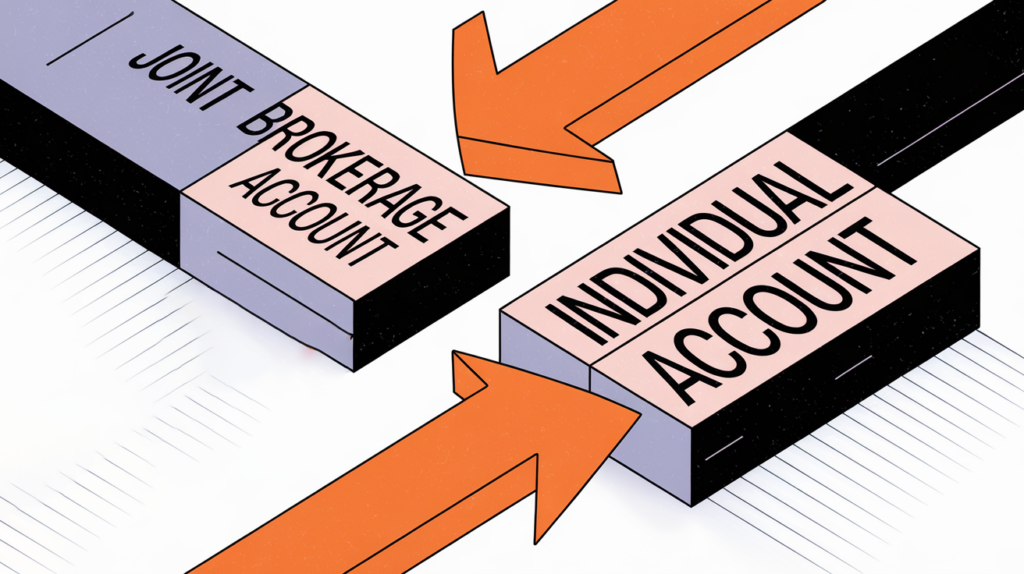

Understanding the Tax Implications of Transferring Joint Brokerage Accounts

Transferring assets from a joint brokerage account to an individual account is a common strategy used in estate planning, gifting, or simply managing personal finances. However, it’s important to be aware of the potential tax consequences before making any changes. This article will guide you through the key tax considerations involved in transferring joint brokerage […]

Filling Out a W-4: A Guide for Multiple Jobs and Non-Traditional Income (Like Caregiving)

Do you juggle multiple jobs or have income from sources like caregiving? If so, you might be wondering how to accurately fill out your W-4 form. At XOA TAX, we often hear from clients who find this process a bit confusing. This comprehensive guide will walk you through the steps and ensure you’re withholding the […]

Transferring Annuity Ownership Within an IRA: A Taxing Situation?

Annuities can be a helpful tool for retirement planning, providing a steady stream of income during your golden years. But what happens when you need to transfer ownership of an annuity held within an IRA? This seemingly simple action can lead to unexpected tax consequences if not handled correctly. Let’s break down the intricacies of […]