Inheriting Assets? Understanding the Step-Up Basis

Inheriting assets like a house or stocks can be a mix of emotions. While it’s a time to remember loved ones, it also comes with tax questions. One important thing to know about is the “step-up basis.” It might sound complicated, but don’t worry, we’ll explain it in a way that’s easy to understand. Key […]

Aging in Place: Tax Benefits for Seniors & Financial Planning

Discover how aging in place can offer significant tax advantages for seniors, potentially saving thousands on capital gains and preserving your estate.

Understanding the Tax Implications of Transferring Joint Brokerage Accounts

Transferring assets from a joint brokerage account to an individual account is a common strategy used in estate planning, gifting, or simply managing personal finances. However, it’s important to be aware of the potential tax consequences before making any changes. This article will guide you through the key tax considerations involved in transferring joint brokerage […]

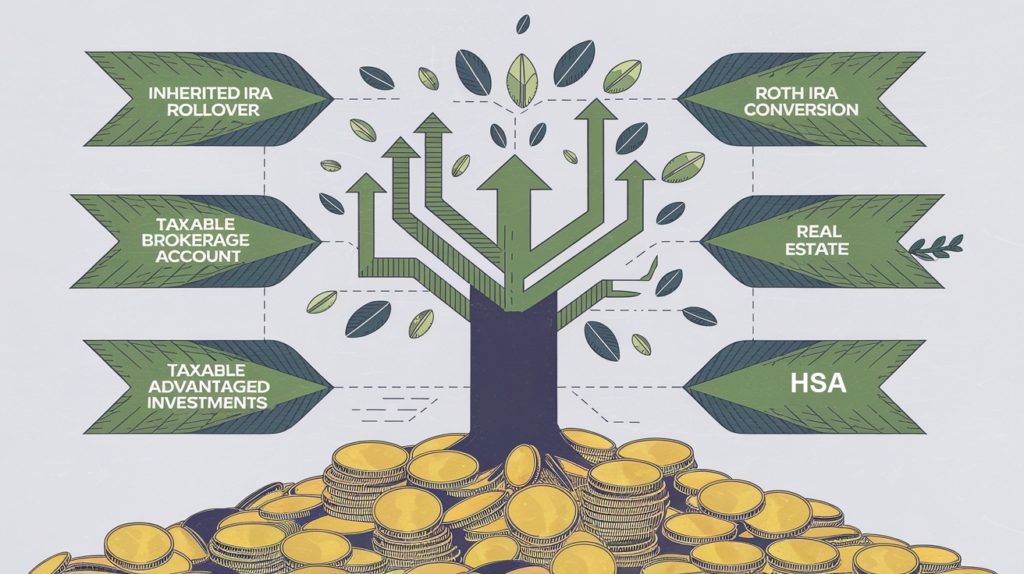

Turning an Inherited IRA into Long-Term Wealth: 5 Smart Reinvestment Strategies

Inheriting an IRA can be a significant financial event. While it might be tempting to use the funds for immediate needs, reinvesting them strategically can create a lasting financial legacy. At XOA TAX, we encourage you to consider these smart ways to reinvest your inherited IRA distributions to maximize growth and secure your financial future. […]

Inherited IRA Distributions: A Guide to Minimizing Taxes in 2025

Inheriting an IRA can be a significant financial event. While it offers opportunities for long-term growth, it also comes with tax implications that require careful consideration. This guide will walk you through the key aspects of managing inherited IRA distributions, particularly in light of recent legislation, to help you make informed decisions and potentially reduce […]

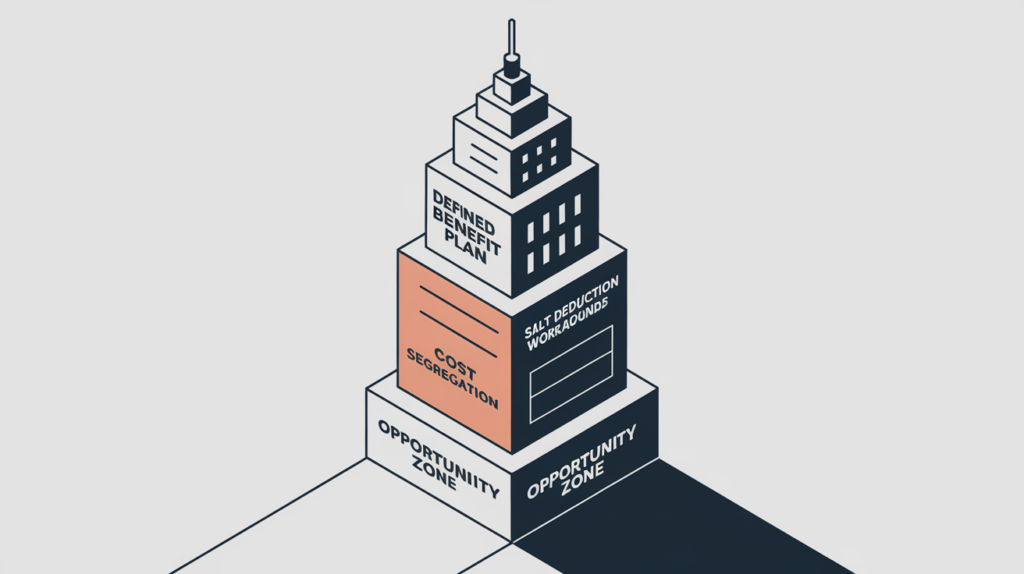

12 Advanced Tax Strategies for High-Earning Business Owners in 2024

Unlock significant tax savings with expert strategies tailored for your business.

Foreign Inheritance & US Taxes: A Complete Guide to Property Abroad

Imagine inheriting a charming villa in Tuscany – sounds idyllic, right? But before you start planning your dream vacation, it’s crucial to understand the U.S. tax implications. While the U.S. doesn’t have a federal inheritance tax, inheriting foreign property can still trigger certain reporting requirements and potential tax liabilities. This comprehensive guide will walk you […]

Inheriting Property After a Parent’s Passing: Understanding the Stepped-Up Basis

Losing a parent is an emotionally challenging experience, and navigating the complexities of their estate can add to the burden. One common area of confusion involves understanding the “stepped-up basis” when inheriting property. This concept can have significant implications for your tax liability, especially when it comes to real estate. Let’s break it down. Key […]

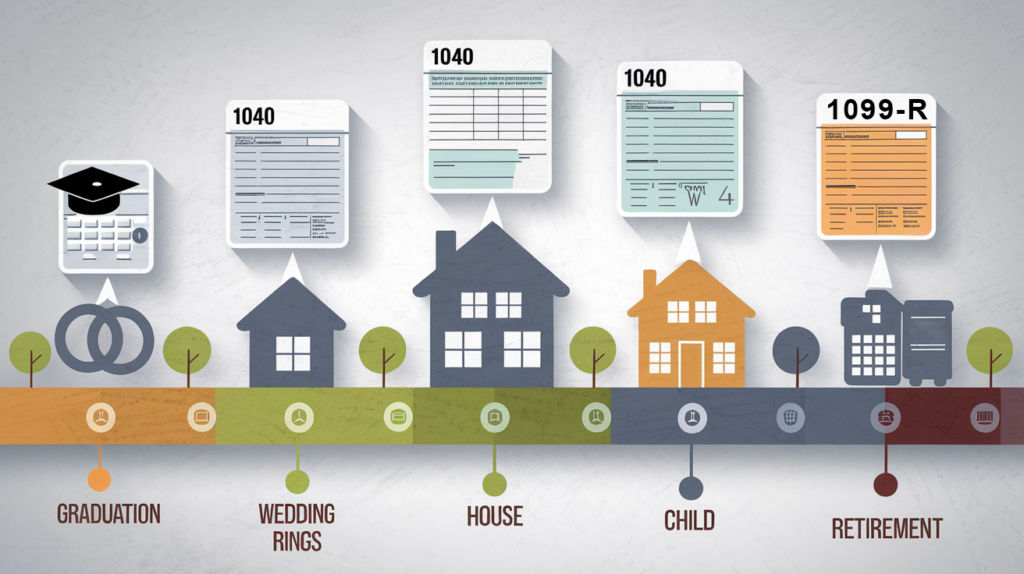

Your Life’s Tax Timeline: A Decade-by-Decade Guide

Taxes are a fact of life, but they don’t have to be a constant source of stress. Just like life itself, your tax situation evolves as you move through different stages. This blog post will be your roadmap, outlining key tax considerations for each decade of your adult life, from your adventurous 20s to your […]

Basic Estate Planning: A Beginner’s Guide

Estate planning is often perceived as something only the wealthy need to consider, but the reality is that everyone over 18 can benefit from a basic plan. It’s about ensuring your wishes are honored and your loved ones are cared for when you’re no longer here. At XOA TAX, we guide you through the fundamentals […]