Filling Out a W-4: A Guide for Multiple Jobs and Non-Traditional Income (Like Caregiving)

Do you juggle multiple jobs or have income from sources like caregiving? If so, you might be wondering how to accurately fill out your W-4 form. At XOA TAX, we often hear from clients who find this process a bit confusing. This comprehensive guide will walk you through the steps and ensure you’re withholding the […]

Transferring Annuity Ownership Within an IRA: A Taxing Situation?

Annuities can be a helpful tool for retirement planning, providing a steady stream of income during your golden years. But what happens when you need to transfer ownership of an annuity held within an IRA? This seemingly simple action can lead to unexpected tax consequences if not handled correctly. Let’s break down the intricacies of […]

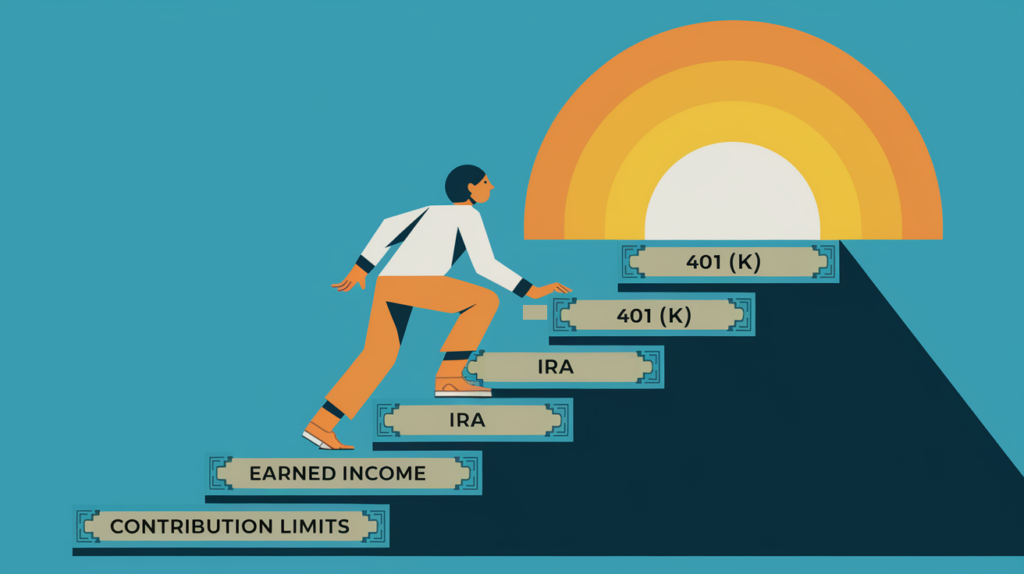

Maximize Retirement Savings on a Limited Income

Planning for a comfortable retirement is a priority for many, but it can seem challenging when you’re working with a limited income. The good news is that with careful planning and an understanding of contribution limits, you can still build a solid nest egg. At XOA TAX, we often help clients navigate these complexities. Let’s […]

Managing Unexpected Capital Gains from a Home Sale: How to Navigate Estimated Taxes and Avoid Penalties

Selling your home can be a big life event, often filled with excitement about new beginnings. But amidst the packing and moving, it’s important to remember the tax implications. If you’ve sold your home for a significant profit, you might find yourself facing a hefty tax bill come April. Don’t worry, though! At XOA TAX, […]

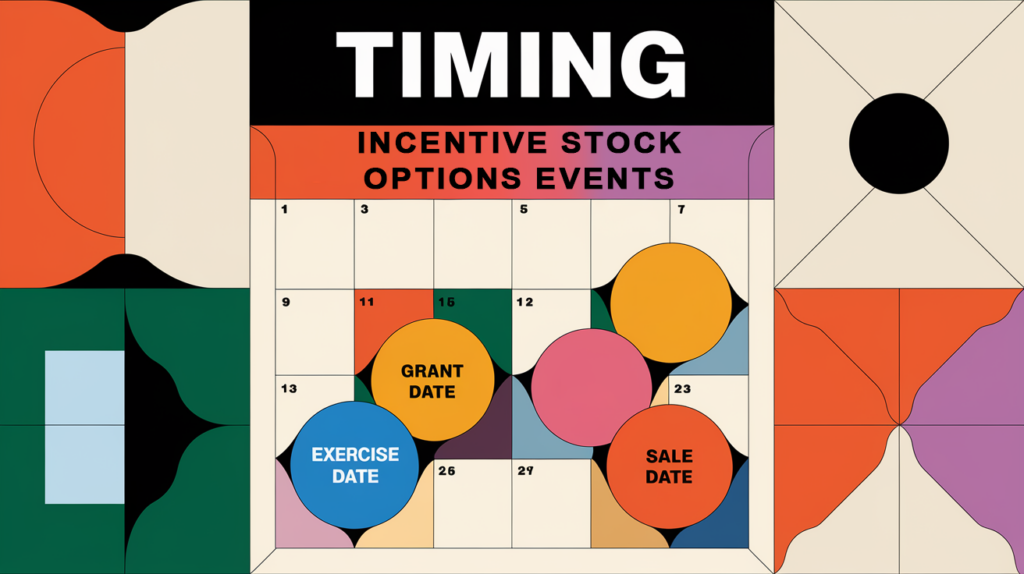

Managing Incentive Stock Options (ISOs) and the AMT: Tips to Navigate Taxes and Timing

Incentive stock options (ISOs) are a popular way for companies to attract and retain top talent. They offer employees the opportunity to purchase company stock at a discounted price, which can lead to significant financial gains. However, ISOs can also be complex from a tax perspective, especially when it comes to the alternative minimum tax […]

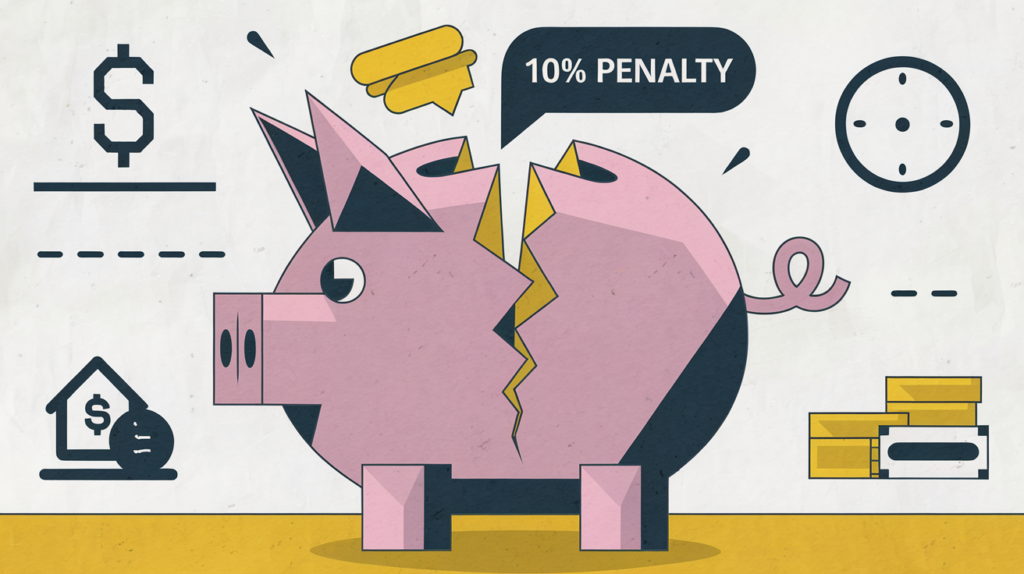

Early IRA Withdrawal? Understand the Tax Implications

Imagine this: You’re facing an unexpected expense—maybe a medical emergency, a much-needed home repair, or a sudden job loss. You’ve worked hard and saved diligently, and your IRA seems like a lifeline. But before you tap into those retirement funds, it’s essential to understand the tax implications of an early IRA withdrawal. Taking money out […]

Navigating HSA Contributions During a Divorce: What You Need to Know

Divorce can be a challenging time, filled with emotional and financial complexities. Among the many financial considerations, managing your Health Savings Account (HSA) often gets overlooked. Whether you’re currently navigating a divorce or anticipating one in the future, understanding how your HSA contributions are affected is crucial. This blog post will provide clarity on managing […]

Claiming Exempt on Your W-4? What You Should Know to Avoid Tax Penalties

At XOA TAX, we often get questions about W-4s, especially the “exempt” status. It sounds pretty great, right? No taxes withheld from your paycheck! However, claiming exempt when you shouldn’t can lead to some unpleasant surprises come tax time. Let’s break down what it really means to be exempt and how to avoid making a […]

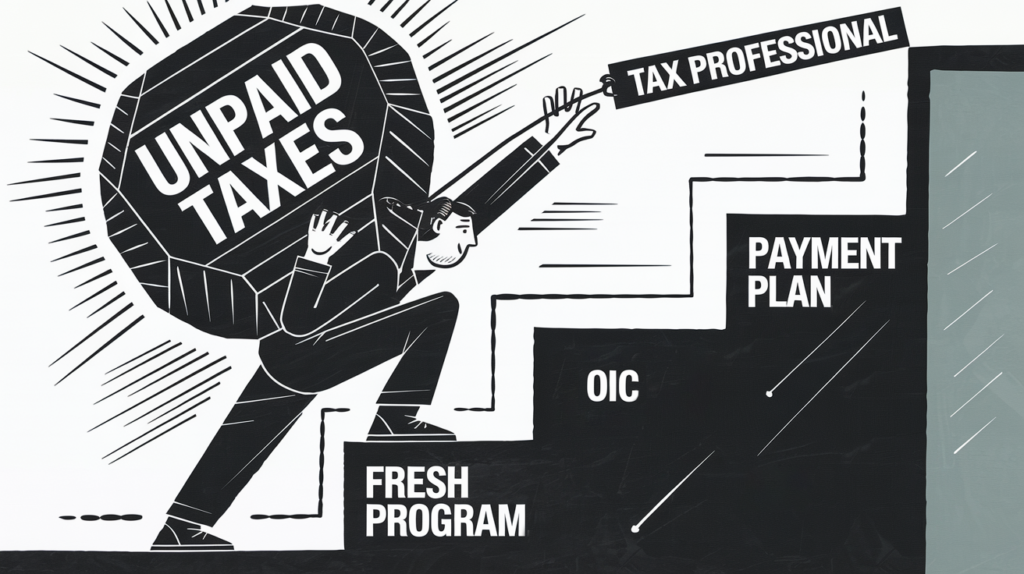

Unpaid Taxes & Financial Hardship: What To Do When You’re Behind

Life throws curveballs. Sometimes, those curveballs can significantly impact your finances, leaving you struggling to meet your tax obligations. Whether it’s a job loss, a failed business venture, or losses in the stock market, these setbacks can be incredibly stressful. If you find yourself in this situation, know that you’re not alone. Many people face […]

Understanding Child Tax Credits for Divorced or Separated Parents

Divorce or separation adds another layer of complexity to tax season. At XOA TAX, we often hear from clients who are unsure how to navigate the Child Tax Credit (CTC) after a life change. It’s important to understand how the rules apply to your specific situation to maximize this valuable tax benefit. Let’s break down […]