Can You Really Reduce Your AGI to $0 with Tax-Deferred Contributions?

Learn how tax-deferred contributions can lower your adjusted gross income (AGI) and explore strategies to maximize your tax savings while building a strong retirement plan.

Roth IRA Pros and Cons: Is It the Right Choice for Your Retirement Tax year 2024-2025?

This comprehensive guide explores the advantages and disadvantages of a Roth IRA, helping you determine if it aligns with your retirement savings goals.

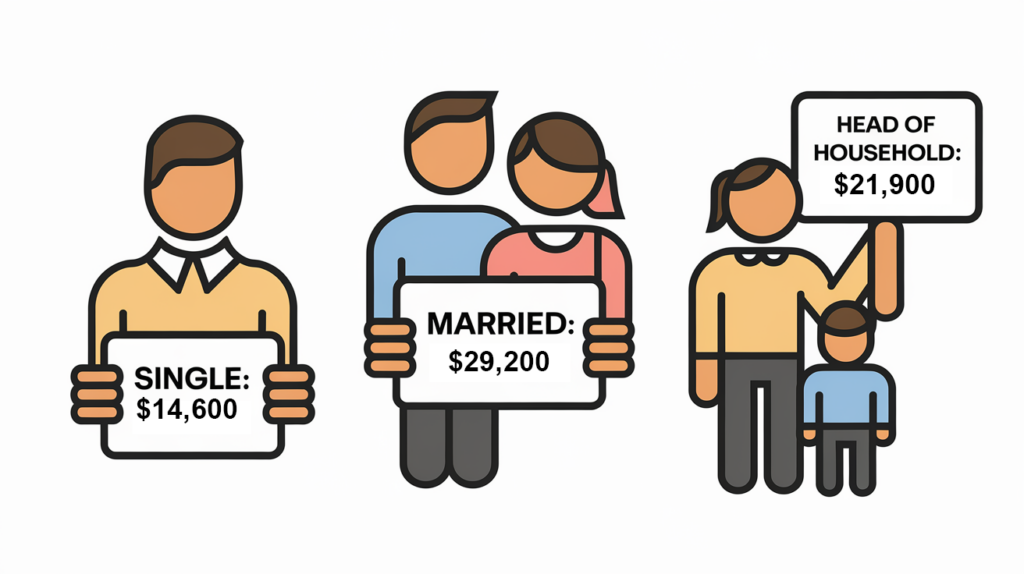

Guide for Standard Deduction 2024-2025: Filing Statuses, Ages, and Dependents

This comprehensive guide explains the 2024 standard deduction, including amounts for various filing statuses, additional deductions for age and blindness, and when itemizing might be more beneficial.

Solo 401(k) Contribution Deadlines, Limits, and Strategies 2024-2025

This comprehensive guide outlines the 2024 and 2025 Solo 401(k) contribution limits, deadlines, and strategies to maximize your retirement savings as a self-employed individual or small business owner, including details on the SECURE 2.0 Act.

Understanding Profit Interest Units: A Deep Dive for Equity Holders

Profit interest units (PIUs) offer a share in future company profits, presenting tax advantages but also requiring careful planning, including potentially crucial 83(b) elections.

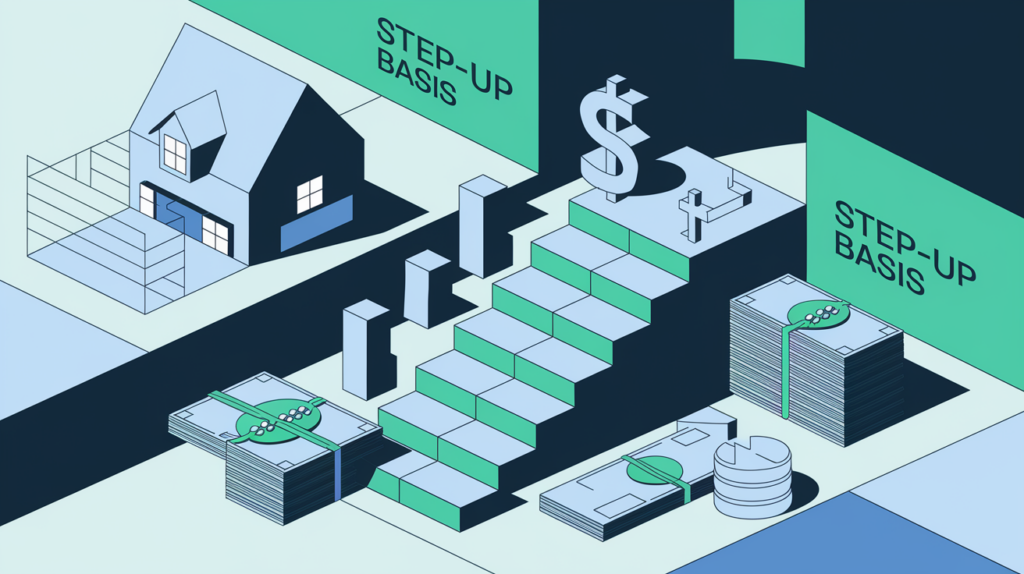

Inheriting Assets? Understanding the Step-Up Basis

Inheriting assets like a house or stocks can be a mix of emotions. While it’s a time to remember loved ones, it also comes with tax questions. One important thing to know about is the “step-up basis.” It might sound complicated, but don’t worry, we’ll explain it in a way that’s easy to understand. Key […]

The Child Tax Credit: Planning for Change

The Child Tax Credit is a valuable tax credit that helps many families reduce their tax burden. For the 2024 tax year, the maximum credit is $2,000 per qualifying child and $500 for other dependents. Additionally, the refundable portion, known as the Additional Child Tax Credit (ACTC), is up to $1,500 for 2024. Key Takeaways […]

Divorce Settlement Strategies: How to Optimize Your House Buyout for Tax Benefits

Learn how to optimize your house buyout during a divorce to minimize tax liabilities and maximize financial benefits by understanding capital gains exclusions, mortgage interest deductions, and state-specific property laws.

A Comprehensive Guide to Cryptocurrency Taxes (2024)

Hey there, fellow crypto enthusiasts! Ever wonder if those Bitcoin gains could mean a bigger tax bill? At XOA TAX, we’re here to help you navigate the world of cryptocurrency taxes – no confusing jargon, just friendly guidance. Think of us as your tax buddies, here to break it down in a way that’s easy […]

Aging in Place: Tax Benefits for Seniors & Financial Planning

Discover how aging in place can offer significant tax advantages for seniors, potentially saving thousands on capital gains and preserving your estate.