Avoiding Roth IRA Contribution Surprises: Year-End Bonus Tips

Year-end bonuses can unexpectedly impact your Roth IRA contributions; learn strategies to avoid penalties and maximize your retirement savings with expert tax planning tips.

Understanding the Pro Rata Rule: What High Earners Need to Know About Roth Conversions

At XOA TAX, we regularly guide individuals on maximizing their retirement savings. Converting a traditional IRA to a Roth IRA is a popular tactic, but it’s crucial to understand the implications of the pro rata rule before you begin. This rule can significantly impact your tax liability, especially for high earners considering conversions in 2024. […]

Navigating the Backdoor Roth IRA: A Step-by-Step Guide for High Earners

Roth IRAs offer fantastic tax advantages for retirement savings, but unfortunately, they come with income limitations. For 2024, if your modified adjusted gross income (MAGI) falls within the phase-out range—starting at $146,000 for single filers and $230,000 for those married filing jointly—your ability to contribute directly to a Roth IRA will be reduced or eliminated. […]

Transferring Annuity Ownership Within an IRA: A Taxing Situation?

Annuities can be a helpful tool for retirement planning, providing a steady stream of income during your golden years. But what happens when you need to transfer ownership of an annuity held within an IRA? This seemingly simple action can lead to unexpected tax consequences if not handled correctly. Let’s break down the intricacies of […]

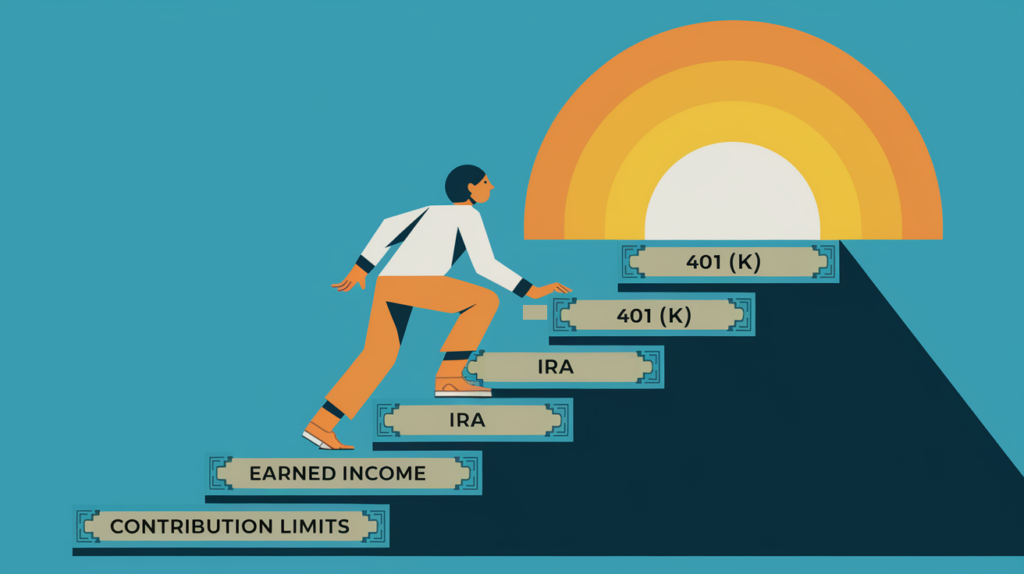

Maximize Retirement Savings on a Limited Income

Planning for a comfortable retirement is a priority for many, but it can seem challenging when you’re working with a limited income. The good news is that with careful planning and an understanding of contribution limits, you can still build a solid nest egg. At XOA TAX, we often help clients navigate these complexities. Let’s […]

Early IRA Withdrawal? Understand the Tax Implications

Imagine this: You’re facing an unexpected expense—maybe a medical emergency, a much-needed home repair, or a sudden job loss. You’ve worked hard and saved diligently, and your IRA seems like a lifeline. But before you tap into those retirement funds, it’s essential to understand the tax implications of an early IRA withdrawal. Taking money out […]

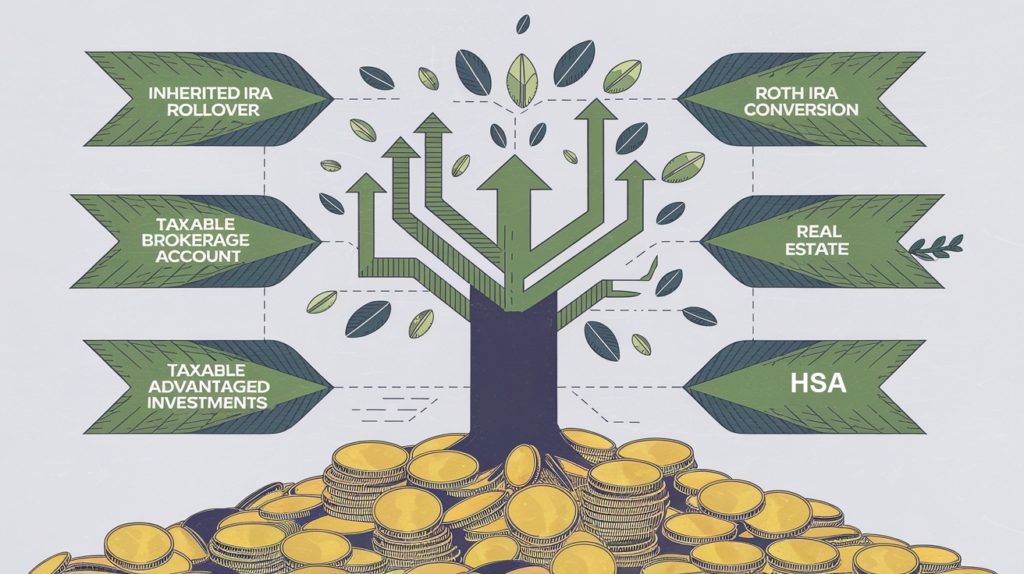

Turning an Inherited IRA into Long-Term Wealth: 5 Smart Reinvestment Strategies

Inheriting an IRA can be a significant financial event. While it might be tempting to use the funds for immediate needs, reinvesting them strategically can create a lasting financial legacy. At XOA TAX, we encourage you to consider these smart ways to reinvest your inherited IRA distributions to maximize growth and secure your financial future. […]

Inherited IRA Distributions: A Guide to Minimizing Taxes in 2025

Inheriting an IRA can be a significant financial event. While it offers opportunities for long-term growth, it also comes with tax implications that require careful consideration. This guide will walk you through the key aspects of managing inherited IRA distributions, particularly in light of recent legislation, to help you make informed decisions and potentially reduce […]

Donor Advised Funds: Maximize Your 2024 Charitable Impact

At XOA TAX, we believe in the power of giving back. But did you know that charitable giving can also be a smart financial move? Donor Advised Funds (DAFs) offer a fantastic way to support your favorite causes while maximizing your tax benefits. Think of a DAF like a charitable savings account: you contribute money […]

401(k) Changes in 2025 – Essential New Rules for a Stronger Retirement Plan

Planning for retirement can be daunting, especially with frequent changes in 401(k) regulations. The upcoming adjustments in 2025, introduced under the SECURE 2.0 Act, bring new opportunities and requirements that could impact your retirement strategy significantly. At XOA TAX, we understand the importance of staying informed to make the most of your retirement savings. Here’s […]