The arrival of tax season often brings a mix of anticipation and apprehension. Amidst the sea of documents and numbers, Form W-2 stands as a critical piece of the puzzle. Whether you’re a long-time taxpayer or a first-time filer, understanding this form is the key to ensuring accurate tax reporting and potentially maximizing your returns.

In this blog post, we’ll walk you through the explanation, essentials, and key points that can help you to fully understand the W2 form. Say goodbye to tax season stress!

Key Takeaways:

- Form W-2 provides essential tax information from your employer, including earnings, tax withholdings, benefits, and more.

- Your Form W-2 should be delivered by January 31st each year and used for preparing your tax return.

- Discrepancies between the information on your W2 and on your tax return may cause your return to be rejected.

- Employer 401(k) contributions are not on Form W-2; they’re reported separately.

What Is Form W-2 (Wage and Tax Statement)?

Form W-2, also known as the Wage and Tax Statement, is a crucial document that serves multiple purposes:

- It reports your annual wages.

- It indicates the amount of taxes withheld from your paycheck.

- It shows other important information, such as employer contributions to your health insurance and dependent care benefits.

Employers are required by law to provide this document to their employees and to the Social Security Administration (SSA) by January 31st each year. If this date falls on a Saturday, Sunday, or legal holiday, the deadline will be the next business day. As an employee, you will use this form to prepare your tax return. If you worked multiple jobs during the year, you will receive a separate W-2 for each job.

Who Needs to File W2 Form?

As an employee, you do not fill out Form W-2; your employer provides it to you. However, you will use the information on your W-2 when filing your federal and state income tax returns. It’s essential to understand that the total taxes withheld from your paychecks impact your overall tax liability. If the total withheld is more than your tax liability, you’ll receive a tax refund. Conversely, if insufficient taxes were withheld, you may owe the IRS.

The IRS uses a cross-checking program to ensure accurate reporting of all W-2 income. Any discrepancies between the information on your tax return and your W-2s may result in delays or rejection in processing your return. In many cases, the discrepancies might cause your return to be audited.

How to Get Your Form W-2?

If your W-2 form for the current tax year hasn’t arrived in your mailbox by mid-February, your first step should be to reach out to your employer for a copy and verify that they have your correct address on file. Alternatively, your employer may guide you on accessing your W-2 online through their HR department or payroll processor.

In case you still haven’t received your Form W-2 by the end of February, it’s time to contact the IRS at 800-829-1040. The IRS will then reach out to your employer to request the missing W-2 Form. Additionally, the IRS may provide you with a Form 4852, which serves as a replacement for the missing W-2, or a Form 1099-R.

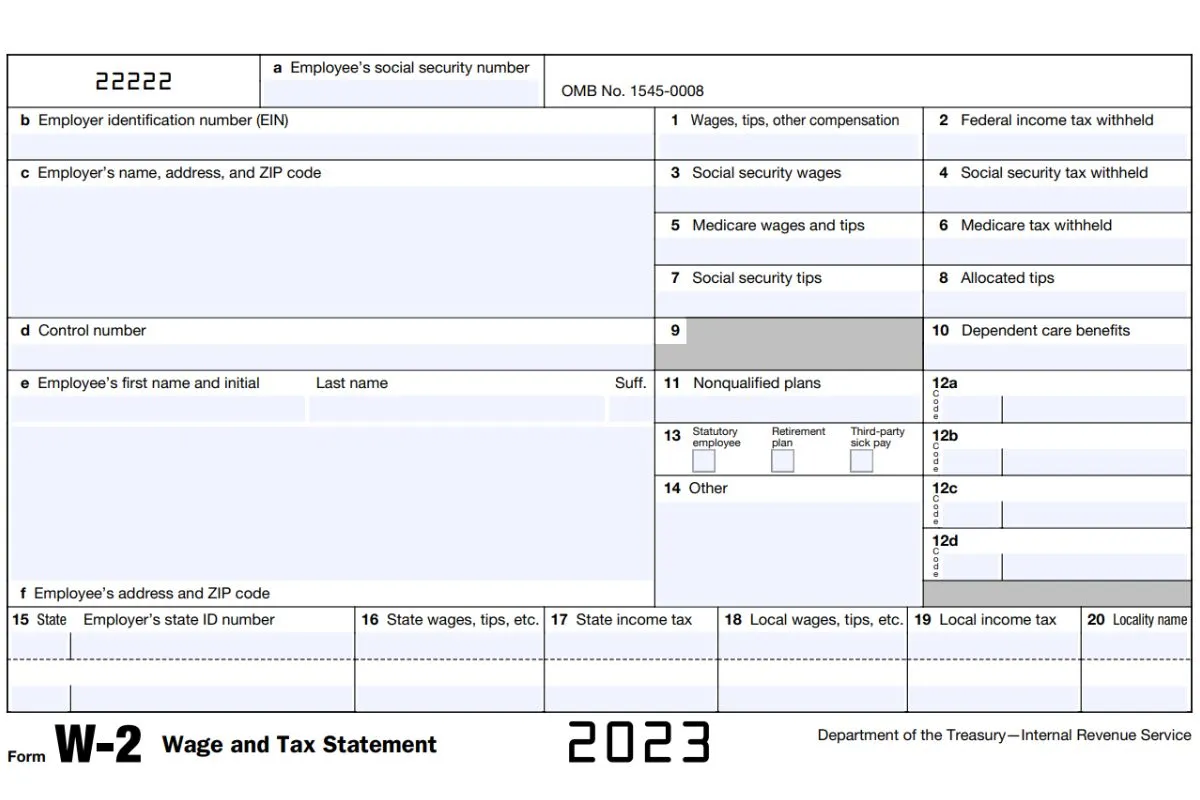

A Quick Guide to Read Form W-2

Reading Form W-2 can be a bit intimidating, but it becomes more manageable when you break it down. Here’s a step-by-step guide to help you understand W2 form better:

Step 1: Review Your Personal Information (Boxes A-F)

- Box A: Ensure your Social Security Number (SSN) is accurate.

- Box B: Check your employer’s identification number (EIN).

- Box C: Verify that your name, address, and ZIP code are correct. If not, inform your employer to make corrections.

- Box D: The control number is an optional unique identifier assigned by employers for internal tracking of W-2 forms. Not mandatory for tax filing

- Box E: Ensure your full legal name is accurately listed as it appears on your Social Security card

- Box F: Confirm that your current address and ZIP code are correctly listed. If there are any errors, inform your employer

Step 2: Examine Your Income and Tax Information

- Box 1 (Wages, Tips, Other Compensation): This box displays your total taxable wages before deductions.

- Box 2 (Federal Income Tax Withheld): Indicates the amount of federal income tax deducted from your paychecks.

- Box 3 (Social Security Wages): Shows your earnings subject to Social Security tax.

- Box 4 (Social Security Tax Withheld): Reflects the amount of Social Security tax withheld.

- Box 5 (Medicare Wages and Tips): Displays earnings subject to Medicare tax.

- Box 6 (Medicare Tax Withheld): Indicates the amount of Medicare tax withheld.

Step 3: Understand Other Relevant Boxes

These boxes may contain additional information specific to your tax situation, such as social security tips, dependent care benefits, special circumstances (third-party sick pay, retirement plan, or statutory employee), and many more.

- Box 7 (Social Security Tips): This box reports the amount of tips you reported to your employer. These tips are subject to Social Security tax.

- Box 8 (Allocated Tips): This box shows tips allocated to you by your employer. You need to report this amount as income on your tax return unless you have records to show that you received a different amount.

- Box 9: This box is no longer in use and is left blank on current W-2 forms.

- Box 10 (Dependent Care Benefits): This box reports the total amount of dependent care benefits provided under a dependent care assistance program. Amounts over the $5,000 limit may be taxable.

- Box 11 (Nonqualified Plans): This box reports amounts distributed to you from your employer’s nonqualified deferred compensation plan or nongovernmental Section 457 pension plan.

- Box 12: This section details various types of compensation or deductions. Each entry includes a code (e.g., D for 401(k) contributions) and an associated amount.

- Box 13: This box includes checkboxes for special circumstances, such as retirement plan participation and statutory employee status.

- Box 14: Employers can use this box to report any additional information that doesn’t fit elsewhere on the form. Examples include union dues or state disability insurance.

Step 4: Check for Extra Information (Boxes 15-20)

Boxes 15-20: These boxes typically provide state and local tax information, including state income tax withheld and wages subject to state taxes.

Step 8: Reconcile With Your Records

Compare the information on your W-2 with your records (paystubs, paychecks, retirement contributions made, etc.) to ensure accuracy. If you spot discrepancies, contact your employer for corrections.

Step 9: Use Your W-2 for Tax Filing

You’ll need the information from your W-2 to complete your federal and state income tax returns. Be sure to keep a copy for your records.

Step 10: File Your Taxes

File your taxes by the deadline, which is typically on or before April 15th, to avoid penalties or interest charges.

By following these steps and understanding each section of your Form W-2, you can effectively read and use this essential document during tax season.

The Bottom Line

As we wrap up our comprehensive guide to Form W-2, we hope you now have a clearer understanding of this essential document and how it impacts your financial life.

Taxes, though often seen as a complex and daunting process, can be navigated with confidence when you have a clear understanding. Remember, W2 Form is just one of many pieces in filing tax, and understanding it is a crucial step to take control of your tax papers.

As the tax season approaches, take the time to review your Form W-2 and ensure its accuracy. Seek professional advice if needed. Reach out to our team of experts and enjoy your stress-free tax season today!

FAQ

1. When Should I Receive My Form W-2 in 2023?

Employers are legally required to provide employees with their Form W-2 by January 31st of each year. Ensure your employer has your current address for timely delivery.

2. Is My Employer Legally Obligated to Give Me the W2 Form?

Yes, employers are legally obligated to provide employees with a Form W-2 by the January 31st deadline. Failure to do so can result in penalties for the employer.

3. Will My Employer’s Matching 401(k) Contributions Appear on My W2 Form?

Your employer’s matching 401(k) contributions will not appear on your Form W-2. Form W-2 primarily reports your taxable income and the taxes withheld from your paychecks. It does not include information about employer contributions to retirement accounts.

Employer contributions to your 401(k) account are typically reported on a different document called the Form 401(k) Summary Annual Report (SAR) or the Form 5500. While employer contributions to your 401(k) do not appear on your W-2, it’s still important to keep track of them on your periodic statements from your retirement plan provider.

4. Do I Need to Include My W2 Form When Filing My State Tax Return?

Yes, you typically need to include a copy of your Form W-2 when filing your state tax return. However, always check your specific state’s tax regulations for any additional requirements or exceptions.

5. Where Do I Send Form W-2 Paper Copies to?

If you are an employer, you must file W-2s with the Social Security Administration no later than January 31, 2023. You should send paper copies of Forms W-2 to the following address:

- Social Security Administration

- Direct Operations Center

- Wilkes-Barre, PA 18769-0001

It’s important to note that no payments, including cash, checks, or money orders, should be submitted with these forms.

>>You may find interesting:

- Form 1040: A Step-By-Step Guide To Gain Income Tax Return

- 1099-NEC vs 1099-MISC: Know the Differences, Maximize Your Benefits

- Quick Guide To Fill Out 1099 Form

- Tax Topic 152: Your Key To Tax Refunds

Sources: ssa.gov

anywhere

anywhere  anytime

anytime

5 Responses

Interesting article on the W2 form. I’ve been filing taxes for years, but it’s always good to brush up on the basics. It’s like revisiting an old recipe – familiar yet always something new to learn.

W2 wisdom. 👍

Regarding W-2’s, I don’t have to file my tax return if I am single, 21 years old, a dependent under my parents, not claiming a child, and made under $12,000… is that correct?

W2 forms? More like ‘Why 2’ complicated, amirite? 😂 But fr, this blog made it way easier to digest. Gotta keep those tax vibes in check. #AdultingInStyle

Just breezed through this W2 guide and it’s a total game-changer! Makes tax season feel less like a maze and more like a walk in the park. Super grateful for these clear, step-by-step instructions. 🌟