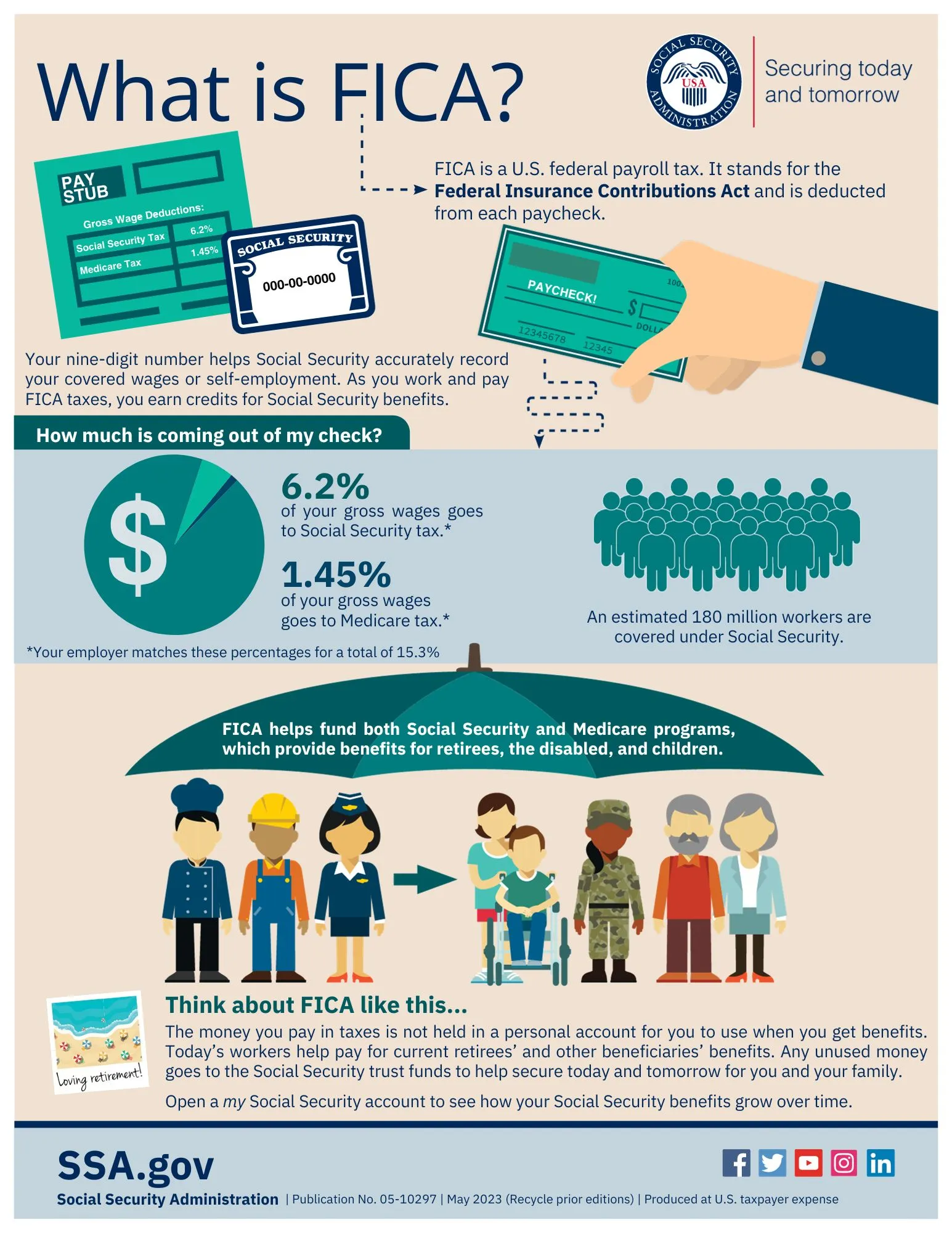

What Is the Federal Insurance Contributions Act (FICA)?

The Federal Insurance Contributions Act (FICA) of 1935 imposed a payroll tax on U.S. wage earners’ paychecks and required employers to make equivalent amounts. The proceeds from this tax are used to fund the nation’s Social Security and Medicare programs.

The goal behind the act from the start was that working people would contribute a fixed amount of each of their paychecks to fund Social Security (and later Medicare) so that they could count on earned financial and health benefits later in life.

The Self-Employment Contributions Act (SECA) of 1954 mandates self-employed people to pay Social Security and Medicare taxes on their net earnings.

Read more: What are FICA and SECA taxes?

Key Takeaways

- Individuals’ FICA contributions pay present benefits while also accumulating future ones promised to them.

- FICA contributions are deducted from a wage earner’s gross pay; the amount deducted is determined by gross wages.

- Employers match the FICA taxes paid by their employees.

- Wage earners cannot opt out of paying FICA taxes.

- FICA has funded Social Security programs that offer payments to retirees, children and surviving spouses, and the disabled since the 1930s.

Understanding FICA

History

The Federal Insurance Contributions Act, or FICA, was passed by the United States Congress in 1935. Its objective was to collect contributions to fund the new Social Security program established by President Franklin D. Roosevelt’s government the same year.

Roosevelt believed that the money collected through FICA from all working Americans belonged directly to them. He didn’t want their retirement, disability, or death benefits to be funded by government funds. He was afraid that politicians would grab the money and utilize it for their own reasons.

When President Lyndon B. Johnson signed Medicare into law in 1965, he included a payroll tax to fund health-care benefits.

FICA contributions are required. Although the rate can be changed on an annual basis, it has remained relatively steady since 1990. The annual limit is determined by the National Average Wage Index.

Rates and Limits

FICA taxes are made up of old-age, survivors, and disability insurance taxes (Social Security) as well as the hospital insurance tax (Medicare), according to the Internal Revenue Service (IRS). Each has a different rate.

Read More: Social Security Tax/Medicare Tax and Self-Employment

For Social Security taxes on earnings, there is a maximum wage base over which no tax is payable. The starting wage is set at $160,200 in 2023 and $168,600 in 2024.

There is no wage base limit for Medicare taxes.

In 2023 and 2024, an overall Social Security tax rate of 12.4% is shared by employees and employers. The employee contributes 6.2%, while the corporation contributes the remaining 6.2%.

The overall Medicare tax rate of 2.9% is divided equally between the employee and the employer. The employee contributes 1.45%, and the employer contributes 1.45%.

Employees pay an additional 0.9% Medicare tax on wages above a certain threshold. That threshold is $200,000 for individuals in 2023 and 2024 ($250,000 for married couples filing jointly). As a result, depending on their earnings, an employee’s total Medicare tax might be 2.35% (1.45% plus 0.9%). The increased Medicare tax does not need to be matched by employers.

The Self-Employed Contributions Act (SECA)

The self-employed are required by SECA to pay both the employee and employer shares of Social Security and Medicare taxes. As a sole owner, for example, you would be liable for paying 12.4% of your income into Social Security and 2.9% toward Medicare.

Furthermore, you would be subject to an extra Medicare tax of 0.9% on self-employment income above the threshold amount.

Self-employed individuals receive a tax break while paying more than salaried earners. They can deduct as a business cost the amount that represents the employer’s portion (half).

FICA and SECA taxes do not fund Supplemental Security Income (SSI) benefits, despite the fact that the SSA administers that program. SSI benefits are paid from general tax resources.

How to Calculate

Example 1

In 2023, an employee earning $50,000 will pay $3,825 in FICA contributions. This equates to $3,100 in Social Security taxes and $725 in Medicare taxes. The same sum would be paid by the wage earner’s employer.

How it’s calculated:

Social Security tax = $50,000 x .062 (the employee rate of 6.2%) = $3,100

Medicare tax = $50,000 x .0145 (the employee rate of 1.45%) = $725

Total FICA = $3,825 ($3,100 + $725)

Example 2

In 2023, an employee earning $250,000 and filing alone will pay $13,282.40 in FICA contributions. This equates to $9,932.40 in Social Security and $3,350 in Medicare taxes. The wage earner’s employer would pay somewhat less because they are not required to pay the additional Medicare tax of 0.9% on any amount over $200,000 in earnings.

How it’s calculated:

Social Security tax = $160,200 (wage base limit) x .062 (the employee rate of 6.2%) = $9,932.40

Medicare tax = $200,000 x .0145 (the employee rate of 1.45%) = $2,900

Additional Medicare tax = $50,000 x .009 (the total rate of 0.9%) = $450

Total Medicare taxes = $3,350 ($2,900 + $450)

Total FICA = $13,282.40 ($9,932.40 + $3,350)

Special Considerations

According to the Congressional Budget Office, the Social Security Trust Fund would run out of money in 2033 to fulfill monthly Social Security payments. This would happen because the program’s revenues would be insufficient to fund its obligations.

This disparity will result from a growing population of Social Security users and a declining workforce required to pay the program through FICA levies.

Policymakers are contemplating a number of options to address this predicament. These include raising the full retirement age (now 67), reducing financial benefits, particularly for high workers, and boosting the payroll tax rate.

Do I Have to Pay?

Yes. Wage earners are required by the Federal Insurance Contributions Act to contribute a percentage of their earnings to fund the Social Security and Medicare programs. Finally, you’ll be eligible for what’s known as earned benefits. You paid for them, and they are yours.

Is Social Security the Same As FICA?

No, although it is linked. FICA is an abbreviation that stands for a law passed by the United States Congress about the time Social Security was formed in 1935. This required all working people in the United States to contribute to Social Security in order for it to provide them with financial benefits later in life. The FICA numbers on your paycheck represent payroll taxes paid to Social Security and, since 1965, Medicare.

What Is the FICA Tax Rate?

Wage earners contribute 6.2% of their earnings up to $160,200 ($168,600 in 2024) toward Social Security. In addition, their employers pay 6.2% on their behalf. As a result, the overall tax rate for Social Security is 12.4%. Any earnings above that level are not taxed for Social Security purposes. Wage earners pay the Medicare rate of 1.45% on income up to $200,000 for people. They pay an additional 0.9% Medicare tax on income above that level. Employers must equal the 1.45% rate but are not required to match the 0.9% rate.

Conclusion

FICA refers to the 1935 United States statute, and later the 1965 law, that required workers and businesses to pay payroll taxes to fund the nation’s Social Security and Medicare systems. FICA taxes are required.

Since then, a portion of every paycheck has been withheld from American wage earners so that they might receive financial benefits from the government in their retirement years.

anywhere

anywhere  anytime

anytime