Serving as a proud US soldier is full of difficulties, and one of it is military taxes. Whether you wear the uniform or support a military spouse, understanding the unique tax benefits and duties will help you optimize your financial situation. In this thorough guide, we’ll walk you through crucial tax advice and personalized perks developed just for service members, making tax season a more manageable journey.

Tax Tips for Military Members:

Military income taxes

Military personnel are entitled to a variety of compensation and allowances, but it is crucial to understand which are and are not taxable. Combat pay, living expenses, uniform allowances, funeral-related expenses, and relocating fees are examples of non-taxable income. Nonetheless, differentiating between taxable and non-taxable pay is critical for correct financial reporting.

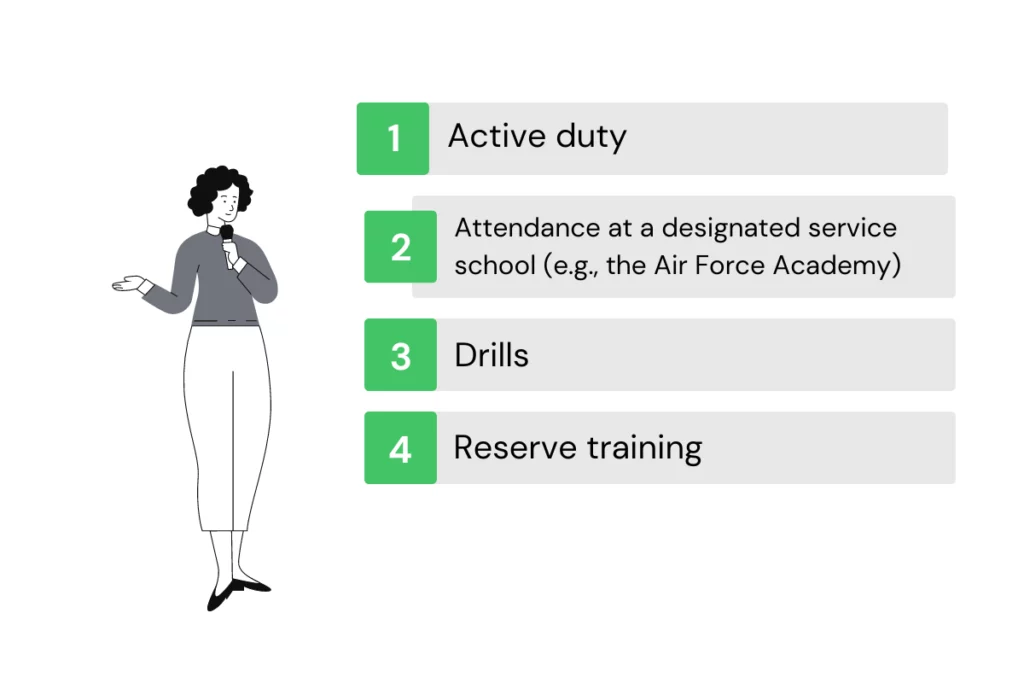

Basic Pay: Basic pay must be incorporated into your gross income for federal income tax considerations, except when it’s earned for service performed in a combat zone (as explained below). Basic pay covers amounts received for:

Special Pay: Similar to basic pay, special pay is taxable unless it’s earned in a combat zone. Special pay might encompass compensation for:

- Foreign duty (outside the 48 contiguous states and the District of Columbia)

- Hardship duty

- Hostile fire or imminent danger

Bonuses and Other Payments: Unless earned in a combat zone, any bonuses or other payments received for the following should be included in your gross income on your federal tax return:

- Enlistment or re-enlistment

- Accrued leave

- Student loan repayments from specific military educational loan repayment programs

On the other hand, income that is not included in your gross income comprises:

Reimbursements or Allowances: Several reimbursements and allowances are provided to military personnel, and they might or might not be included in your gross income. Here are some examples:

- Living allowances, such as BAH (Basic Allowance for Housing), BAS (Basic Allowance for Subsistence), and OHA (Overseas Housing Allowance).

- Allowances for moving your household, personal items, trailer or mobile home, storage of belongings, and temporary lodging.

- Certain travel allowances for dependent students, leave between consecutive overseas tours, and per diem expenses.

- Payments for group term life insurance, professional education, or uniform allowances are examples of such payments.

- The value of in-kind benefits, such as legal assistance, medical/dental care, uniforms furnished to enlisted personnel, and commissary/exchange discounts.

- Benefits received under a dependent-care assistance program.

Military Base Realignment and Closure Benefits: Qualified payments under the Homeowners Assistance Program (HAP) for military base realignment and closure benefits are typically excluded from income, though certain limits may apply. This exclusion aims to provide support to military personnel facing changes due to base closures or realignments.

By understanding the tax implications of different types of compensation, you can ensure that your financial reporting remains precise and aligned with regulations.

Deductible Travel and Lodging Expenses

Deductible Travel and Lodging Expenses: If you’re a member of the National Guard, Armed Forces Reservist, or a part of the reserve components like the Army, Navy, Marine Corps, Air Force, Coast Guard Reserve, Army National Guard, Air National Guard, or the Reserve Corps of the Public Health Service, you can benefit from deductions for travel and lodging expenses when your work requires you to travel over 100 miles. This applies even if you don’t itemize your deductions.

These deductions cover various expenses related to your duty-related travel, including mileage, lodging, parking, tolls, and 50% of meal costs. So, from the moment you depart until you return home, these deductions can offer significant financial relief, ensuring that you’re fairly compensated for the expenses incurred in service to your country. You can read more about it here.

Uniform Expenses in Some States

While federal deductions for uniform expenses have changed, some states, like California, still allow deductions for military uniform expenses. Keep track of any uniform-related costs, as they might be deductible in certain states.

Tax Relief for Moving Expenses

This deduction extends to moving household goods, personal effects, and even travel expenses. Notably, this provision doesn’t solely apply to service members themselves – it can also include members of your household, provided they meet the criteria (excluding tenants or employees, unless they qualify as your dependents).

The unique advantage here is that unlike the regular moving expense deductions, there’s no need to satisfy distance or time requirements to qualify for these valuable deductions. This is just one way the tax code recognizes the sacrifices and commitments of our military personnel, making tax season a bit more manageable during times of transition.

Tax Benefits for Military Spouses:

Military Spouses Residency Relief Act (MSRRA)

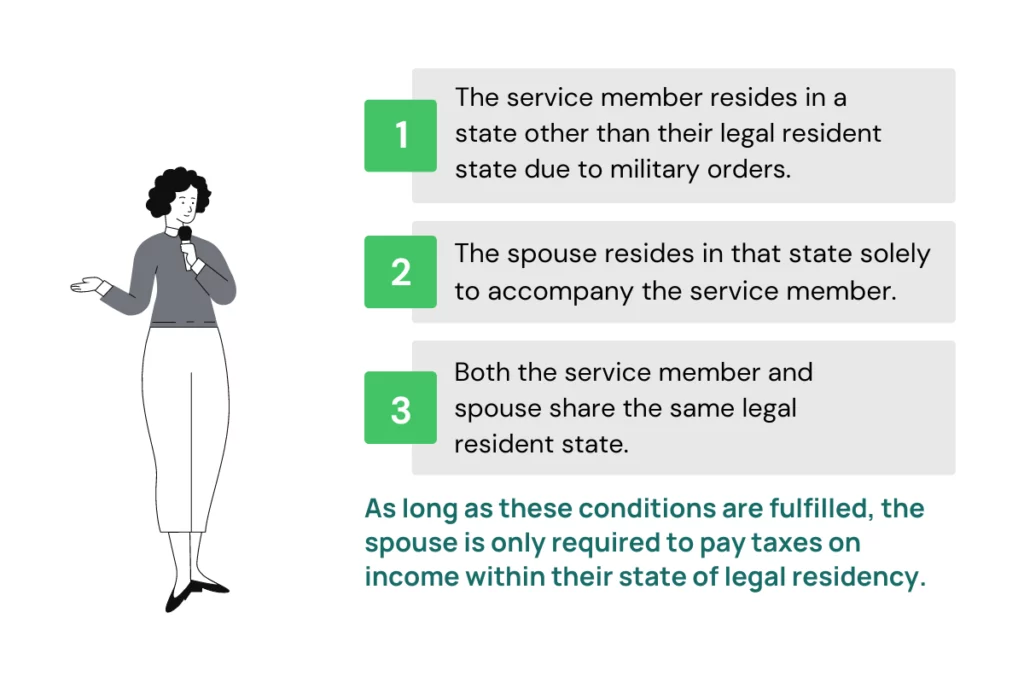

Under the MSRRA provisions, military spouses can uphold their original state of residence or opt for their service member spouse’s state of residence, even when relocating due to military orders. This simplifies tax filing for military spouses, shielding them from multiple state tax liabilities. The MSRRA comes into play when certain conditions are met:

Veterans Benefits and Transition Act of 2018 (VBTA)

The VBTA extends tax benefits to military spouses, allowing them to use their spouse’s state of residency for tax purposes. This is particularly helpful for spouses who did not share the same state residency before deployment.

Exemptions for Income and Property Taxes

Thanks to MSRRA and VBTA, military spouses are exempt from income and property taxes in the duty-station state, even if their income might be taxable in their home state. This eliminates the hassle of filing taxes in multiple states and provides significant financial relief.

Expert Military Taxes Services at Your Disposal

Military taxes services cater to the unique needs of service members, whether you’re actively serving or have recently transitioned to civilian life. These experts understand the ins and outs of military tax laws, helping you navigate the nuances and ensuring your military tax return is accurate and optimized.

>>>You may also be interested in:

Is It Worth Claiming Medical Expenses On Taxes

How Many Dependents Can I Claim? A Complete Guide

Child Tax Credit 2023: Requirements and How to Claim It

Sources: military.com, revenue.nebraska.gov

anywhere

anywhere  anytime

anytime